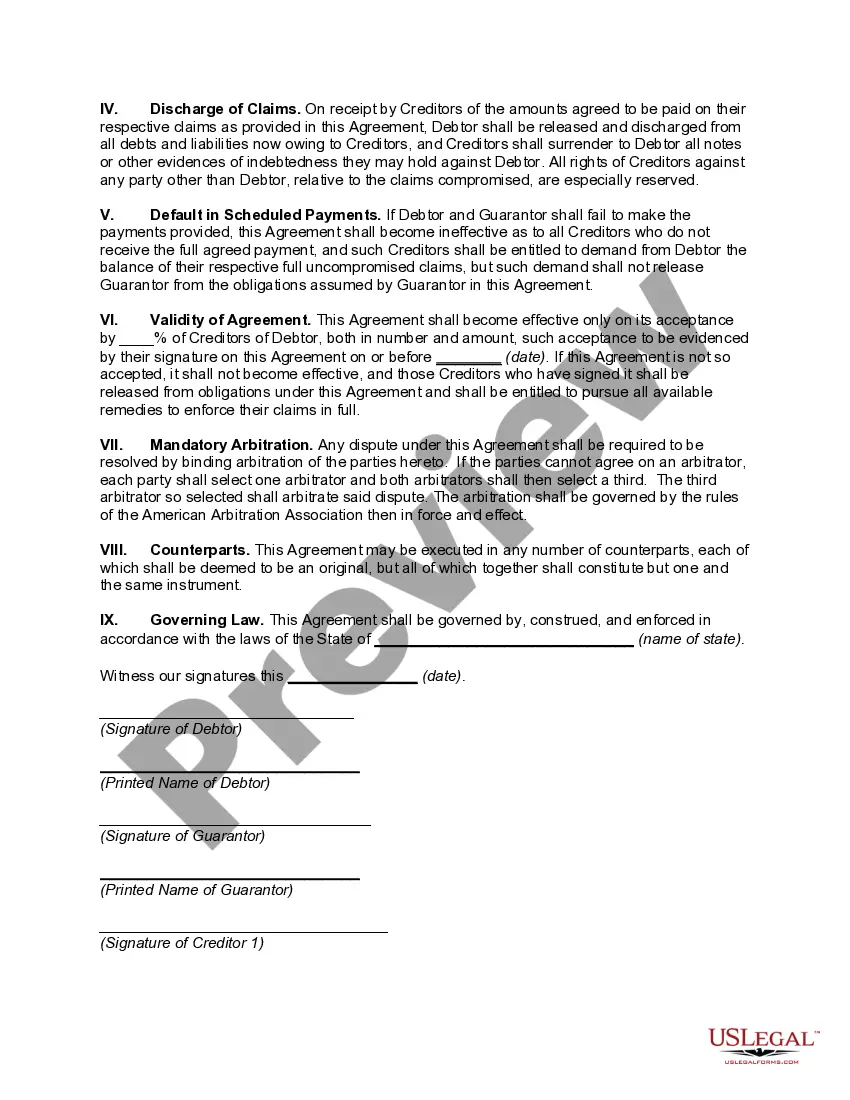

Composition with Creditors with Third Party Guaranty is a financial restructuring process used by debtors to reach an agreement with their creditors. This arrangement entails a third party guaranteeing the loan repayment, typically a bank or other financial institution. The guarantor's role is to ensure that the agreement is kept by the debtor, regardless of their financial situation. The guarantor typically has no direct involvement in the negotiations between the debtor and creditors but will be responsible for any missed payments. The Composition with Creditors with Third Party Guaranty process can be broken down into three main types: 1. Voluntary Composition: A voluntary composition involves the debtor voluntarily entering into a payment plan with their creditors and the guarantor agreeing to cover any missed payments. 2. Compulsory Composition: A compulsory composition is similar to a voluntary composition except that it is imposed by a court order. This is typically used when the debtor is unable to agree on terms with their creditors. 3. Coercive Composition: A coercive composition is a type of compulsory composition in which the debtor is forced to accept a payment plan they do not agree with. The creditor may be granted additional leverage through coercive composition, such as the ability to garnish wages or other assets. In all types of Composition with Creditors with Third Party Guaranty, the guarantor is liable for any missed payments and is responsible for ensuring that the agreement is kept by the debtor. This type of arrangement can be a beneficial solution for both debtors and creditors, as it can provide a more flexible solution to debt restructuring and can reduce the risk of default.

Composition with Creditors with Third Party Guaranty

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Composition With Creditors With Third Party Guaranty?

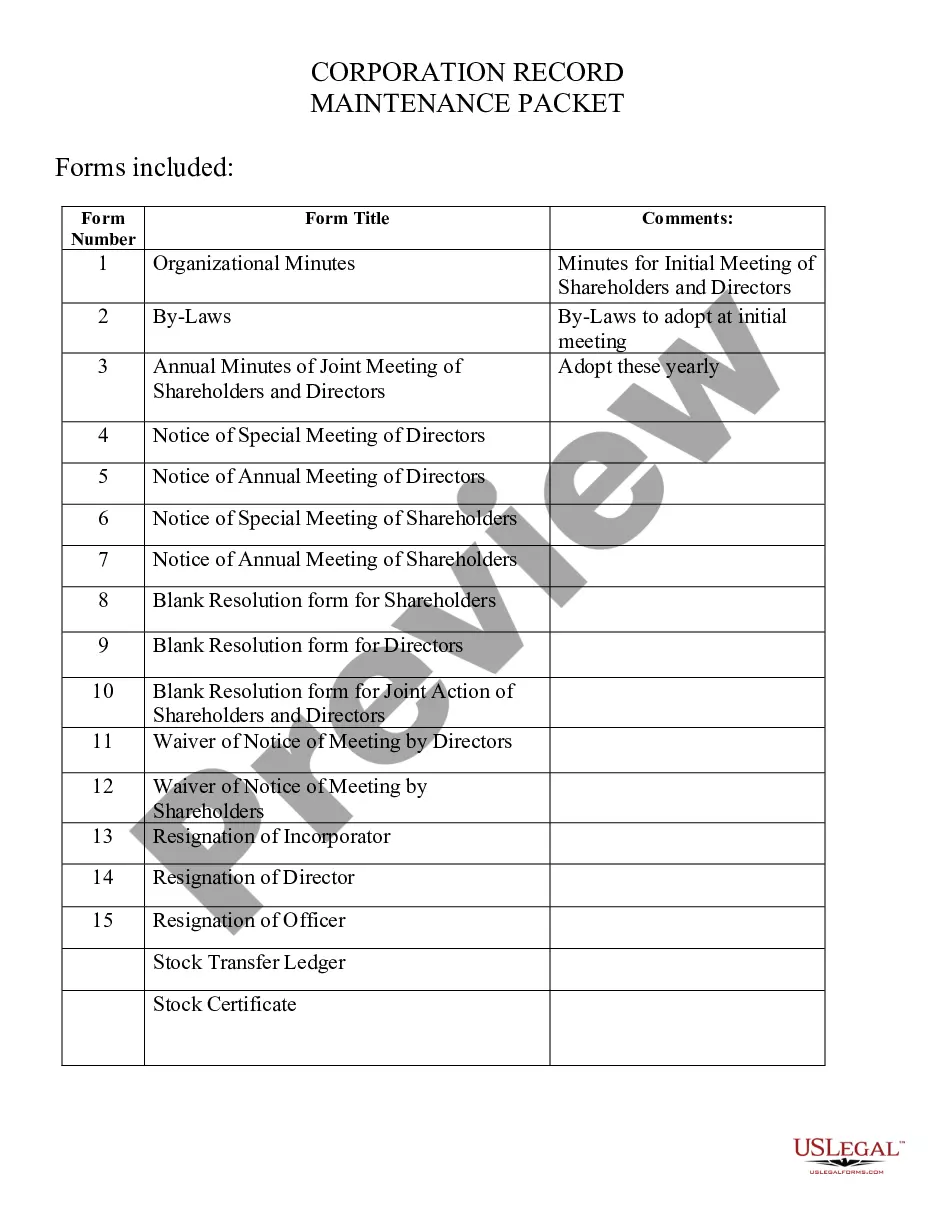

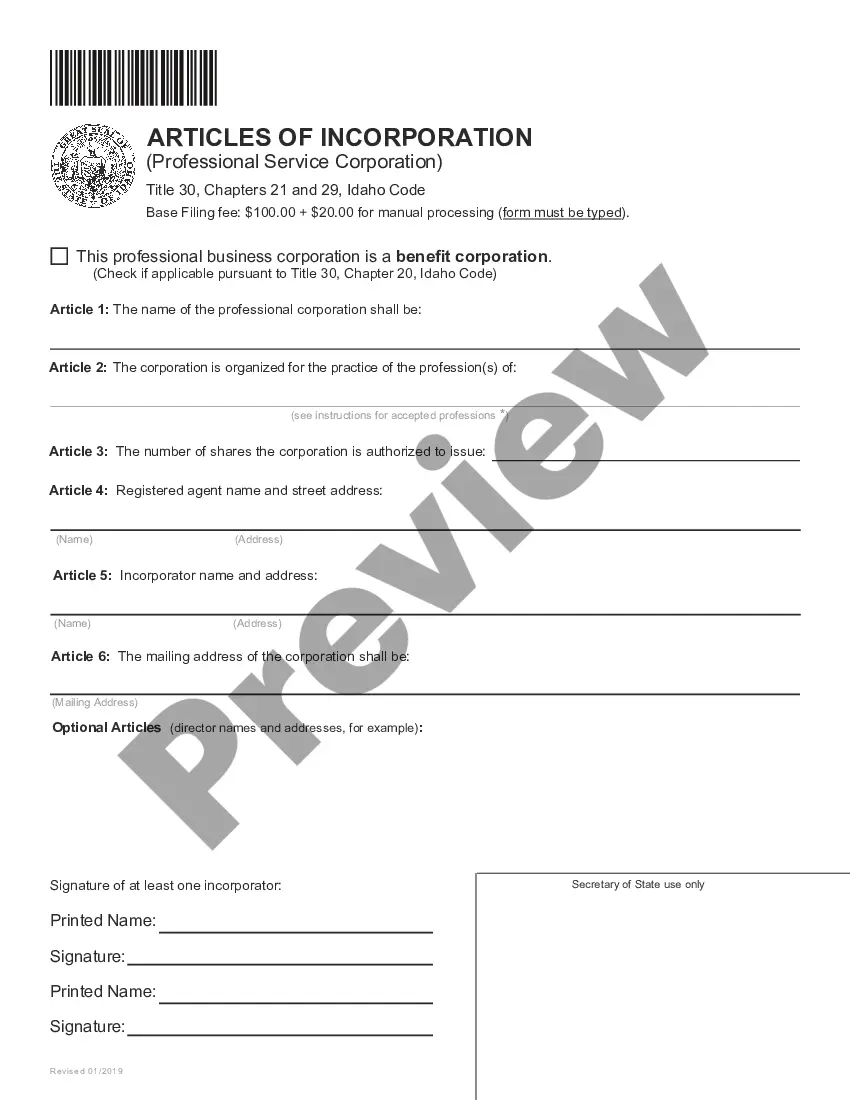

Coping with legal paperwork requires attention, precision, and using well-drafted templates. US Legal Forms has been helping people nationwide do just that for 25 years, so when you pick your Composition with Creditors with Third Party Guaranty template from our library, you can be sure it meets federal and state regulations.

Dealing with our service is straightforward and fast. To obtain the necessary document, all you’ll need is an account with a valid subscription. Here’s a quick guide for you to obtain your Composition with Creditors with Third Party Guaranty within minutes:

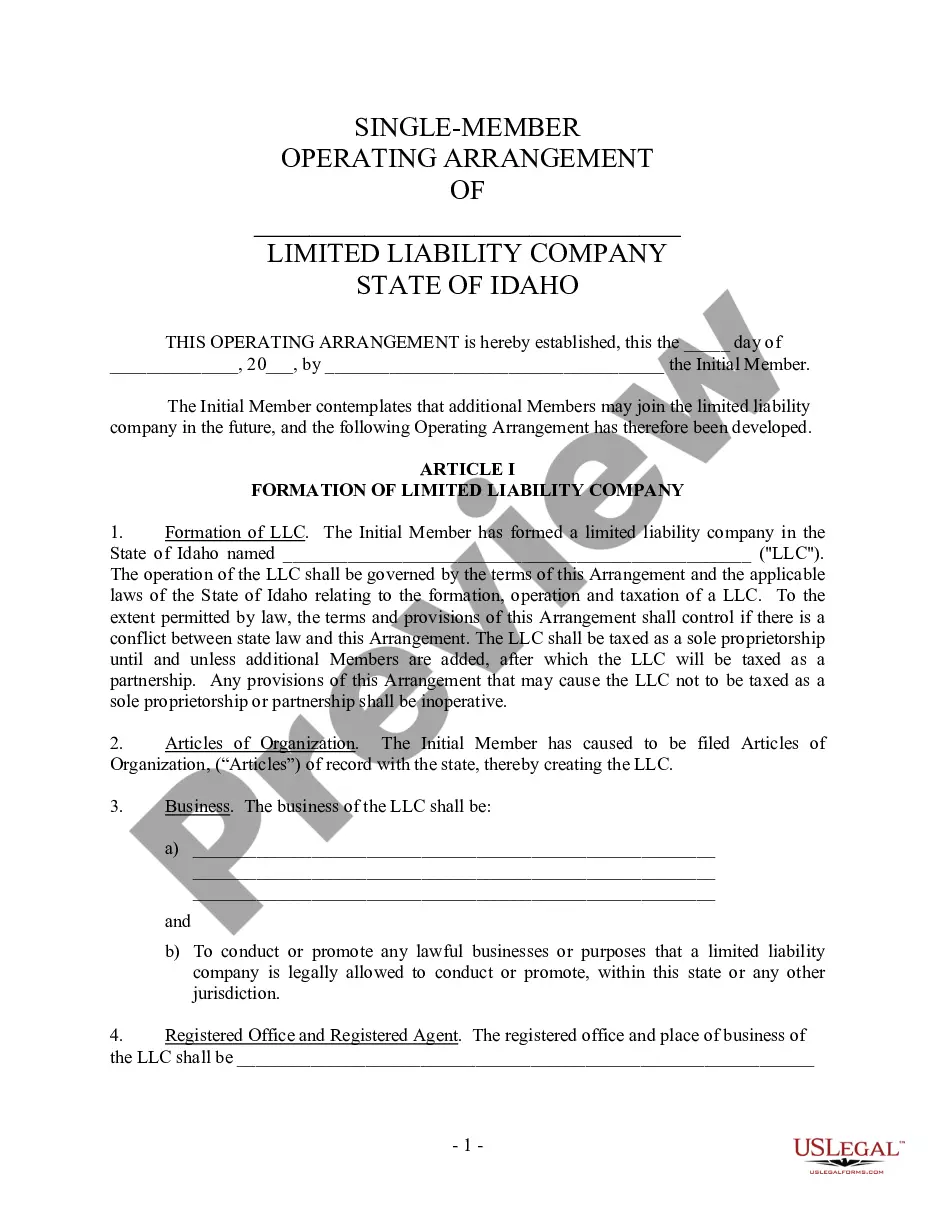

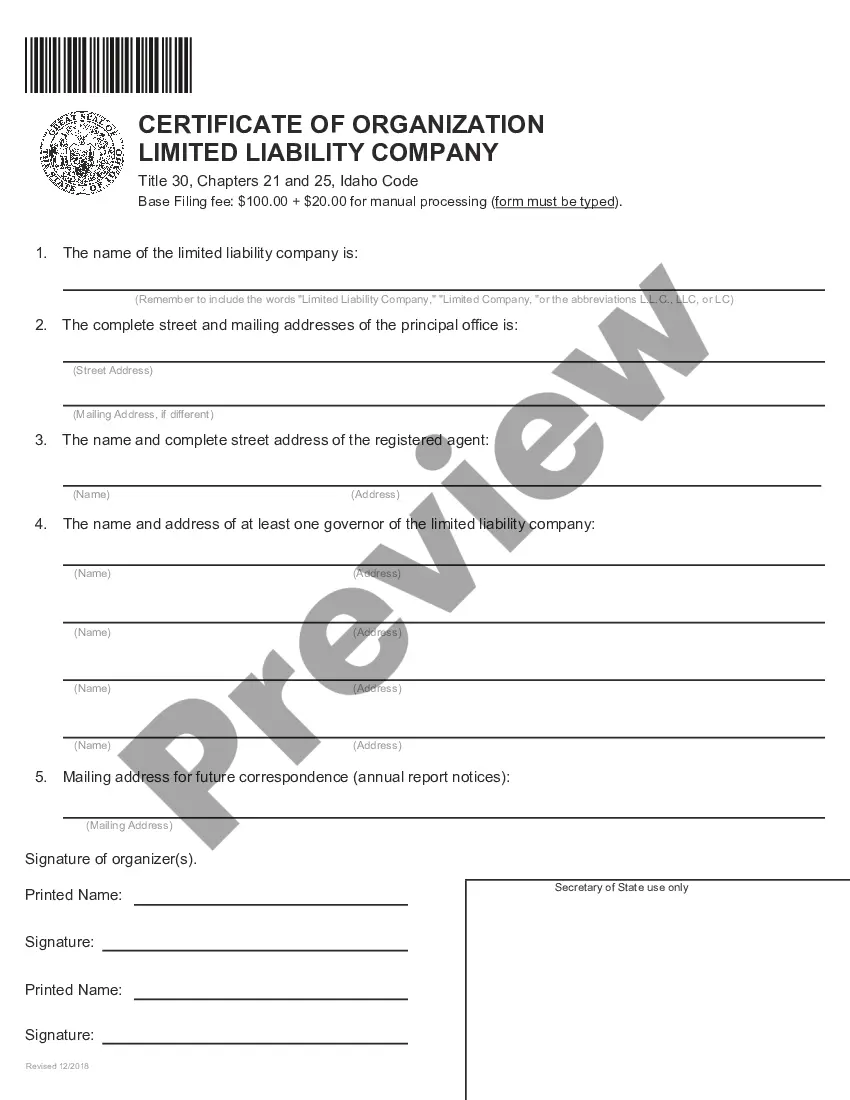

- Remember to attentively check the form content and its correspondence with general and law requirements by previewing it or reading its description.

- Look for an alternative formal blank if the previously opened one doesn’t match your situation or state regulations (the tab for that is on the top page corner).

- Log in to your account and download the Composition with Creditors with Third Party Guaranty in the format you need. If it’s your first experience with our website, click Buy now to continue.

- Create an account, decide on your subscription plan, and pay with your credit card or PayPal account.

- Choose in what format you want to obtain your form and click Download. Print the blank or add it to a professional PDF editor to prepare it electronically.

All documents are created for multi-usage, like the Composition with Creditors with Third Party Guaranty you see on this page. If you need them in the future, you can fill them out without re-payment - simply open the My Forms tab in your profile and complete your document any time you need it. Try US Legal Forms and prepare your business and personal paperwork quickly and in full legal compliance!

Form popularity

FAQ

Section 141 of the Indian Contract Act,1872 has mentioned the right of surety to get a share in the security which has been kept while entering into the contract of guarantee. The place of surety is the same as the place of the creditor in terms of security.

The ?impairment of collateral? defense represents one of the most popular guarantor defenses. Guar- antors often assert it against secured lenders that fail to perfect their security or that release collateral with- out the guarantor's consent.

WHAT IS A COMPOSITION? A creditor composition agreement is a non-statutory, out-of-court arrangement in which a debtor negotiates and enters into a settlement of its unsecured liabilities with its vendors, landlords, and other large creditors to provide debt relief and a restructuring.

Suretyship: An express promise by a third party (the surety) to a creditor to be primarily responsible for the debtor's obligation to the creditor. Simply put, the third party is completely and primarily responsible for the debt of the principal.

By guaranty, a person called the guarantor, binds himself to the creditor to fulfill the obligation of the principal debtor in case the latter should fail to do so. A guarantor is an insurer of the debt and essentially guarantees that the debt will be paid one way or another.

A guarantor is liable to pay if the principal debtor defaults. The creditor has to enforce the guarantee within the limitation period stipulated under the limitation act. As per article 55 of limitation act 1963, the time-limit of 36 months would be reckoned from the date the guarantee contract is breached.

The agreement is that the debtor will pay the creditors less than what they owe in order to settle the debt. This is called a composition. The creditors agree to this because they would rather get some of their money back than none at all.

Right to be notified of contract changes The lender must give you, the guarantor, full written details of any changes to the credit contract that either increase the borrower's obligations or shorten the amount of time the borrower has to pay the debt.