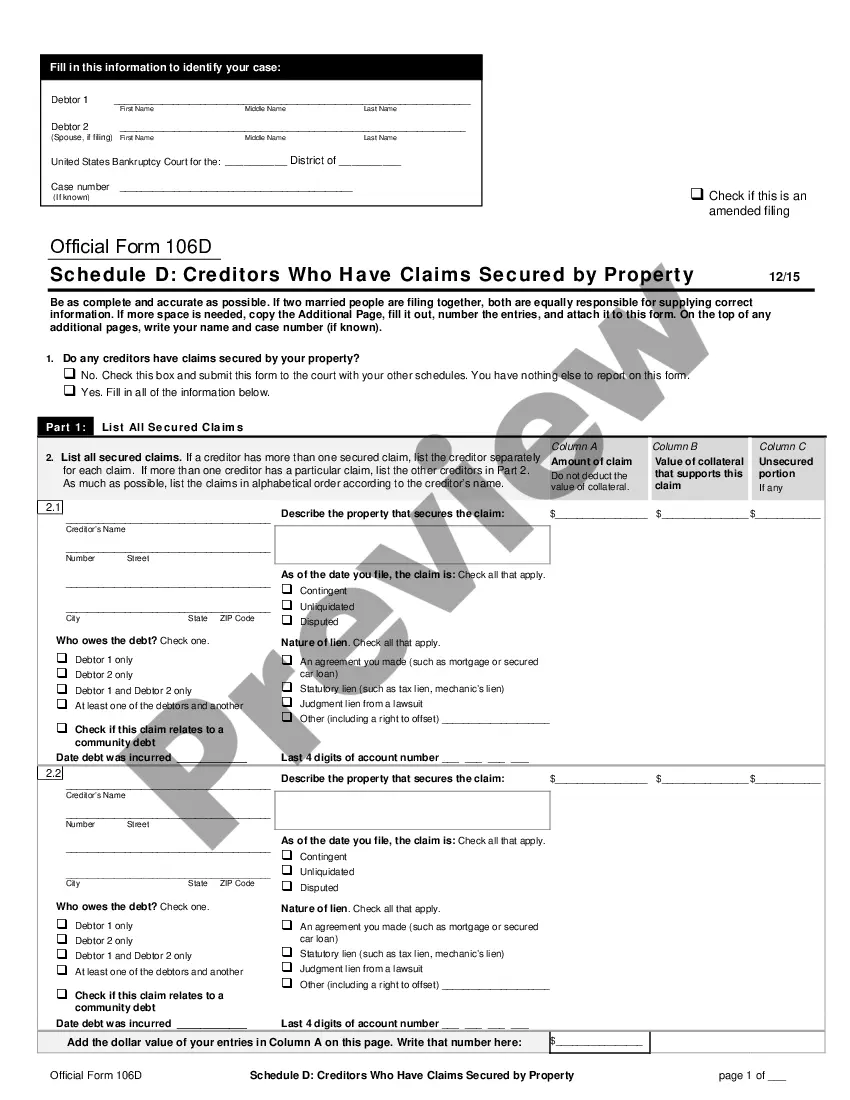

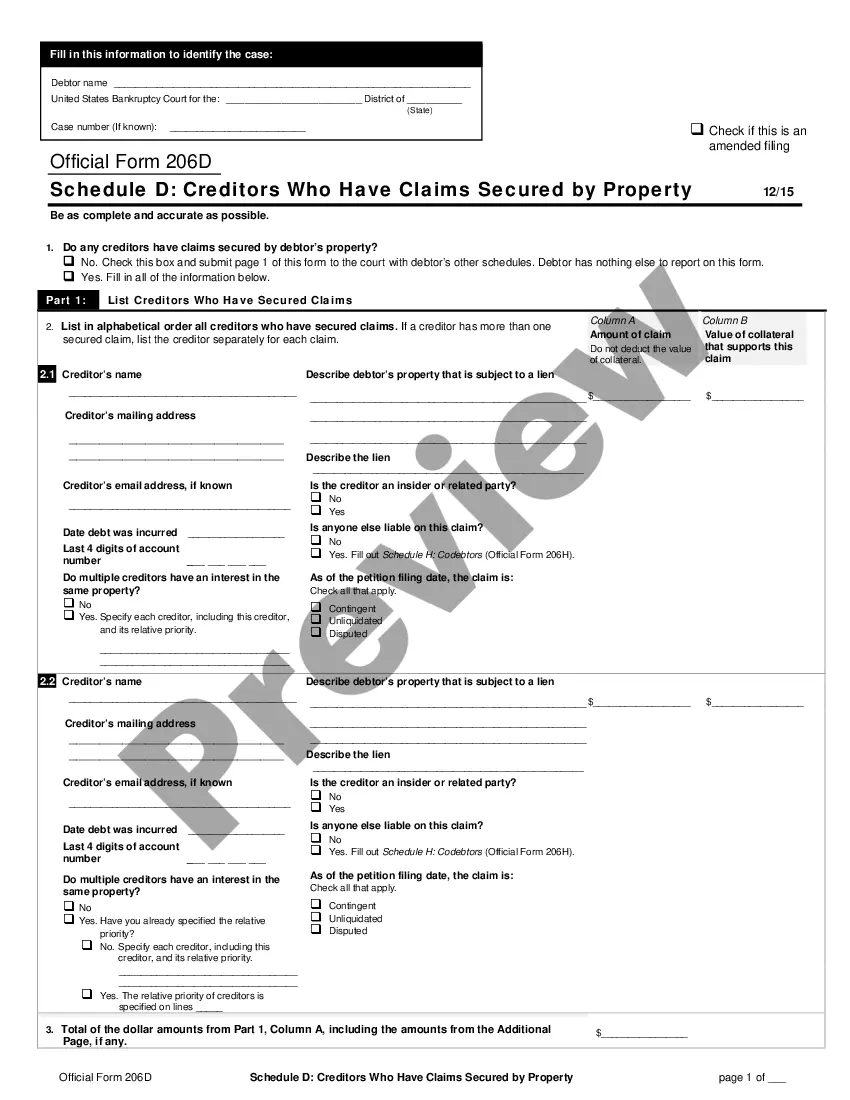

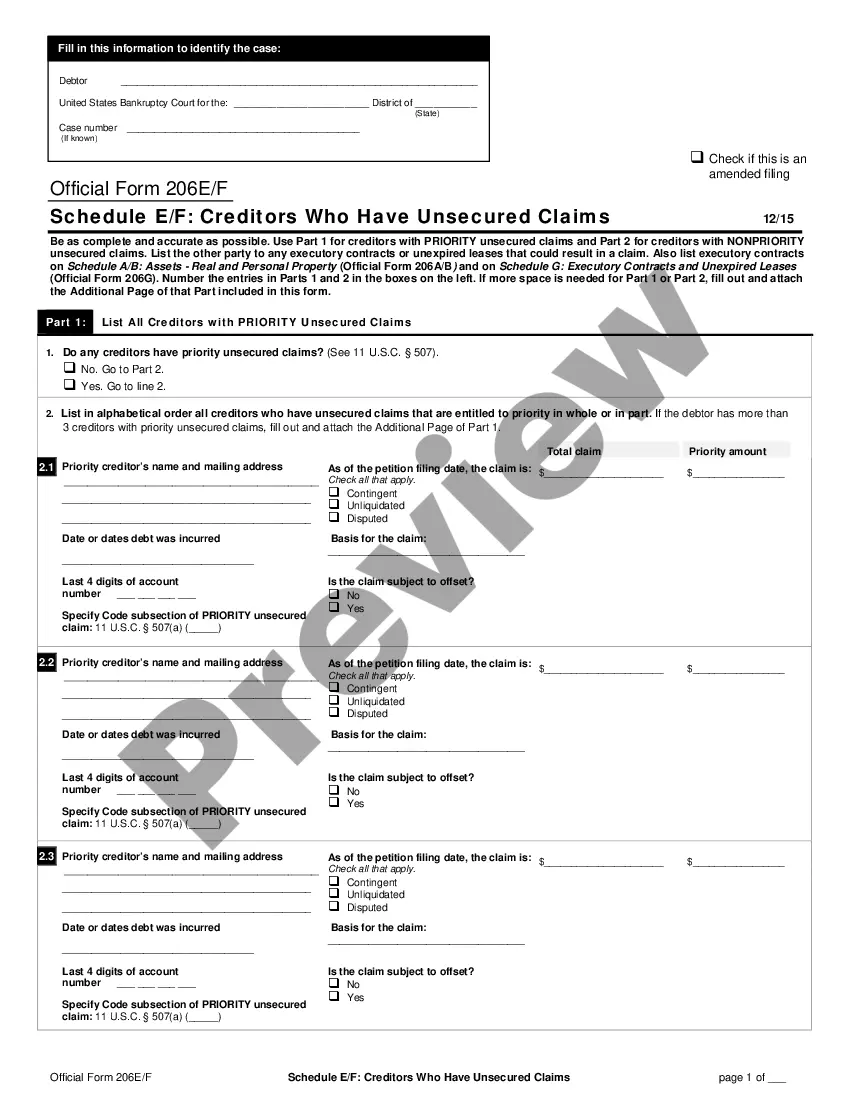

Schedule E/F: Creditors Who Have Unsecured Claims (individuals) is a form filed as part of a bankruptcy case that is used to list creditors who have unsecured claims against the debtor. An unsecured claim is one that does not have any collateral attached to it, such as a mortgage or vehicle loan. The form requires the debtor to provide identifying information about each creditor, including the creditor’s name, address, and the amount of the claim. The form may also request additional information, such as the type of unsecured claim (e.g., credit card debt, medical debt, etc.), and the date the claim was created. There are two types of Schedule E/F: Creditors Who Have Unsecured Claims (individuals): those for individuals and those for corporate entities. The form for individuals is used by debtors who have filed for bankruptcy protection as an individual, while the form for corporate entities is used by debtors who have filed as a business.

Schedule E/F: Creditors Who Have Unsecured Claims (individuals)

Description

How to fill out Schedule E/F: Creditors Who Have Unsecured Claims (individuals)?

How much time and resources do you typically spend on composing official documentation? There’s a greater way to get such forms than hiring legal experts or wasting hours browsing the web for a proper blank. US Legal Forms is the leading online library that offers professionally drafted and verified state-specific legal documents for any purpose, including the Schedule E/F: Creditors Who Have Unsecured Claims (individuals).

To get and complete a suitable Schedule E/F: Creditors Who Have Unsecured Claims (individuals) blank, follow these simple steps:

- Look through the form content to ensure it complies with your state laws. To do so, read the form description or use the Preview option.

- If your legal template doesn’t satisfy your needs, find another one using the search tab at the top of the page.

- If you are already registered with our service, log in and download the Schedule E/F: Creditors Who Have Unsecured Claims (individuals). Otherwise, proceed to the next steps.

- Click Buy now once you find the correct blank. Choose the subscription plan that suits you best to access our library’s full service.

- Register for an account and pay for your subscription. You can make a transaction with your credit card or via PayPal - our service is totally secure for that.

- Download your Schedule E/F: Creditors Who Have Unsecured Claims (individuals) on your device and fill it out on a printed-out hard copy or electronically.

Another benefit of our service is that you can access previously purchased documents that you securely store in your profile in the My Forms tab. Obtain them at any moment and re-complete your paperwork as frequently as you need.

Save time and effort completing formal paperwork with US Legal Forms, one of the most trusted web solutions. Join us now!

Form popularity

FAQ

Unsecured claims still take priority over other debts that the person may owe, but they aren't secured with collateral. These claims usually have priority for public policy reasons, where the public would otherwise be harmed by unpaid debts.

Unsecured creditors include suppliers, customers, contractors, and clients of the insolvent company, who must make a claim for repayment of their debt. As we've mentioned, it's common for this group of creditors to receive no dividend at all from the liquidation process as they fall at the end of the payment hierarchy.

Priority unsecured creditors are parties that the bankruptcy law favors over other unsecured creditors, even though they do not have a security interest in the debtor's property. Examples of priority unsecured claims include: Alimony or child support payments, The costs of the trustee in handling the bankruptcy, and.

Usually, bankruptcy is the only option for unsecured creditors if the borrower defaults. Unsecured creditors can range from credit card companies to doctor's offices.

Some of the most common types of priority unsecured debt include: Child support. Other domestic support, such as alimony. Certain income taxes, depending on age and whether they were timely filed.

Non-priority debts include the bulk of unsecured debts, such as: Past-due credit card bills and outstanding credit card balances. Unpaid personal loan payments. Private debts to friends and family members. Overdue bills, including those for rent, utilities and cellphones.

Unsecured Debt - If you simply promise to pay someone a sum of money at a particular time, and you have not pledged any real or personal property to collateralize the debt, the debt is unsecured. For example, most debts for services and some credit card debts are ?unsecured?.