Retainer Agreement

Description

How to fill out Retainer Agreement?

When it comes to drafting a legal document, it’s easier to leave it to the specialists. Nevertheless, that doesn't mean you yourself cannot get a template to utilize. That doesn't mean you yourself can’t find a sample to utilize, nevertheless. Download Retainer Agreement right from the US Legal Forms web site. It gives you numerous professionally drafted and lawyer-approved forms and samples.

For full access to 85,000 legal and tax forms, customers simply have to sign up and choose a subscription. After you’re signed up with an account, log in, look for a particular document template, and save it to My Forms or download it to your gadget.

To make things less difficult, we have provided an 8-step how-to guide for finding and downloading Retainer Agreement promptly:

- Make sure the document meets all the necessary state requirements.

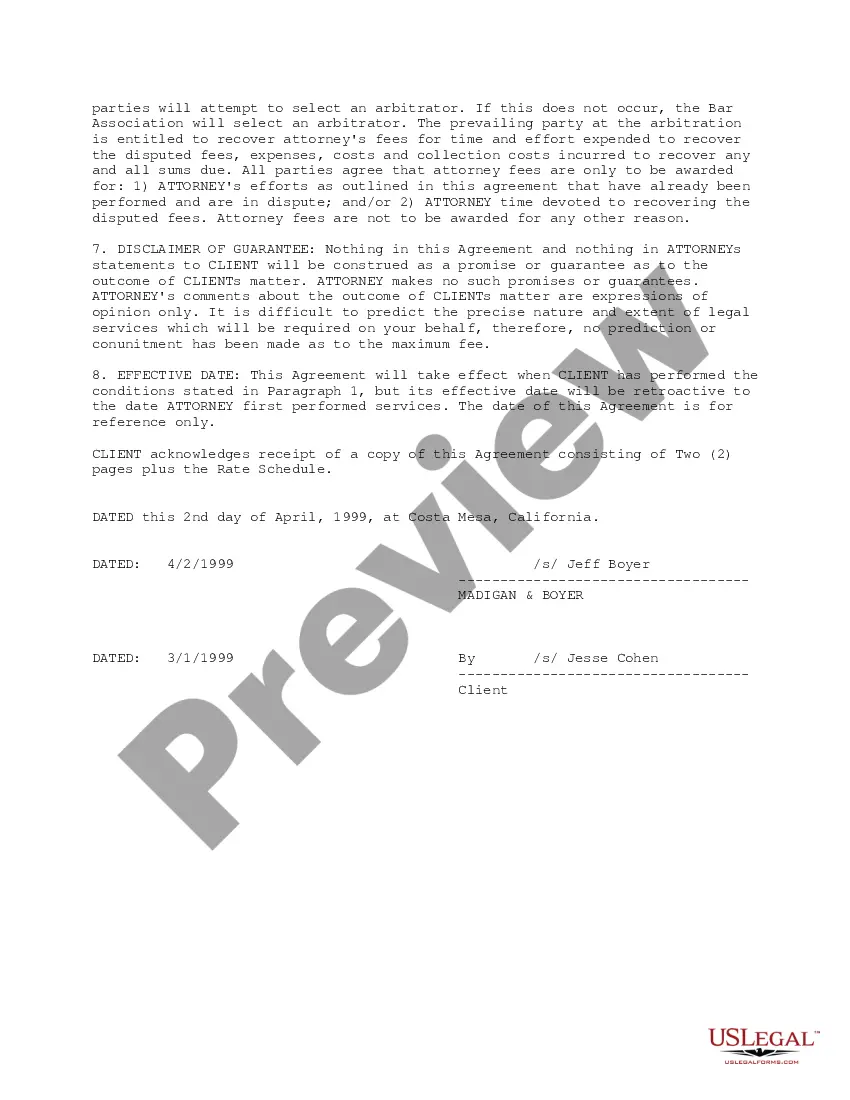

- If available preview it and read the description before buying it.

- Press Buy Now.

- Select the suitable subscription to meet your needs.

- Create your account.

- Pay via PayPal or by credit/bank card.

- Choose a preferred format if a number of options are available (e.g., PDF or Word).

- Download the document.

As soon as the Retainer Agreement is downloaded it is possible to complete, print and sign it in almost any editor or by hand. Get professionally drafted state-relevant files in a matter of seconds in a preferable format with US Legal Forms!

Form popularity

FAQ

In a definitive sense, a retainer is a fee that is paid in advance in order to hold services (ie. a wedding or event date). While a deposit may also reserve a date, it is returned when the services have been completed. A retainer is by default non-refundable and is not returned.

The amount you're to receive each month. The date you're to be paid by. Any invoicing procedures you're expected to follow. Exactly how much work and what type of work you expect to do. When your client needs to let you know about the month's work by.

By asking you to sign a retainer agreement at the initial meeting, the law firm wants to lock you up, exclusively, such that you are no longer able to speak with any other lawyer or law firm about your case.You are not required to stay with your lawyer simply because you signed a retainer agreement.

Generally, if the attorney is on a cash basis of accounting, the retainer is taxable when received. The client is normally given a periodic accounting of the time and costs spent on the case. If the prepaid funds are exhausted, the client is billed for any balance due.

Accounting for a Retainer Fee If the firm is using the accrual basis of accounting, retainers are recognized as a liability upon receipt of the cash, and are recognized as revenue only after the associated work has been performed.

Accounting for a Retainer Fee If the firm is using the accrual basis of accounting, retainers are recognized as a liability upon receipt of the cash, and are recognized as revenue only after the associated work has been performed.

A retainer fee is an amount of money paid in advance by a client to assure your services will be available to them for an extended amount of time. The client pays a lump sum upfront, or makes a recurring monthly payment, and you work with them on a long-term project, or provide them with access to services each month.

A retainer fee is an advance payment that's made by a client to a professional, and it is considered a down payment on the future services rendered by that professional. Regardless of occupation, the retainer fee funds the initial expenses of the working relationship.

As such, a retainer agreement is a formal document outlining the relationship between an attorney and client. It details the different obligations and expectations involved, which can include ethical work principles, retainer fees, modes of communication, and professional ground rules.

1The amount you're to receive each month.2The date you're to be paid by.3Any invoicing procedures you're expected to follow.4Exactly how much work and what type of work you expect to do.5When your client needs to let you know about the month's work by.How to Set Up a Retainer Agreement: Earn More From Your Best\nwww.bidsketch.com > blog > sales > freelance-retainer-agreement