Utilization by a REIT of partnership structures in financing five development projects

Description Partnership Financing Complete

How to fill out Reit Partnership Structures?

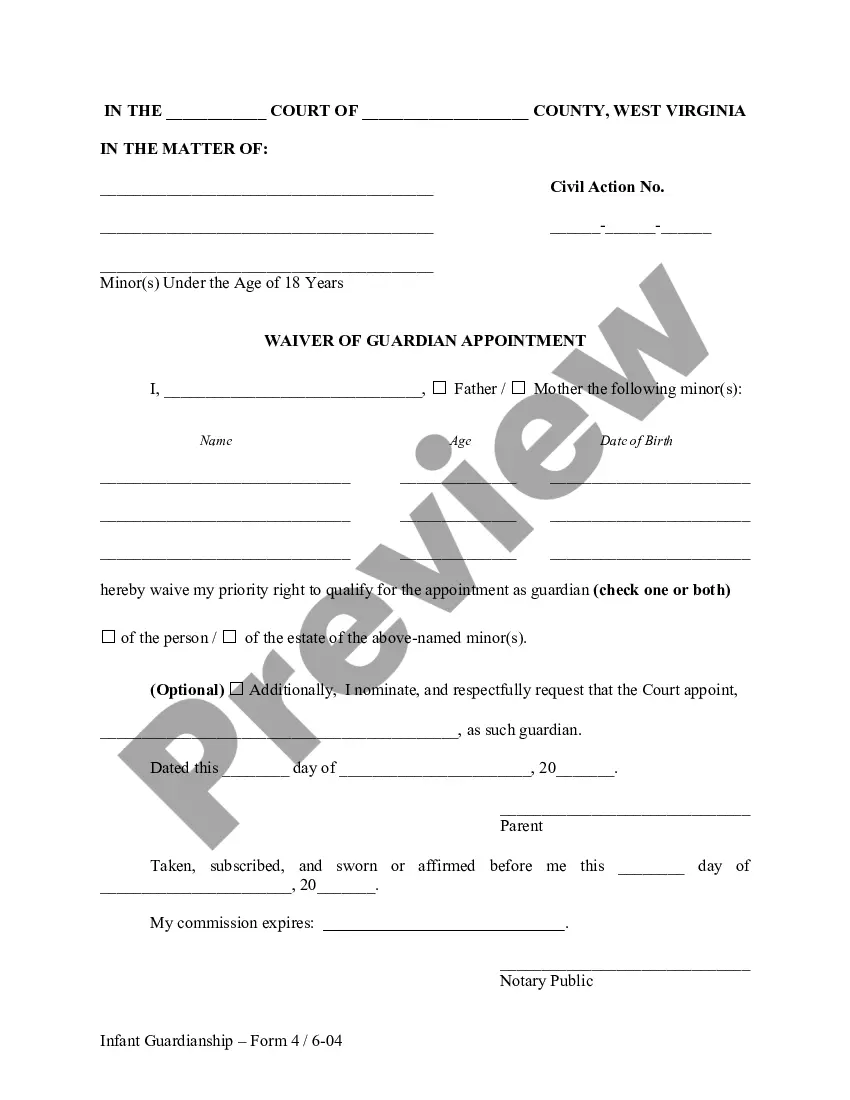

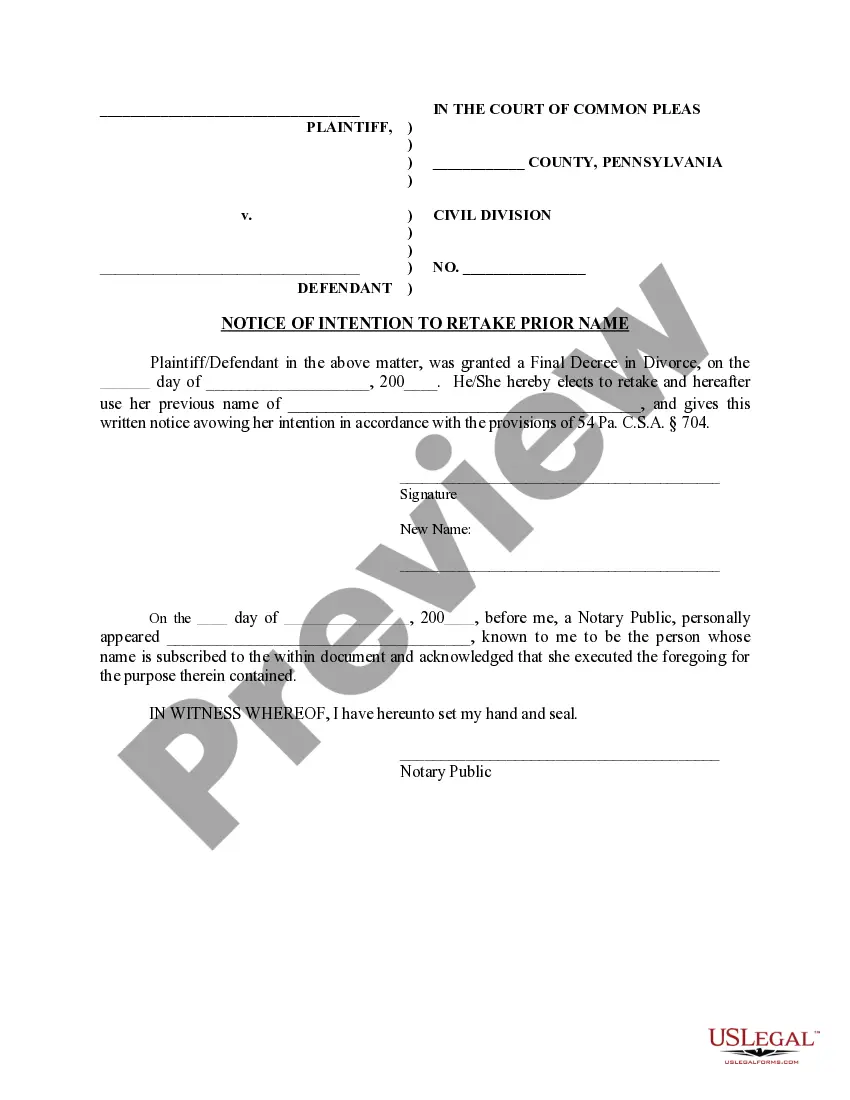

When it comes to drafting a legal form, it is easier to delegate it to the specialists. However, that doesn't mean you yourself can’t get a sample to utilize. That doesn't mean you yourself can’t find a sample to use, nevertheless. Download Utilization by a REIT of partnership structures in financing five development projects from the US Legal Forms site. It gives you numerous professionally drafted and lawyer-approved forms and samples.

For full access to 85,000 legal and tax forms, users just have to sign up and choose a subscription. Once you’re registered with an account, log in, find a specific document template, and save it to My Forms or download it to your gadget.

To make things less difficult, we have provided an 8-step how-to guide for finding and downloading Utilization by a REIT of partnership structures in financing five development projects quickly:

- Make sure the form meets all the necessary state requirements.

- If possible preview it and read the description before purchasing it.

- Hit Buy Now.

- Choose the appropriate subscription to suit your needs.

- Make your account.

- Pay via PayPal or by debit/visa or mastercard.

- Select a preferred format if several options are available (e.g., PDF or Word).

- Download the file.

Once the Utilization by a REIT of partnership structures in financing five development projects is downloaded you are able to complete, print out and sign it in almost any editor or by hand. Get professionally drafted state-relevant files in a matter of seconds in a preferable format with US Legal Forms!

By Partnership Structures Form popularity

Partnership Financing Purchase Other Form Names

Partnership Financing Print FAQ

LLC partnership (also known as a multi-member LLC) Limited liability partnership (LLP) Limited partnership (LP) General partnership (GP)

The different types of corporations and business structures. When it comes to types of corporations, there are typically four that are brought up: S corps, C corps, non-profit corporations, and LLCs.

C corporation (C corp) S corporation (S corp) Limited liability company (LLC)

A partnership is a form of business where two or more people share ownership, as well as the responsibility for managing the company and the income or losses the business generates.There are three types of partnerships: General partnership. Limited partnership. Joint venture.

General Partnership: Limited Partnership: Limited Liability Partnership (L.L.P): Partnership at Will: Particular Partnership:

Types of Partnership General Partnership, Limited Partnership, Limited Liability Partnership and Public Private Partnership.

GoPro & Red Bull. Pottery Barn & Sherwin-Williams. Casper & West Elm. Bonne Belle & Dr. Pepper. BMW & Louis Vuitton. Uber & Spotify. Apple & MasterCard. Airbnb & Flipboard.

There are three relatively common partnership types: general partnership (GP), limited partnership (LP) and limited liability partnership (LLP).

The most common forms of business are the sole proprietorship, partnership, corporation, and S corporation. A Limited Liability Company (LLC) is a business structure allowed by state statute. Legal and tax considerations enter into selecting a business structure.