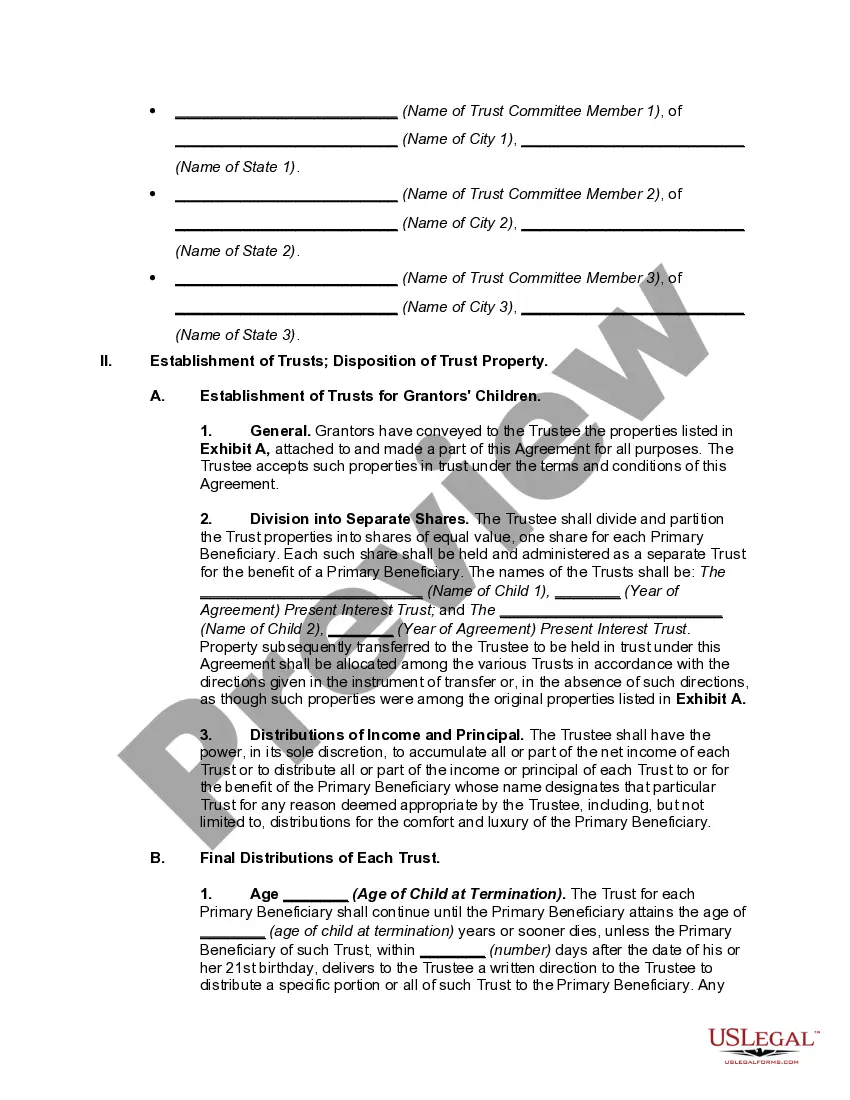

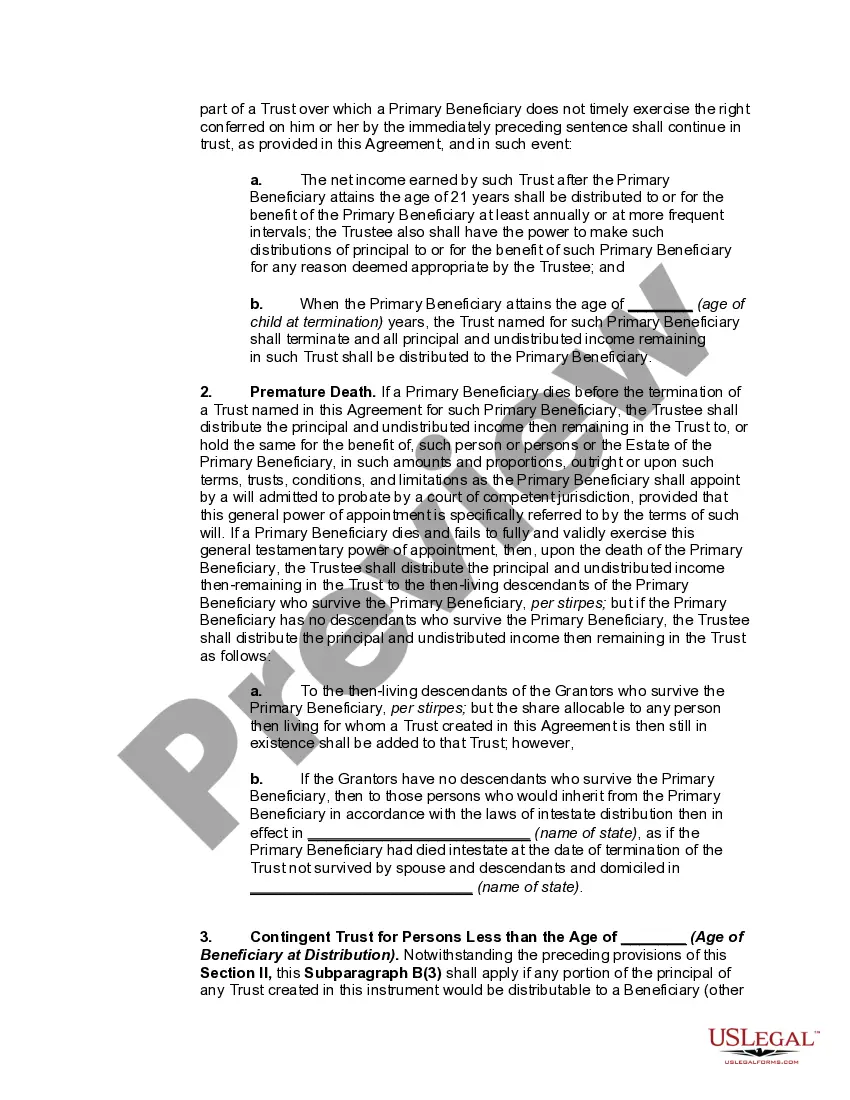

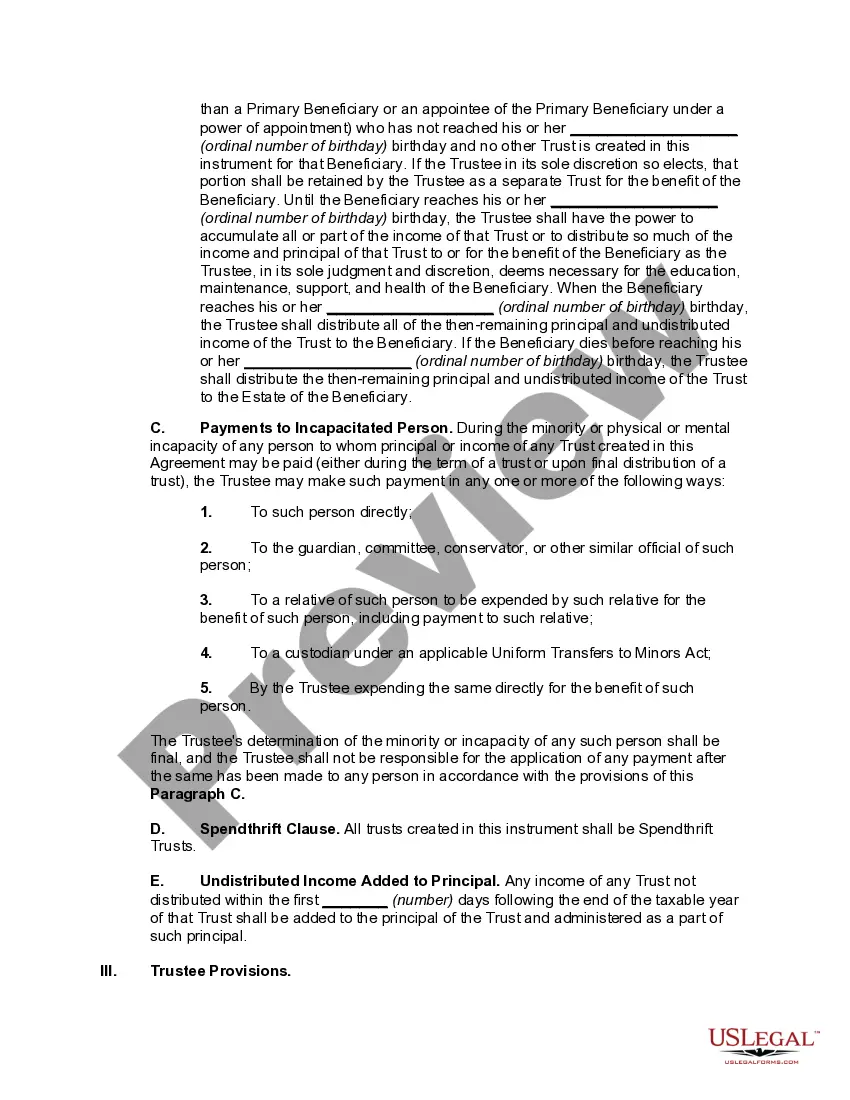

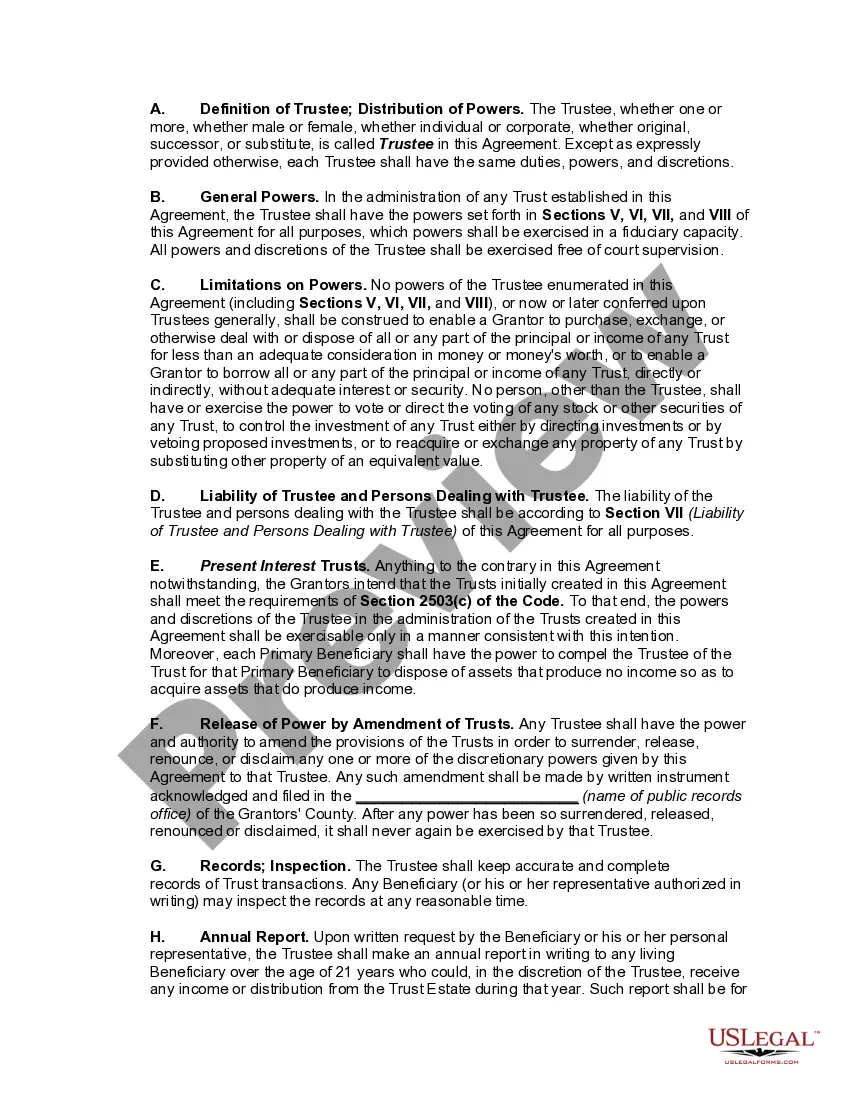

Multiple Trusts for Children -- Trust Agreement for Minor Qualifying for Annual Gift-Tax Exclusion is a type of trust that allows the donor to make a gift of money or other assets to a minor child without incurring any gift tax. This type of trust is set up in such a way that it qualifies for the annual gift tax exclusion, which allows for an individual to give up to $15,000 per year per recipient without paying any tax. There are two main types of Multiple Trusts for Children -- Trust Agreement for Minor Qualifying for Annual Gift-Tax Exclusion: irrevocable and revocable. An irrevocable trust cannot be changed or revoked by the donor, and the assets put into the trust cannot be taken out. A revocable trust, on the other hand, can be changed or revoked by the donor and the assets can be taken out at any time. The trust agreement for Minor Qualifying for Annual Gift-Tax Exclusion must include the name of the donor, the name of the beneficiary (the minor child), and the terms and conditions of the trust. The trust should also specify who is responsible for the management of the trust assets, how the assets should be used (i.e., for the benefit of the minor child), and when the trust will terminate. In addition, the trust may contain provisions for the income and principal to be distributed to the minor child or to other beneficiaries at certain ages or upon certain events.

Children Trust Agreement Minor

Description Trusts Children Trust Agreement

How to fill out Multiple Trusts For Children -- Trust Agreement For Minor Qualifying For Annual Gift-Tax Exclusion?

How much time and resources do you typically spend on composing official paperwork? There’s a better option to get such forms than hiring legal experts or spending hours searching the web for an appropriate template. US Legal Forms is the top online library that offers professionally designed and verified state-specific legal documents for any purpose, including the Multiple Trusts for Children -- Trust Agreement for Minor Qualifying for Annual Gift-Tax Exclusion.

To get and prepare an appropriate Multiple Trusts for Children -- Trust Agreement for Minor Qualifying for Annual Gift-Tax Exclusion template, adhere to these simple steps:

- Look through the form content to make sure it complies with your state laws. To do so, check the form description or use the Preview option.

- In case your legal template doesn’t meet your requirements, find another one using the search bar at the top of the page.

- If you are already registered with our service, log in and download the Multiple Trusts for Children -- Trust Agreement for Minor Qualifying for Annual Gift-Tax Exclusion. If not, proceed to the next steps.

- Click Buy now once you find the correct document. Choose the subscription plan that suits you best to access our library’s full opportunities.

- Register for an account and pay for your subscription. You can make a payment with your credit card or through PayPal - our service is totally safe for that.

- Download your Multiple Trusts for Children -- Trust Agreement for Minor Qualifying for Annual Gift-Tax Exclusion on your device and complete it on a printed-out hard copy or electronically.

Another benefit of our service is that you can access previously acquired documents that you securely store in your profile in the My Forms tab. Get them at any moment and re-complete your paperwork as often as you need.

Save time and effort completing formal paperwork with US Legal Forms, one of the most trustworthy web solutions. Sign up for us today!