Impeding Internal Revenue Service (IRS) is a form of fraud or tax evasion involving the use of false documents, false statements or other means to interfere with the Internal Revenue Service's ability to collect taxes. The most common forms of Impeding Internal Revenue Service include: 1. Filing False Tax Returns: This is the act of filing a false tax return with the IRS. This includes underreporting income, overstating deductions, or claiming false credits. 2. Tax Evasion: This is the deliberate attempt to evade paying taxes by concealing income or assets. This includes hiding income offshore, using false deductions or credits, or making false statements. 3. Tax Fraud: This is a criminal act of intentionally misrepresenting facts or withholding information to mislead the IRS in order to gain a tax advantage. This includes filing false returns, filing multiple returns, and submitting false documents. 4. Money Laundering: This is the process of disguising illegally obtained funds or assets in order to make them appear legitimate. Money laundering is often used to avoid taxes or to hide the true source of income. 5. Identity Theft: This is the act of using someone else's identity to file a false tax return or to gain access to another person's bank account or credit card information. This type of fraud has become increasingly common in recent years.

Impeding Internal Revenue Service

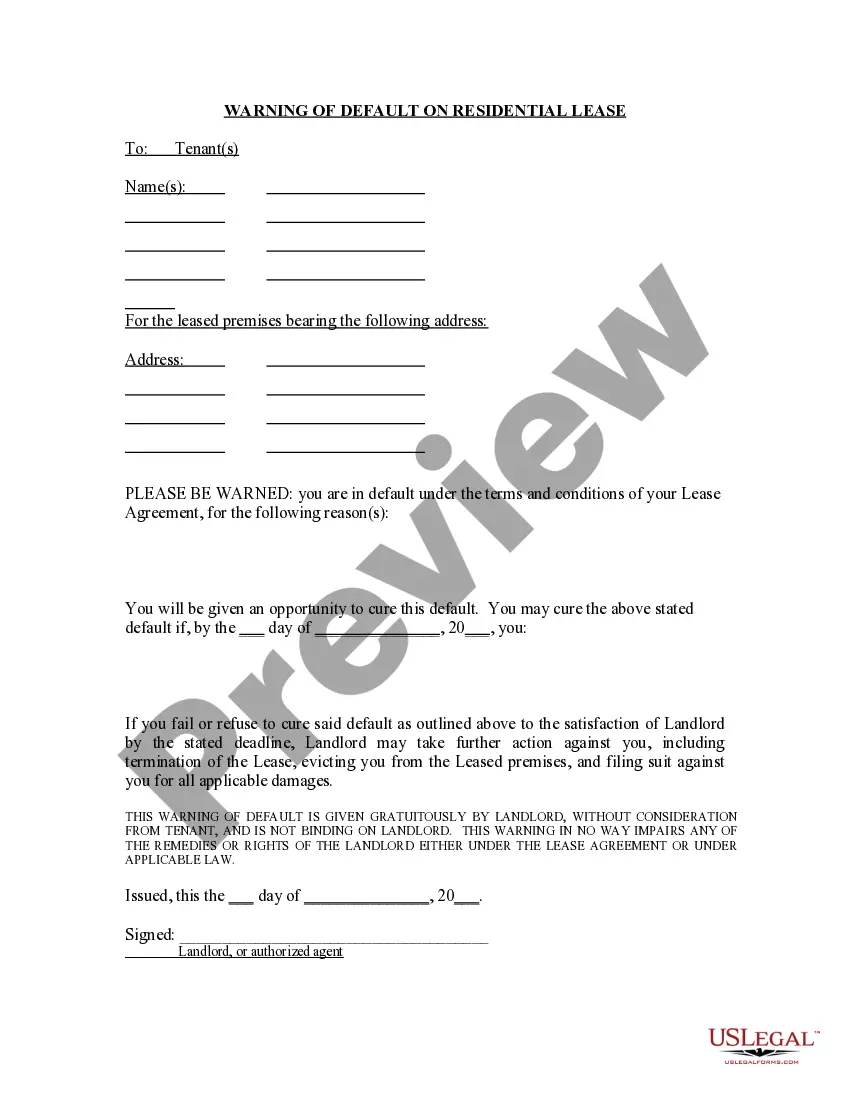

Description

How to fill out Impeding Internal Revenue Service?

Preparing official paperwork can be a real stress if you don’t have ready-to-use fillable templates. With the US Legal Forms online library of formal documentation, you can be confident in the blanks you find, as all of them comply with federal and state regulations and are examined by our experts. So if you need to complete Impeding Internal Revenue Service, our service is the best place to download it.

Obtaining your Impeding Internal Revenue Service from our service is as easy as ABC. Previously authorized users with a valid subscription need only sign in and click the Download button after they find the correct template. Afterwards, if they need to, users can get the same blank from the My Forms tab of their profile. However, even if you are new to our service, signing up with a valid subscription will take only a few moments. Here’s a brief guideline for you:

- Document compliance verification. You should attentively examine the content of the form you want and check whether it satisfies your needs and complies with your state law regulations. Previewing your document and looking through its general description will help you do just that.

- Alternative search (optional). If there are any inconsistencies, browse the library through the Search tab on the top of the page until you find an appropriate template, and click Buy Now when you see the one you need.

- Account registration and form purchase. Register for an account with US Legal Forms. After account verification, log in and choose your most suitable subscription plan. Make a payment to continue (PayPal and credit card options are available).

- Template download and further usage. Choose the file format for your Impeding Internal Revenue Service and click Download to save it on your device. Print it to complete your papers manually, or use a multi-featured online editor to prepare an electronic copy faster and more effectively.

Haven’t you tried US Legal Forms yet? Sign up for our service today to obtain any official document quickly and easily every time you need to, and keep your paperwork in order!