Money Laundering — Proceeds of a Specified Unlawful Activity Defined (revised 2013) is a term used to describe the practice of illegally obtaining money and disguising it as legitimate income. It is also referred to as ‘laundering’. Money laundering is often done by criminals who have acquired their money through unlawful activities such as drug trafficking, prostitution, fraud, extortion, embezzlement and bribery. There are four main types of money laundering: placement, layering, integration and reinvestment. Placement involves transferring money from the original source to another financial institution. Layering is the process of converting the illegally obtained money into other forms such as investments or assets to obscure its origin. Integration involves introducing the illegally obtained funds back into the financial system by making them appear to be legitimate. Finally, reinvestment is the process of using the money to generate more income. Money laundering activities are prohibited and punishable under the Anti-Money Laundering (AML) laws of many countries. It is important for financial institutions to implement measures to detect and prevent money laundering activities. These include customer due diligence, KYC (Know Your Customer) checks, suspicious activity monitoring and reporting.

Money Laundering - Proceeds of a Specified Unlawful Activity Defined (revised 2013)

Description

How to fill out Money Laundering - Proceeds Of A Specified Unlawful Activity Defined (revised 2013)?

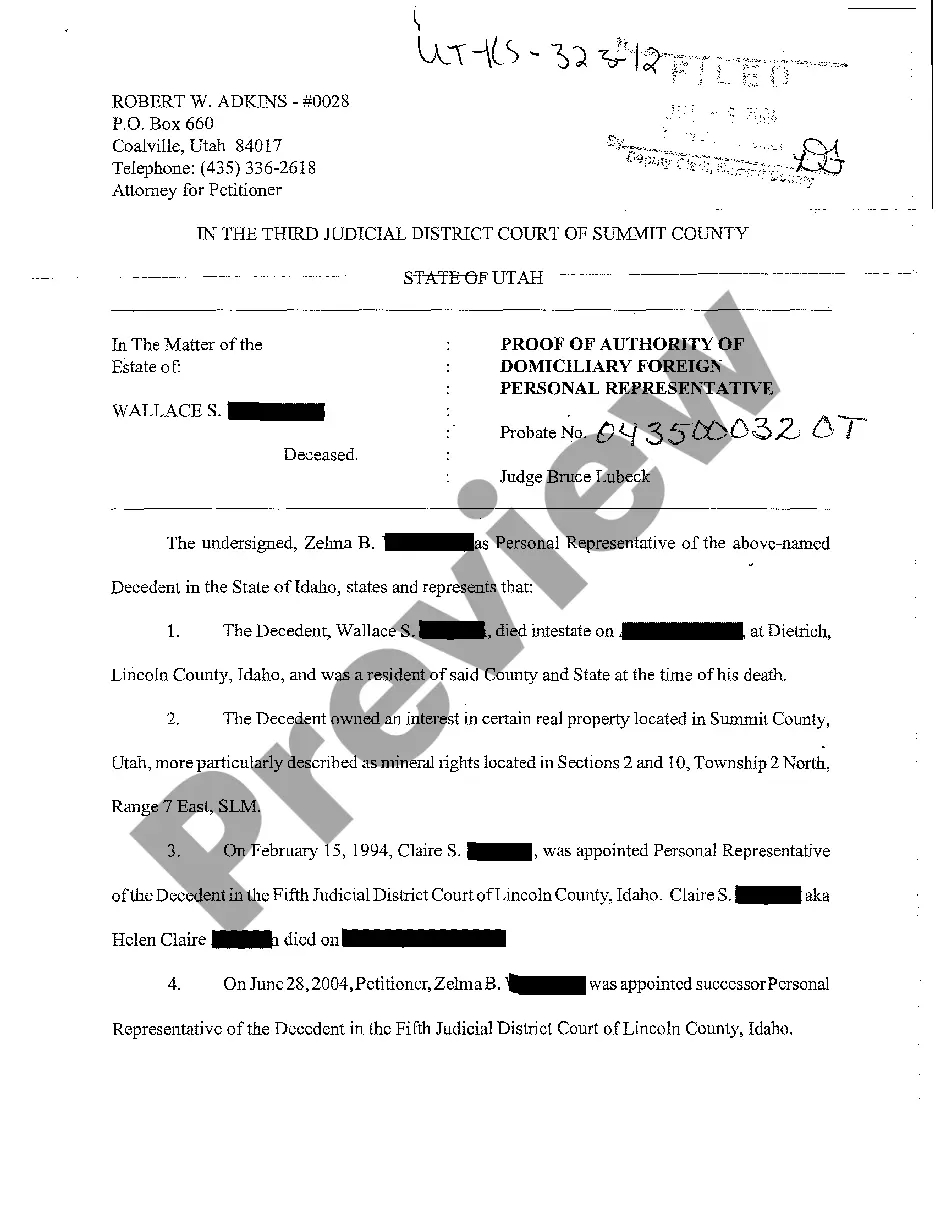

Preparing legal paperwork can be a real burden if you don’t have ready-to-use fillable templates. With the US Legal Forms online library of formal documentation, you can be certain in the blanks you find, as all of them comply with federal and state laws and are checked by our specialists. So if you need to fill out Money Laundering - Proceeds of a Specified Unlawful Activity Defined (revised 2013), our service is the best place to download it.

Obtaining your Money Laundering - Proceeds of a Specified Unlawful Activity Defined (revised 2013) from our catalog is as easy as ABC. Previously authorized users with a valid subscription need only sign in and click the Download button once they find the correct template. Later, if they need to, users can take the same document from the My Forms tab of their profile. However, even if you are new to our service, signing up with a valid subscription will take only a few minutes. Here’s a brief guide for you:

- Document compliance verification. You should carefully examine the content of the form you want and ensure whether it satisfies your needs and complies with your state law requirements. Previewing your document and reviewing its general description will help you do just that.

- Alternative search (optional). If there are any inconsistencies, browse the library using the Search tab above until you find a suitable template, and click Buy Now once you see the one you want.

- Account creation and form purchase. Sign up for an account with US Legal Forms. After account verification, log in and choose your preferred subscription plan. Make a payment to proceed (PayPal and credit card options are available).

- Template download and further usage. Choose the file format for your Money Laundering - Proceeds of a Specified Unlawful Activity Defined (revised 2013) and click Download to save it on your device. Print it to fill out your papers manually, or take advantage of a multi-featured online editor to prepare an electronic copy faster and more efficiently.

Haven’t you tried US Legal Forms yet? Subscribe to our service now to get any formal document quickly and easily whenever you need to, and keep your paperwork in order!

Form popularity

FAQ

Jail time: A minimum sentence of 16 months and up to four years in jail. Fine: The fine is up to $250,000, or twice the amount of money laundered. For the purposes of calculating the fine, the court imposes the higher of the two amounts.

See §§ 1956(c)(7)(A), 1957(f)(3), and 1961(1)(B) ("Specified unlawful activity" is defined as any act or activity constituting an offense listed in section 1961(1), which includes both mail and wire fraud statutes.).

Specified unlawful activities include over 250 crimes in six categories: (1) most RICO predicate offenses; (2) certain offenses against foreign nations; (3) acts constituting a criminal enterprise under the Controlled Substances Act; (4) miscellaneous offenses against persons and property; (5) federal health care

§1956. Laundering of monetary instruments. (ii) to avoid a transaction reporting requirement under State or Federal law, shall be sentenced to a fine of not more than $500,000 or twice the value of the property involved in the transaction, whichever is greater, or imprisonment for not more than twenty years, or both.

See §§ 1956(c)(7)(A), 1957(f)(3), and 1961(1)(B) ("Specified unlawful activity" is defined as any act or activity constituting an offense listed in section 1961(1), which includes both mail and wire fraud statutes.).

To be sure, 18 U.S.C. §1956 criminalizes financial transactions that satisfy the conventional understanding of money laundering-namely, transactions intended ?to conceal or disguise the nature, the location, the source, the ownership, or the control of the proceeds of specified unlawful activity.? 18 U.S.C.

Money Laundering - Engaging in Monetary Transactions in Property Derived From Specified Unlawful Activity.