Assignment and Conveyance of Overriding Royalty Interest

Description Assignment Of Royalty Form

How to fill out Assignment And Conveyance Of Overriding Royalty Interest?

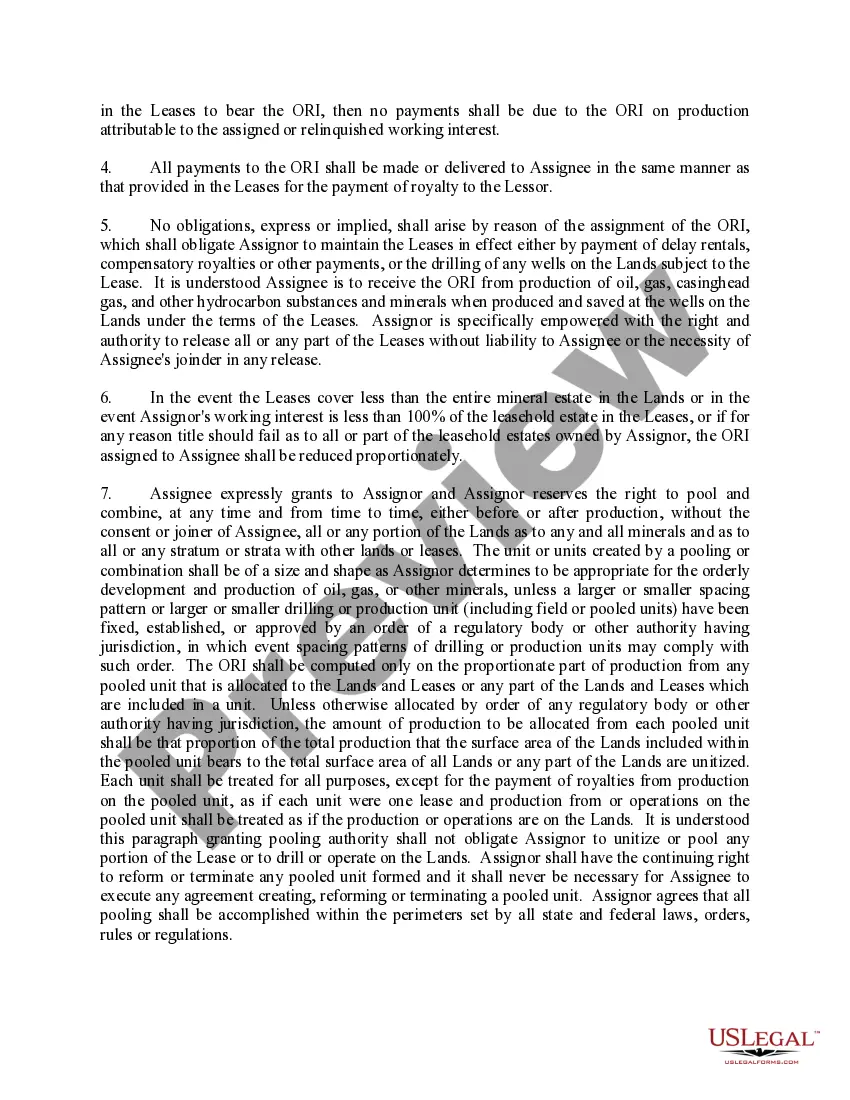

When it comes to drafting a legal document, it is easier to delegate it to the professionals. However, that doesn't mean you yourself can not find a template to utilize. That doesn't mean you yourself cannot find a sample to utilize, nevertheless. Download Assignment and Conveyance of Overriding Royalty Interest straight from the US Legal Forms web site. It offers a wide variety of professionally drafted and lawyer-approved forms and samples.

For full access to 85,000 legal and tax forms, users just have to sign up and choose a subscription. Once you are registered with an account, log in, find a certain document template, and save it to My Forms or download it to your gadget.

To make things less difficult, we’ve incorporated an 8-step how-to guide for finding and downloading Assignment and Conveyance of Overriding Royalty Interest promptly:

- Be sure the form meets all the necessary state requirements.

- If available preview it and read the description before buying it.

- Click Buy Now.

- Select the appropriate subscription for your needs.

- Create your account.

- Pay via PayPal or by credit/credit card.

- Choose a preferred format if a few options are available (e.g., PDF or Word).

- Download the file.

As soon as the Assignment and Conveyance of Overriding Royalty Interest is downloaded it is possible to fill out, print out and sign it in almost any editor or by hand. Get professionally drafted state-relevant papers in a matter of minutes in a preferable format with US Legal Forms!

Ohio Assignment Of Oil And Gas Royalties Form popularity

Ohio Overriding Royalty Interest Other Form Names

FAQ

A gross overriding royalty can be created on a mine which produces a product like petroleum in that it can be sold without alteration of its basic character.The costs of smelting and refining the gold will reduce the proceeds to the mine owner, a percentage of which will be paid as royalty.

Overriding Royalty Interest (ORRI) a percentage share of production, or the value derived from production, which is free of all costs of drilling and producing, and is created by the lessee or working interest owner and paid by the lessee or working interest owner.

Net revenue is the amount that is shared among the property owners. To determine net revenue interest, multiply the royalty interest by the owner's shared interest. For example, if you have a 5/16 royalty, your net royalty interest would be 25% multiplied by 5/16, which equals 7.8125% calculated to four decimal places.

An owner can separate the mineral rights from his or her land by: Conveying (selling or otherwise transferring) the land but retaining the mineral rights. (This is accomplished by including a statement in the deed conveying the land that reserves all rights to the minerals to the seller.)

An overriding royalty interest is the right to receive revenue from the production of oil and gas from a well. The overriding royalty is carved out of the lessee's (operator's) working interest and entitles its owner to a fraction of production.

The value of an overriding royalty interest is simple to calculate since it is a percent of the working interest lease. The ORRI value is based on production on the acreage leased by the working interest.

An overriding royalty interest generally entitles the owner of the interest to a specified share of the oil and gas produced under the terms of the lease. In Texas and in many other oil-producing states, overriding royalty interests are generally treated as interests in real estate.