Certificate of Repossession of Encumbered Aircraft

Description Vehicle Repossesion Letter

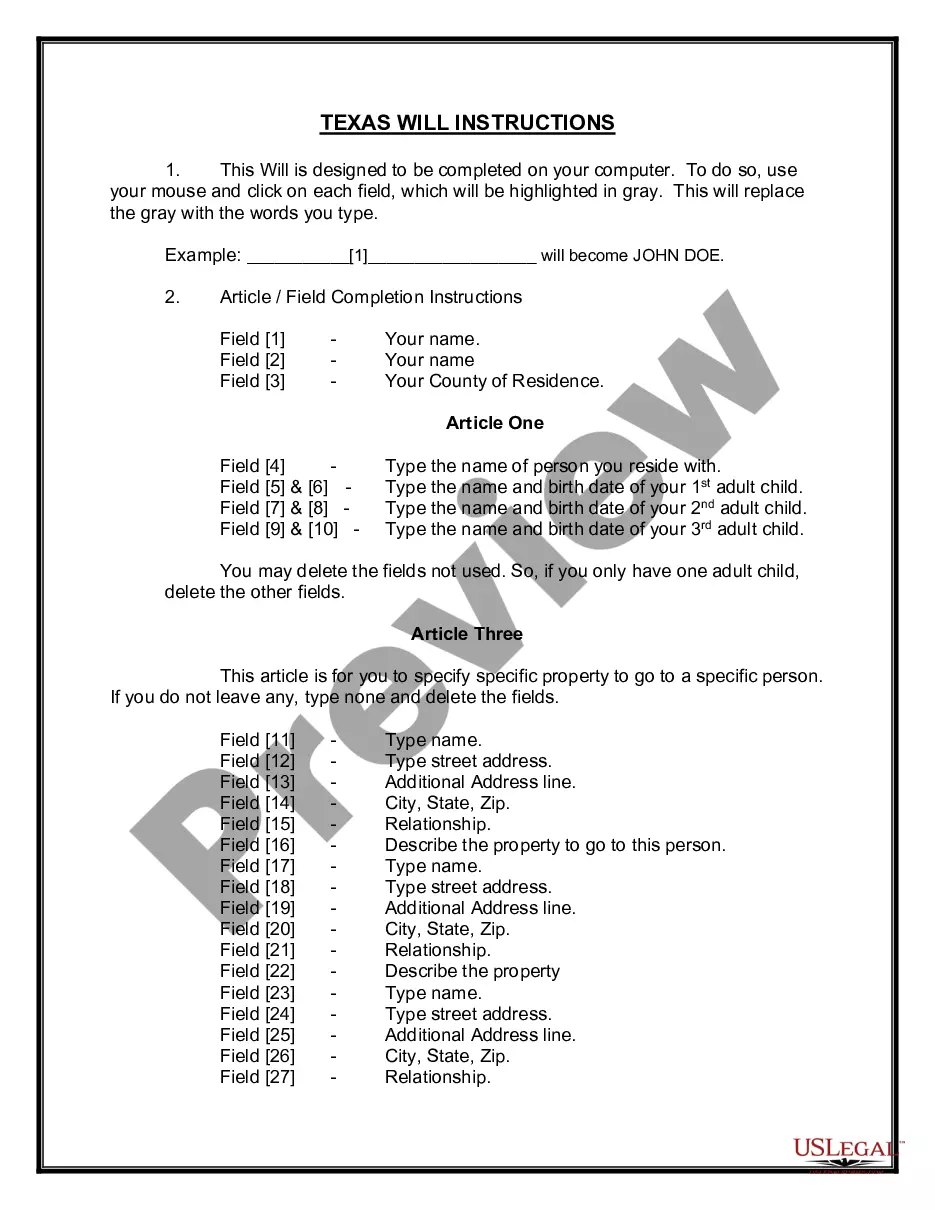

How to fill out Certificate Repossession File?

When it comes to drafting a legal document, it is better to delegate it to the experts. Nevertheless, that doesn't mean you yourself cannot get a template to utilize. That doesn't mean you yourself can’t find a sample to use, however. Download Certificate of Repossession of Encumbered Aircraft from the US Legal Forms site. It offers numerous professionally drafted and lawyer-approved documents and templates.

For full access to 85,000 legal and tax forms, users simply have to sign up and choose a subscription. After you’re registered with an account, log in, look for a particular document template, and save it to My Forms or download it to your device.

To make things much easier, we have incorporated an 8-step how-to guide for finding and downloading Certificate of Repossession of Encumbered Aircraft fast:

- Be sure the form meets all the necessary state requirements.

- If available preview it and read the description before buying it.

- Click Buy Now.

- Choose the appropriate subscription for your needs.

- Make your account.

- Pay via PayPal or by debit/credit card.

- Select a preferred format if a number of options are available (e.g., PDF or Word).

- Download the file.

When the Certificate of Repossession of Encumbered Aircraft is downloaded you can fill out, print out and sign it in almost any editor or by hand. Get professionally drafted state-relevant documents in a matter of seconds in a preferable format with US Legal Forms!

Certificate Repossession Document Form popularity

Certificate Repossession Other Form Names

Repossession Paper FAQ

After repossession, you'll have to pay for the storage of any personal items left in the car and some lone agreements may require you to pay the costs of repossession and storage of the car itself.

If your car or other property is repossessed, you might still owe the lender money on the contract. The amount you owe is called the "deficiency" or "deficiency balance."

According to Experian, auto repossessions stay on your credit report for seven years after the original delinquency date. It can negatively impact your credit for the duration of the seven years but that impact lessens over time.

Paying off a repossession can help your credit score since it reduces debt owed, and you may be able to get the item removed from your credit report. However, the significance of impact on your score depends on your credit history and profile and whether you take a settlement.

A repossession will have a serious impact on your credit score for as long as it stays on your credit reportusually seven years, starting on the date the loan stopped being paid.Late payments: For every month you miss a payment, there's a negative item on your report.

Repossession happens when somebody stops paying their secured loans. When that happens, the creditor can take back the property securing the loan. The process of taking back this property is called repossession.

When your car is repossessed due to late payments the lender will notify the credit bureaus of the repossession. If you owe outstanding fees the lender can take you to a collections agency to recoup the additional fees. The car repossession and collections will remain on your credit report for up to seven years.

If you dispute the repossession and can't get it removed, then you need to give it some time. Your credit score will eventually improve and the repossession will come off your credit reports. However, as you open new accounts and make on-time payments, you should see your score improve.

While neither scenario is good, in most cases, a charge off is better than a repossession.On the other hand, when an unsecured car loan is charged off, the debt will be discharged, and you will not owe any more money.