False Income Tax Return — Elements of the Offense (26 U.S.C. Sec. 7206(1)) is a federal offense that involves the filing of a false or fraudulent return, statement, or other document with the Internal Revenue Service (IRS). The elements of this offense include making and subscribing any return, statement, or other document that is known to be false in any material matter, or aiding, counseling, procuring, or advising the preparation or presentation of a false return, statement, or other document. There are two types of False Income Tax Return — Elements of the Offense (26 U.S.C. Sec. 7206(1)). The first type is willful tax fraud, which involves intentionally filing a false or fraudulent return, statement, or other document with the IRS. The second type is reckless tax fraud, which involves acting with a reckless disregard for the truth or falsity of the return, statement, or other document. Under 26 U.S.C. Sec. 7206(1), anyone found guilty of willfully or recklessly filing a false or fraudulent return, statement, or other document with the IRS can be fined up to $100,000 and/or sentenced to up to three years in prison.

False Income Tax Return - Elements of the Offense (26 U.S.C. Sec. 7206(1))

Description

How to fill out False Income Tax Return - Elements Of The Offense (26 U.S.C. Sec. 7206(1))?

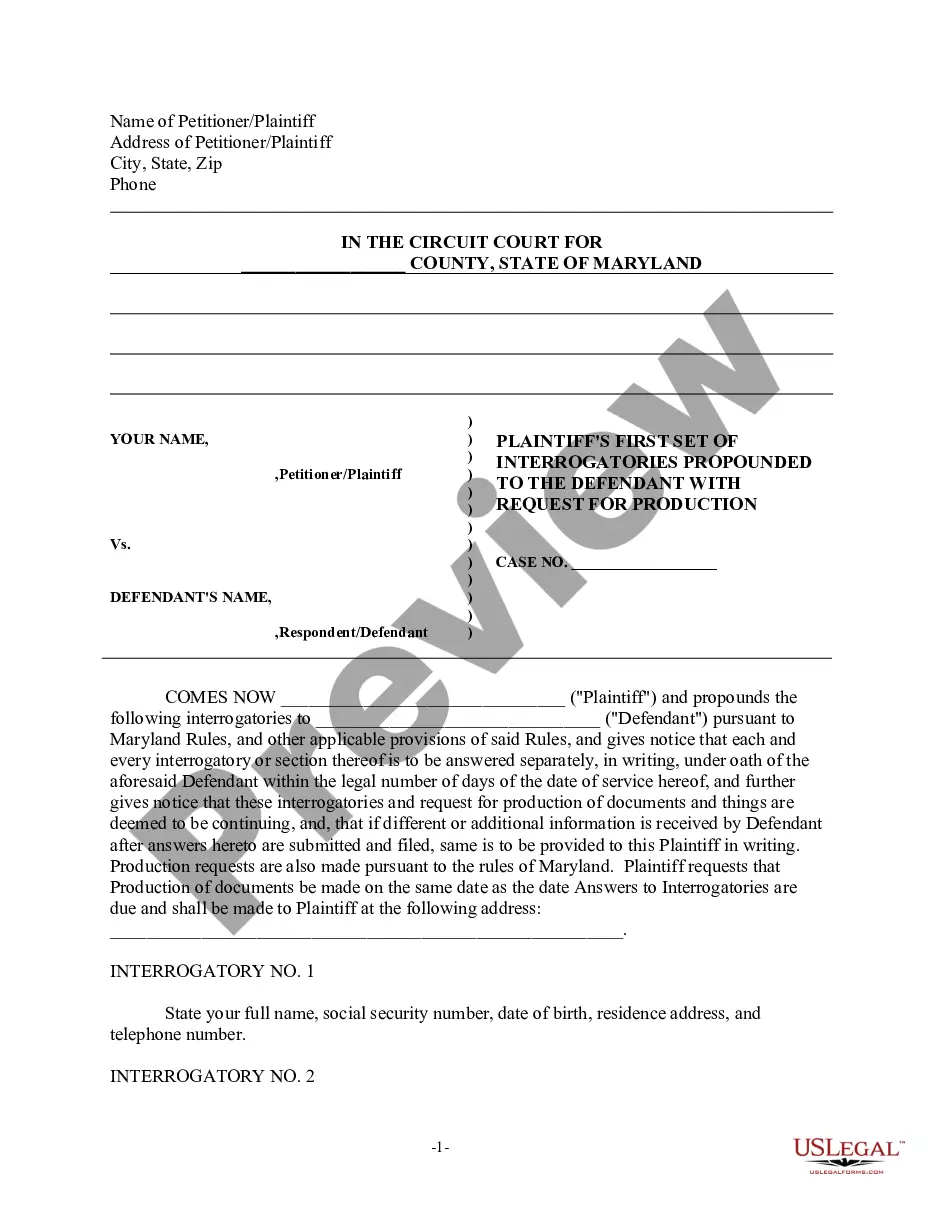

If you’re searching for a way to properly complete the False Income Tax Return - Elements of the Offense (26 U.S.C. Sec. 7206(1)) without hiring a lawyer, then you’re just in the right spot. US Legal Forms has proven itself as the most extensive and reputable library of formal templates for every individual and business scenario. Every piece of documentation you find on our web service is designed in accordance with federal and state regulations, so you can be sure that your documents are in order.

Follow these straightforward instructions on how to get the ready-to-use False Income Tax Return - Elements of the Offense (26 U.S.C. Sec. 7206(1)):

- Make sure the document you see on the page meets your legal situation and state regulations by checking its text description or looking through the Preview mode.

- Enter the form title in the Search tab on the top of the page and select your state from the list to locate another template in case of any inconsistencies.

- Repeat with the content verification and click Buy now when you are confident with the paperwork compliance with all the demands.

- Log in to your account and click Download. Register for the service and opt for the subscription plan if you still don’t have one.

- Use your credit card or the PayPal option to purchase your US Legal Forms subscription. The blank will be available to download right after.

- Choose in what format you want to save your False Income Tax Return - Elements of the Offense (26 U.S.C. Sec. 7206(1)) and download it by clicking the appropriate button.

- Upload your template to an online editor to complete and sign it quickly or print it out to prepare your paper copy manually.

Another wonderful thing about US Legal Forms is that you never lose the paperwork you acquired - you can find any of your downloaded blanks in the My Forms tab of your profile any time you need it.

Form popularity

FAQ

7206 filing a fraudulent and false statement verified via written declaration under penalty of perjury is a felony and carries a penalty of imprisonment for up to 3 years, a $100,000 fine for individuals or a $500,000 fine for corporations, or both, and reimbursement to the federal government to cover the costs of

Three Elements of Tax Evasion Omitting or understating income. Claiming improper deductions or credits. Providing false income information.

The Internal Revenue Code (IRC) is the body of law that codifies all federal tax laws, including income, estate, gift, excise, alcohol, tobacco, and employment taxes.

The elements of § 7201 are willfulness; the existence of a tax deficiency; and an affirmative act constituting an evasion or attempted evasion of the tax.

Title 26, United States Code, Section 7206(2), makes it a crime to willfully aid or assist in preparing or presenting a false return or document and provides as follows: Any person who?? (2) Aid or Assistance.

Shall be guilty of a felony and, upon conviction thereof, shall be fined not more than $100,000 ($500,000 in the case of a corporation), or imprisoned not more than 3 years, or both, together with the costs of prosecution.

Section 7201 creates two offenses: (a) the willful attempt to evade or defeat the assessment of a tax, and (b) the willful attempt to evade or defeat the payment of a tax. Sansone v. United States, 380 U.S. 343, 354 (1965).