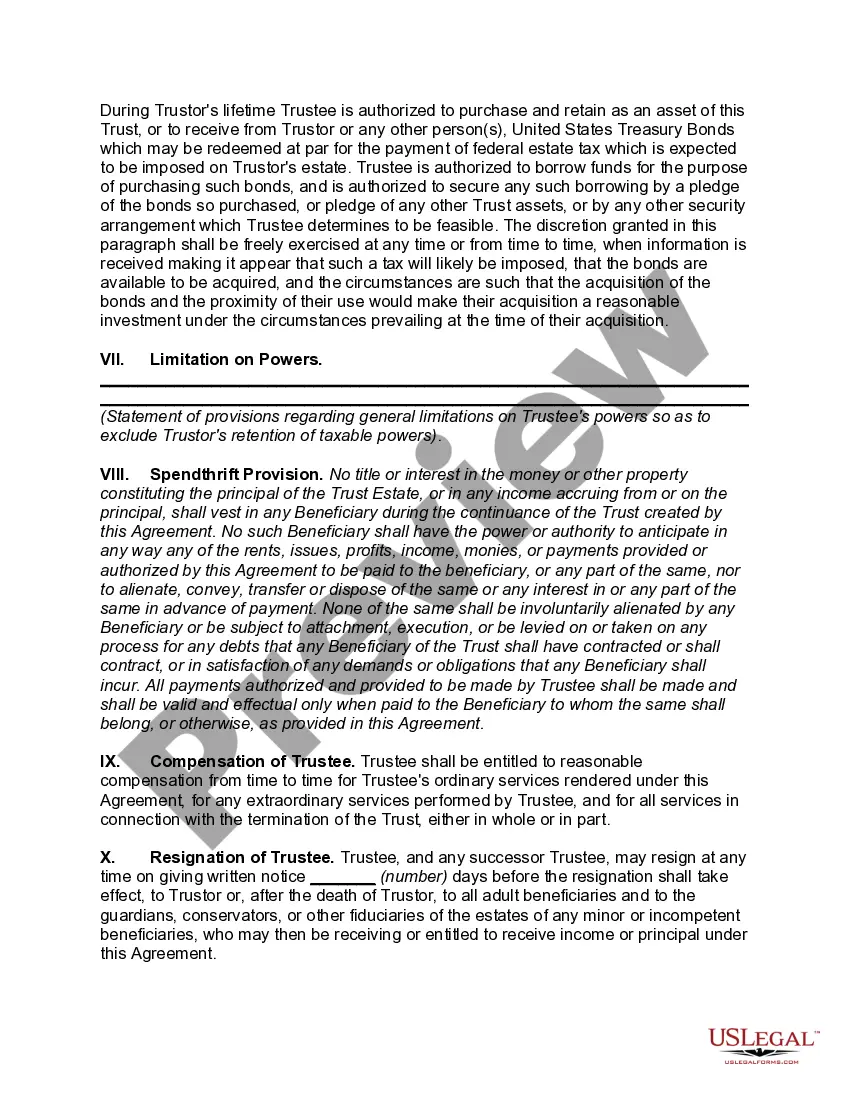

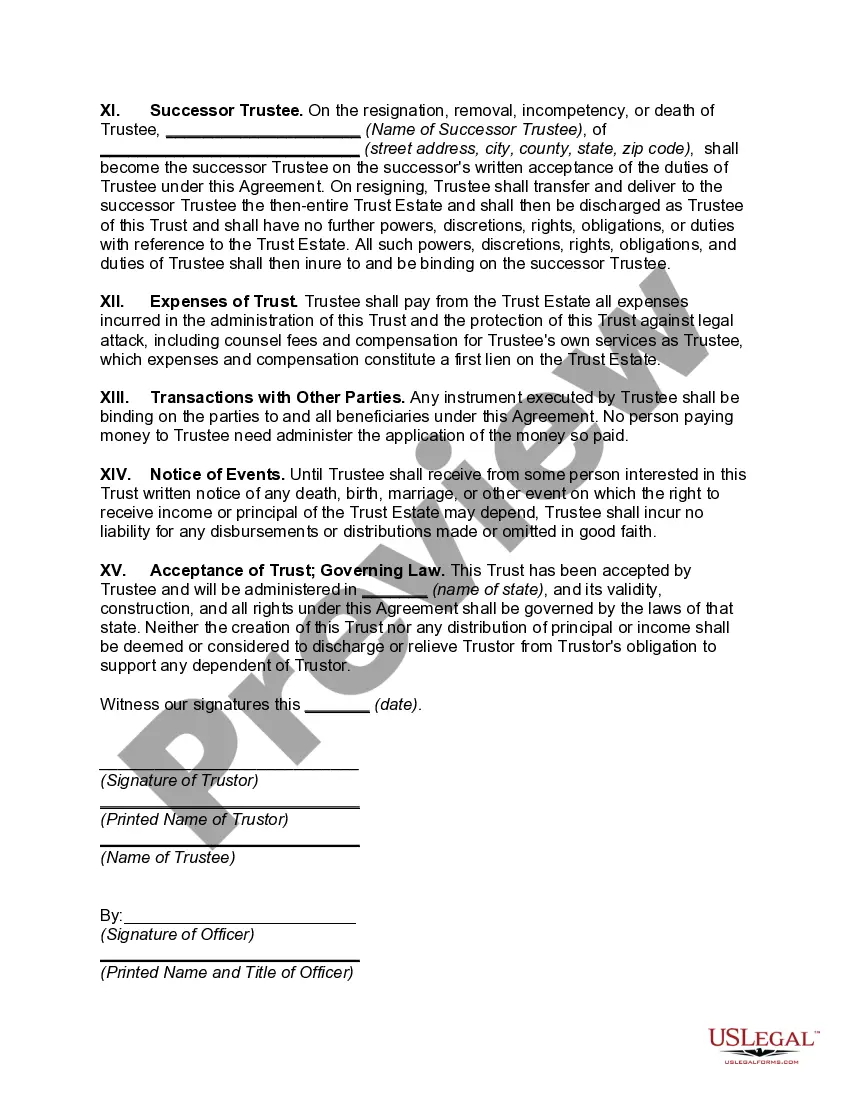

A Trust Agreement for Minor Qualifying for Annual Gift-tax Exclusion is a legal document that is created with the purpose of allowing a parent or guardian to transfer their assets to a child or minor without having to pay any gift tax. This agreement is typically used when a parent or guardian wants to provide financial assistance to a minor, but does not want to incur a gift tax liability. The trust agreement will outline the terms of the transfer and set out the rights and responsibilities of the minor beneficiary, the parent or guardian, and the trustee. The trust agreement will also specify the amount of money that can be transferred to the minor each year without incurring any gift tax. The two main types of Trust Agreement for Minor Qualifying for Annual Gift-tax Exclusion are the custodial trust and the irrevocable trust. A custodial trust is typically used when the parent or guardian wishes to retain control over the assets transferred to the minor until the minor reaches a certain age, at which point the assets will be distributed to the minor. An irrevocable trust is more permanent and the assets transferred to the minor cannot be revoked or amended.

Trust Agreement for Minor Qualifying for Annual Gift-tax Exclusion

Description

How to fill out Trust Agreement For Minor Qualifying For Annual Gift-tax Exclusion?

US Legal Forms is the most straightforward and cost-effective way to find appropriate legal templates. It’s the most extensive online library of business and individual legal documentation drafted and verified by lawyers. Here, you can find printable and fillable templates that comply with national and local laws - just like your Trust Agreement for Minor Qualifying for Annual Gift-tax Exclusion.

Obtaining your template requires just a couple of simple steps. Users that already have an account with a valid subscription only need to log in to the web service and download the form on their device. Afterwards, they can find it in their profile in the My Forms tab.

And here’s how you can obtain a properly drafted Trust Agreement for Minor Qualifying for Annual Gift-tax Exclusion if you are using US Legal Forms for the first time:

- Look at the form description or preview the document to make sure you’ve found the one meeting your needs, or locate another one using the search tab above.

- Click Buy now when you’re sure of its compatibility with all the requirements, and judge the subscription plan you prefer most.

- Register for an account with our service, log in, and pay for your subscription using PayPal or you credit card.

- Choose the preferred file format for your Trust Agreement for Minor Qualifying for Annual Gift-tax Exclusion and download it on your device with the appropriate button.

After you save a template, you can reaccess it at any time - simply find it in your profile, re-download it for printing and manual fill-out or upload it to an online editor to fill it out and sign more effectively.

Take advantage of US Legal Forms, your trustworthy assistant in obtaining the corresponding official paperwork. Try it out!

Form popularity

FAQ

Yes. If the grantor desires the gift to qualify for the annual gift tax exclusion, the trustee must follow the Crummey withdrawal notice procedure each time a gift is made to the trust.

A minor's trust can be created for a beneficiary under the age of 21 pursuant to Internal Revenue Code Section 2503(c). Gifts to the trust will be treated as gifts of present interests in property, qualifying for the annual exclusion, notwithstanding the trustee controls the use of the property in the trust.

Gifts in trust are commonly used to pass wealth from one generation to another by establishing a trust fund. Typically, the IRS taxes the value of a gift being transferred up to the annual gift tax exclusion amount. A gift in trust is a way to avoid taxes on gifts that exceed the annual gift tax exclusion amount.

§2503(b), Exclusions from Gifts Where there has been a transfer to any person of a present interest in property, the possibility that such interest may be diminished by the exercise of a power shall be disregarded in applying this subsection, if no part of such interest will at any time pass to any other person.

The annual federal gift tax exclusion allows an individual to gift up to $17,000 (or $34,000 if spouses elect to split gifts) in 2023 to as many people as he or she wishes, without those gifts counting against the $12.92 million lifetime gift tax exemption.

Is There Tax on Gifts to Children? Gifts made to children may be subject to tax, but typically only if they are large gifts. As of 2022, any gift under $16,000 isn't typically subject to gift tax and doesn't need to be reported to the IRS. This is due to the annual gift tax exclusion.

The Annual Gift Exclusion Amount Can Be Saved Every Year in a Crummey Trust. You can use your annual exclusion amount, and provide guidance and instruction on how the funds will be used to benefit members of your family. An annual exclusion trust, also known as a Crummey Trust, is one way to do this.

The annual federal gift tax exclusion allows an individual to gift up to $17,000 (or $34,000 if spouses elect to split gifts) in 2023 to as many people as he or she wishes, without those gifts counting against the $12.92 million lifetime gift tax exemption.