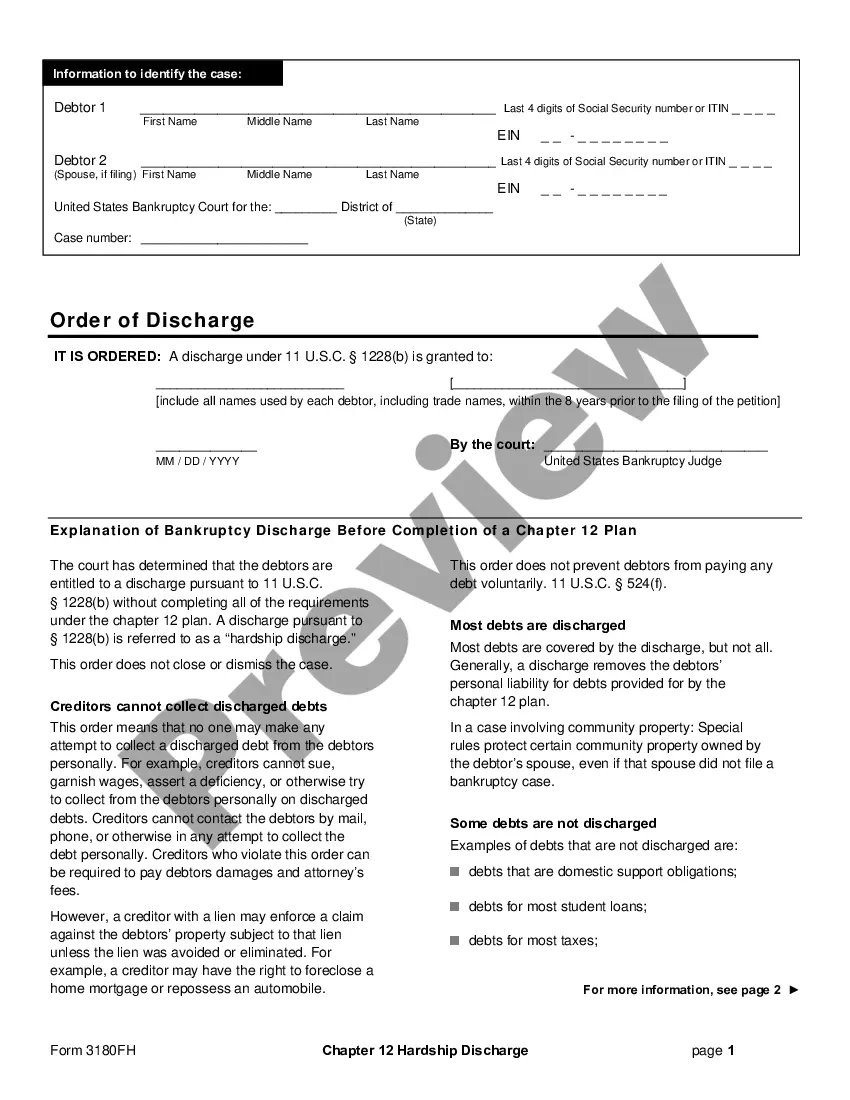

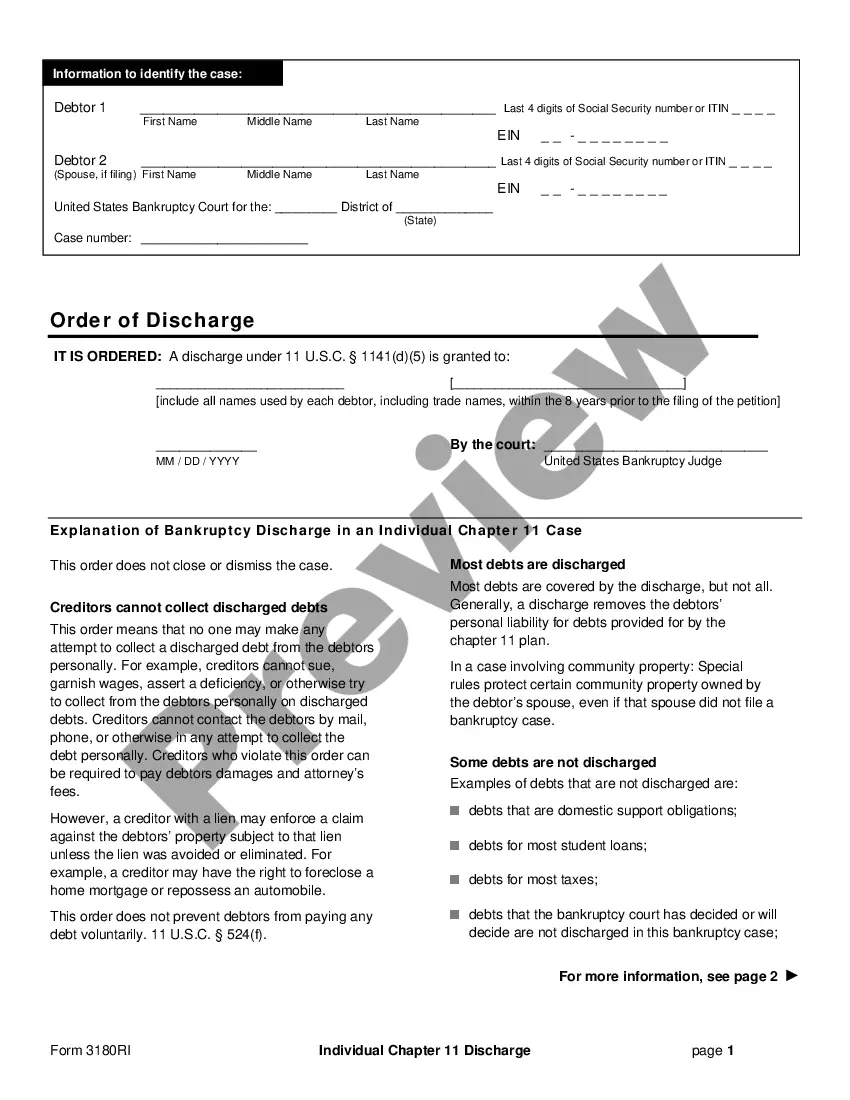

A Chapter 13 Hardship Discharge is a legal action that allows a debtor to receive a discharge from their outstanding debts without the need to complete their repayment plan. This type of discharge is available in limited circumstances and is only available in a Chapter 13 bankruptcy. There are two types of Chapter 13 Hardship Discharges: Total Hardship Discharge and Partial Hardship Discharge. A Total Hardship Discharge eliminates all the debtor's debts, except those which are not dischargeable such as certain taxes, child support, student loans, and criminal fines. To qualify for a Total Hardship Discharge, the debtor must prove that their financial situation has changed since filing for bankruptcy, and they are unable to make their plan payments. A Partial Hardship Discharge eliminates some of the debtor's debts, but does not eliminate all of them. To qualify for a Partial Hardship Discharge, the debtor must prove that their financial situation has changed since filing for bankruptcy, and they are unable to make their plan payments. The debtor's income must also be below a certain level in order to qualify for a Partial Hardship Discharge. In either case, the debtor must also demonstrate that they have made a good faith effort to make their plan payments and that their current financial situation is unlikely to improve in the future. The court will evaluate the debtor's financial situation and determine if a Chapter 13 Hardship Discharge is appropriate.

Chapter 13 Hardship Discharge

Description

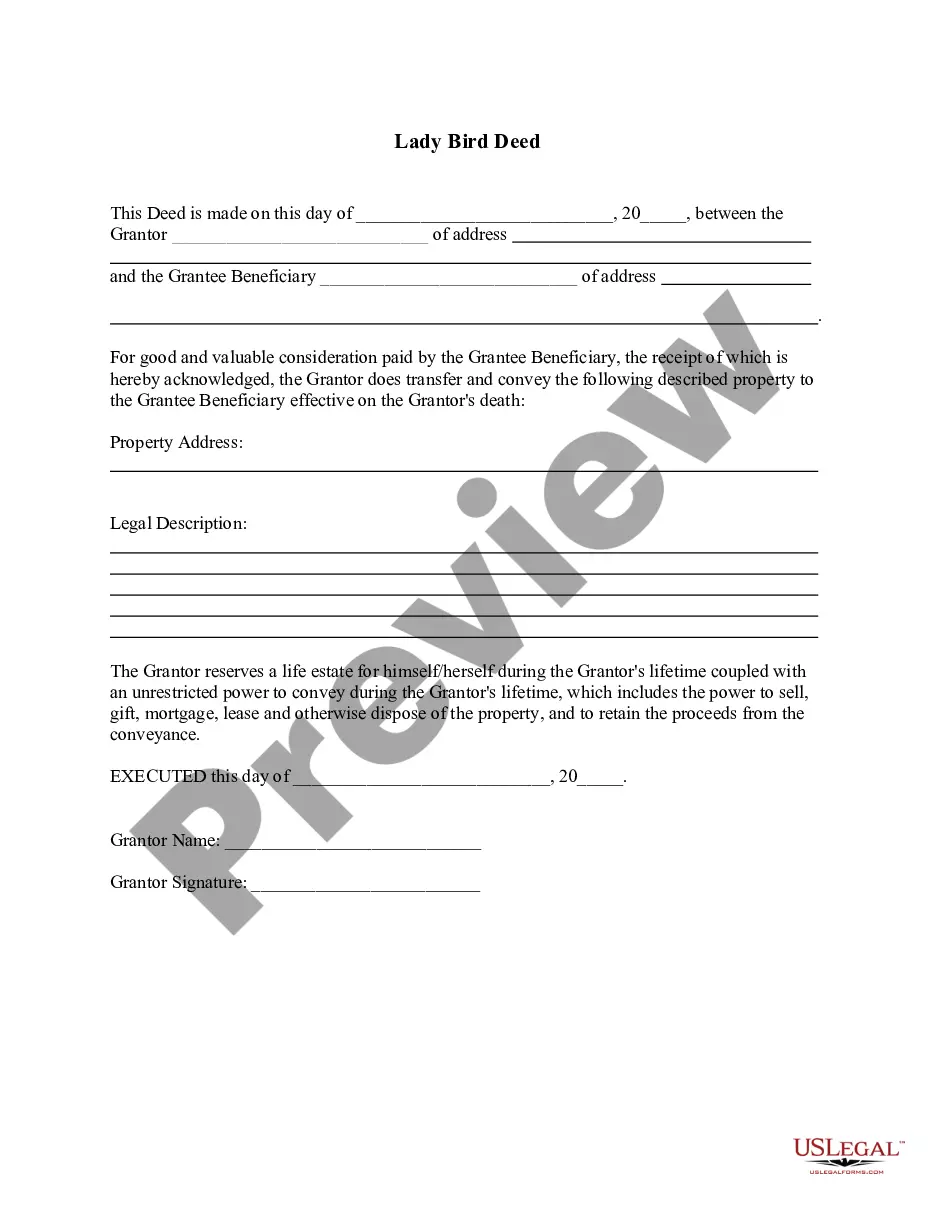

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Chapter 13 Hardship Discharge?

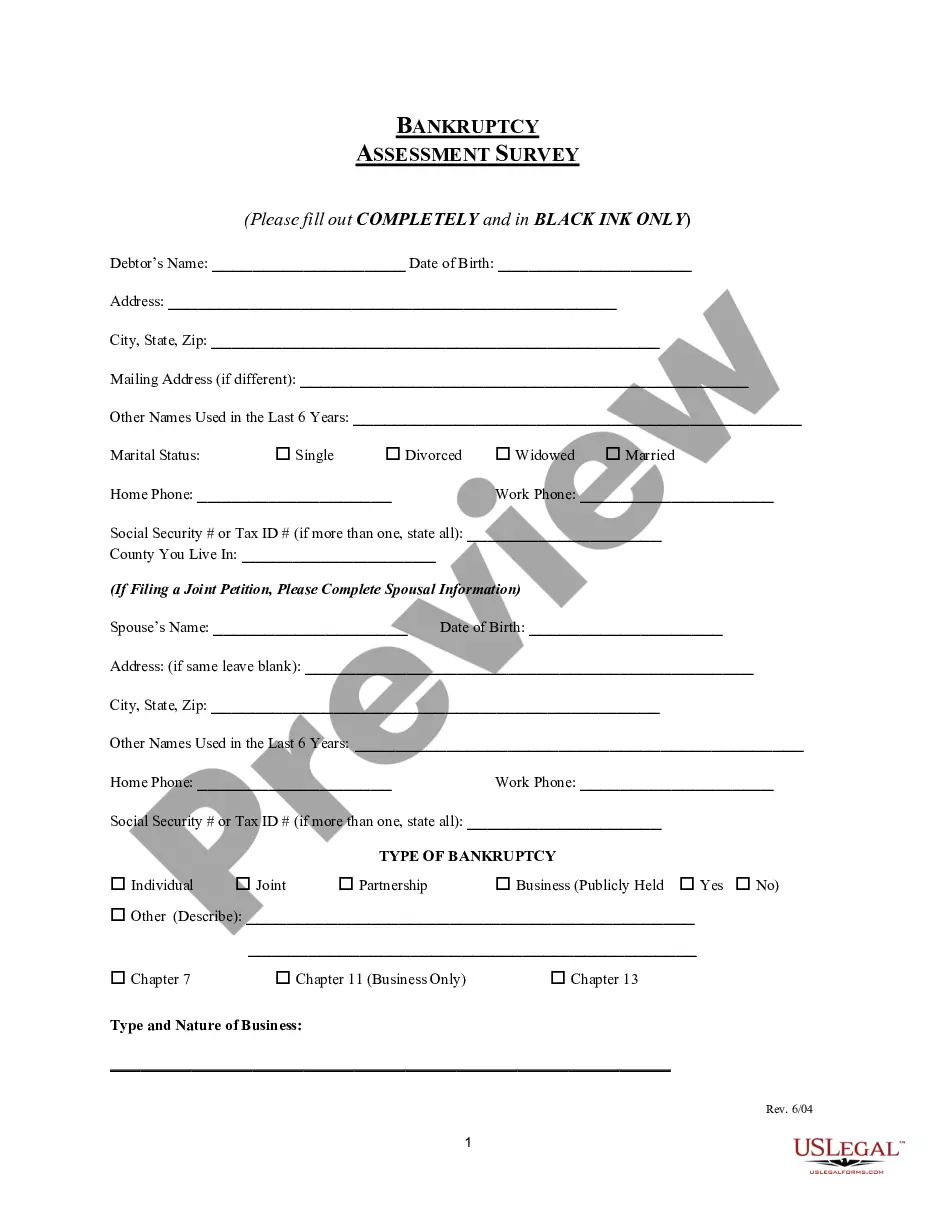

Preparing legal paperwork can be a real stress unless you have ready-to-use fillable templates. With the US Legal Forms online library of formal documentation, you can be certain in the blanks you find, as all of them correspond with federal and state regulations and are examined by our experts. So if you need to fill out Chapter 13 Hardship Discharge, our service is the best place to download it.

Getting your Chapter 13 Hardship Discharge from our catalog is as easy as ABC. Previously authorized users with a valid subscription need only sign in and click the Download button once they find the correct template. Afterwards, if they need to, users can get the same blank from the My Forms tab of their profile. However, even if you are unfamiliar with our service, signing up with a valid subscription will take only a few minutes. Here’s a brief instruction for you:

- Document compliance check. You should attentively examine the content of the form you want and check whether it suits your needs and fulfills your state law requirements. Previewing your document and looking through its general description will help you do just that.

- Alternative search (optional). Should there be any inconsistencies, browse the library using the Search tab on the top of the page until you find an appropriate template, and click Buy Now once you see the one you want.

- Account creation and form purchase. Register for an account with US Legal Forms. After account verification, log in and choose your preferred subscription plan. Make a payment to continue (PayPal and credit card options are available).

- Template download and further usage. Choose the file format for your Chapter 13 Hardship Discharge and click Download to save it on your device. Print it to complete your papers manually, or take advantage of a multi-featured online editor to prepare an electronic version faster and more efficiently.

Haven’t you tried US Legal Forms yet? Sign up for our service today to get any official document quickly and easily whenever you need to, and keep your paperwork in order!

Form popularity

FAQ

To obtain the hardship discharge the debtor must first show an inability to continue making the scheduled Chapter 13 plan payments. In other words, something has happened to you financially that reduced your income or ability to pay your creditors. The change in finances must be beyond the debtor's control.

Hardship vs Dependency. Terminology can get confusing because "hardship" and "dependency" discharges are often both loosely labeled "hardship." Specifically, a hardship discharge is when the financial needs of family member(s) require more than the military member can provide while remaining in the military.

To qualify for a hardship discharge, the change in your circumstances must not be your fault. Also, you must typically show that a serious and permanent reason or condition prevents you from completing your plan, such as a life-changing medical condition that arose after filing your case.

How to Qualify for a Chapter 13 Hardship Discharge Prove that you were unable to complete payments due to circumstances beyond your control.Have paid unsecured creditors an amount equal to that of a Chapter 7 bankruptcy.Show it's not feasible to modify your current plan.

(2) Hardship. Hardship exists when, in circumstances not involving death or disability of a member of a Soldiers family, separation from the service would materially affect the care or support of the Soldier's family by materially alleviating undue hardship.

Generally, this discharge requires severe medical, psychological or financial problems in the member's immediate family. Medical and psychological problems are termed dependency, while financial problems are described as hardship, though many military personnel use the terms interchangeably.

Some examples of dischargeable debts in Chapter 13 include credit card debt, medical bills, utility bills, and personal loans. Unsecured Debts ? Unsecured debts are not linked to any collateral, such as utility bills and medical bills.

An example of a Hardship Discharge would be if you are married and have children, but your spouse dies, leaving you to the sole parent to children. What is this? In this case, your kids' care takes priority, and the military will grant a Hardship Discharge because it is convenient for the government.