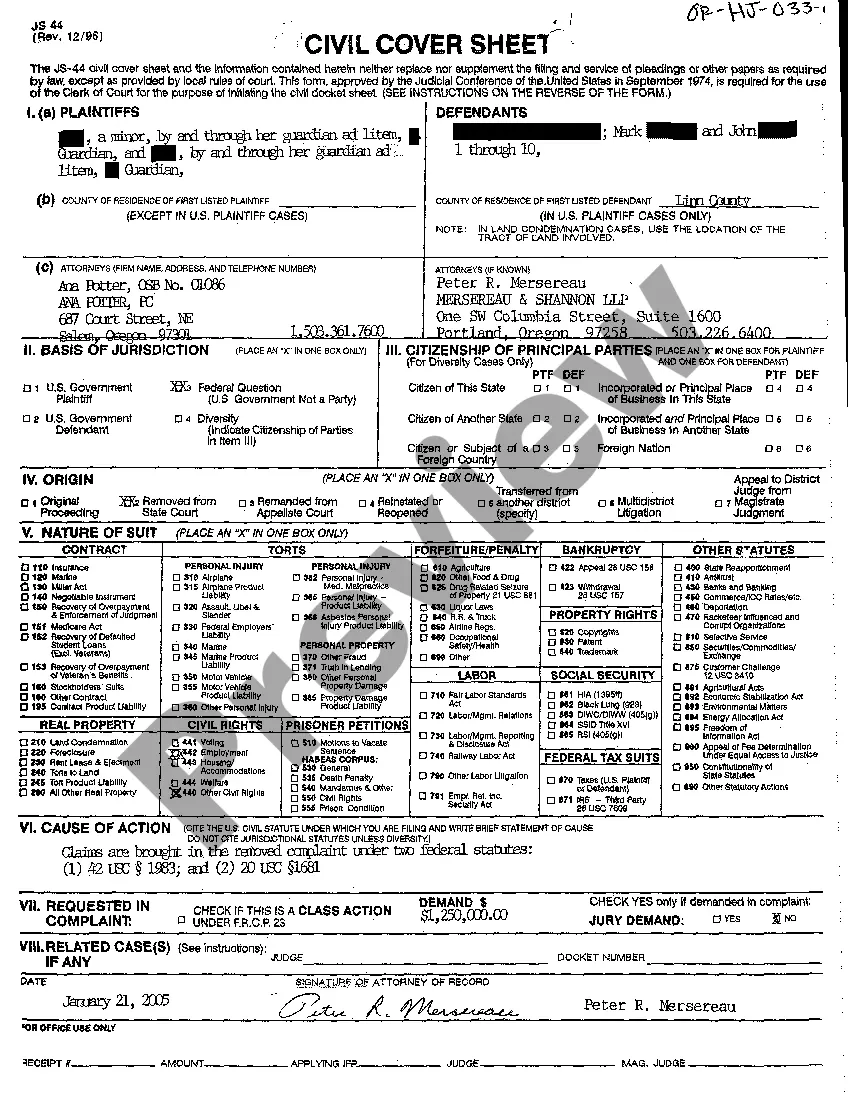

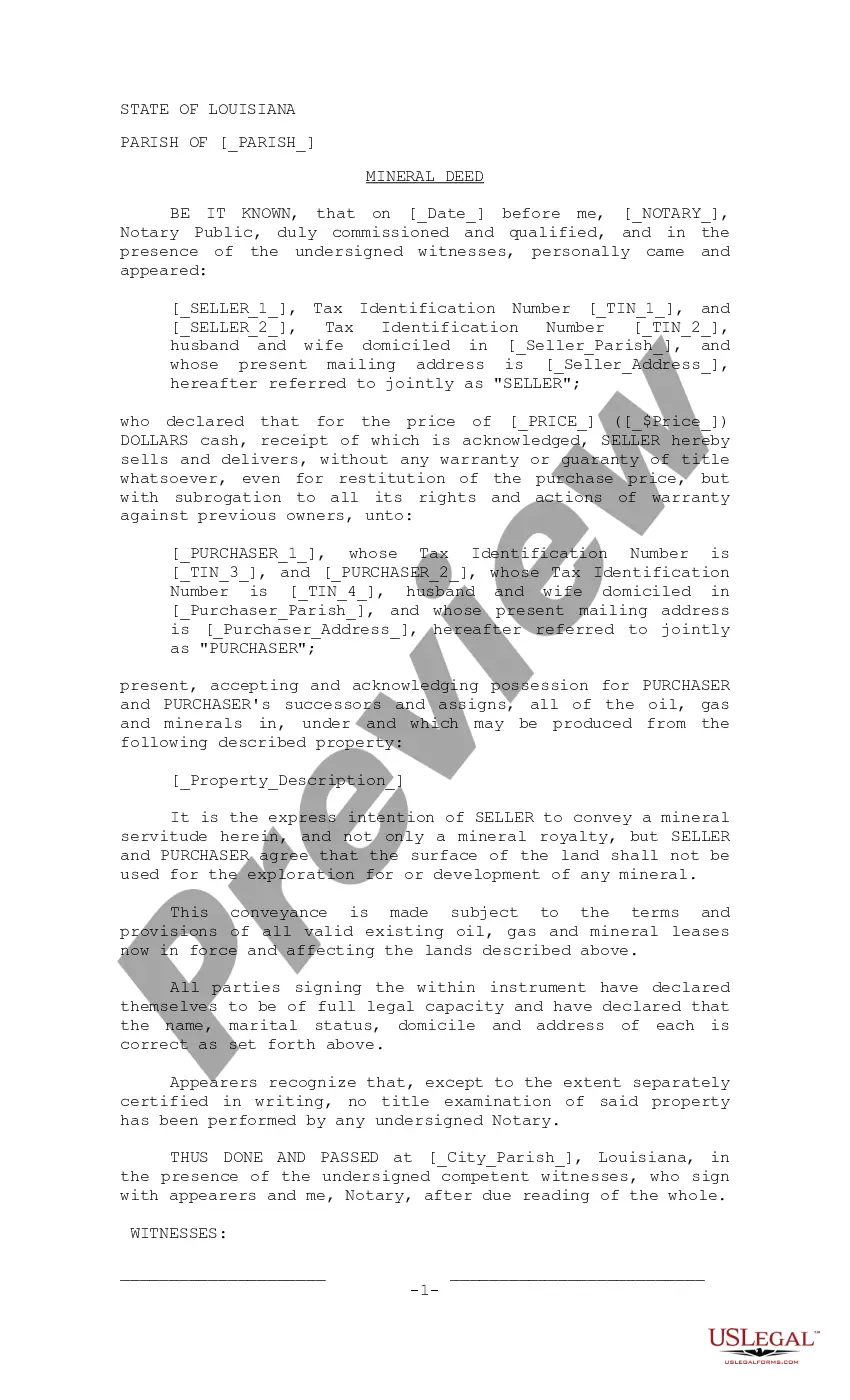

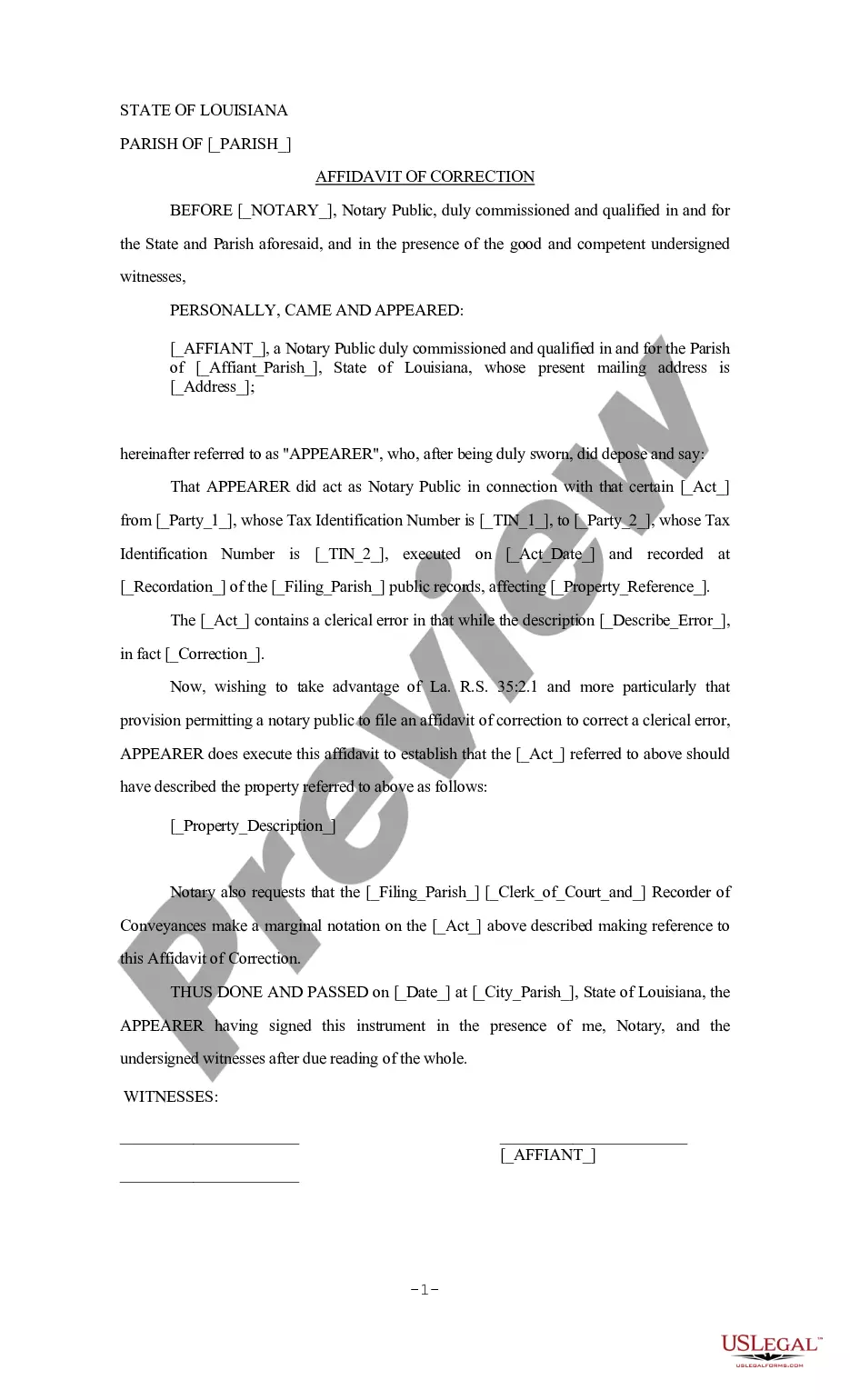

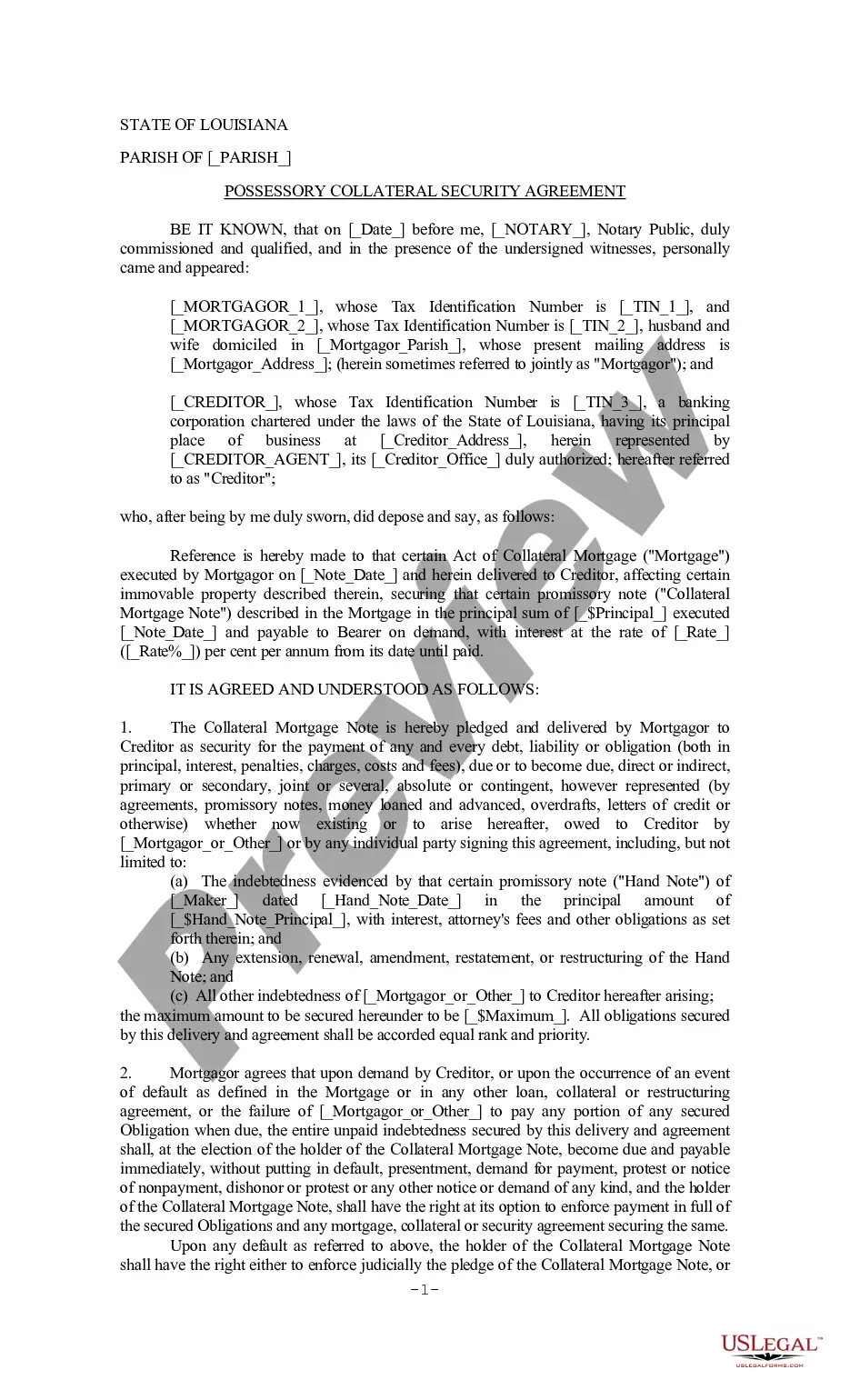

Loan Application Review or Checklist Form for Loan Secured by Real Property is a document used to verify the accuracy of a loan application for a loan secured by real property. This form typically includes a review of the borrower's financial, credit, and legal situation in order to determine if they are a suitable risk for the loan. It may also include a review of the property itself to determine if it meets the requirements of the loan. Common types of Loan Application Review or Checklist Form for Loan Secured by Real Property include: • Credit Analysis: This includes a review of the borrower's creditworthiness and past credit history. • Income and Assets Verification: This includes a review of the borrower's income, assets, and liabilities. • Real Estate Appraisal: This includes a review of the property's value and condition. • Legal Review: This includes a review of the legal documents associated with the loan. • Collateral Review: This includes a review of the property being used as collateral.

Loan Application - Review or Checklist Form for Loan Secured by Real Property

Description

How to fill out Loan Application - Review Or Checklist Form For Loan Secured By Real Property?

Working with official paperwork requires attention, precision, and using well-drafted templates. US Legal Forms has been helping people countrywide do just that for 25 years, so when you pick your Loan Application ??? Review or Checklist Form for Loan Secured by Real Property template from our service, you can be certain it complies with federal and state regulations.

Dealing with our service is easy and quick. To obtain the required document, all you’ll need is an account with a valid subscription. Here’s a quick guideline for you to get your Loan Application ??? Review or Checklist Form for Loan Secured by Real Property within minutes:

- Remember to attentively examine the form content and its correspondence with general and law requirements by previewing it or reading its description.

- Search for another official blank if the previously opened one doesn’t suit your situation or state regulations (the tab for that is on the top page corner).

- Log in to your account and save the Loan Application ??? Review or Checklist Form for Loan Secured by Real Property in the format you need. If it’s your first experience with our website, click Buy now to proceed.

- Create an account, decide on your subscription plan, and pay with your credit card or PayPal account.

- Decide in what format you want to save your form and click Download. Print the blank or upload it to a professional PDF editor to submit it electronically.

All documents are created for multi-usage, like the Loan Application ??? Review or Checklist Form for Loan Secured by Real Property you see on this page. If you need them one more time, you can fill them out without re-payment - simply open the My Forms tab in your profile and complete your document whenever you need it. Try US Legal Forms and accomplish your business and personal paperwork quickly and in full legal compliance!

Form popularity

FAQ

You can get a loan even if you're unemployed. Lenders look at multiple sources of income, including government benefits, alimony, and worker's compensation payments. If you have no income at all, you may be eligible for a secured loan using some form of property as collateral.

This initial application will often ask for your personal information, such as your name, contact information, date of birth, and Social Security number. You may also be required to state your desired loan amount and purpose as well as additional financial details like your gross monthly income or mortgage payment.

The Loan Documents Checklist provides a detailed list and description of items you need to process your loan. All documents must be legible and there can be no cut-offs on pages. Also, you should provide Adobe of PDF files which make organizing and processing your documents much easier.

To verify your income, your mortgage lender will likely require a couple of recent paycheck stubs (or their electronic equivalent) and your most recent W-2 form. In some cases the lender may request a proof of income letter from your employer, particularly if you recently changed jobs.

For standard employment income, the lender will generally review the previous two years W2's and most recent 30 days of pay stubs to help guide in what income can be used for qualifying.

In assessing whether to finance a small business, lenders are often willing to consider individual factors that represent strengths or weaknesses for a loan. Tools to use.Credit history.Reviewing your commercial credit history.Reviewing your consumer credit history.Work smart.Providing collateral to secure a loan.

Bank statements are among the most common documents used for income verification. Bank statements show the movement of funds into and out of an account and provide insight into the borrower's income, spending, and debt repayment history. Retired and self-employed borrowers often use bank statements as proof of income.

Pay stubs, W-2s or other proof of income Lenders generally ask for documentation of other income streams, such as spousal support or child support payments, Social Security benefits, investment or rental income, and income from a business or side gig.