Loan Commitment Form and Variations

Description Mortgage Commitment Letter Sample

How to fill out Loan Commitment Form And Variations?

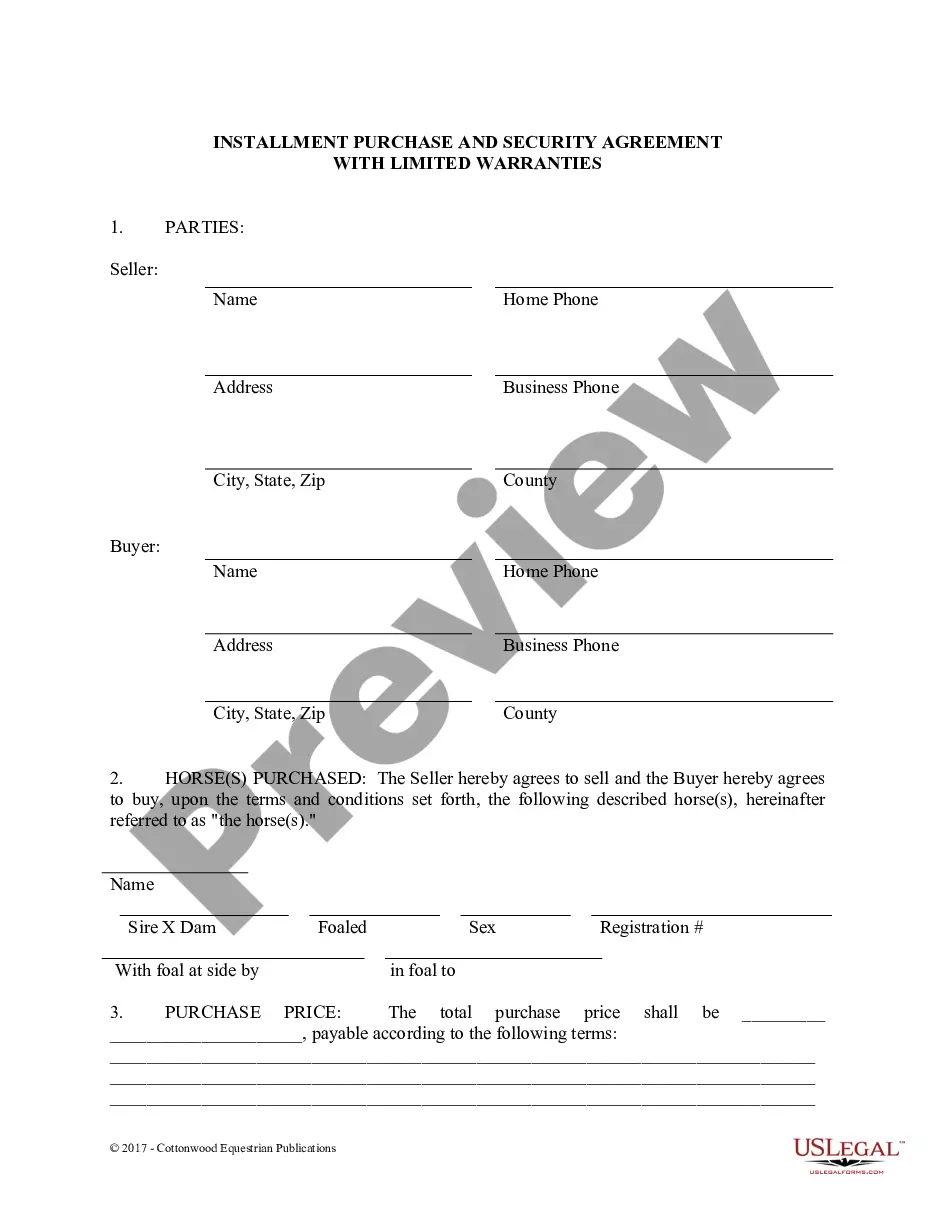

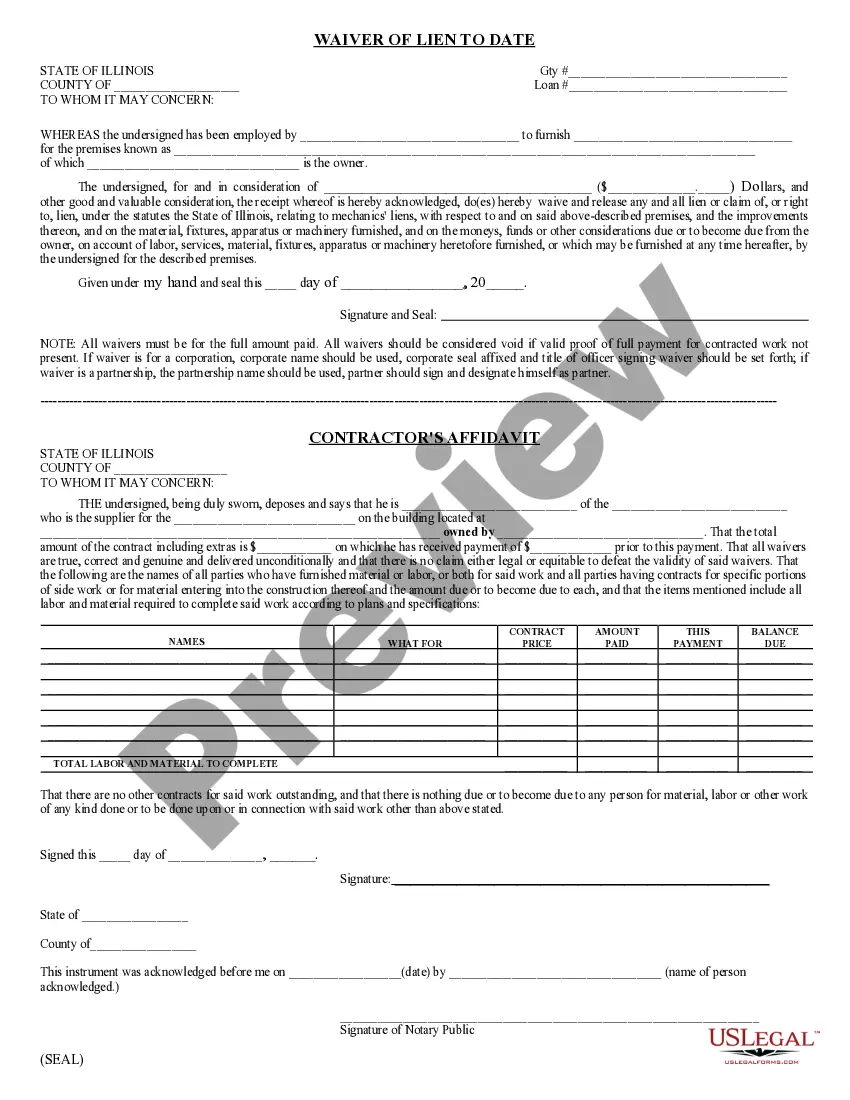

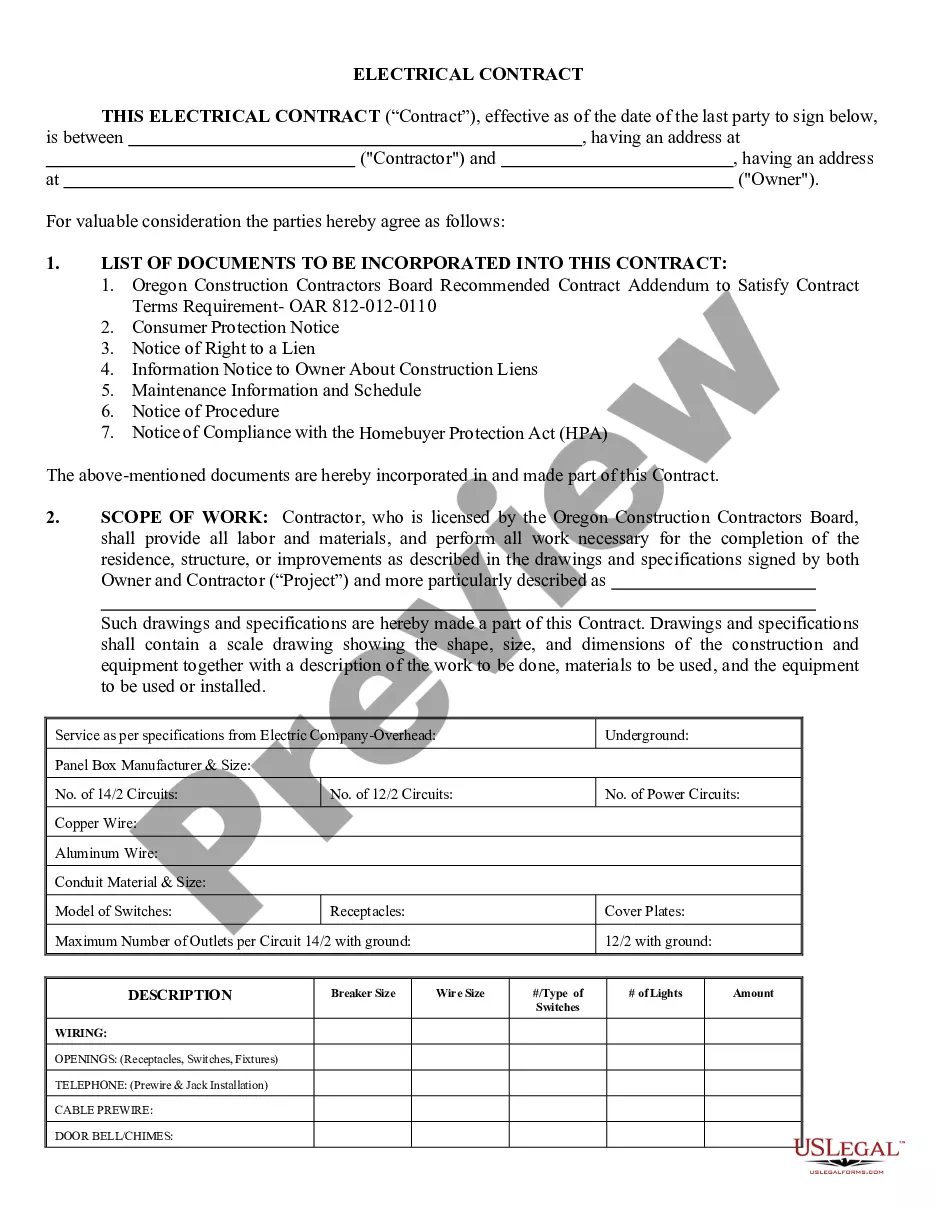

When it comes to drafting a legal document, it is easier to delegate it to the experts. However, that doesn't mean you yourself can not find a template to use. That doesn't mean you yourself can not get a sample to utilize, nevertheless. Download Loan Commitment Form and Variations from the US Legal Forms site. It provides a wide variety of professionally drafted and lawyer-approved forms and templates.

For full access to 85,000 legal and tax forms, customers just have to sign up and choose a subscription. When you are signed up with an account, log in, search for a particular document template, and save it to My Forms or download it to your gadget.

To make things much easier, we have included an 8-step how-to guide for finding and downloading Loan Commitment Form and Variations quickly:

- Be sure the form meets all the necessary state requirements.

- If available preview it and read the description before buying it.

- Hit Buy Now.

- Choose the appropriate subscription to suit your needs.

- Create your account.

- Pay via PayPal or by credit/bank card.

- Select a preferred format if several options are available (e.g., PDF or Word).

- Download the file.

Once the Loan Commitment Form and Variations is downloaded you may fill out, print out and sign it in almost any editor or by hand. Get professionally drafted state-relevant files in a matter of seconds in a preferable format with US Legal Forms!

Commitment Letter Mortgage Form popularity

Mortgage Commitment Letter Other Form Names

FAQ

Although the average time it takes for a lender to completely close a mortgage is 53 days, it could be as little as 15 days. The actual timing of the mortgage commitment letter arriving in escrow depends on many factors and must arrive before the house can close.

The letter will also feature your lender's information, your loan number, and the date your commitment letter will expire. You'll also find the terms of you loan listed in the letter. These may include the amount of money you'll pay each month and the number of monthly payments you'll make until the loan is paid off.

A mortgage commitment letter (also called an approval letter) is an agreement between a buyer and their lender outlining the agreed-upon terms of a mortgage. It signifies that financing is officially approved.

Names and addresses of the borrower and lender. The type of loan applied for. The loan amount. The agreed upon loan repayment period. The interest rate for the loan. Date of lock expiration (if the loan is locked in) for the interest rate.

A loan commitment is a lender's promise to offer a loan or credit of a specified amount to a borrower. Also called a commitment letter, it includes all of the terms and conditions of the loan.

Once your application for a mortgage loan has been approved and you have received a commitment letter from the lender, the final step before you can call the house your own is the closing, or settlement, of the purchase transaction and mortgage loan.

1Step 1 Loan Amount, Borrower and Lender.2Step 2 Payment.3Step 3 Interest.4Step 4 Expenses.5Step 5 Governing Law.6Step 6 Signing.

1Come up with a schedule for repayment. Use a family contract template that includes a repayment schedule.2Set and interest rate.3Put your agreement in writing.4Keep payment records.

1Starting the Document. Write the date at the top of the page.2Write the Terms of the Loan. State the purpose of the personal payment agreement and the terms for returning the money.3Date the Document.4Statement of Agreement.5Sign the Document.6Record the Document.