Tax Evasion — Tax Deficiency Defined is the deliberate act of not paying a debt or taxes that are due to the government. Tax evasion is a serious crime and can result in criminal prosecution and heavy fines. Tax evasion is typically accomplished by not declaring all of one's income, which can be done by not filing a tax return, not reporting all of one's income, or not reporting all of one's deductions. There are three main types of tax evasion — Tax Deficiency Defined. These include: 1. Willful Tax Evasion — This involves not filing a tax return, not reporting all of one's income, or not reporting all of one's deductions. It is considered a serious crime and can result in criminal prosecution and heavy fines. 2. Tax Fraud — This type of tax evasion involves using false documents or providing false information on a tax return to reduce the amount of tax paid. Tax fraud can also include using tax havens to hide assets or income. 3. Negligent Tax Evasion — This type of tax evasion occurs when a taxpayer fails to file a tax return or report all of their income and deductions. Negligent tax evasion can result in penalties and fines.

Tax Evasion - Tax Deficiency Defined

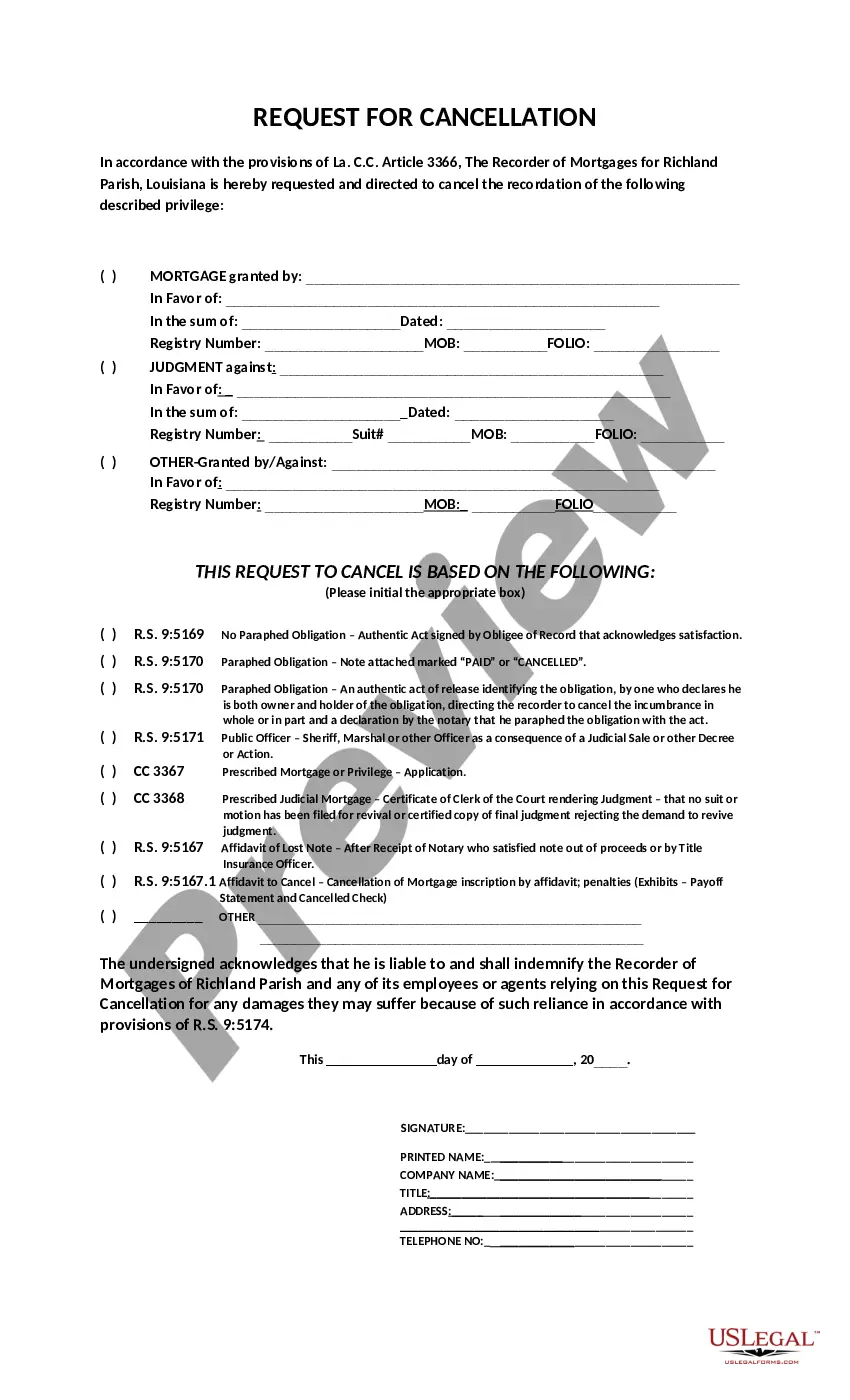

Description

How to fill out Tax Evasion - Tax Deficiency Defined?

Preparing official paperwork can be a real stress unless you have ready-to-use fillable templates. With the US Legal Forms online library of formal documentation, you can be confident in the blanks you obtain, as all of them correspond with federal and state regulations and are verified by our experts. So if you need to prepare Tax Evasion - Tax Deficiency Defined, our service is the perfect place to download it.

Getting your Tax Evasion - Tax Deficiency Defined from our library is as easy as ABC. Previously authorized users with a valid subscription need only sign in and click the Download button after they find the proper template. Later, if they need to, users can use the same document from the My Forms tab of their profile. However, even if you are new to our service, registering with a valid subscription will take only a few minutes. Here’s a quick guide for you:

- Document compliance check. You should attentively examine the content of the form you want and ensure whether it suits your needs and meets your state law regulations. Previewing your document and looking through its general description will help you do just that.

- Alternative search (optional). If there are any inconsistencies, browse the library through the Search tab above until you find a suitable blank, and click Buy Now once you see the one you want.

- Account creation and form purchase. Sign up for an account with US Legal Forms. After account verification, log in and choose your most suitable subscription plan. Make a payment to proceed (PayPal and credit card options are available).

- Template download and further usage. Select the file format for your Tax Evasion - Tax Deficiency Defined and click Download to save it on your device. Print it to fill out your paperwork manually, or use a multi-featured online editor to prepare an electronic copy faster and more efficiently.

Haven’t you tried US Legal Forms yet? Subscribe to our service today to get any formal document quickly and easily any time you need to, and keep your paperwork in order!