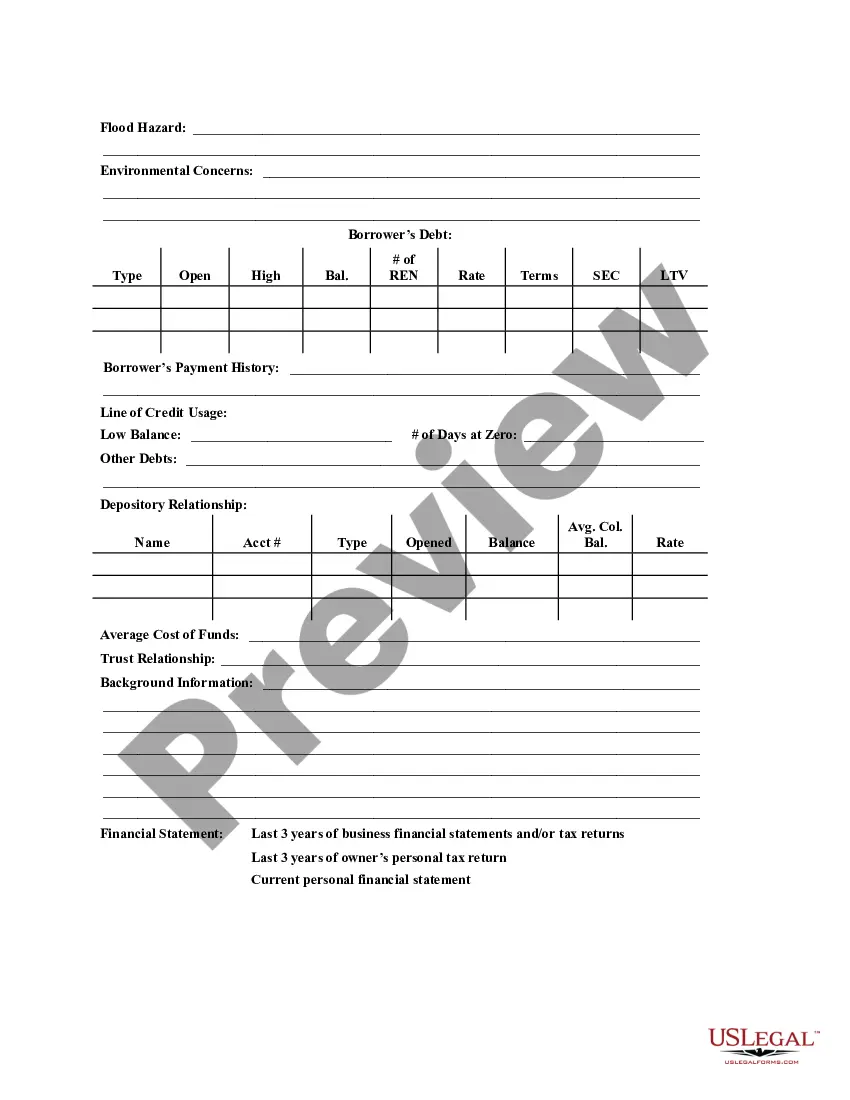

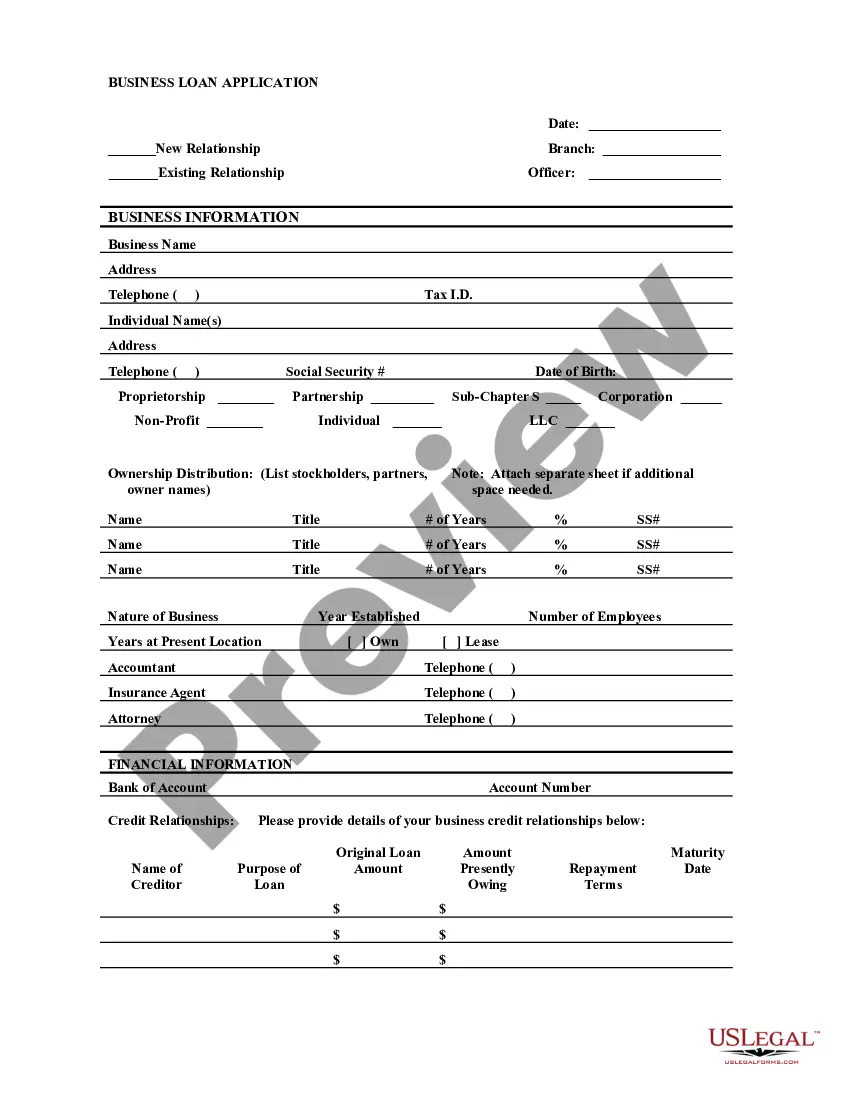

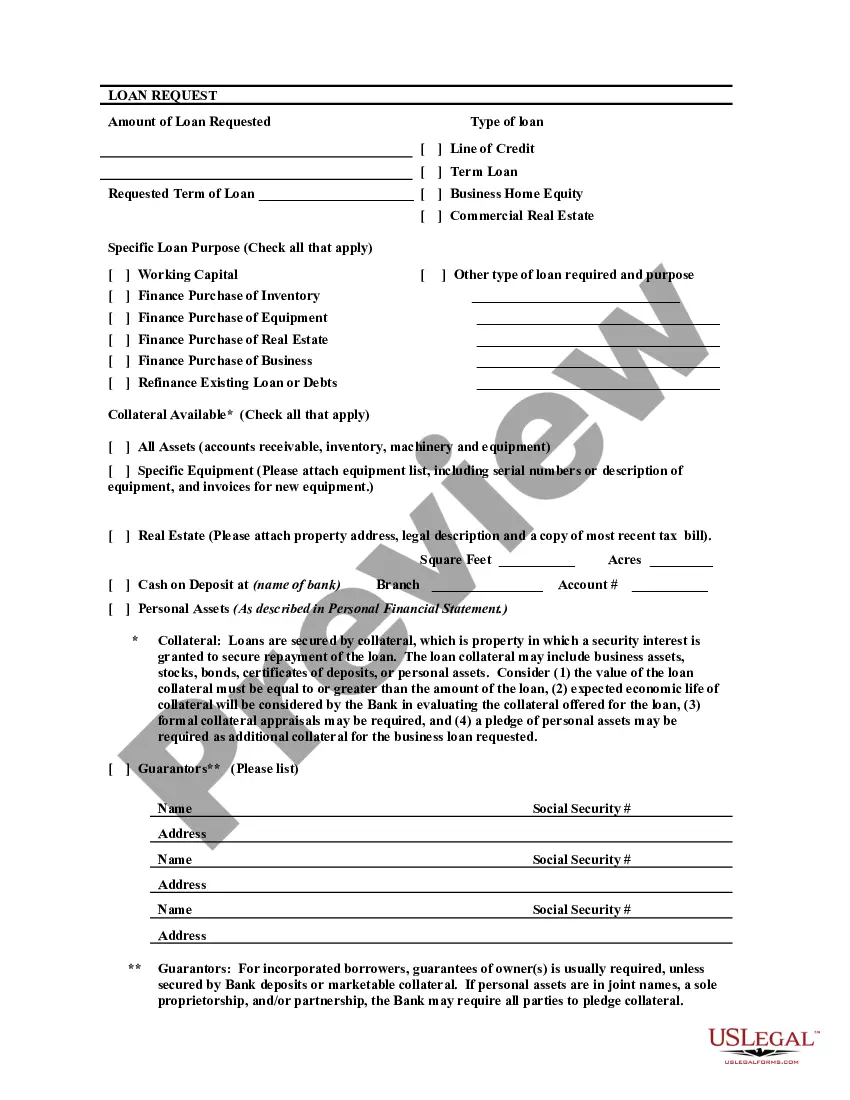

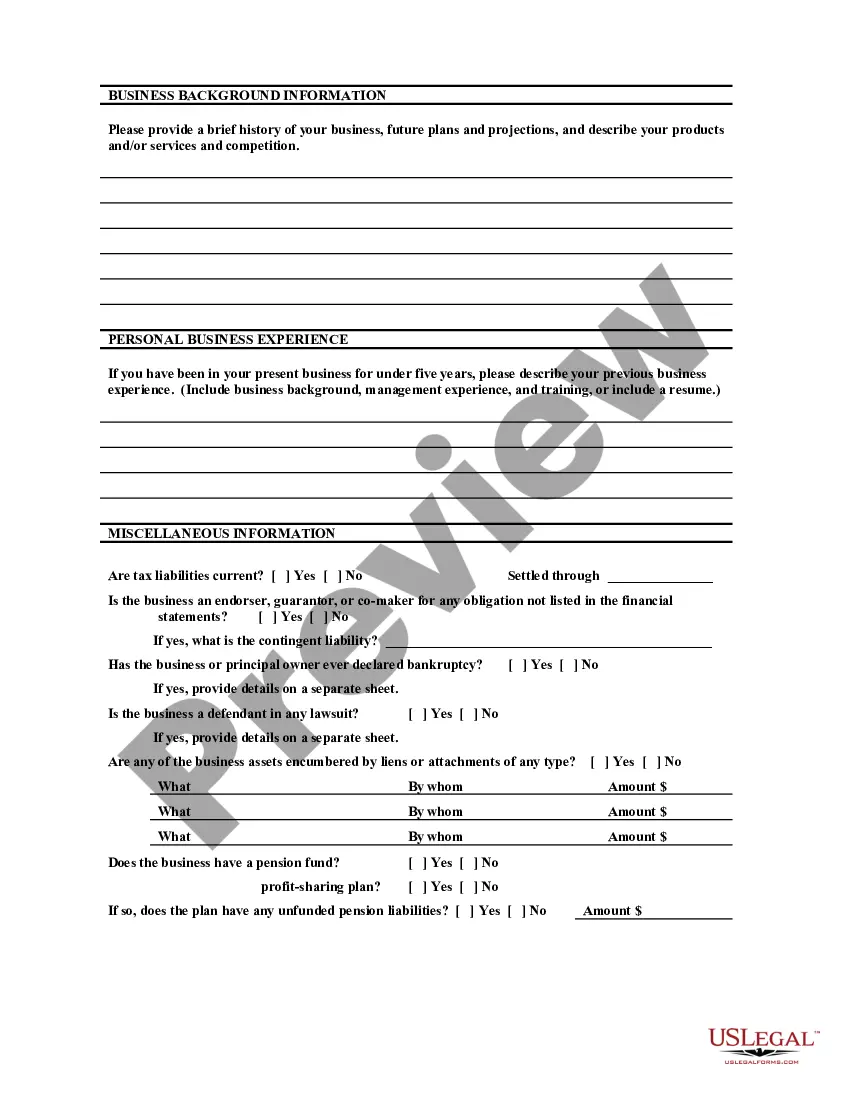

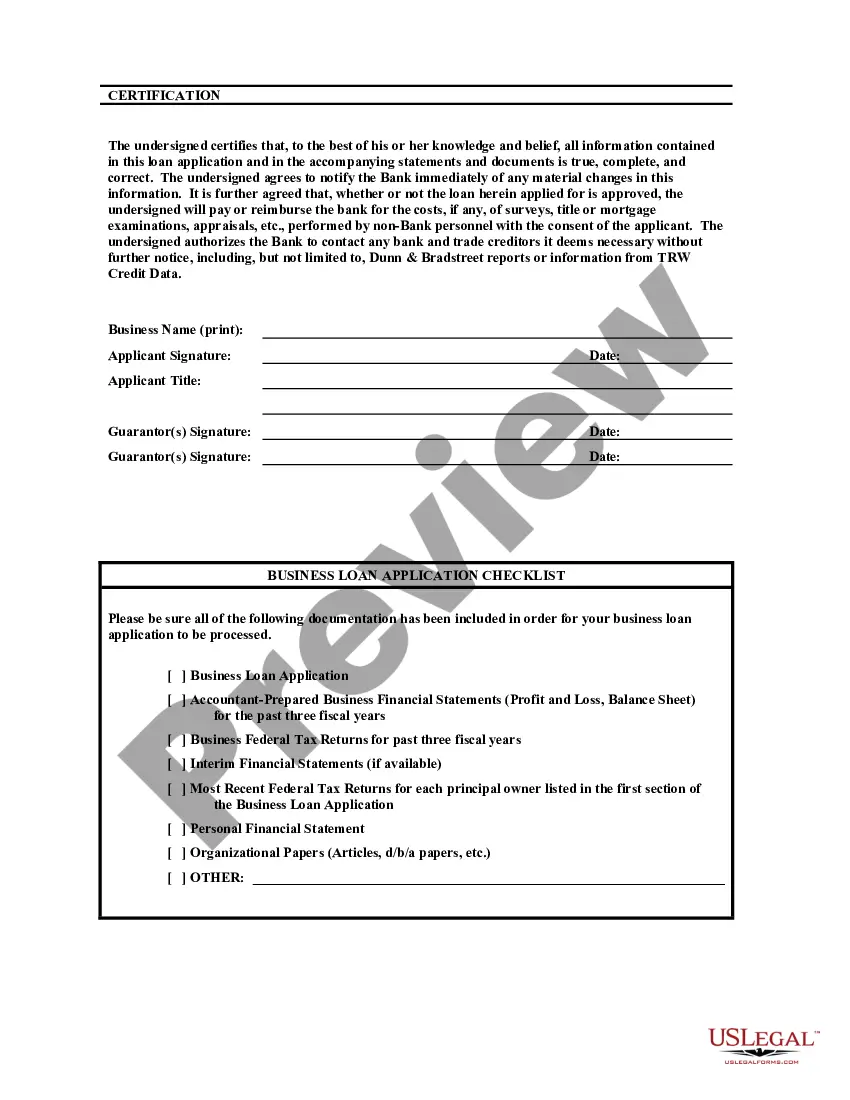

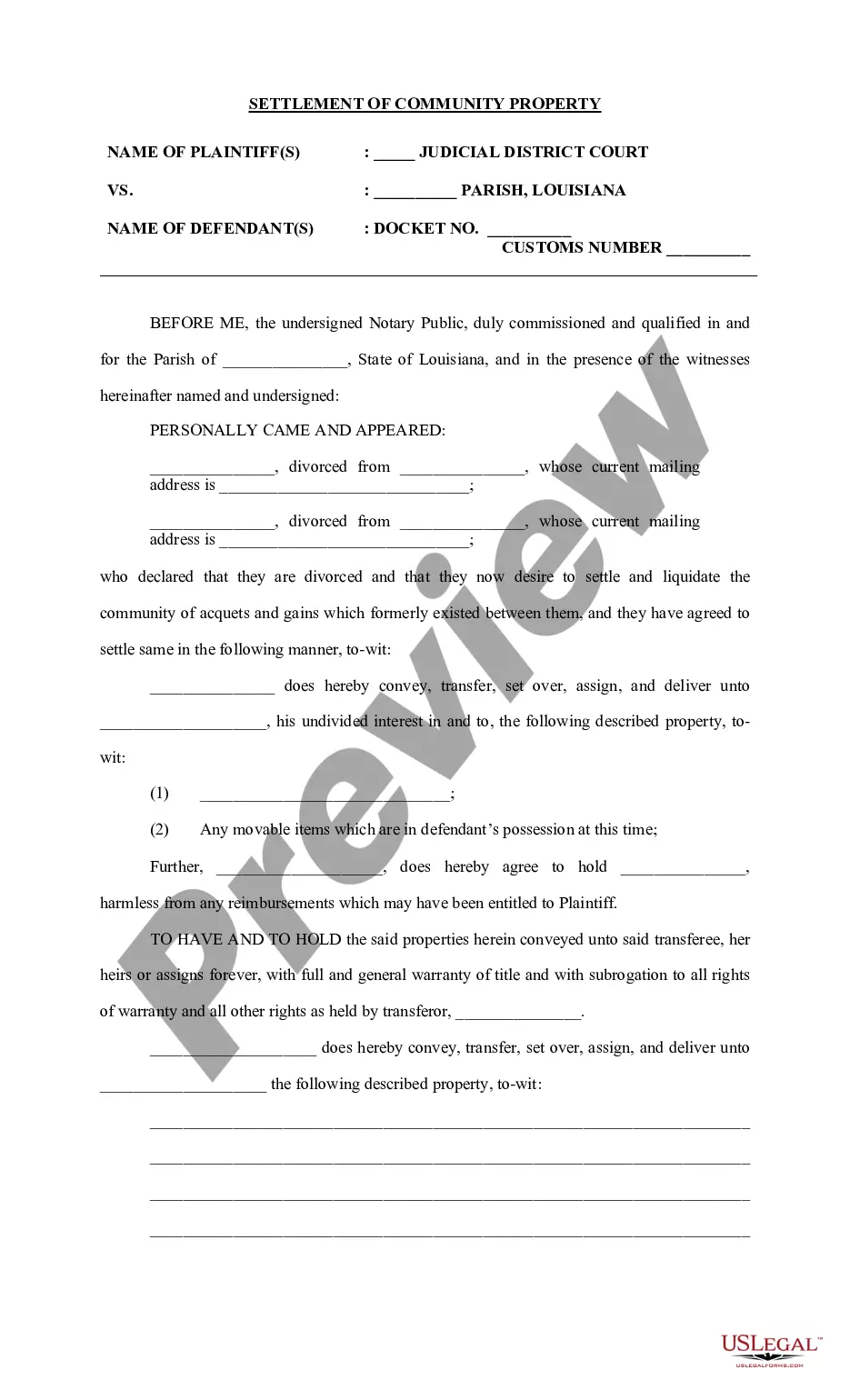

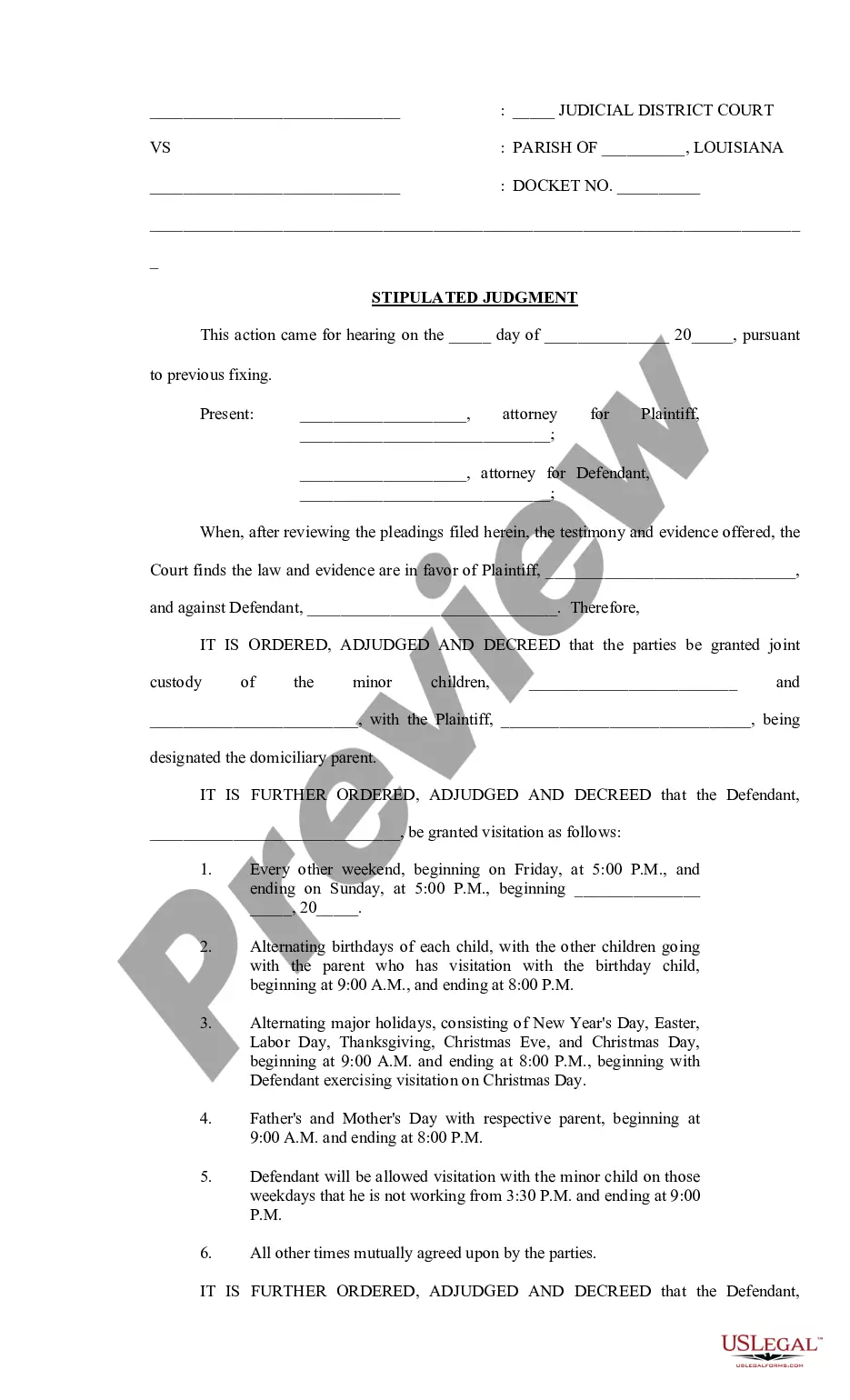

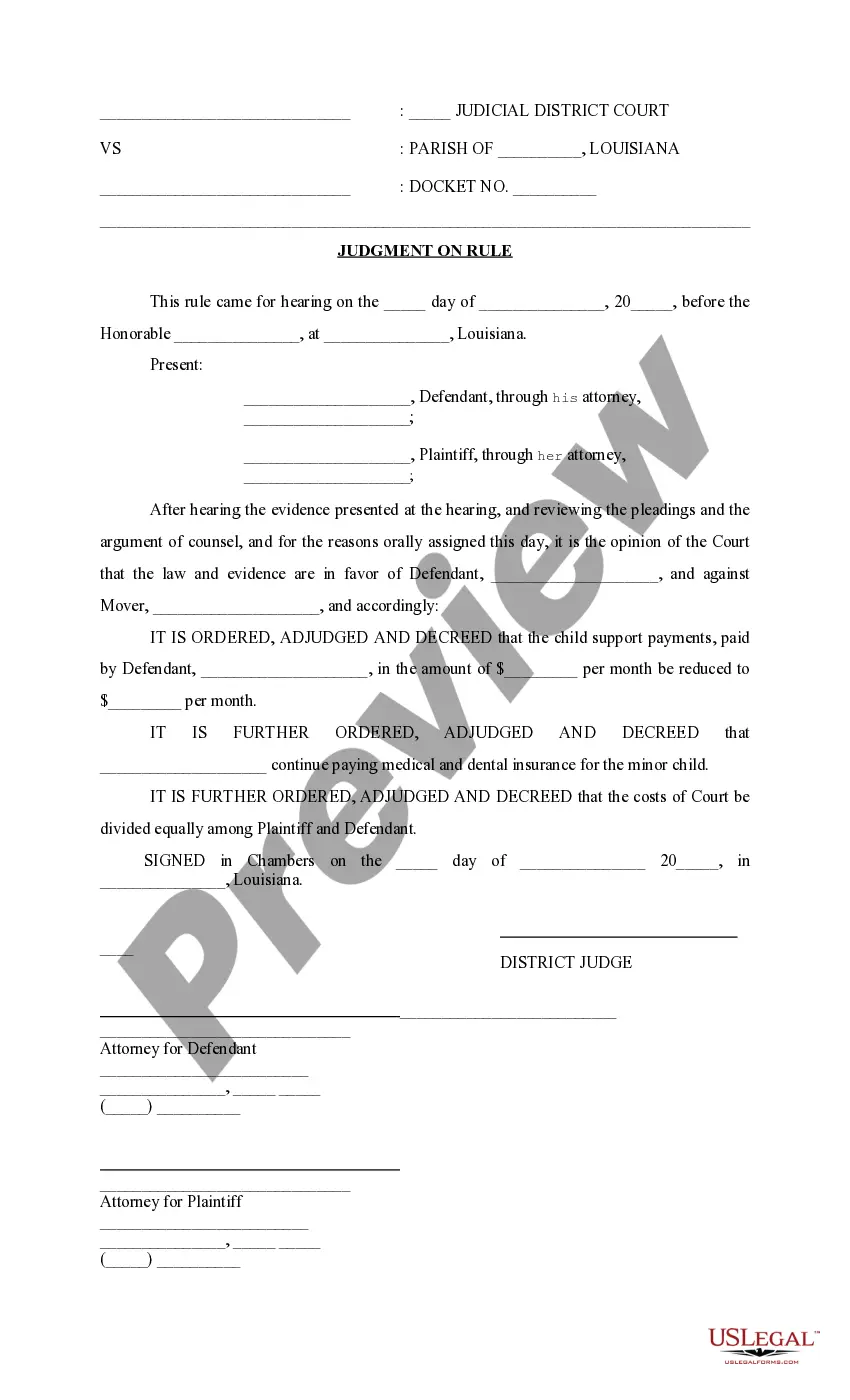

A Bank Loan Application Form and Checklist is a document used by a bank to assess a prospective borrower’s financial health and creditworthiness. The form and checklist provide the bank with an accurate assessment of the borrower’s financial history and current assets in order to determine the likelihood of repayment of the loan. The form typically includes questions related to the borrower’s income, employment, credit history, assets, liabilities, and other financial information. The checklist is used to verify the accuracy of the information provided in the form and to ensure the borrower meets the bank’s lending criteria. There are two main types of Bank Loan Application Form and Checklist: a Personal Loan Form and Checklist and a Business Loan Form and Checklist. The Personal Loan Form and Checklist is used for individual borrowers and includes questions related to the borrower’s current income, employment, and credit history. The Business Loan Form and Checklist is used for businesses and includes questions related to the business’s revenue, assets, liabilities, and other financial information.

Bank Loan Application Form and Checklist

Description

How to fill out Bank Loan Application Form And Checklist?

How much time and resources do you usually spend on composing official paperwork? There’s a greater way to get such forms than hiring legal specialists or spending hours searching the web for an appropriate template. US Legal Forms is the top online library that provides professionally drafted and verified state-specific legal documents for any purpose, including the Bank Loan Application Form and Checklist.

To acquire and prepare an appropriate Bank Loan Application Form and Checklist template, adhere to these simple instructions:

- Look through the form content to make sure it meets your state laws. To do so, check the form description or take advantage of the Preview option.

- If your legal template doesn’t satisfy your needs, find another one using the search bar at the top of the page.

- If you are already registered with our service, log in and download the Bank Loan Application Form and Checklist. If not, proceed to the next steps.

- Click Buy now once you find the correct blank. Select the subscription plan that suits you best to access our library’s full service.

- Sign up for an account and pay for your subscription. You can make a payment with your credit card or through PayPal - our service is absolutely reliable for that.

- Download your Bank Loan Application Form and Checklist on your device and complete it on a printed-out hard copy or electronically.

Another benefit of our service is that you can access previously purchased documents that you safely keep in your profile in the My Forms tab. Obtain them anytime and re-complete your paperwork as often as you need.

Save time and effort preparing official paperwork with US Legal Forms, one of the most reliable web services. Join us now!

Form popularity

FAQ

Here are five common requirements that financial institutions look at when evaluating loan applications. Credit Score and History. An applicant's credit score is one of the most important factors a lender considers when evaluating a loan application.Income.Debt-to-income Ratio.Collateral.Origination Fee.

Employment and income information Employment Status. Work phone number. Employer name. Gross monthly income amount and source(s) of income (all sources you want considered for your loan) Monthly mortgage or rent payment amount.

Fullerton India's process for personal loans is simple, completely digital, and involves quick decisioning so as to meet your requirements on time. Step1: Check the Eligibility Criteria.Step 2: Check Interest Rates and Other Charges.Step 3: Calculate your EMI.Step 4: Check Required Documents.

Proof of identity, such as a driver's license, passport, or state-issued ID card. Proof of your income. You may need to provide pay stubs, tax returns, W-2s and 1099s, bank statements, or your employer's contact information. If you are self-employed, the loan provider may ask for bank statements, 1099s, or tax returns.

Pre-approval requires proof of employment, assets, income tax returns, and a qualifying credit score. Mortgage pre-approval letters are typically valid for 60 to 90 days.

Lenders look at your income, employment history, savings and monthly debt payments, and other financial obligations to make sure you have the means to comfortably take on a mortgage.

What are the 5 Things to consider before accepting the Bank loan? Credibility. The rate of Interest. Payment flexibility. Response times. Understand the terms of the bank loan.

The Loan Documents Checklist provides a detailed list and description of items you need to process your loan. All documents must be legible and there can be no cut-offs on pages. Also, you should provide Adobe of PDF files which make organizing and processing your documents much easier.