Assignment of Operating Rights Interests

Description

How to fill out Assignment Of Operating Rights Interests?

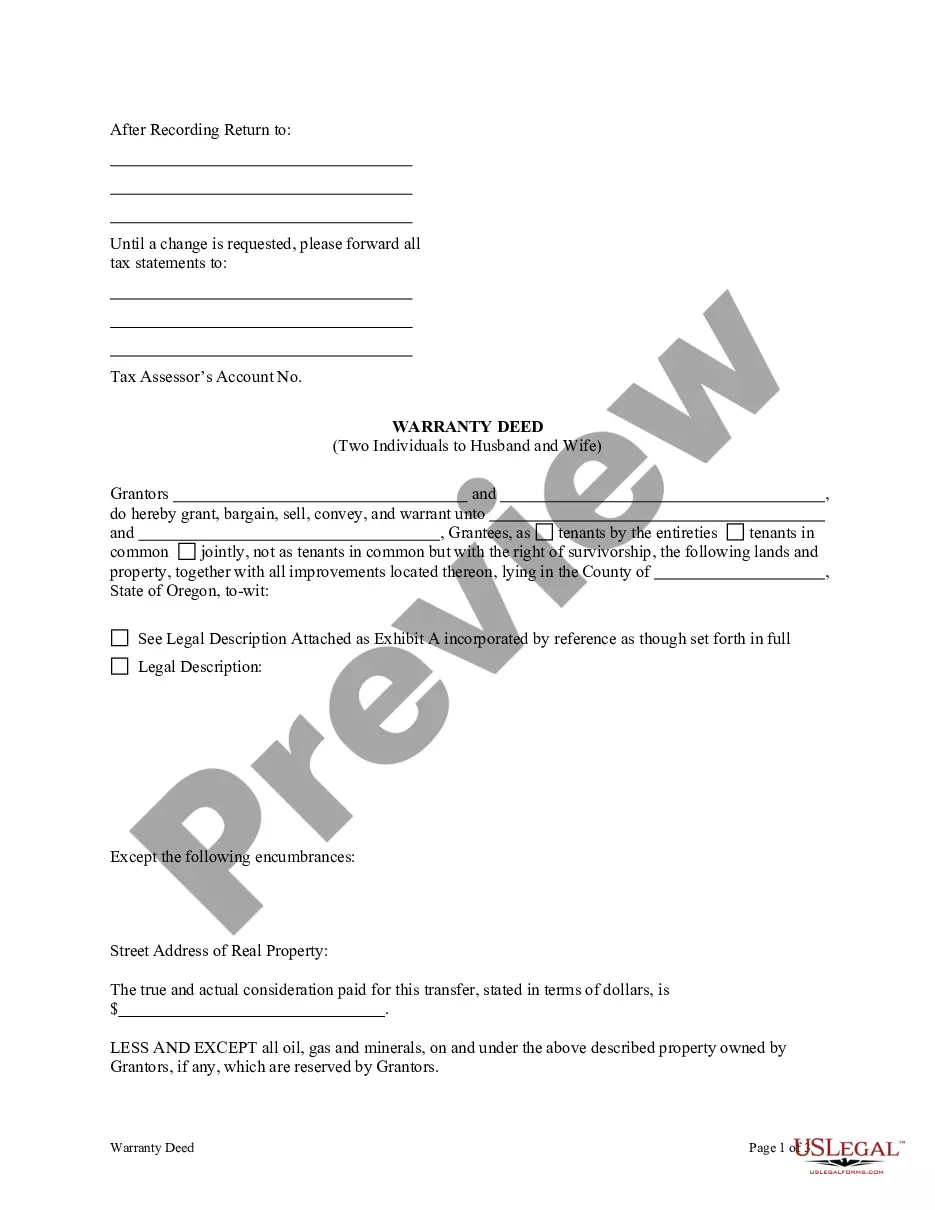

When it comes to drafting a legal document, it is easier to leave it to the specialists. Nevertheless, that doesn't mean you yourself can not find a template to utilize. That doesn't mean you yourself cannot get a template to utilize, however. Download Assignment of Operating Rights Interests from the US Legal Forms website. It provides numerous professionally drafted and lawyer-approved documents and templates.

For full access to 85,000 legal and tax forms, customers just have to sign up and choose a subscription. As soon as you’re signed up with an account, log in, find a particular document template, and save it to My Forms or download it to your device.

To make things much easier, we’ve incorporated an 8-step how-to guide for finding and downloading Assignment of Operating Rights Interests fast:

- Make sure the form meets all the necessary state requirements.

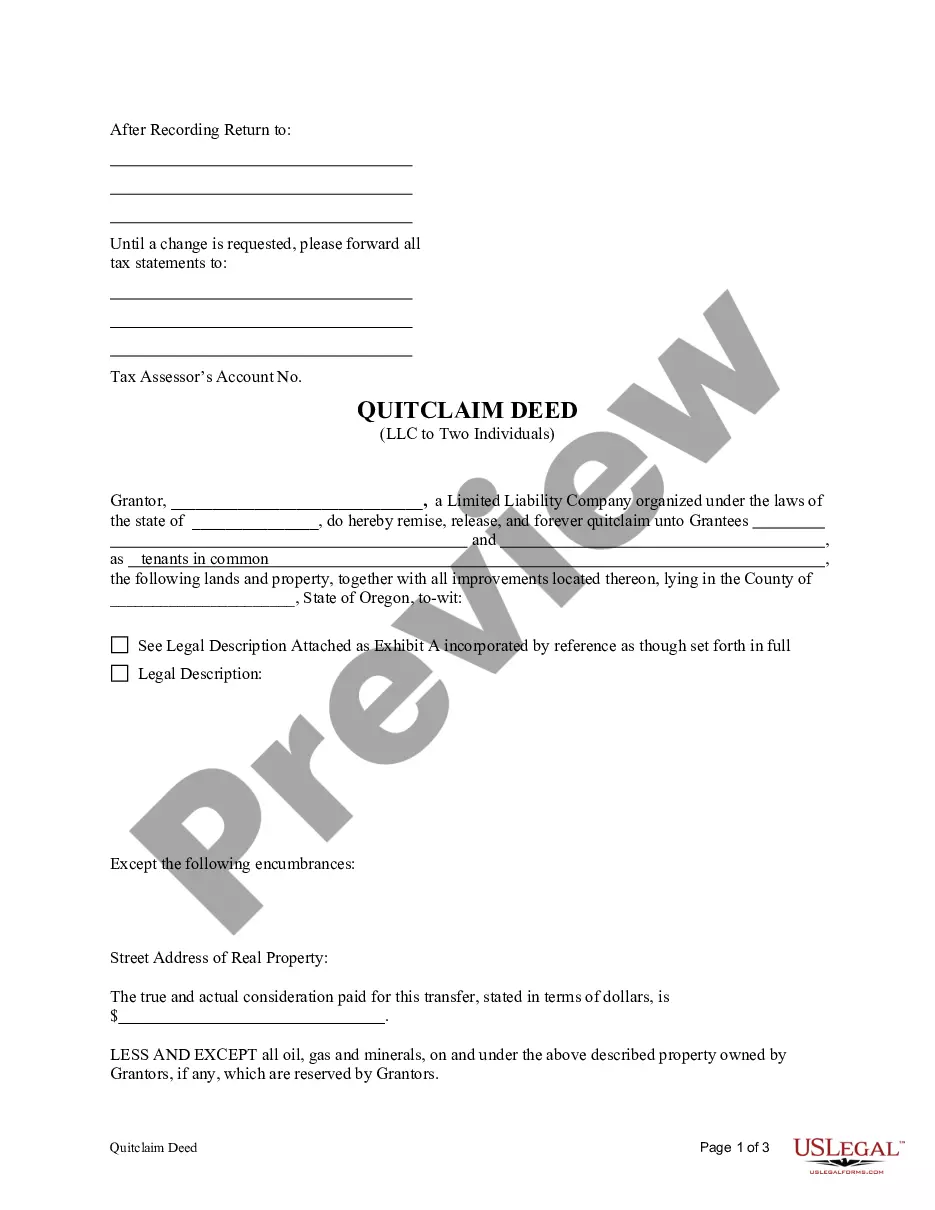

- If available preview it and read the description before buying it.

- Click Buy Now.

- Select the appropriate subscription to meet your needs.

- Make your account.

- Pay via PayPal or by debit/credit card.

- Choose a preferred format if a few options are available (e.g., PDF or Word).

- Download the document.

As soon as the Assignment of Operating Rights Interests is downloaded you may fill out, print out and sign it in any editor or by hand. Get professionally drafted state-relevant papers in a matter of minutes in a preferable format with US Legal Forms!

Form popularity

FAQ

One important factor you must keep in mind is that if real estate contains mineral rights, simply buying the property doesn't make you the owner of them. Since mineral rights can be sold separately from the land itself, even if you own the land, someone else may hold ownership of what's below it.

Mineral rights are often sold separately from the land they are on. You may have title to the mineral rights on a property you own, or a previous owner may have sold or leased them in which case, they may not be yours to sell. But there is no need to abandon the idea of monetizing your mineral reserves!

One important factor you must keep in mind is that if real estate contains mineral rights, simply buying the property doesn't make you the owner of them. Since mineral rights can be sold separately from the land itself, even if you own the land, someone else may hold ownership of what's below it.

Mineral rights don't come into effect until you begin to dig below the surface of the property. But the bottom line is: if you do not have the mineral rights to a parcel of land, then you do not have the legal ability to explore, extract, or sell the naturally occurring deposits below.

Mineral rights are the ownership rights to underground resources such as fossil fuels (oil, natural gas, coal, etc.), metals and ores, and mineable rocks such as limestone and salt. In the United States, mineral rights are legally distinct from surface rights.