Legend on Stock Certificate with Reference to Separate Document Restricting Transfer of Shares

Description Document Transfer Shares

How to fill out Legend On Stock Certificate With Reference To Separate Document Restricting Transfer Of Shares?

Employ the most extensive legal catalogue of forms. US Legal Forms is the perfect place for getting up-to-date Legend on Stock Certificate with Reference to Separate Document Restricting Transfer of Shares templates. Our platform offers a large number of legal forms drafted by certified attorneys and categorized by state.

To get a template from US Legal Forms, users simply need to sign up for an account first. If you are already registered on our platform, log in and choose the document you need and buy it. Right after purchasing templates, users can find them in the My Forms section.

To obtain a US Legal Forms subscription online, follow the steps listed below:

- Check if the Form name you’ve found is state-specific and suits your requirements.

- When the form has a Preview option, utilize it to check the sample.

- In case the template doesn’t suit you, use the search bar to find a better one.

- Hit Buy Now if the sample corresponds to your requirements.

- Select a pricing plan.

- Create your account.

- Pay with the help of PayPal or with the credit/bank card.

- Choose a document format and download the sample.

- After it is downloaded, print it and fill it out.

Save your time and effort with the platform to find, download, and fill in the Form name. Join thousands of delighted subscribers who’re already using US Legal Forms!

Stock Certificate Legend Form popularity

Stock Certificate With Other Form Names

FAQ

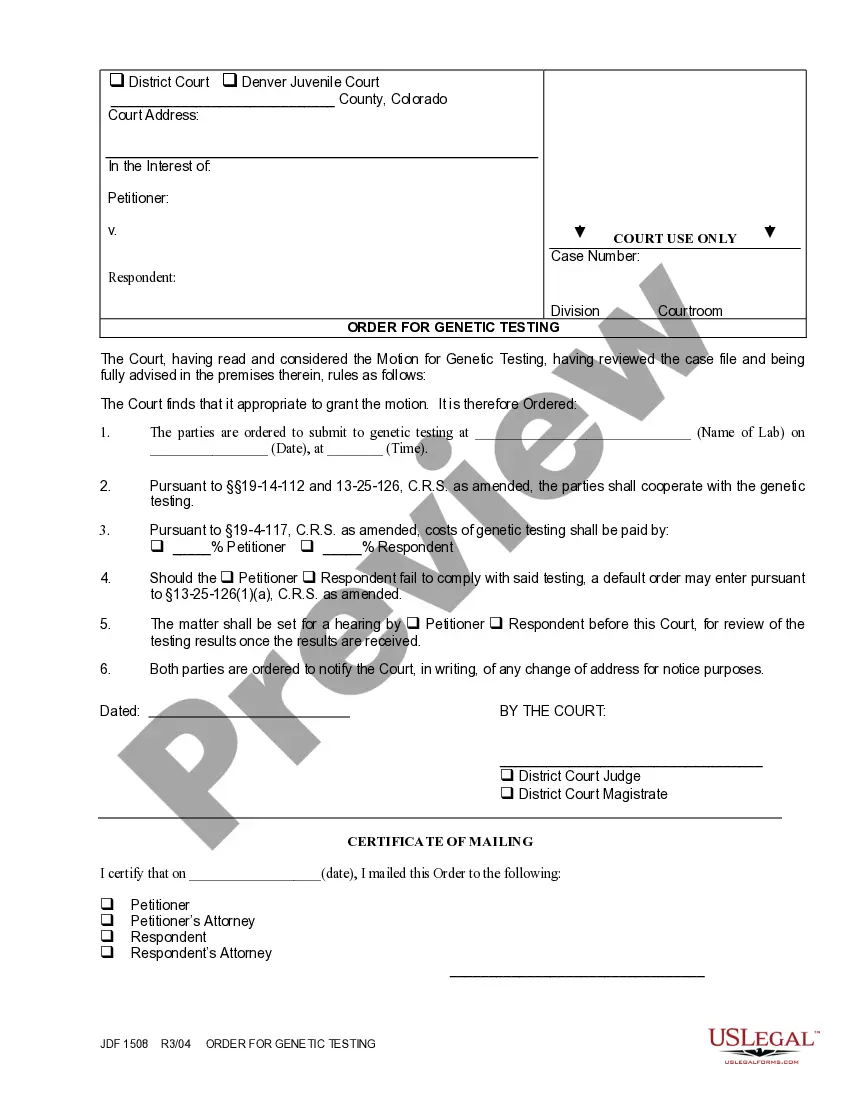

A legend is a statement on a stock certificate noting restrictions on the transfer of the stock. A stock legend is typically put in place due to the requirements established by the Securities and Exchange Commission (SEC) for unregistered securities.

Rule 144 is a set of SEC guidelines outlining the sale of restricted or unregistered securities. In order to be freely transacted, Rule 144 mandates that 5 conditions must be satisfied, including a minimum holding period, quantity restrictions, and disclosure of the transaction.

Only a transfer agent can remove a restrictive legend. But the transfer agent won't remove the legend unless the issuer consentsusually in the form of an opinion letter from the issuer's counsel to the transfer agent.

Restrictive legends are stamped or printed on the certificate or instrument, face or reverse, of restricted securities and usually begin with These securities are not registered . . . . Restricted securities that are not represented by a certificate (generally referred to as book entry) will have a notation of

When you acquire restricted securities or hold control securities, you must find an exemption from the SEC's registration requirements to sell them in a public marketplace. Rule 144 allows public resale of restricted and control securities if a number of conditions are met.

In order to have the legend on a stock certificate removed, investors should contact the company's shareholder relations department to find out the details of the removal process. Following that, the company will send a confirmation authorizing its transfer agent to remove the legend.

Restricted securities are securities acquired in an unregistered, private sale from the issuing company or from an affiliate of the issuer.Even if you've met all the conditions of Rule 144, you still cannot sell your restricted securities to the public until you've had the legend removed from the certificate.