Waiver of Preemptive Rights with copy of restated articles of organization

Description Rights With Copy

How to fill out What Is A Preemptive Right?

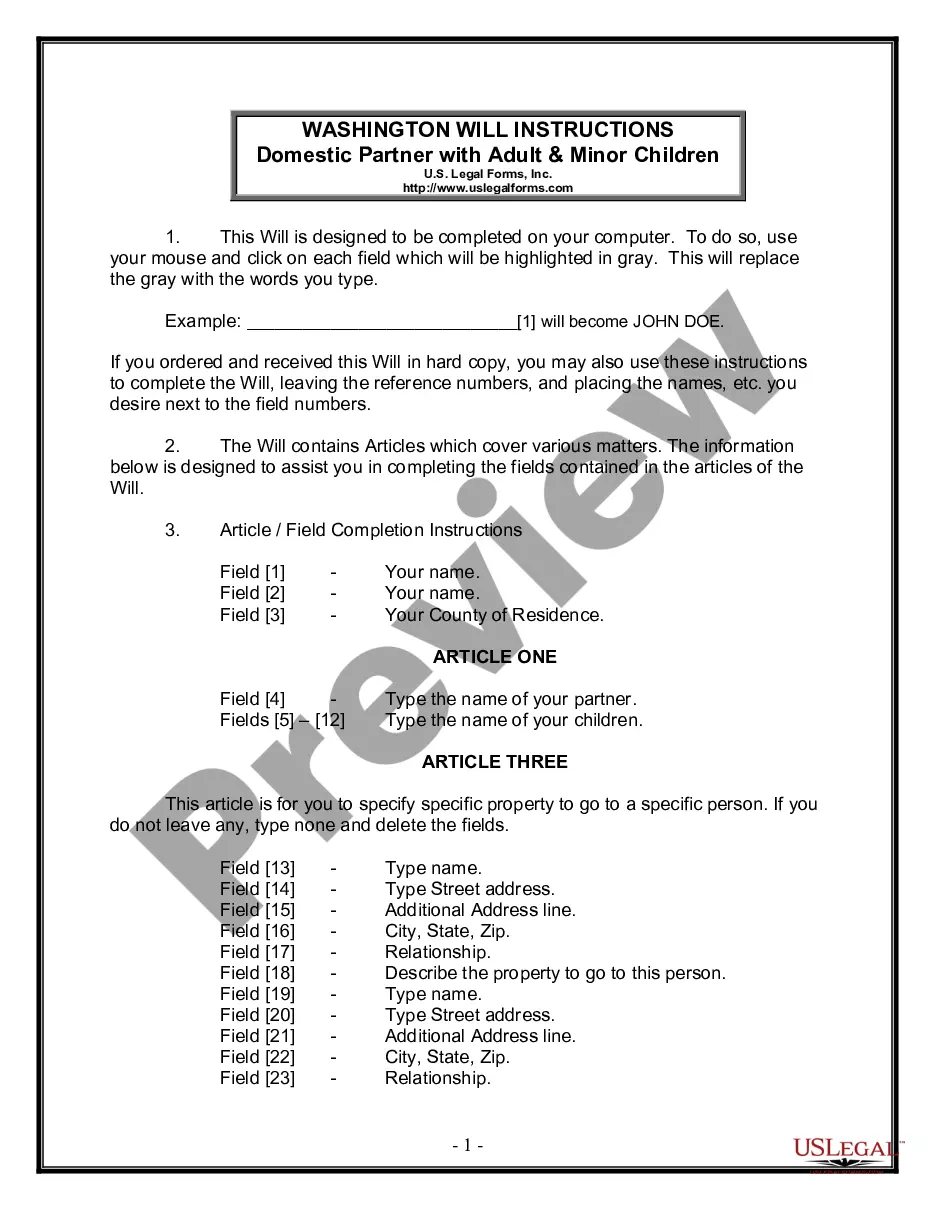

When it comes to drafting a legal document, it’s easier to delegate it to the professionals. However, that doesn't mean you yourself cannot get a sample to use. That doesn't mean you yourself cannot find a template to use, however. Download Waiver of Preemptive Rights with copy of restated articles of organization right from the US Legal Forms site. It provides numerous professionally drafted and lawyer-approved documents and templates.

For full access to 85,000 legal and tax forms, users just have to sign up and select a subscription. When you’re registered with an account, log in, search for a specific document template, and save it to My Forms or download it to your gadget.

To make things much easier, we’ve included an 8-step how-to guide for finding and downloading Waiver of Preemptive Rights with copy of restated articles of organization promptly:

- Make sure the form meets all the necessary state requirements.

- If available preview it and read the description before buying it.

- Click Buy Now.

- Select the appropriate subscription for your needs.

- Make your account.

- Pay via PayPal or by debit/visa or mastercard.

- Select a needed format if a few options are available (e.g., PDF or Word).

- Download the document.

As soon as the Waiver of Preemptive Rights with copy of restated articles of organization is downloaded you are able to fill out, print and sign it in any editor or by hand. Get professionally drafted state-relevant files within a matter of minutes in a preferable format with US Legal Forms!

Preemptive Right Form popularity

Preemptive Rights Agreement Other Form Names

Preemptive Rights Sample FAQ

Preemptive rights enable shareholders to maintain their proportionate ownership and voice in the corporation. stock split. A division of shares of a company into a larger number of shares. (A 2 for 1 split allows a shareholder to double the number of shares but worth one half of their previous value).

In short, the preemptive rights are necessary to shareholders because it allows existing shareholders of a company to avoid involuntary dilution of their ownership stake by giving them the chance to buy a proportional interest in any future issuance of common stock.

Two commonly used approaches for estimating a stock's intrinsic value are the discounted dividend model and the corporate valuation model. The dividend model focuses on dividends, while the corporate model goes beyond dividends and focuses on sales, costs, and free cash flows.

What Are Preemptive Rights? Preemptive rights give a shareholder the opportunity to buy additional shares in any future issue of a company's common stock before the shares are made available to the general public.

Adjective. of or relating to preemption. taken as a measure against something possible, anticipated, or feared; preventive; deterrent: a preemptive tactic against a ruthless business rival. preempting or possessing the power to preempt; appropriative; privileged: a commander's preemptive authority.

Pre-emptive rights provide existing shareholders (or those shareholders to which the right is granted in the agreement) the right to subscribe for any additional shares issued by the company, given them the chance to ensure their percentage ownership in the corporation is not diluted.

The two primary reasons for the existence of the preemptive right are: the first is that it protects the power of control of current Stockholders. The second is more important, a preemptive right protects stockholders against the dilution of value that would occur if new shares were sold at relatively low prices.

As used in a company shareholders' or operating agreements in the United States, the preemptive right is important to shareholders because it protects current shareholders against dilution of their ownership interest in the company.

Owners of common stock have preemptive rights to maintain the same proportion of ownership in the company over time.If the company circulates another offering of stock, shareholders can purchase as much stock as it takes to keep their ownership comparable.