Approval of deferred compensation investment account plan

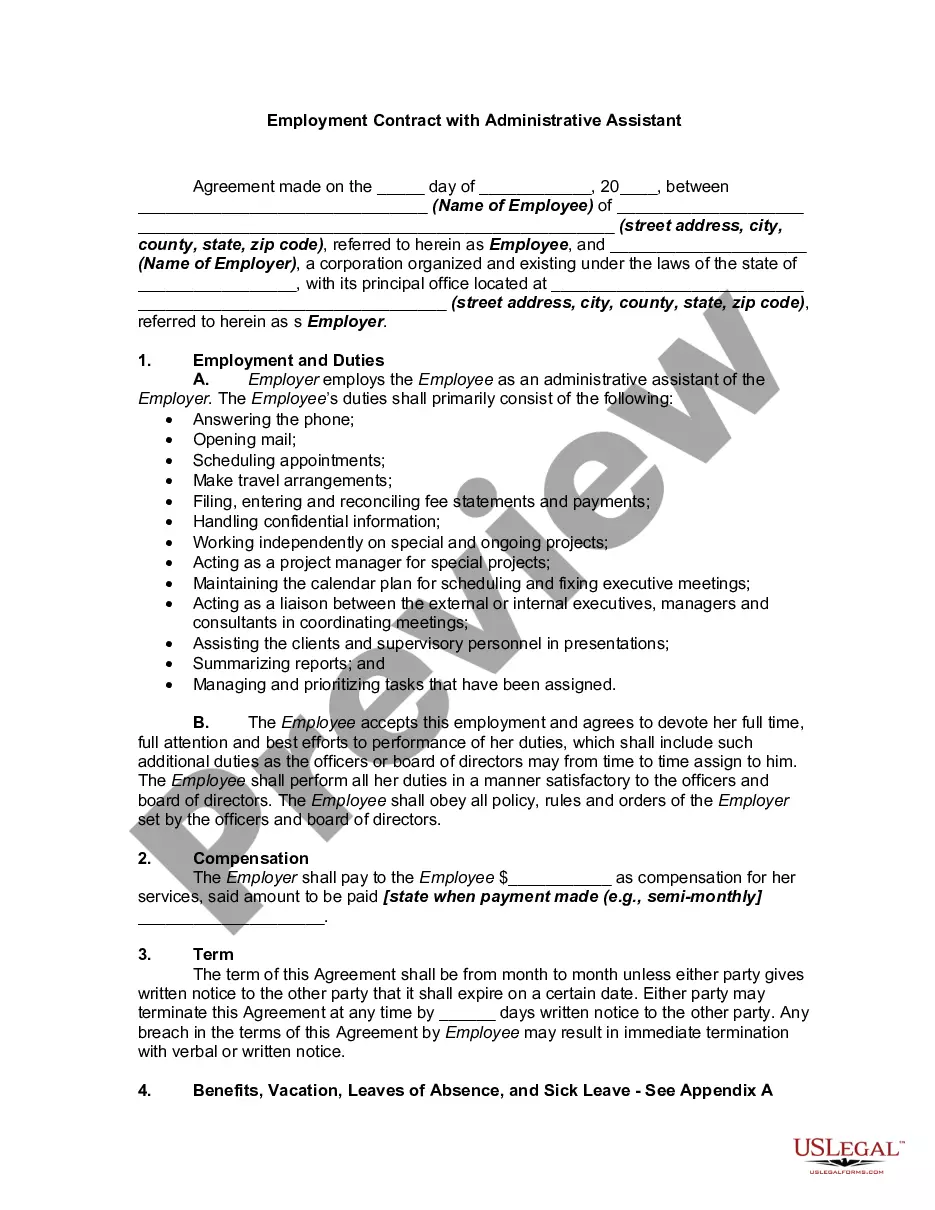

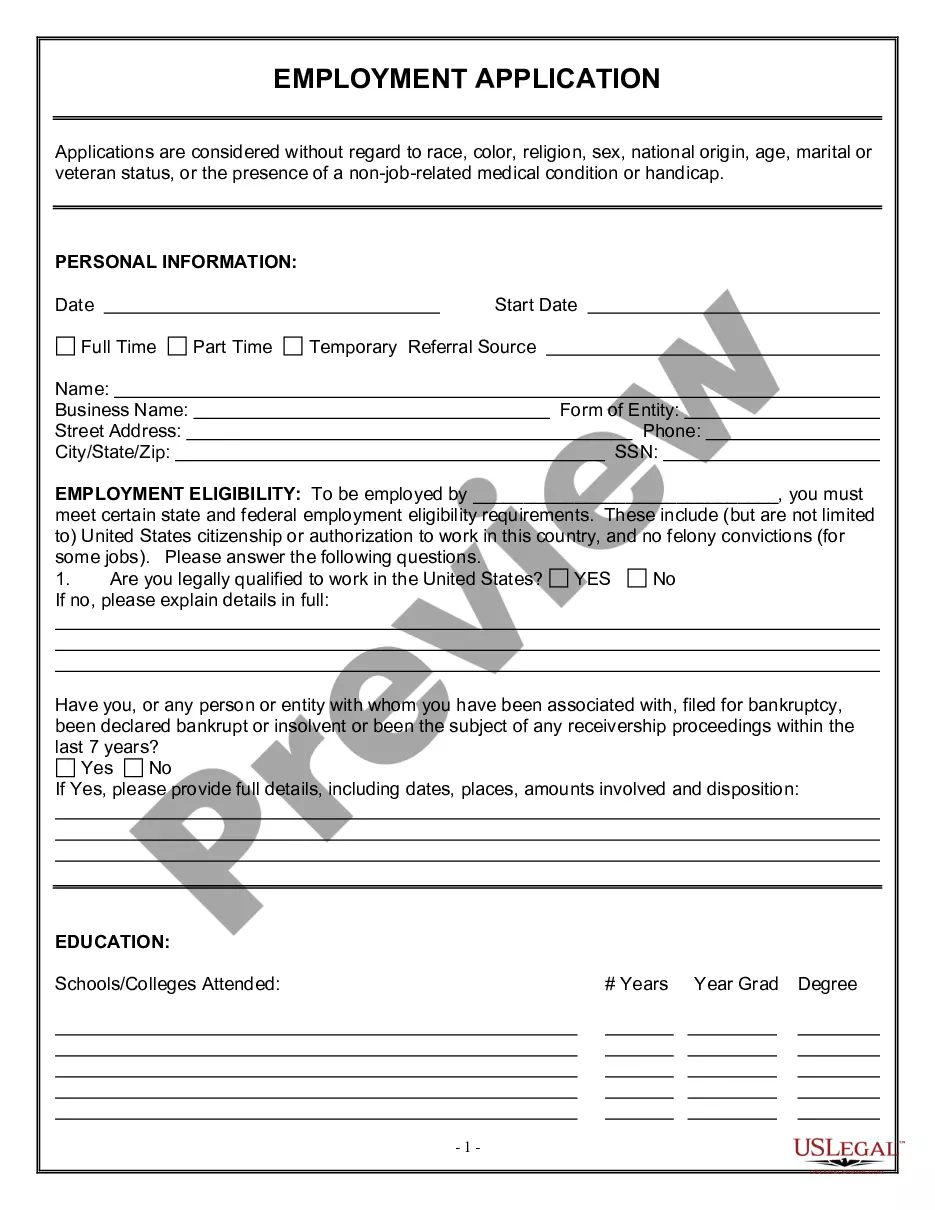

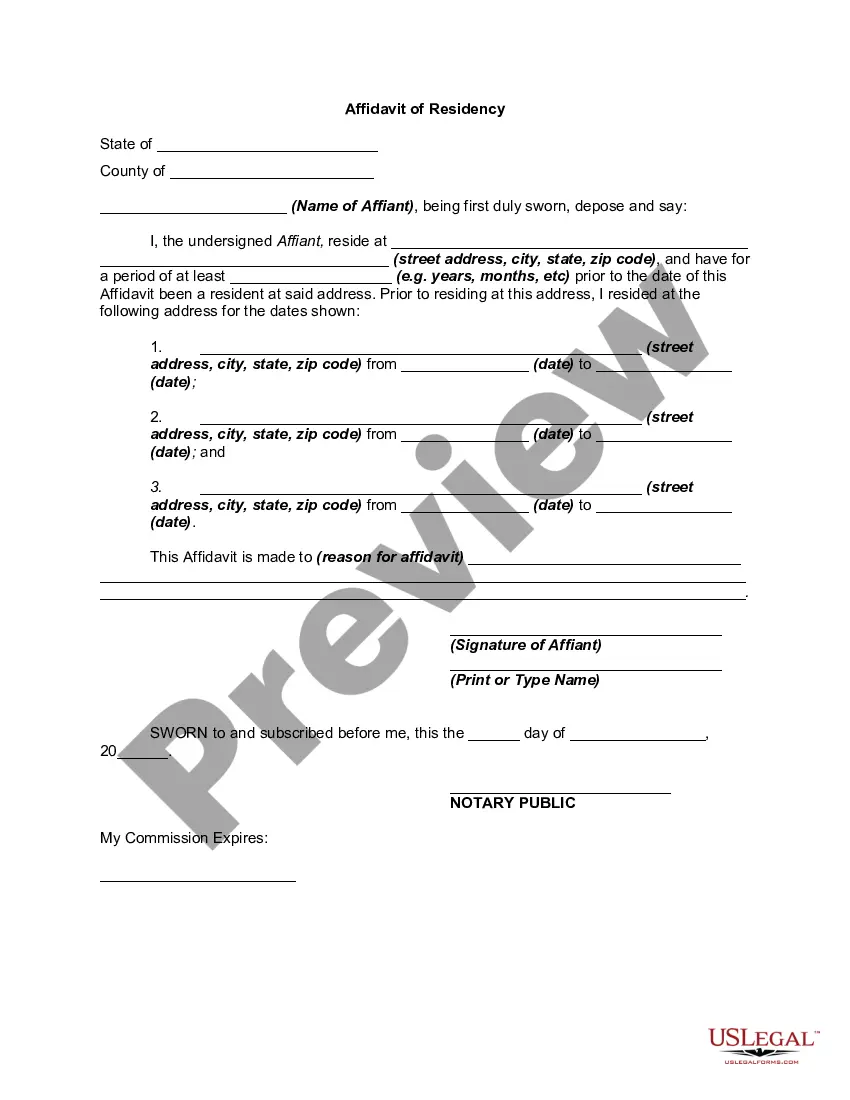

Description

How to fill out Approval Of Deferred Compensation Investment Account Plan?

When it comes to drafting a legal document, it is easier to leave it to the professionals. However, that doesn't mean you yourself cannot get a template to use. That doesn't mean you yourself can’t get a sample to utilize, however. Download Approval of deferred compensation investment account plan right from the US Legal Forms web site. It provides a wide variety of professionally drafted and lawyer-approved forms and samples.

For full access to 85,000 legal and tax forms, customers simply have to sign up and choose a subscription. After you’re signed up with an account, log in, find a particular document template, and save it to My Forms or download it to your gadget.

To make things easier, we’ve incorporated an 8-step how-to guide for finding and downloading Approval of deferred compensation investment account plan quickly:

- Make sure the document meets all the necessary state requirements.

- If possible preview it and read the description before purchasing it.

- Press Buy Now.

- Choose the appropriate subscription to suit your needs.

- Create your account.

- Pay via PayPal or by debit/credit card.

- Select a preferred format if a number of options are available (e.g., PDF or Word).

- Download the document.

When the Approval of deferred compensation investment account plan is downloaded you can fill out, print and sign it in almost any editor or by hand. Get professionally drafted state-relevant documents within a matter of seconds in a preferable format with US Legal Forms!

Form popularity

FAQ

How deferred compensation is taxed. Generally speaking, the tax treatment of deferred compensation is simple: Employees pay taxes on the money when they receive it, not necessarily when they earn it.The year you receive your deferred money, you'll be taxed on $200,000 in income10 years' worth of $20,000 deferrals.

Deferred compensation plans are an incentive that employers use to hold onto key employees. Deferred compensation can be structured as either qualified or non-qualified. The attractiveness of deferred compensation is dependent on the employee's personal tax situation. These plans are best suited for high earners.

Qualified plans include 401(k) plans, 403(b) plans, profit-sharing plans, and Keogh (HR-10) plans. Nonqualified plans include deferred-compensation plans, executive bonus plans, and split-dollar life insurance plans.

Depending on the terms of your plan, you may end up forfeiting all or part of your deferred compensation if you leave the company early. That's why these plans are also used as golden handcuffs to keep important employees at the company.They can't be transferred or rolled over into an IRA or new employer plan.

A deferred compensation plan allows employees to place income into a retirement account where it sits untaxed until they withdraw the funds. After withdrawal, the funds become subject to taxes, although this is usually much less if payment is deferred until retirement.

The short answer is yes. You can defer a significant portion of your compensation under a non-qualified retirement or deferred compensation plan. Deferred compensation plans are safe from your own creditors, but not the claims of your employer's creditors.

Deferred compensation plans don't have required minimum distributions, either. Based upon your plan options, generally, you may choose 1 of 2 ways to receive your deferred compensation: as a lump-sum payment or in installments.However, you will owe regular income tax on the entire lump sum upon distribution.

Your company will designate an amount you may defer and for how long you may defer that amountusually five years, 10 years or until you retire.In some cases, the company may make the choice for you by offering a guaranteed rate of return on the compensation, but this is rare.