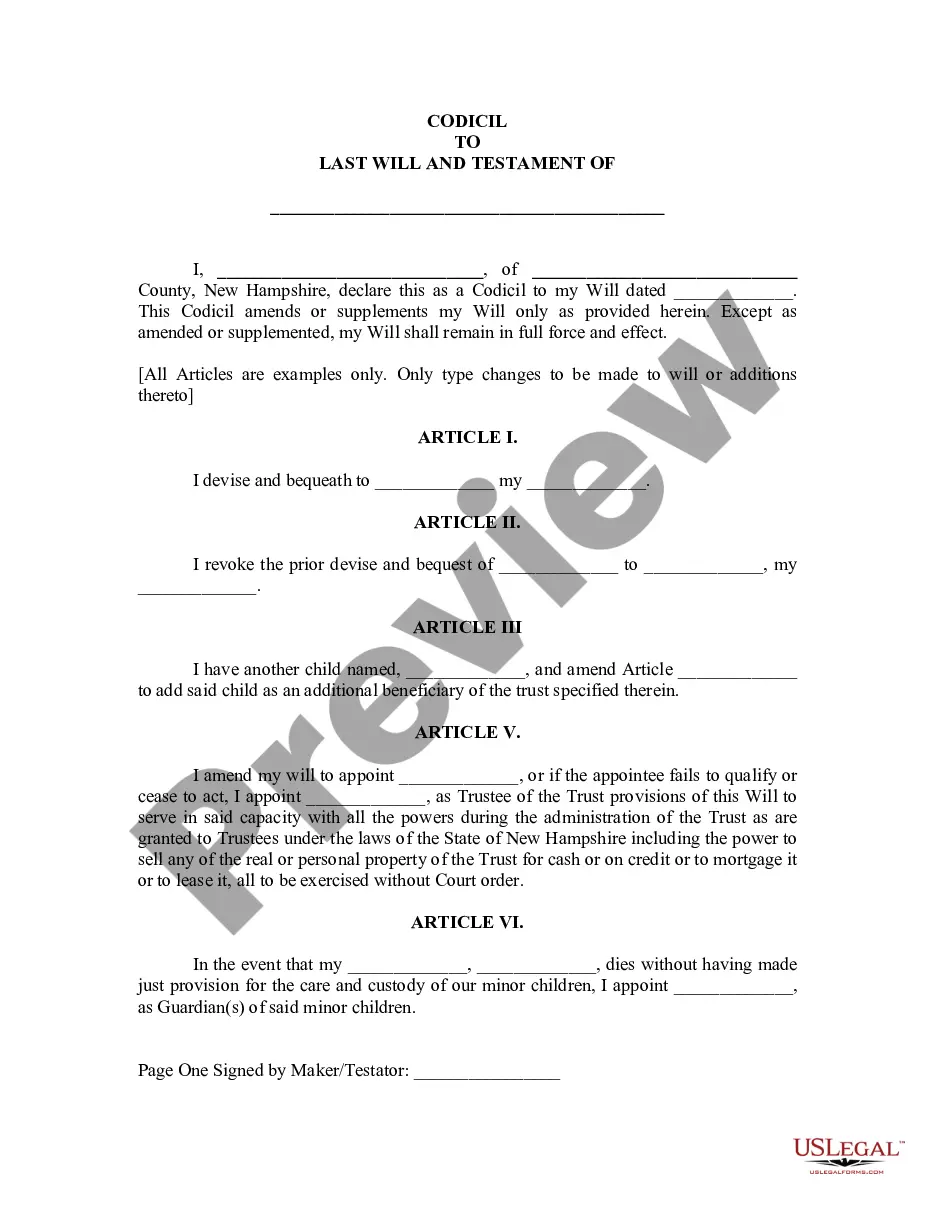

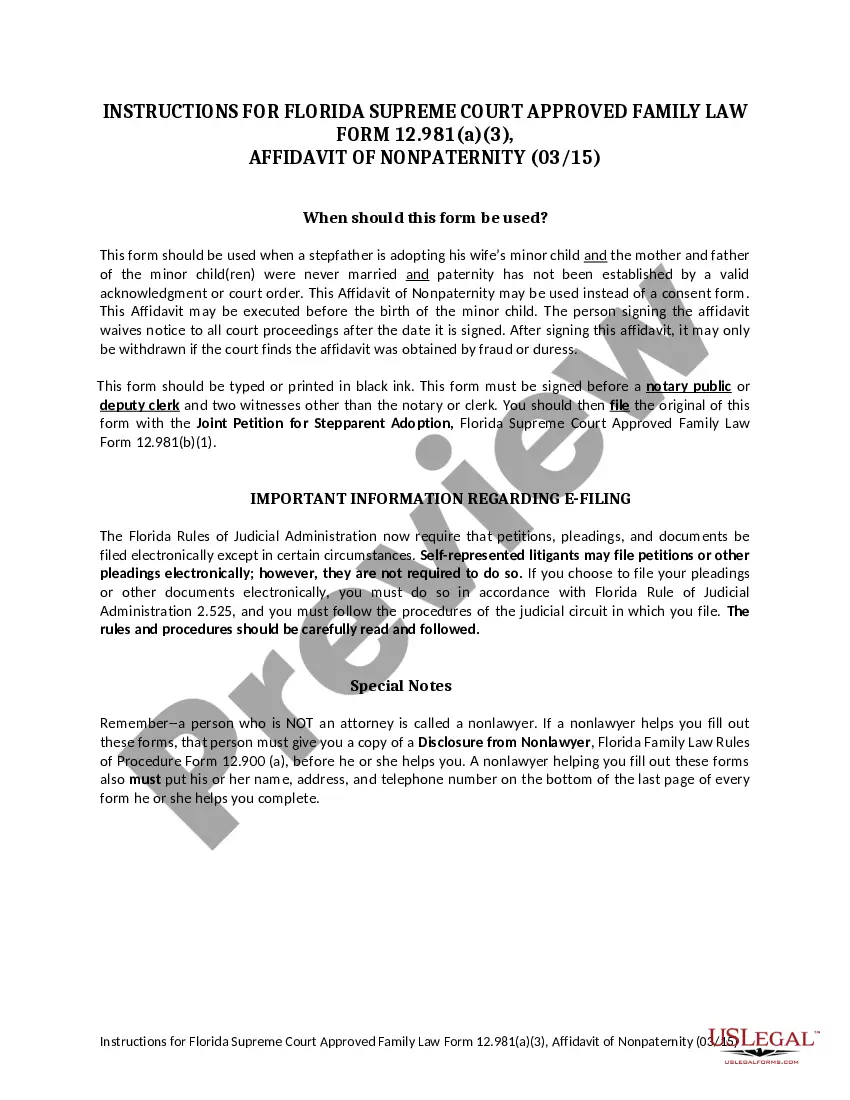

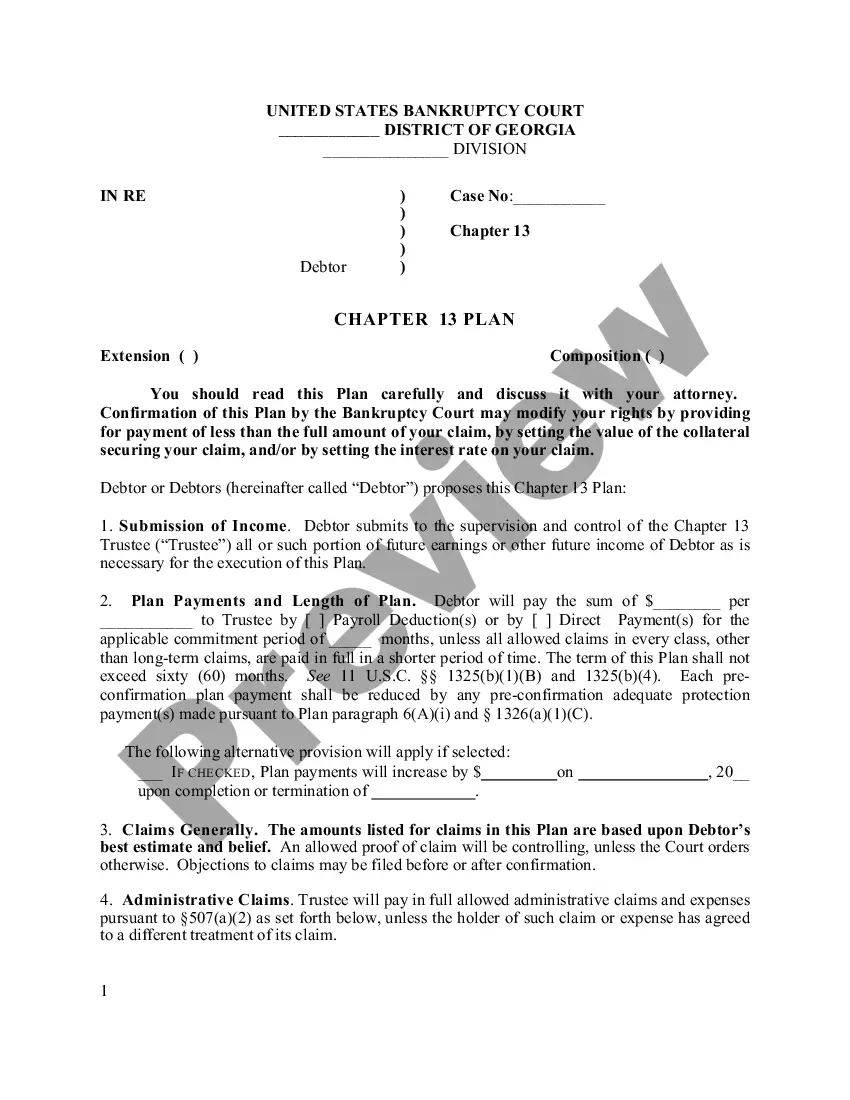

2.95 Reports on Exporting and Importing Monetary Instruments / 31 U.S.C. Sec. 5316(a)(1) refer to the requirement for a financial institution to file a report with the US Treasury Department when it exports or imports certain monetary instruments. These instruments include cash, travelers' checks, checks, money orders, and other similar instruments. Reports must be filed on Form 8300 within 15 days of the transaction. Different types of reports include: • Cash Transaction ReportsCarsRs): Financial institutions must file Cars for transactions where more than $10,000 in currency or coins is received in a single transaction or two or more related transactions. • Suspicious Activity ReportsSARSRs): Financial institutions must file SARS when there is suspicion of money laundering or other criminal activity. Fin CENEN Report 114 (FBAR): Financial institutions with foreign accounts must file Bars to report any accounts with a total value over $10,000. • Treasury Report of International Transportation of Currency or Monetary Instruments (MIR): Financial institutions must file Emirs when they transport currency or monetary instruments out of the United States.

2.95 REPORTS ON EXPORTING AND IMPORTING MONETARY INSTRUMENTS / 31 U.S.C. Sec. 5316(a)(1)

Description

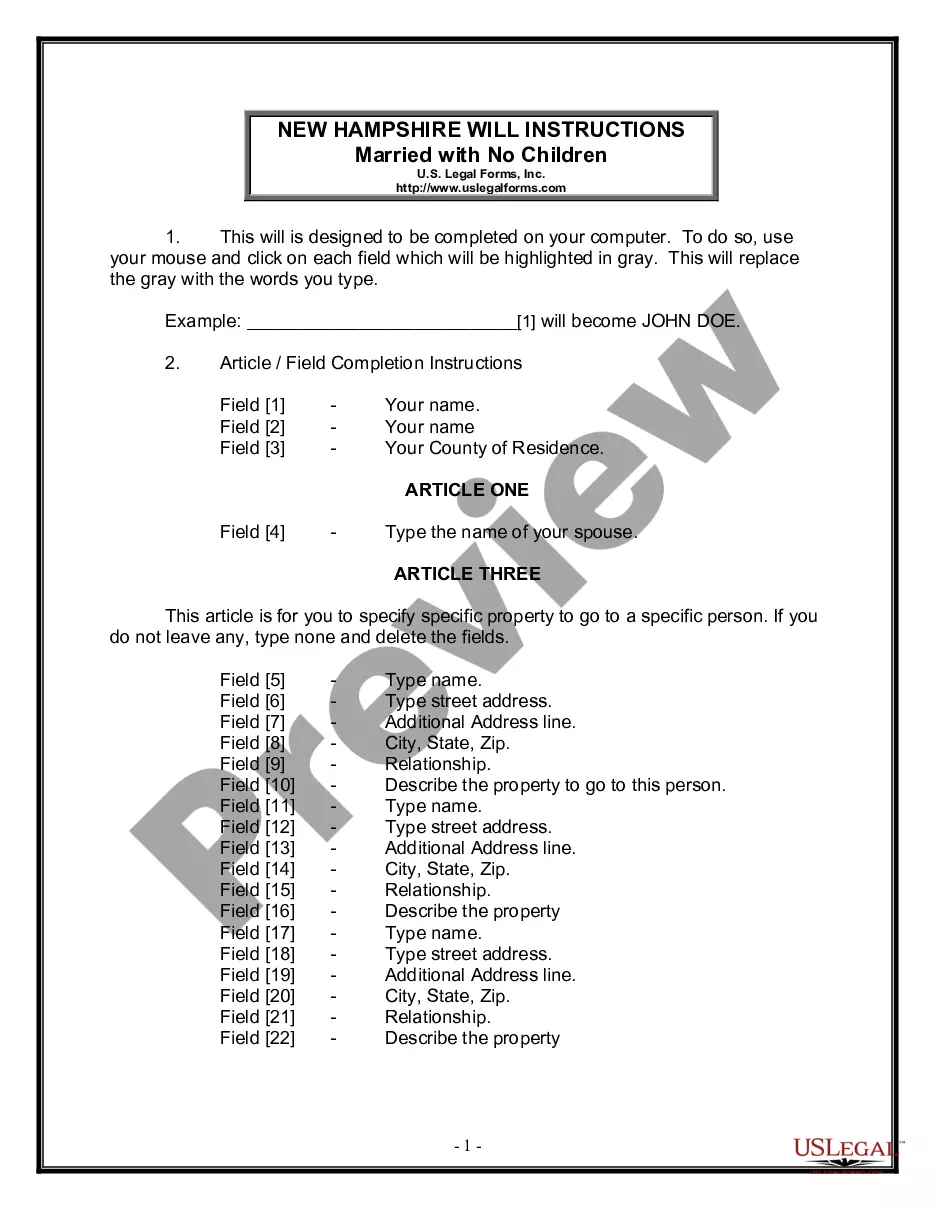

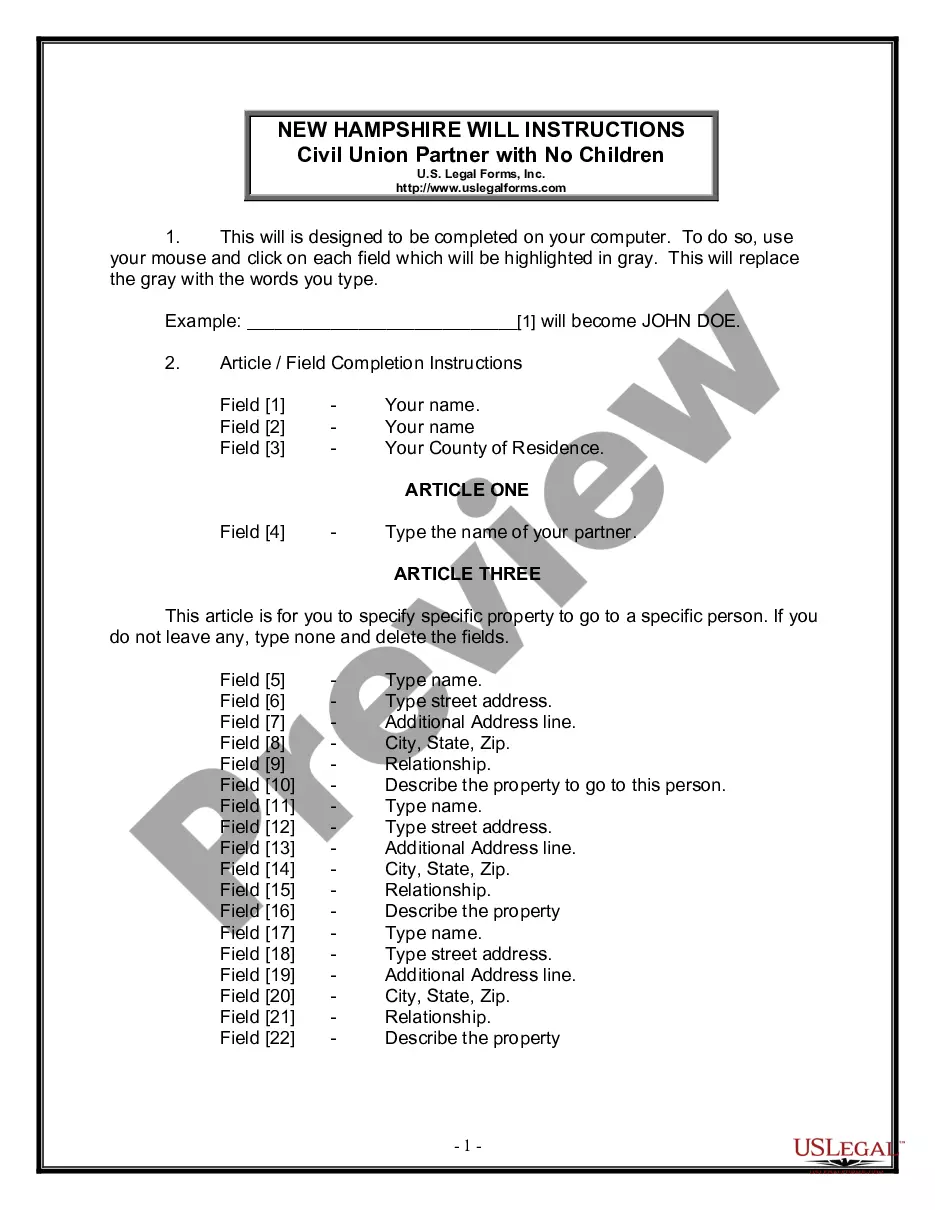

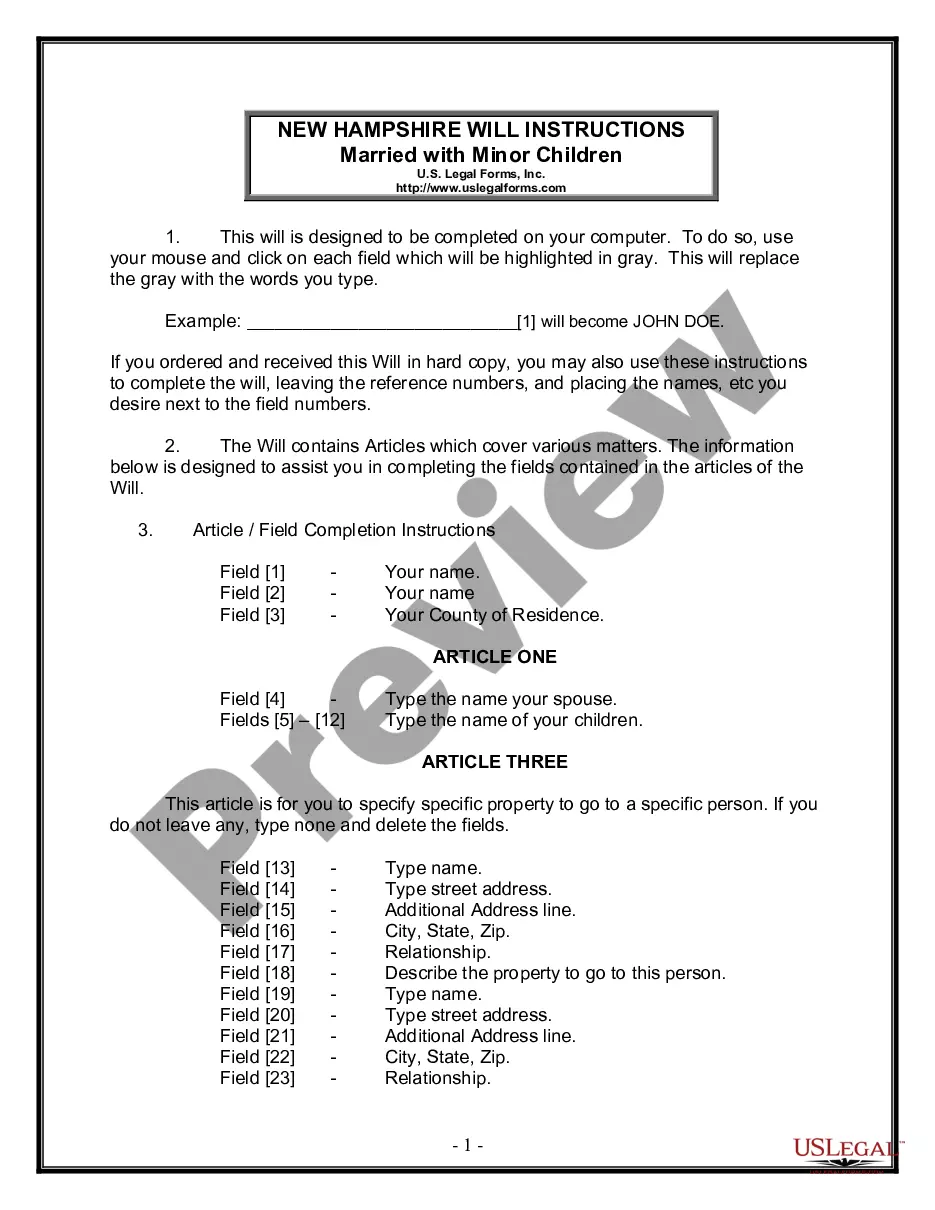

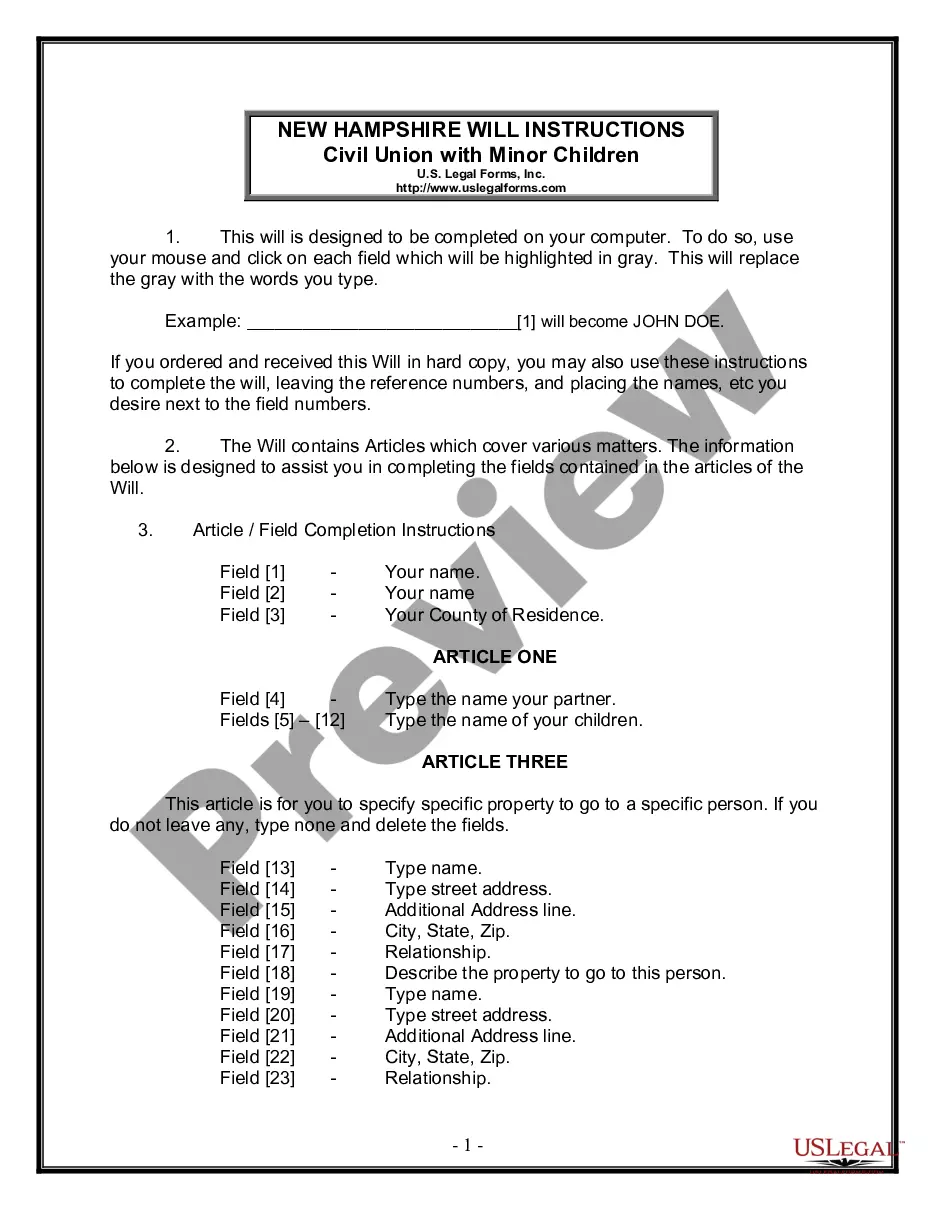

How to fill out 2.95 REPORTS ON EXPORTING AND IMPORTING MONETARY INSTRUMENTS / 31 U.S.C. Sec. 5316(a)(1)?

US Legal Forms is the most easy and profitable way to locate suitable legal templates. It’s the most extensive online library of business and personal legal paperwork drafted and verified by lawyers. Here, you can find printable and fillable templates that comply with national and local regulations - just like your 2.95 REPORTS ON EXPORTING AND IMPORTING MONETARY INSTRUMENTS / 31 U.S.C. Sec. 5316(a)(1).

Obtaining your template takes just a few simple steps. Users that already have an account with a valid subscription only need to log in to the web service and download the form on their device. Later, they can find it in their profile in the My Forms tab.

And here’s how you can obtain a properly drafted 2.95 REPORTS ON EXPORTING AND IMPORTING MONETARY INSTRUMENTS / 31 U.S.C. Sec. 5316(a)(1) if you are using US Legal Forms for the first time:

- Read the form description or preview the document to ensure you’ve found the one corresponding to your needs, or find another one using the search tab above.

- Click Buy now when you’re sure of its compatibility with all the requirements, and select the subscription plan you like most.

- Create an account with our service, sign in, and pay for your subscription using PayPal or you credit card.

- Choose the preferred file format for your 2.95 REPORTS ON EXPORTING AND IMPORTING MONETARY INSTRUMENTS / 31 U.S.C. Sec. 5316(a)(1) and save it on your device with the appropriate button.

Once you save a template, you can reaccess it at any time - just find it in your profile, re-download it for printing and manual completion or import it to an online editor to fill it out and sign more efficiently.

Take advantage of US Legal Forms, your trustworthy assistant in obtaining the required formal documentation. Try it out!