Full text and statutory guidelines for the Model State Structured Settlement Protection Act.

Model State Structured Settlement Protection Act

Description

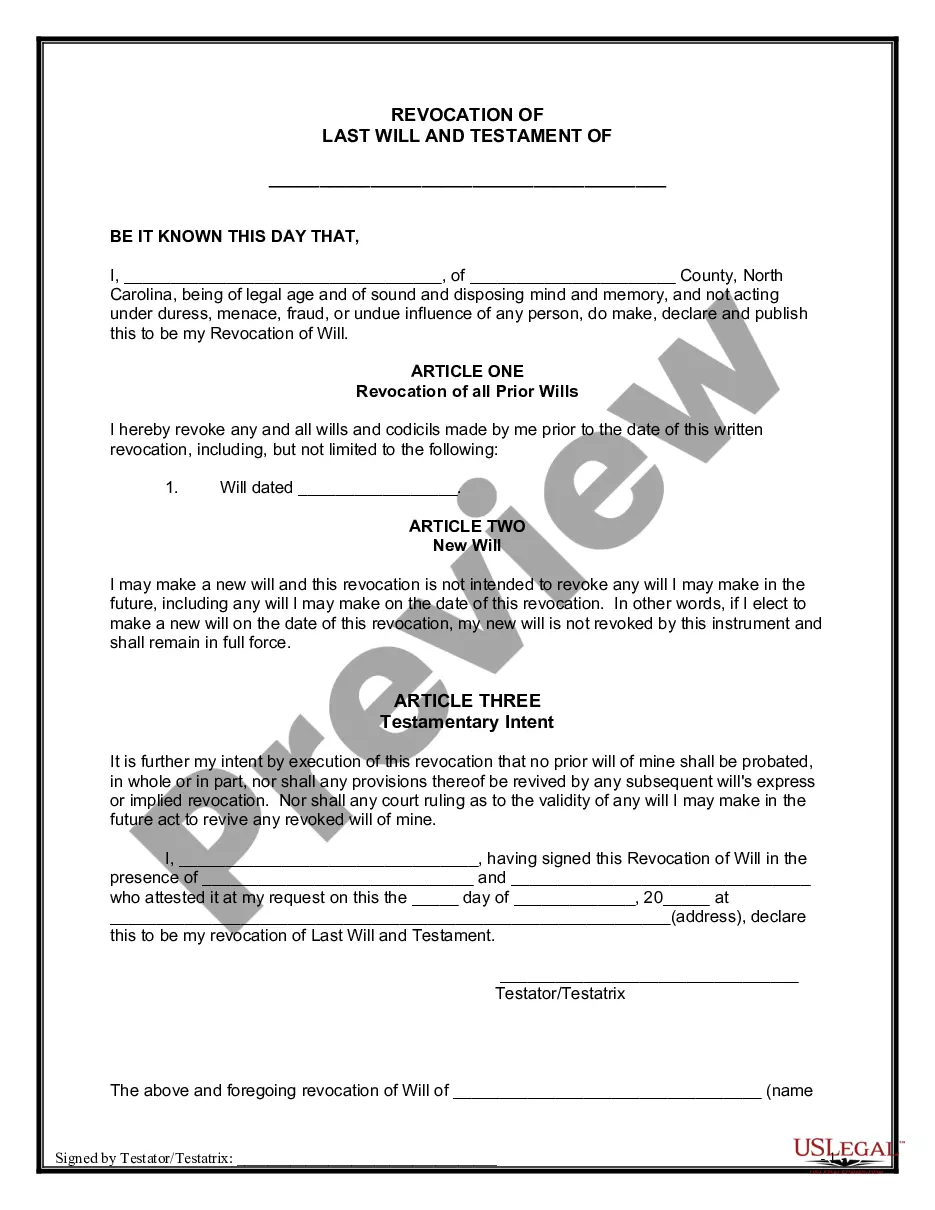

How to fill out Model State Structured Settlement Protection Act?

Use the most extensive legal library of forms. US Legal Forms is the best platform for getting up-to-date Model State Structured Settlement Protection Act templates. Our platform provides 1000s of legal documents drafted by certified attorneys and sorted by state.

To get a sample from US Legal Forms, users only need to sign up for a free account first. If you’re already registered on our platform, log in and select the document you are looking for and buy it. After buying templates, users can find them in the My Forms section.

To obtain a US Legal Forms subscription online, follow the steps below:

- Find out if the Form name you’ve found is state-specific and suits your requirements.

- In case the form features a Preview function, use it to review the sample.

- In case the sample does not suit you, make use of the search bar to find a better one.

- Hit Buy Now if the sample corresponds to your requirements.

- Choose a pricing plan.

- Create an account.

- Pay via PayPal or with the debit/visa or mastercard.

- Select a document format and download the template.

- After it is downloaded, print it and fill it out.

Save your time and effort with our platform to find, download, and fill in the Form name. Join thousands of pleased clients who’re already using US Legal Forms!

Form popularity

FAQ

How Do Structured Settlement Purchasing Companies Make Money? Factoring companies generally take anywhere from 9 to 18 percent to cover their operating costs and turn a profit.

A structured settlement is when part or all of the settlement amount is paid to the plaintiff over a period of years. Part of the settlement will generally be paid to the plaintiff and his/her lawyer immediately after the settlement as a lump sum, and the rest will be structured over a period of years.

How much does JG Wentworth charge? The cost of selling your annuity or settlement to JG Wentworth varies based on the details of the agreement. Typically, JG Wentworth's fees range from 9% to 15% of the asset's total value.

When Are Settlements Tax-Free? Because structured settlements for compensatory damages are tax-exempt, so too are proceeds from selling future payments. Structured settlement payments and revenue from selling these payments are also exempt from state taxes and taxes on dividends and capital gains.

The qualified assignment fee (ranging from $0 to $750) is commissionable with some companies. In other cases it is not. Insurance laws in effect in most states expressly prohibit reduction of commissions or rebating. There are different market based structured settlement options for both plaintiffs and attorney.

Structured settlements are tax-free financial vehicles used to compensate for personal injuries and losses.Structured settlements are annuities awarded as recompense in a civil lawsuit. These financial vehicles are meant to provide a long-term income stream to maintain a claimant's financial needs.

Typically, this fee amounts to approximately 9 to 15 percent of the total value of the annuity or structured settlement. This may seem high, but it is the cost of the service and enables you to cover your needs now. Life does not always work on schedule and you may have the following needs: Unpaid medical bills.

Unlike stocks, bonds and mutual funds, structured settlements do not fluctuate with market changes. Payments are guaranteed by the insurance company that issued the annuity. A structured settlement often yields, in total, more than a lump-sum payout would because of the interest your annuity may earn over time.