A Stock Redemption Agreement Between Corporation and Stockholder on Retirement of Shareholder is a contract between a corporation and a shareholder that outlines the terms for the retirement of a shareholder and the redemption of their stock in the corporation. This agreement is typically used when a shareholder retires from the company, is no longer active and has decided to sell their stock. The agreement sets out the amount of money to be paid to the shareholder, the method of payment, the date of payment, and any other terms that the parties have agreed to. The main types of Stock Redemption Agreement Between Corporation and Stockholder on Retirement of Shareholder are: 1. Mandatory Stock Redemption Agreement: This agreement requires the corporation to purchase a certain amount of shares from the retiring stockholder. 2. Voluntary Stock Redemption Agreement: This agreement allows the retiring stockholder to choose the amount of shares to be sold to the corporation. 3. Reverse Stock Redemption Agreement: This agreement allows the corporation to purchase the retiring stockholder’s shares at a pre-determined price. 4. Stock Appreciation Rights Agreement: This agreement allows the retiring stockholder to receive the appreciation in the value of the stock since the date of the agreement.

Stock Redemption Agreement Between Corporation and Stockholder on Retirement of Shareholder

Description

How to fill out Stock Redemption Agreement Between Corporation And Stockholder On Retirement Of Shareholder?

If you’re searching for a way to properly complete the Stock Redemption Agreement Between Corporation and Stockholder on Retirement of Shareholder without hiring a lawyer, then you’re just in the right spot. US Legal Forms has proven itself as the most extensive and reliable library of official templates for every individual and business scenario. Every piece of paperwork you find on our online service is created in accordance with nationwide and state laws, so you can be certain that your documents are in order.

Follow these simple guidelines on how to acquire the ready-to-use Stock Redemption Agreement Between Corporation and Stockholder on Retirement of Shareholder:

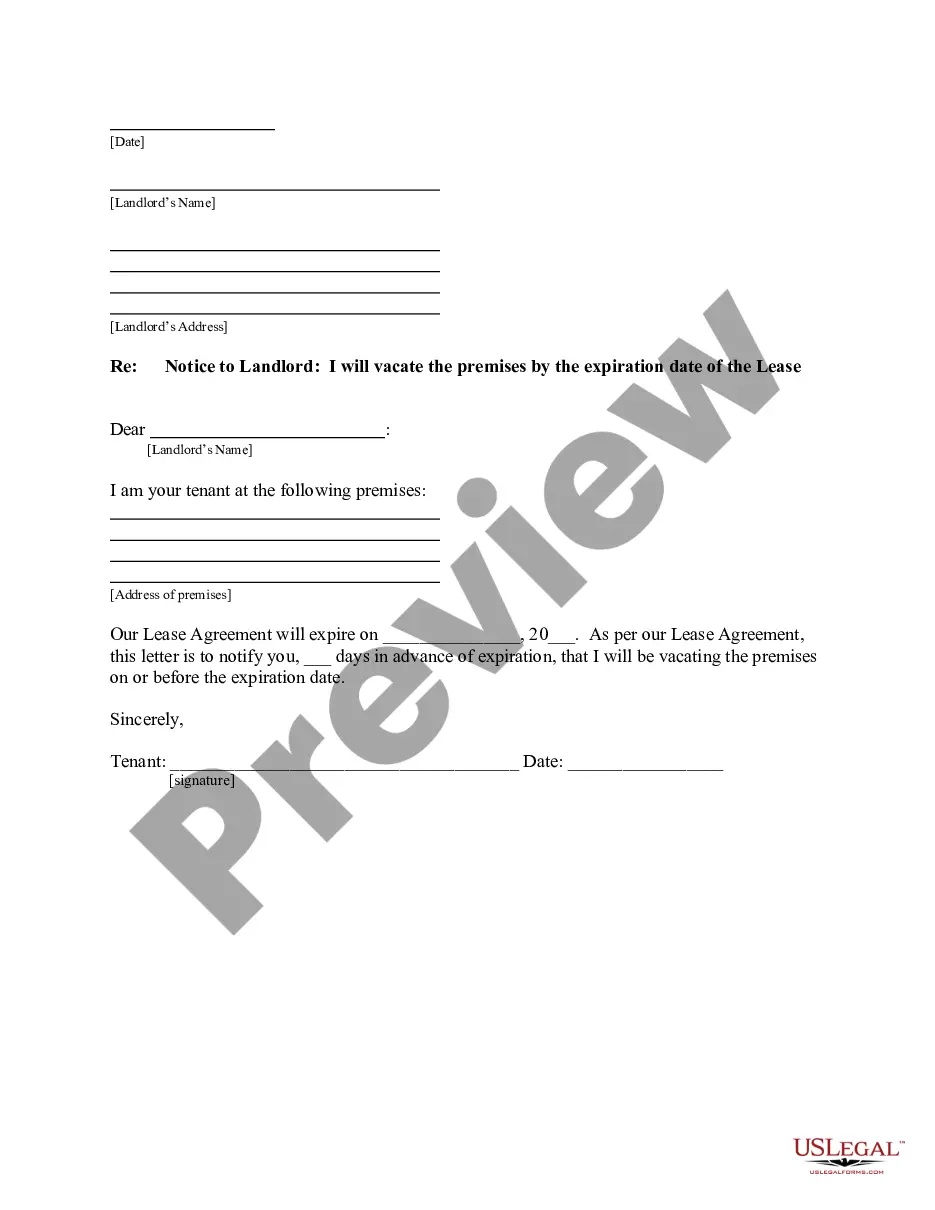

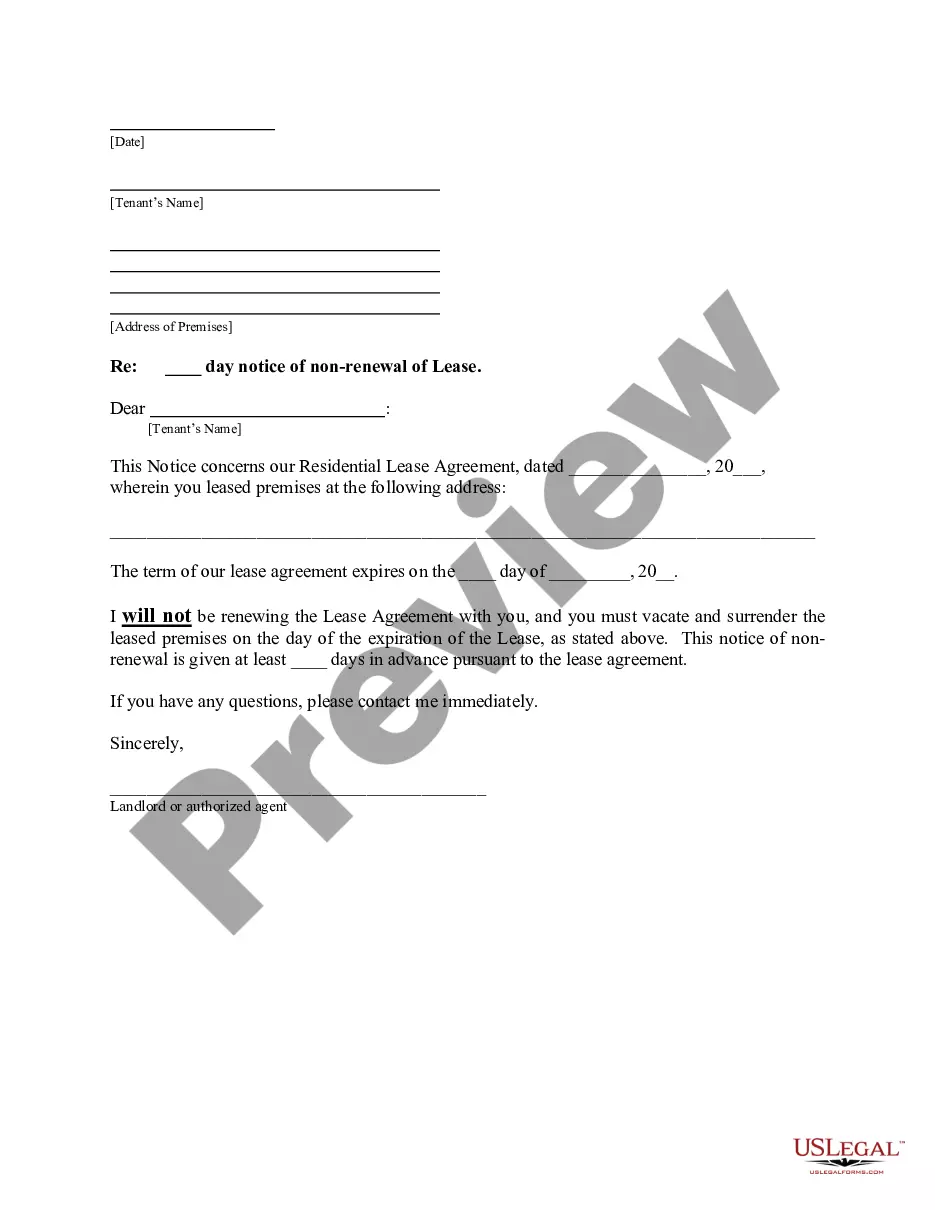

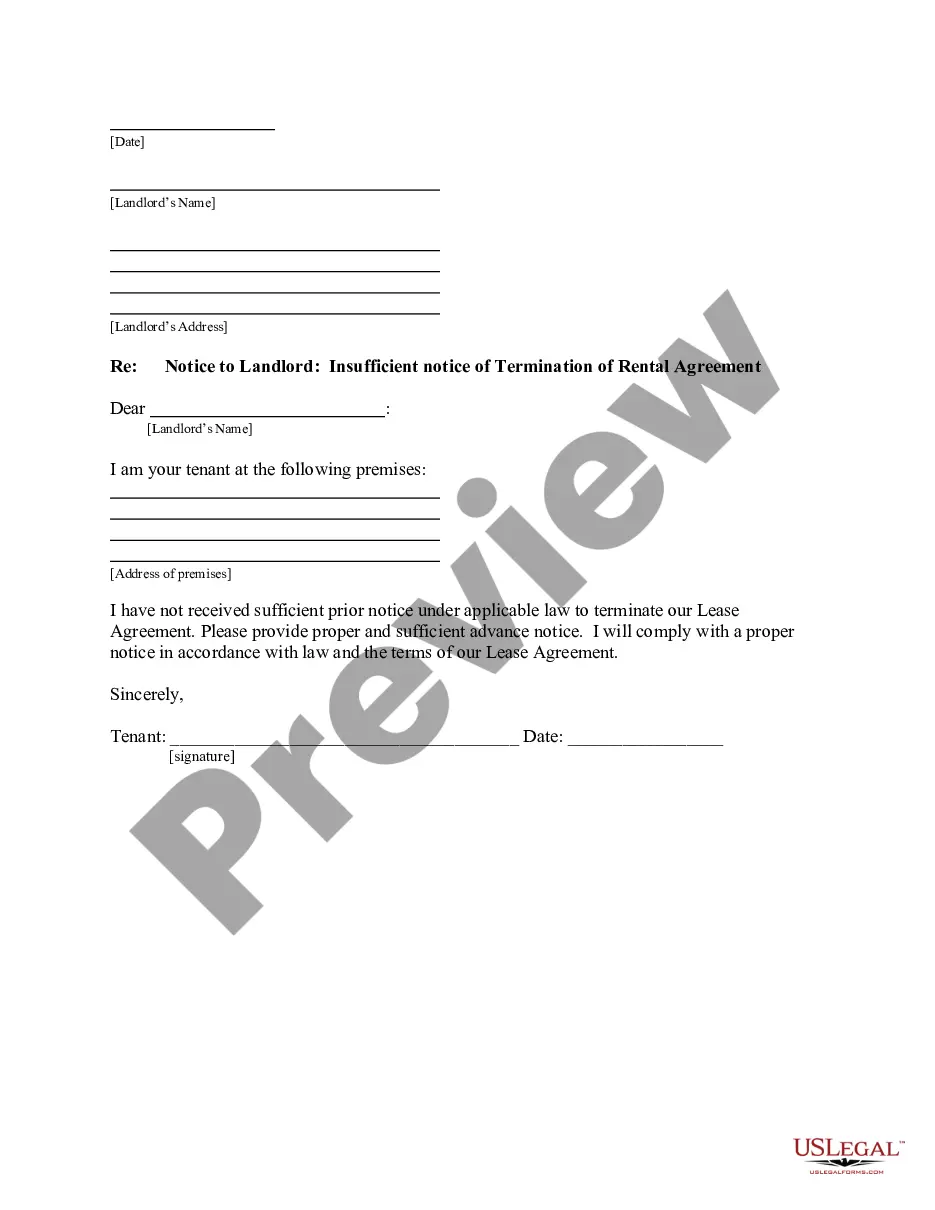

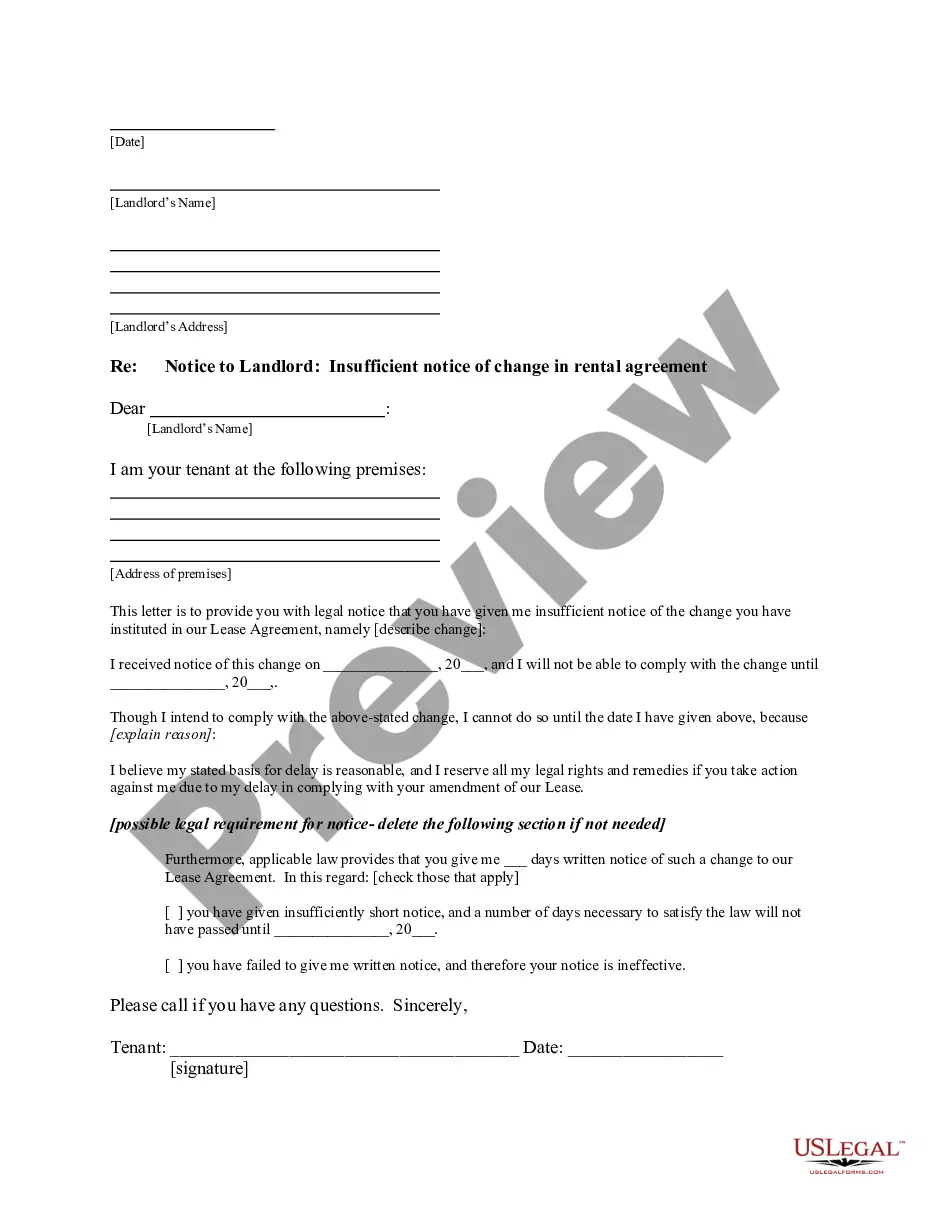

- Ensure the document you see on the page meets your legal situation and state laws by examining its text description or looking through the Preview mode.

- Enter the document title in the Search tab on the top of the page and choose your state from the dropdown to find an alternative template in case of any inconsistencies.

- Repeat with the content check and click Buy now when you are confident with the paperwork compliance with all the demands.

- Log in to your account and click Download. Sign up for the service and select the subscription plan if you still don’t have one.

- Use your credit card or the PayPal option to purchase your US Legal Forms subscription. The document will be available to download right after.

- Choose in what format you want to save your Stock Redemption Agreement Between Corporation and Stockholder on Retirement of Shareholder and download it by clicking the appropriate button.

- Upload your template to an online editor to complete and sign it quickly or print it out to prepare your hard copy manually.

Another great thing about US Legal Forms is that you never lose the paperwork you purchased - you can pick any of your downloaded templates in the My Forms tab of your profile whenever you need it.

Form popularity

FAQ

The four types of buy sell agreements are: Cross-purchase agreement. Entity purchase agreement. Wait-and-See. Business-continuation general partnership.

When a corporation purchases the stock of a departing shareholder, it's called a ?redemption.? When the other stockholders purchase the stock, it's called a cross-purchase. Typically, the redemption versus cross-purchase decision doesn't impact the ultimate control results.

Redeem shares the easy way Redeemable shares are shares that a company has agreed it will, or may, redeem (in other words buy back) at some future date. The shareholder will still have the right to sell or transfer the shares subject to the articles of association or any shareholders' agreement.

purchase agreement is a document that allows a company's partners or other shareholders to purchase the interest or shares of a partner who dies, becomes incapacitated or retires.

Buyout agreement (also known as a buy-sell agreement) refers to a contract that gives rights to at least one party of the contract to buy the share, assets, or rights of another party given a specific event. These agreements can arise in a variety of contexts as stand-alone contracts or parts of larger agreements.

In a cross-purchase agreement, the remaining owners or partners purchase the share of the business that is for sale. In an entity-purchase agreement (also known as a redemption agreement), the business entity itself buys the deceased's share of the business.

This is called a "cross purchase" of stock. Each shareholder is thus personally liable for the payment of the stock and the disabled or deceased shareholder's estate is actually selling to as many people as there are surviving shareholders.

A stock redemption is a transaction in which a corporation acquires its own stock from a shareholder in exchange for cash or other property. The redeeming corporation generally does not recognize gain or loss, unless it distributes appreciated property.