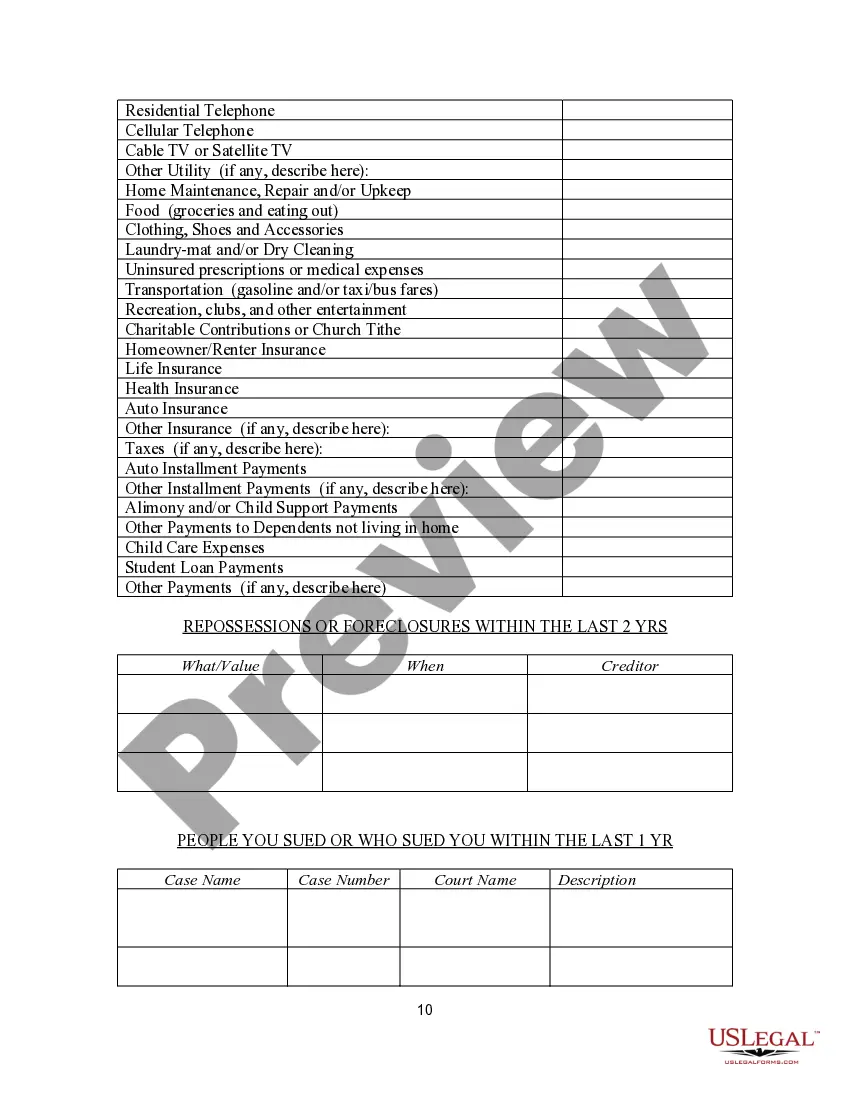

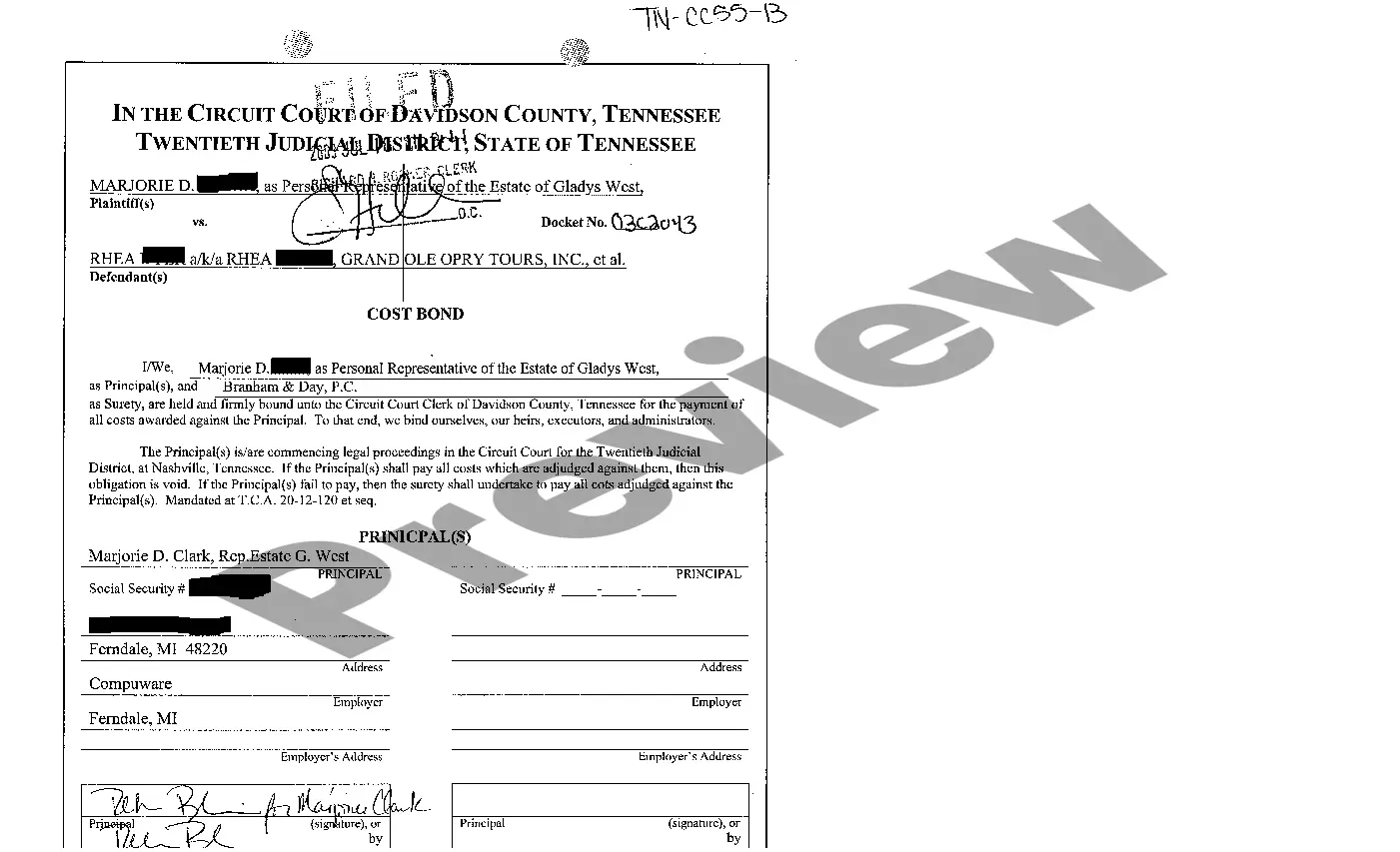

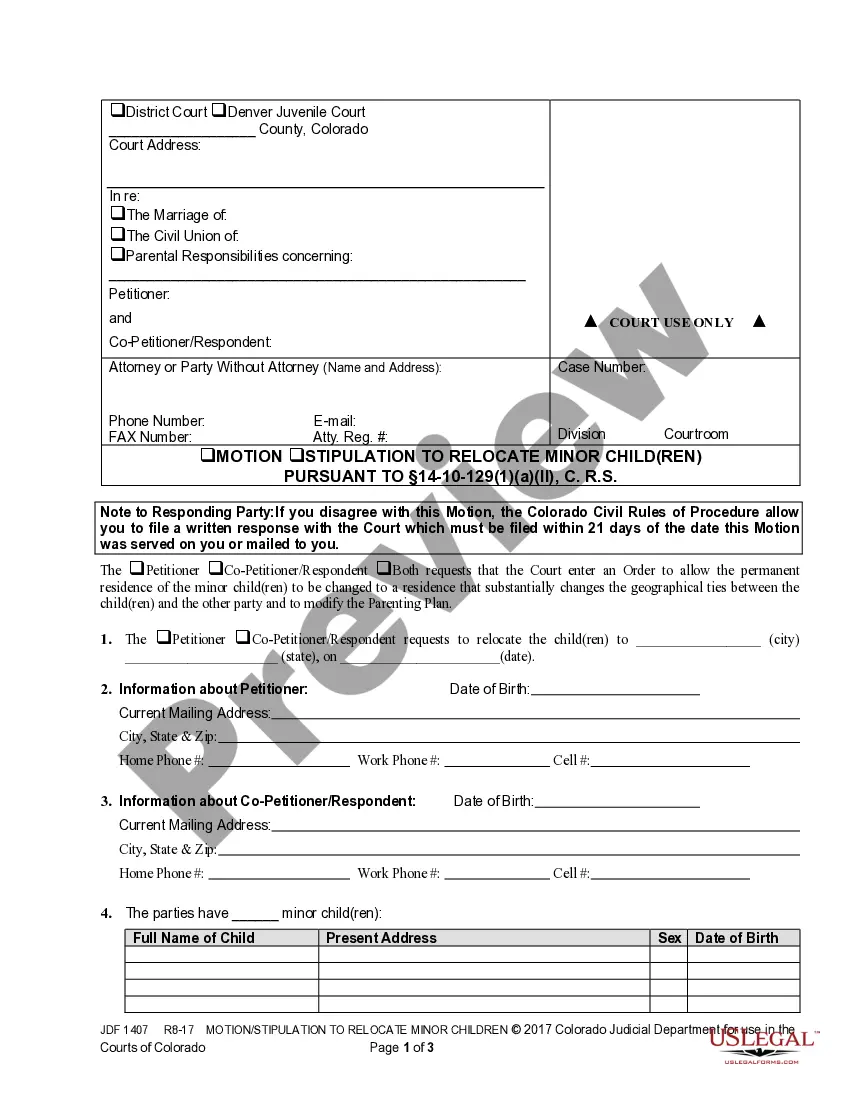

A Bankruptcy Client Interview Form is a legal document used by bankruptcy attorneys and debtors to collect the necessary information to evaluate the debtor's financial situation and determine if bankruptcy is the best option. The form helps the attorney obtain an overview of the debtor's financial condition, including assets, liabilities, income, expenses and other information. It also helps the attorney determine if any other alternatives, such as debt consolidation, are available. The form typically includes questions about the debtor's income, debts, assets, liabilities, and other financial information. It also includes questions about the debtor's employment, marital status, and other personal information. The form is designed to provide the attorney with a comprehensive picture of the debtor's financial picture. There are two types of Bankruptcy Client Interview Form: a Chapter 7 Form and a Chapter 13 Form. The Chapter 7 Form is used for individuals who wish to file for liquidation bankruptcy, while the Chapter 13 Form is used for individuals who wish to file for reorganization bankruptcy.

Bankruptcy Client Interview Form

Description

How to fill out Bankruptcy Client Interview Form?

US Legal Forms is the most straightforward and profitable way to locate suitable formal templates. It’s the most extensive online library of business and individual legal paperwork drafted and verified by legal professionals. Here, you can find printable and fillable templates that comply with federal and local regulations - just like your Bankruptcy Client Interview Form.

Getting your template requires only a few simple steps. Users that already have an account with a valid subscription only need to log in to the web service and download the form on their device. Afterwards, they can find it in their profile in the My Forms tab.

And here’s how you can obtain a professionally drafted Bankruptcy Client Interview Form if you are using US Legal Forms for the first time:

- Read the form description or preview the document to guarantee you’ve found the one corresponding to your requirements, or find another one utilizing the search tab above.

- Click Buy now when you’re sure of its compatibility with all the requirements, and judge the subscription plan you like most.

- Register for an account with our service, log in, and pay for your subscription using PayPal or you credit card.

- Choose the preferred file format for your Bankruptcy Client Interview Form and download it on your device with the appropriate button.

After you save a template, you can reaccess it anytime - simply find it in your profile, re-download it for printing and manual completion or upload it to an online editor to fill it out and sign more proficiently.

Take full advantage of US Legal Forms, your reputable assistant in obtaining the corresponding formal paperwork. Try it out!

Form popularity

FAQ

Secured creditors like banks are going to get paid first. This is because their credit is secured by assets?typically ones that your business controls. Your plan and the courts may consider how integral the assets are that secure your loans to determine which secured creditors get paid first though.

Key Takeaways. Companies can file for either Chapter 7 or Chapter 11 bankruptcy if they're unable to pay their debts. Chapter 7 simply liquidates the company's assets, while Chapter 11 allows the business to continue to operate under a reorganization plan.

Severance pay is a predetermined salary you can receive after being terminated or laid off due to a company shutdown. The amount and length of time you may receive severance pay often varies, depending on your employer's policies and your individual employment contract.

Be sure to carefully examine every aspect of your financial history before entering your meeting. The bankruptcy trustee appointed to your case will be thorough and will likely ask you very personal financial questions. Be prepared to answer these questions honestly and openly as you are under oath during the hearing.

In Chapter 7 bankruptcy, the wages you earn after filing your case are not considered property of your bankruptcy estate. This means that the bankruptcy trustee can't take them to pay your creditors. As a result, you are entitled to keep all wages you earn for work performed after your filing date.

You should probably not quit your job. Quitting your job before filing for bankruptcy will raise the suspicions of the bankruptcy trustee, who takes the means test seriously. The bankruptcy trustee may dismiss your case, which means you'll need to resort to filing a Chapter 13 bankruptcy.

Employees are laid off, and those who are owed wages and benefits become creditors. A ?case trustee? is appointed to liquidate (sell or otherwise reduce to cash) all of the company's assets and property and review the claims filed by the company's creditors.

Conducting the lawyer-client interview Make the client feel comfortable.Observe non-verbal communication.Listen, listen, listen during your initial consultation.Integrate with your practice management software.Track potential clients by their stage in the client intake process.