Sample Warrant Purchase Agreement between The Wiser Oil Company and Wise Investment Company, LLC

Description Llc Limited Liability

How to fill out Agreement Between Company?

When it comes to drafting a legal document, it is easier to leave it to the specialists. However, that doesn't mean you yourself can not find a sample to use. That doesn't mean you yourself can’t find a sample to use, nevertheless. Download Sample Warrant Purchase Agreement between The Wiser Oil Company and Wise Investment Company, LLC straight from the US Legal Forms site. It gives you a wide variety of professionally drafted and lawyer-approved forms and samples.

For full access to 85,000 legal and tax forms, customers just have to sign up and choose a subscription. After you’re signed up with an account, log in, search for a particular document template, and save it to My Forms or download it to your gadget.

To make things less difficult, we’ve incorporated an 8-step how-to guide for finding and downloading Sample Warrant Purchase Agreement between The Wiser Oil Company and Wise Investment Company, LLC promptly:

- Make confident the document meets all the necessary state requirements.

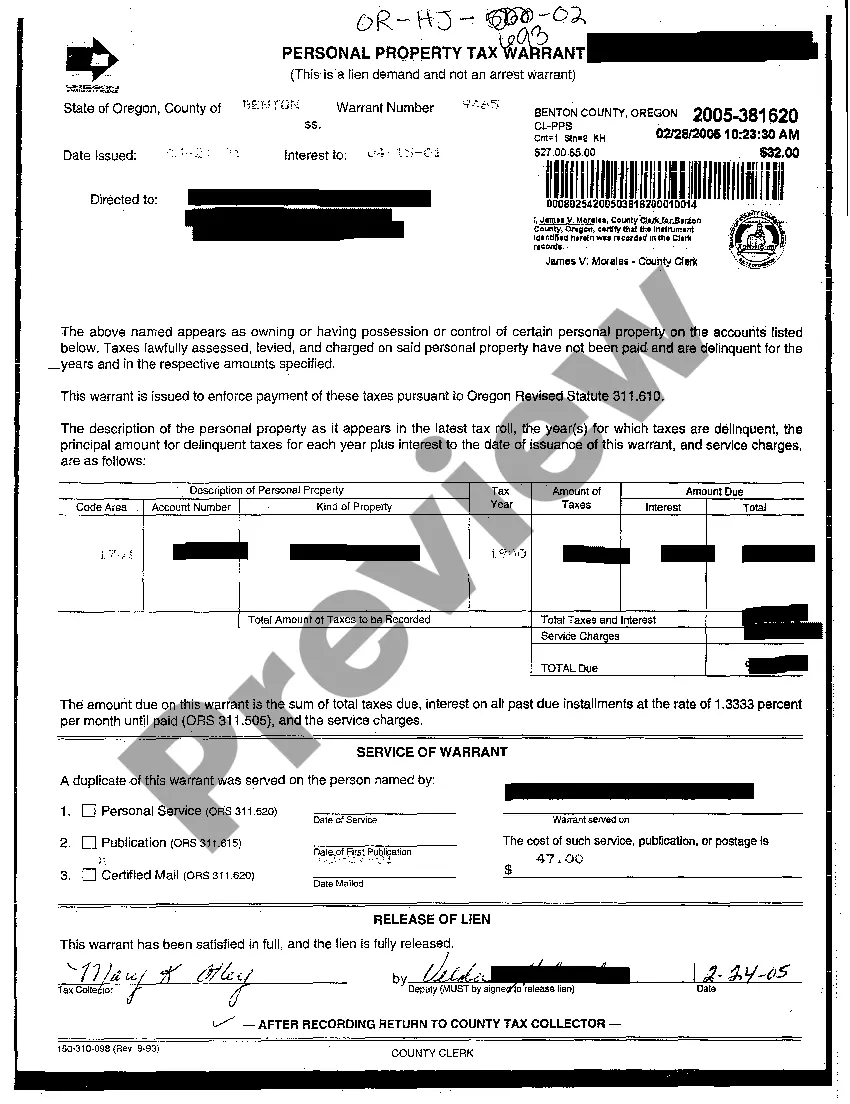

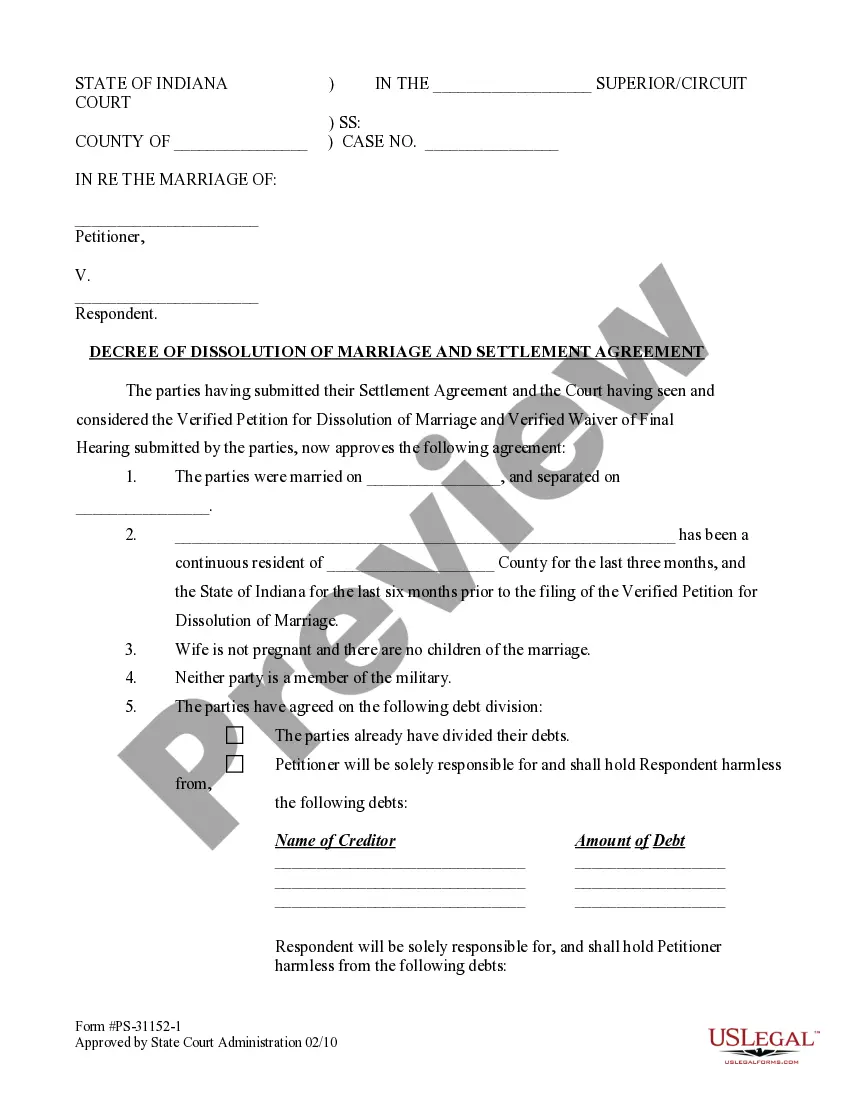

- If available preview it and read the description before buying it.

- Click Buy Now.

- Choose the suitable subscription to suit your needs.

- Make your account.

- Pay via PayPal or by credit/visa or mastercard.

- Select a preferred format if a number of options are available (e.g., PDF or Word).

- Download the document.

When the Sample Warrant Purchase Agreement between The Wiser Oil Company and Wise Investment Company, LLC is downloaded you are able to complete, print out and sign it in almost any editor or by hand. Get professionally drafted state-relevant papers in a matter of seconds in a preferable format with US Legal Forms!

Agreement Llc Liability Form popularity

Purchase Agreement Llc Other Form Names

Purchase Agreement Between FAQ

Gather information on all the owners/members who will want to be part of the LLC. Search for and choose a unique business name for your investment LLC. Provide an official address. Assign a Registered Agent for the LLC. File Articles of Organization to officially form your LLC.

Limited liability companies (LLCs) are business entities authorized by each state's laws. LLCs are popular for many reasons, including ease of creation and protection for the members' (or owners') personal assets. Generally speaking, you can create an LLC for any legitimate reason, including investing.

One of the most common reasons to use an LLC for investing is to invest in real estate. An LLC will protect you from potential liabilities that arise, as well as provide a framework for dividing up the investment ownership of the property.

An investment LLC allows a group of people to invest together. It is not necessarily an investment in a business; it can be used for other things like real estate. An LLC is a flexible entity with some of the same characteristics of a corporation, and also of a partnership.

You can invest without owning a single stock or bond. Owning a limited liability company (LLC) is a popular way to hold ownership stakes in a family business or startup. There are unique benefits and protections afforded to LLC owners which make it easy to understand why they are so highly favored.

Using An LLC For Real Estate Investments One of the most common reasons to use an LLC for investing is to invest in real estate. An LLC will protect you from potential liabilities that arise, as well as provide a framework for dividing up the investment ownership of the property.

If you invest in an LLC taxed as either a partnership or an S corporation, you will be taxed on the LLC's income even if no cash is distributed to you to pay the tax. In other words, investing in an LLC can unnecessarily complicate your personal tax situation.

By default, single-owner LLCs are taxed as sole proprietorships, but LLCs can choose to be taxed as S-Corps or C-Corps, which may benefit some businesses by reducing their employment taxes (Medicare and Social Security taxes).