Letter to Equifax Requesting Free Copy of Your Credit Report based on Denial of Credit

Description Requesting Copy Complete

How to fill out Letter Denial Blank?

When it comes to drafting a legal form, it’s better to delegate it to the professionals. However, that doesn't mean you yourself can not get a sample to utilize. That doesn't mean you yourself can not find a sample to utilize, nevertheless. Download Letter to Equifax Requesting Free Copy of Your Credit Report based on Denial of Credit from the US Legal Forms site. It offers numerous professionally drafted and lawyer-approved documents and samples.

For full access to 85,000 legal and tax forms, customers just have to sign up and choose a subscription. Once you are signed up with an account, log in, look for a specific document template, and save it to My Forms or download it to your device.

To make things much easier, we’ve incorporated an 8-step how-to guide for finding and downloading Letter to Equifax Requesting Free Copy of Your Credit Report based on Denial of Credit quickly:

- Make confident the document meets all the necessary state requirements.

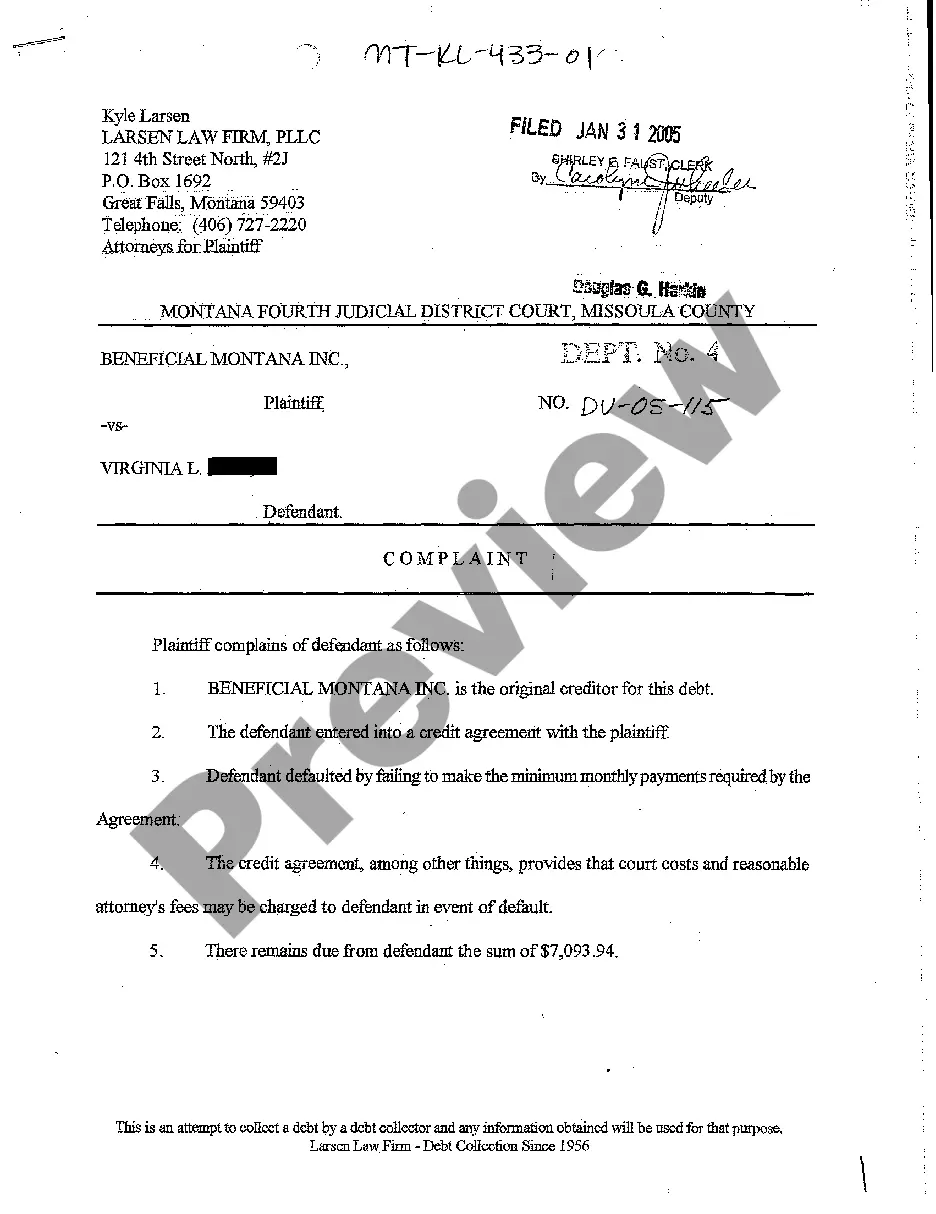

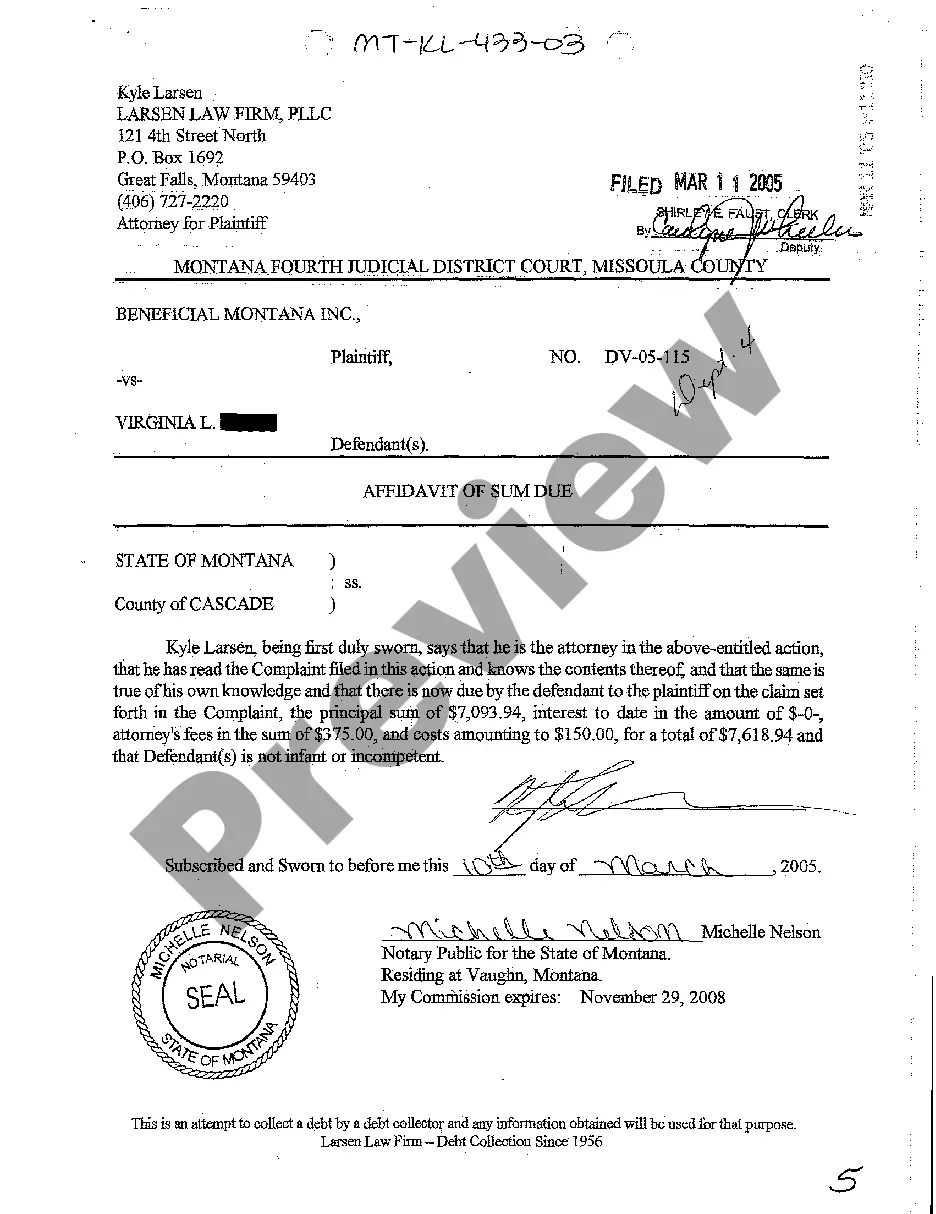

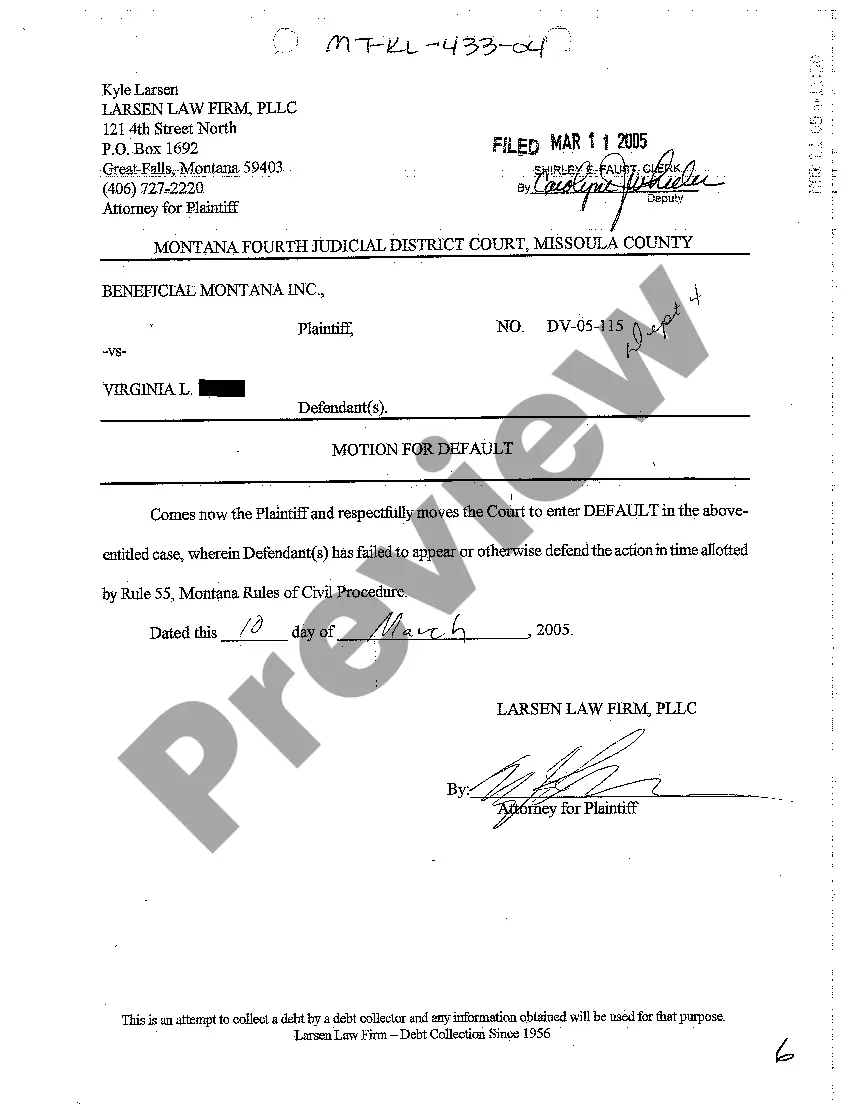

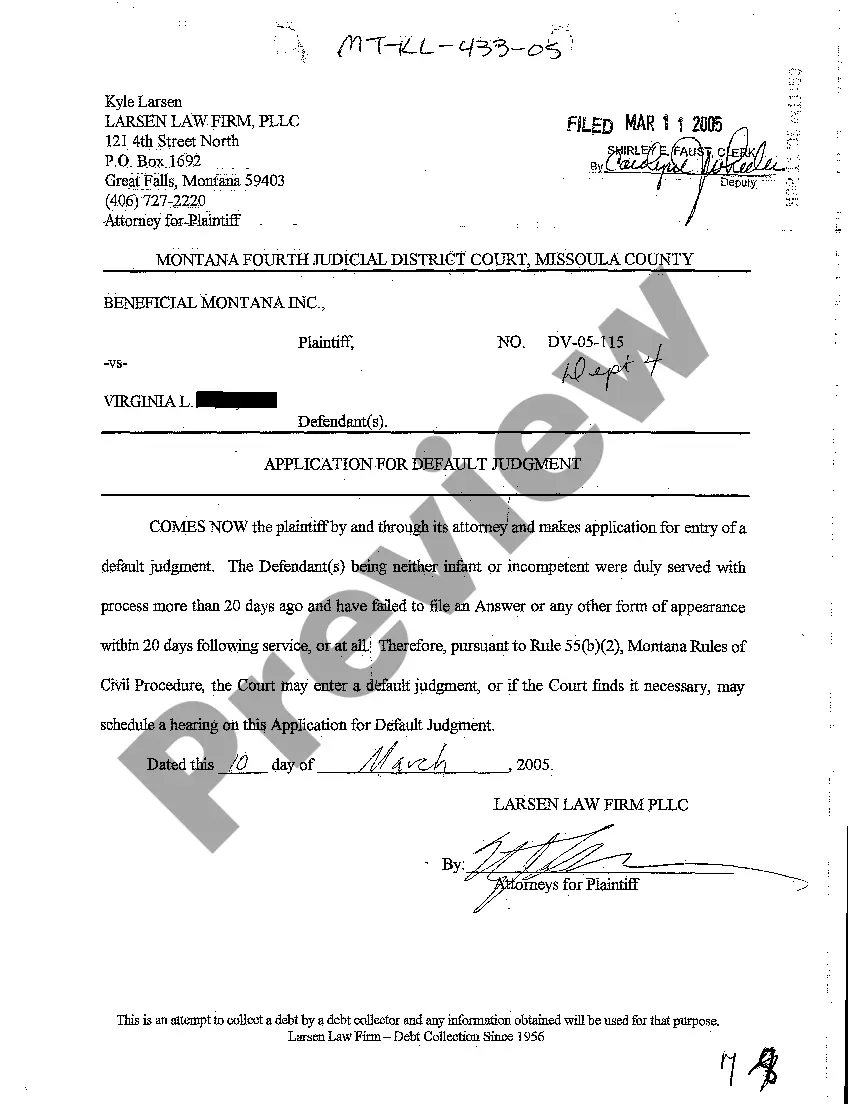

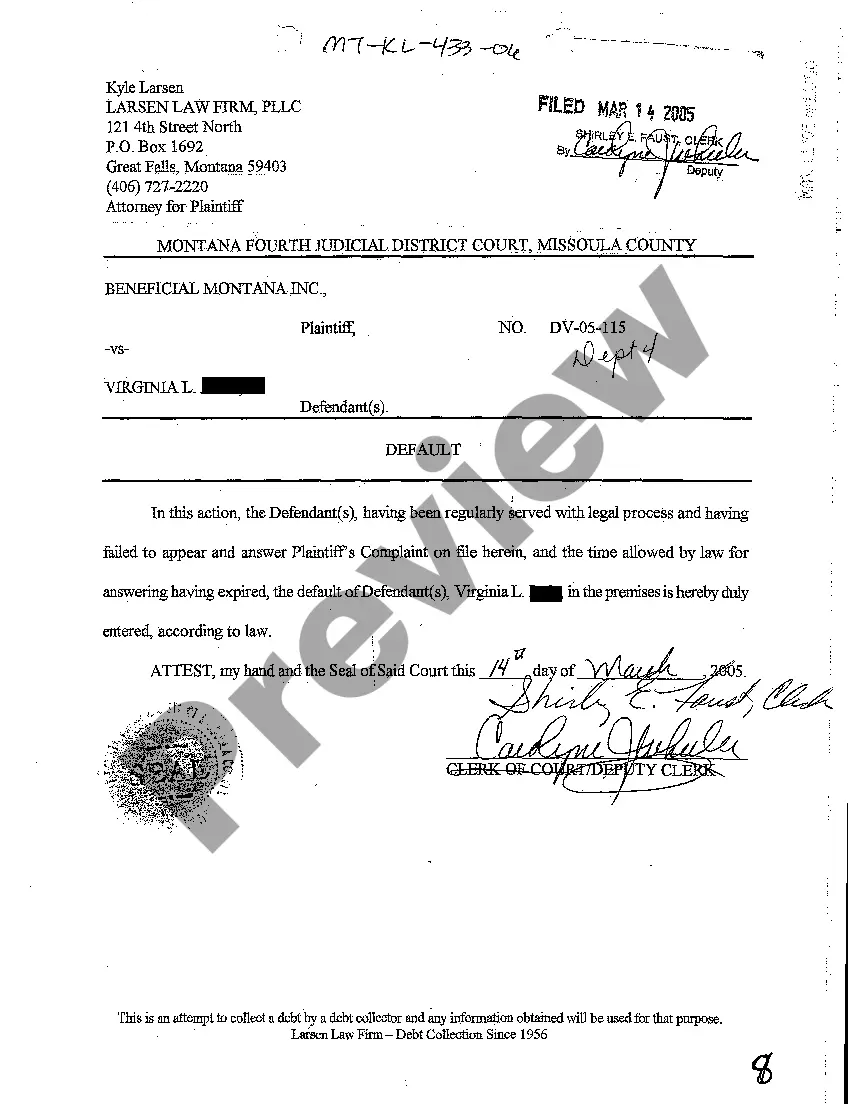

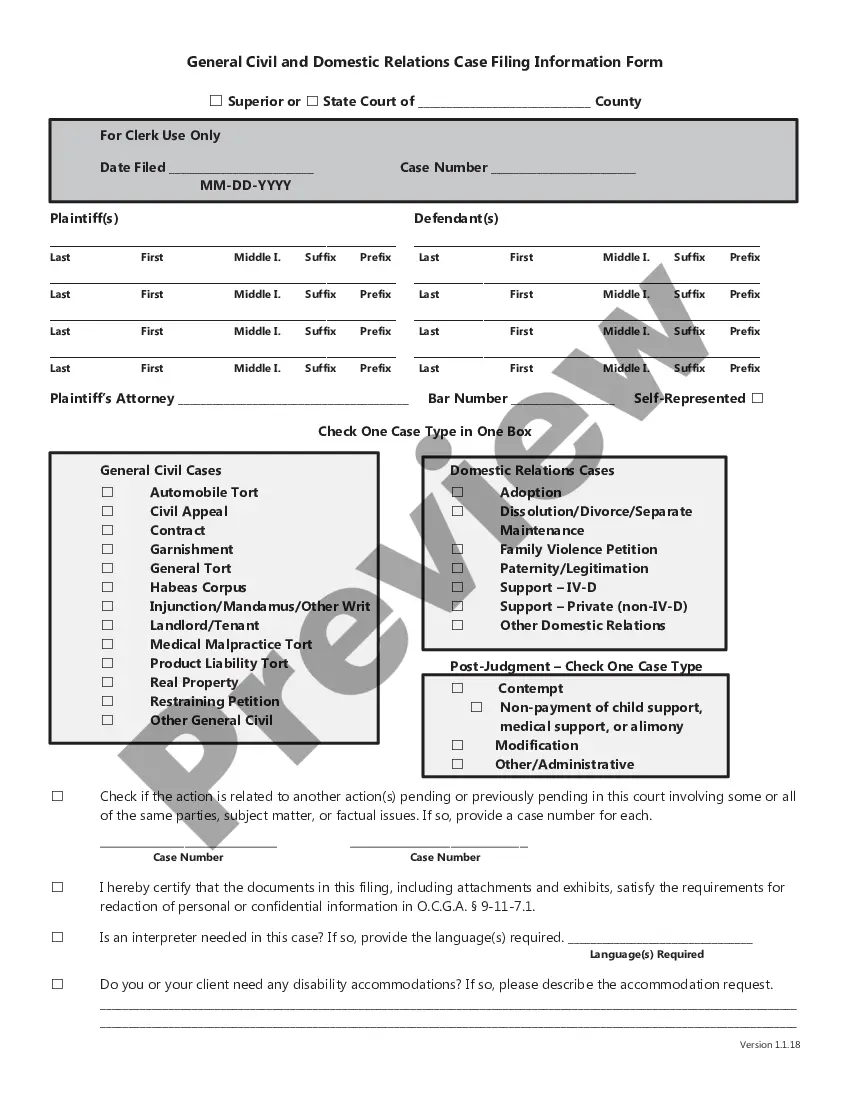

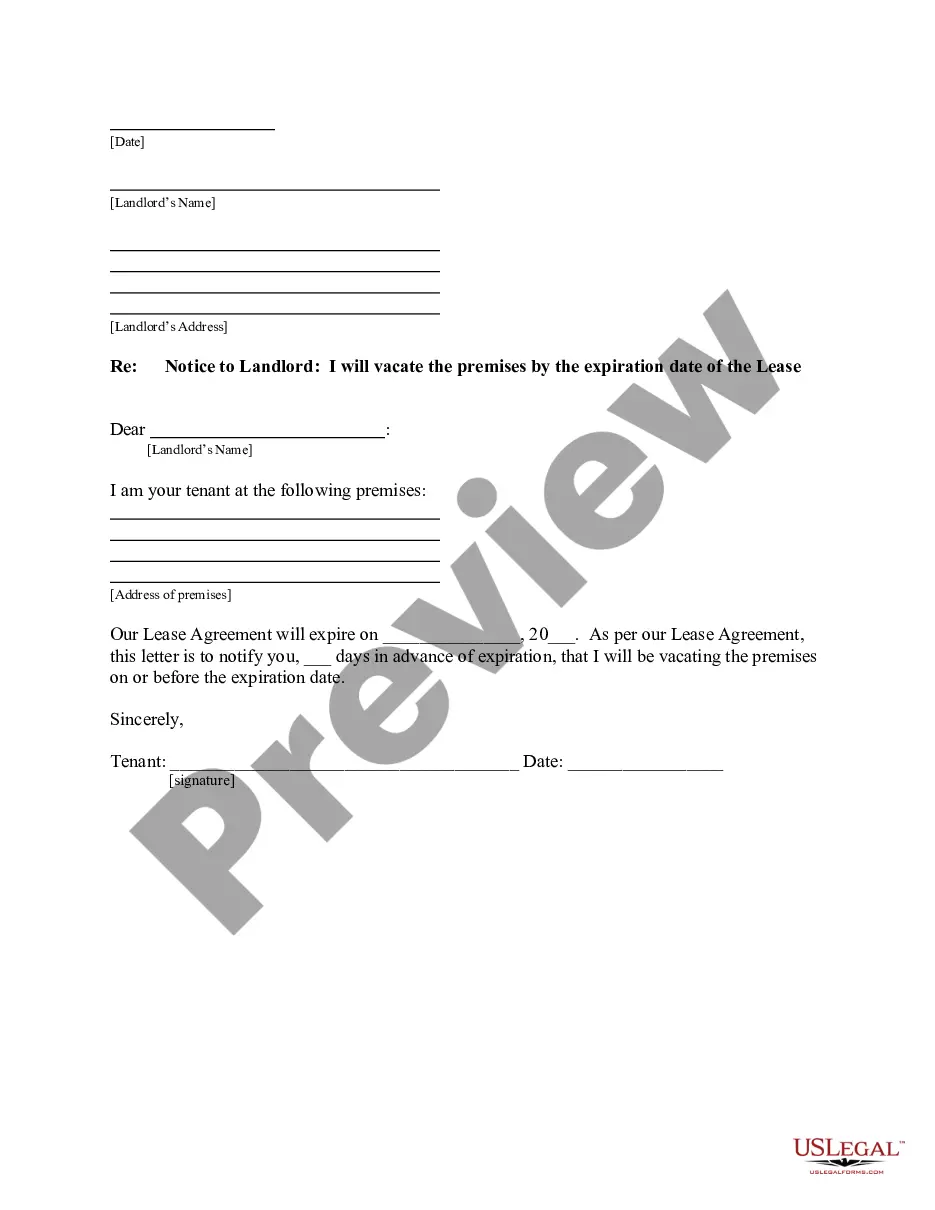

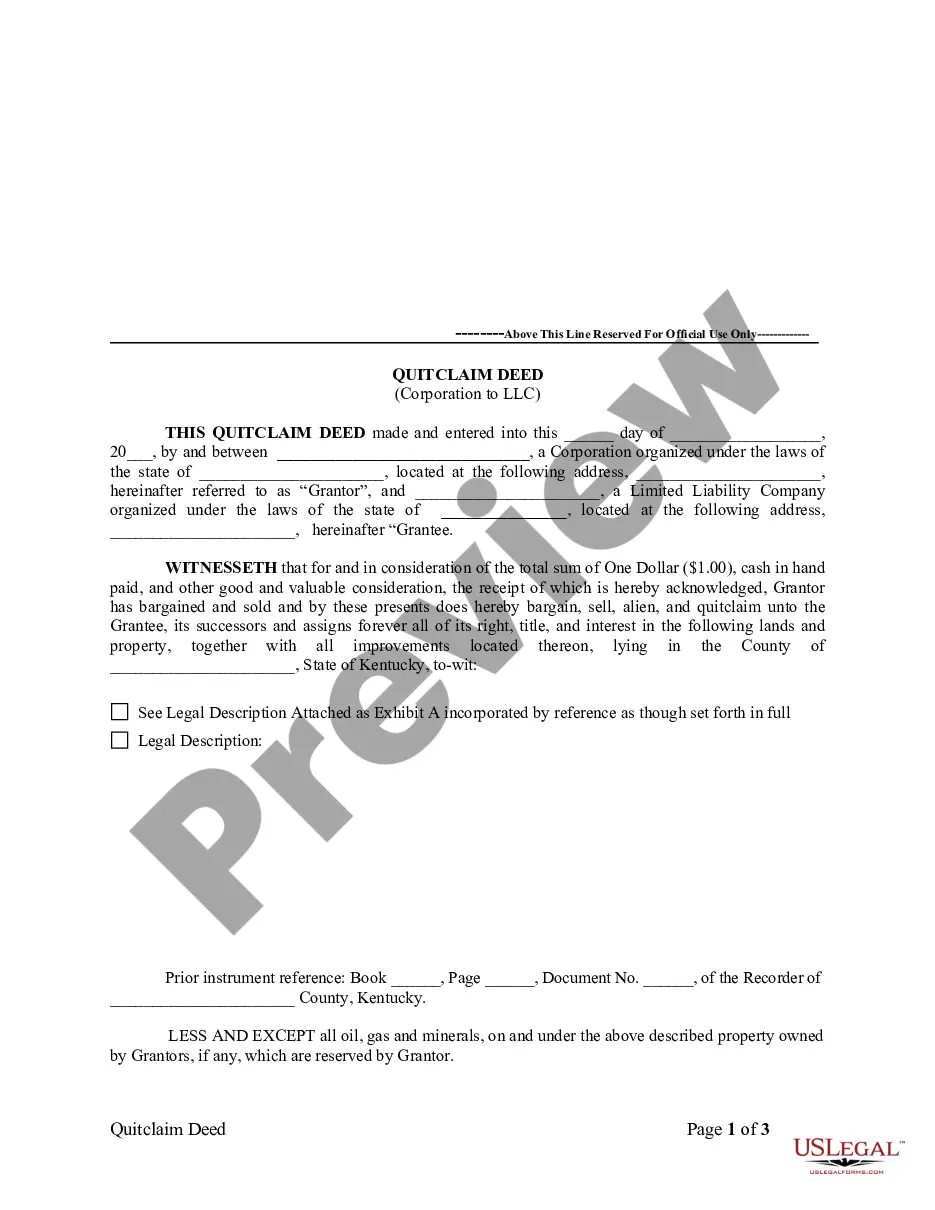

- If available preview it and read the description prior to buying it.

- Press Buy Now.

- Choose the appropriate subscription to suit your needs.

- Create your account.

- Pay via PayPal or by credit/visa or mastercard.

- Select a needed format if several options are available (e.g., PDF or Word).

- Download the file.

When the Letter to Equifax Requesting Free Copy of Your Credit Report based on Denial of Credit is downloaded you may complete, print and sign it in any editor or by hand. Get professionally drafted state-relevant papers within a matter of seconds in a preferable format with US Legal Forms!

Letter Credit Template Form popularity

Letter Requesting Credit Other Form Names

Letter Denial Printable FAQ

Use an appropriate business letter format. Keep it simple. If appropriate, provide the recipient with pertinent information to help them remember who you are. Briefly explain what it is you want the reader to do.

Keep it professional. Your payment notice letter should be short and to the point. Make sure you mention if they have made the required payment to disregard this notice. State specifically what the consequences will be if they do not pay in full by the due date.

Write the letter with a certain and formal language. Be particular on why you need a credit card account and why you are a great credit risk. Tell him or her your request. Explain the reasons for your application. Explain why you are an excellent credit risk. Request for an urgent response.

Explain precisely what your request is. Mention the reason for the request. Use polite language and a professional tone. Demonstrate respect and gratitude to the reader. The content of the letter should be official. You may provide contact information where you can be reached.

A 609 letter is a method of requesting the removal of negative information (even if it's accurate) from your credit report, thanks to the legal specifications of section 609 of the Fair Credit Reporting Act.

Online: Visit www.annualcreditreport.com to get a free copy of your credit reports every 12 months from each of the three nationwide credit bureaus (Equifax, Experian and TransUnion) Create a myEquifax account to get six free Equifax credit reports each year.

Equifax. Experian or call 1-866-200-6020. TransUnion.

You don't have to do anything if you were denied credit.You are entitled under the FCRA to a free credit report if you received an adverse action in the last 60 days. I got an adverse action notice in the last 60 days.