Affidavit That Primary Term of Lease Not Extended by Additional Bonus Payment by Lessor

Description

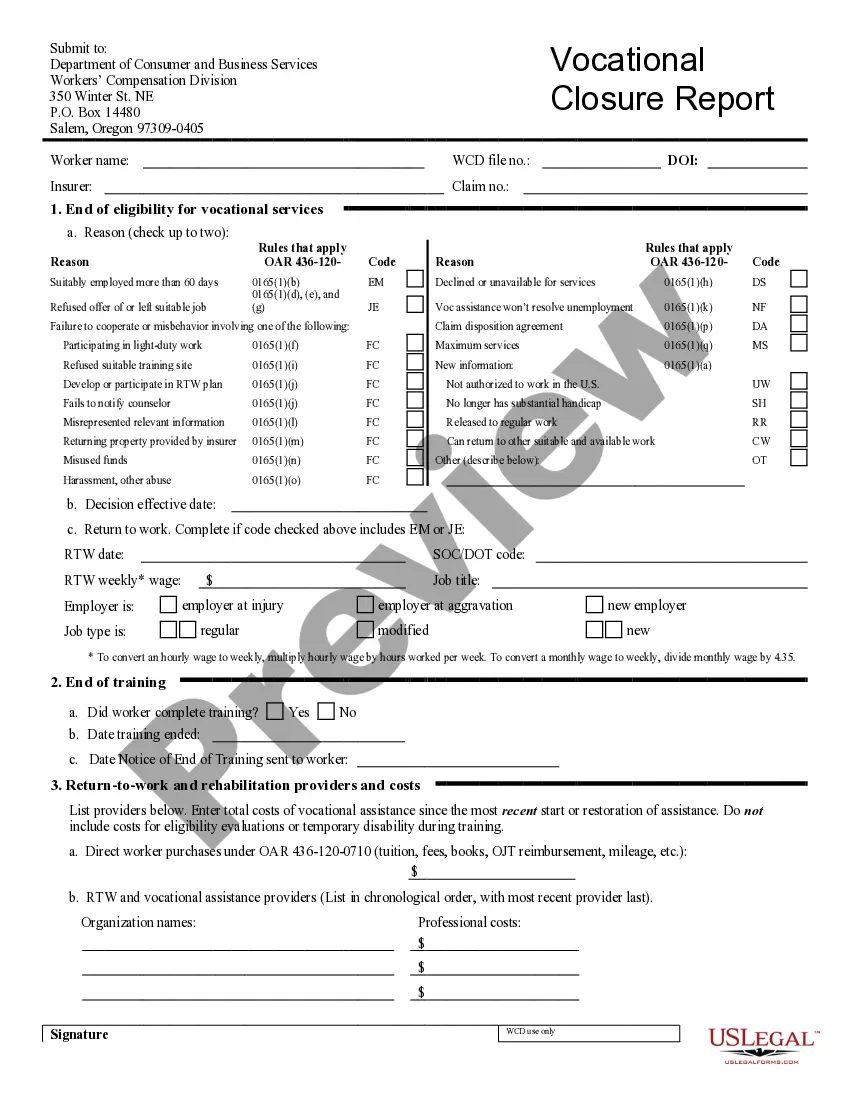

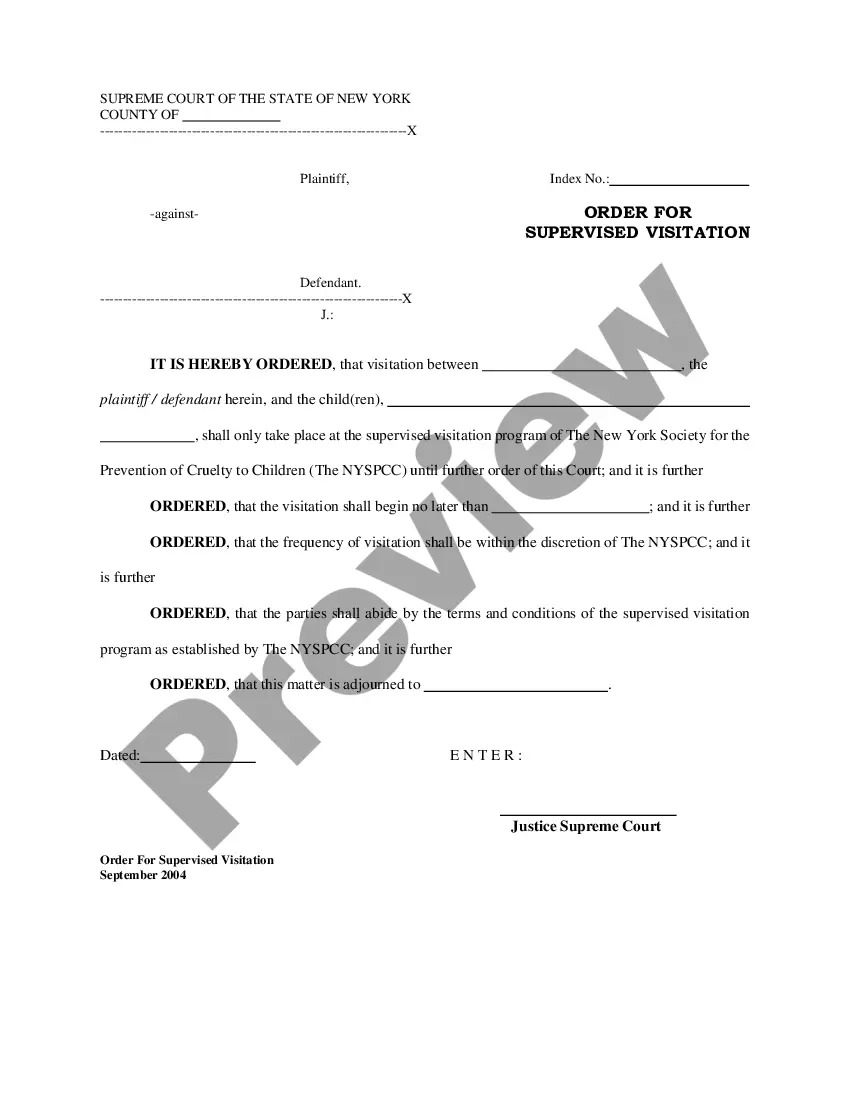

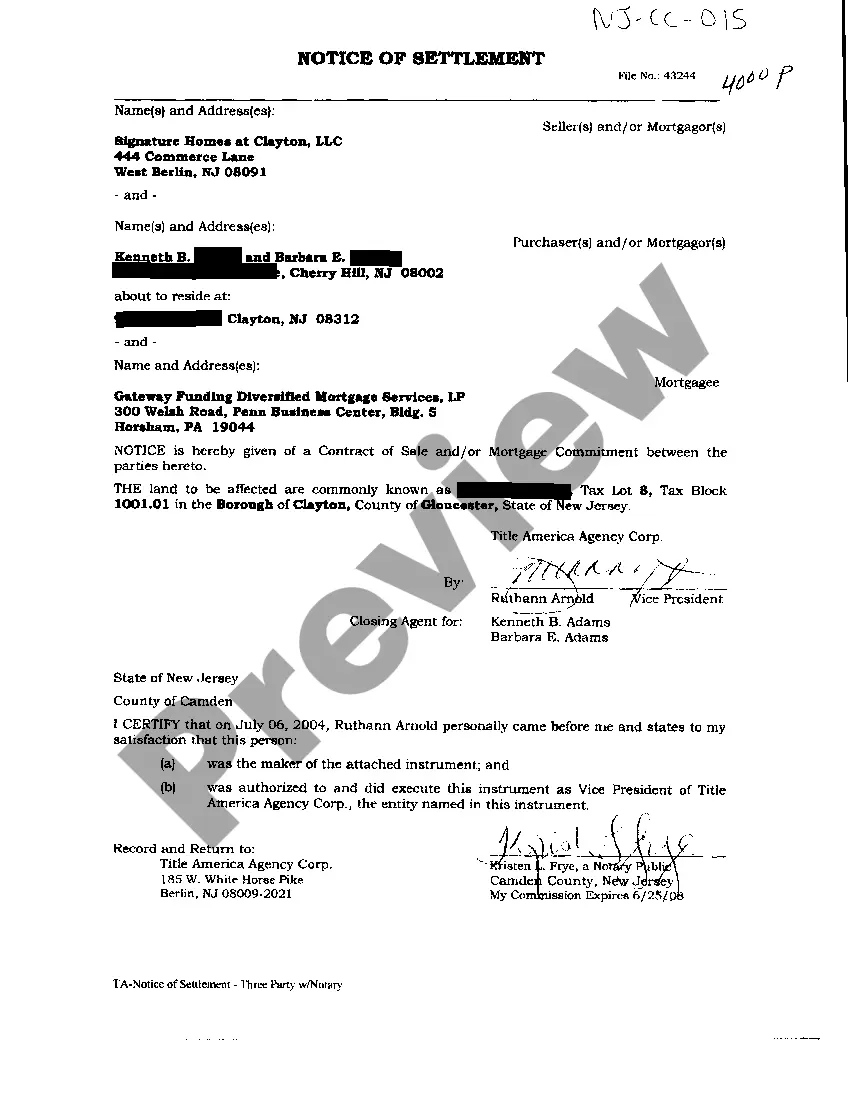

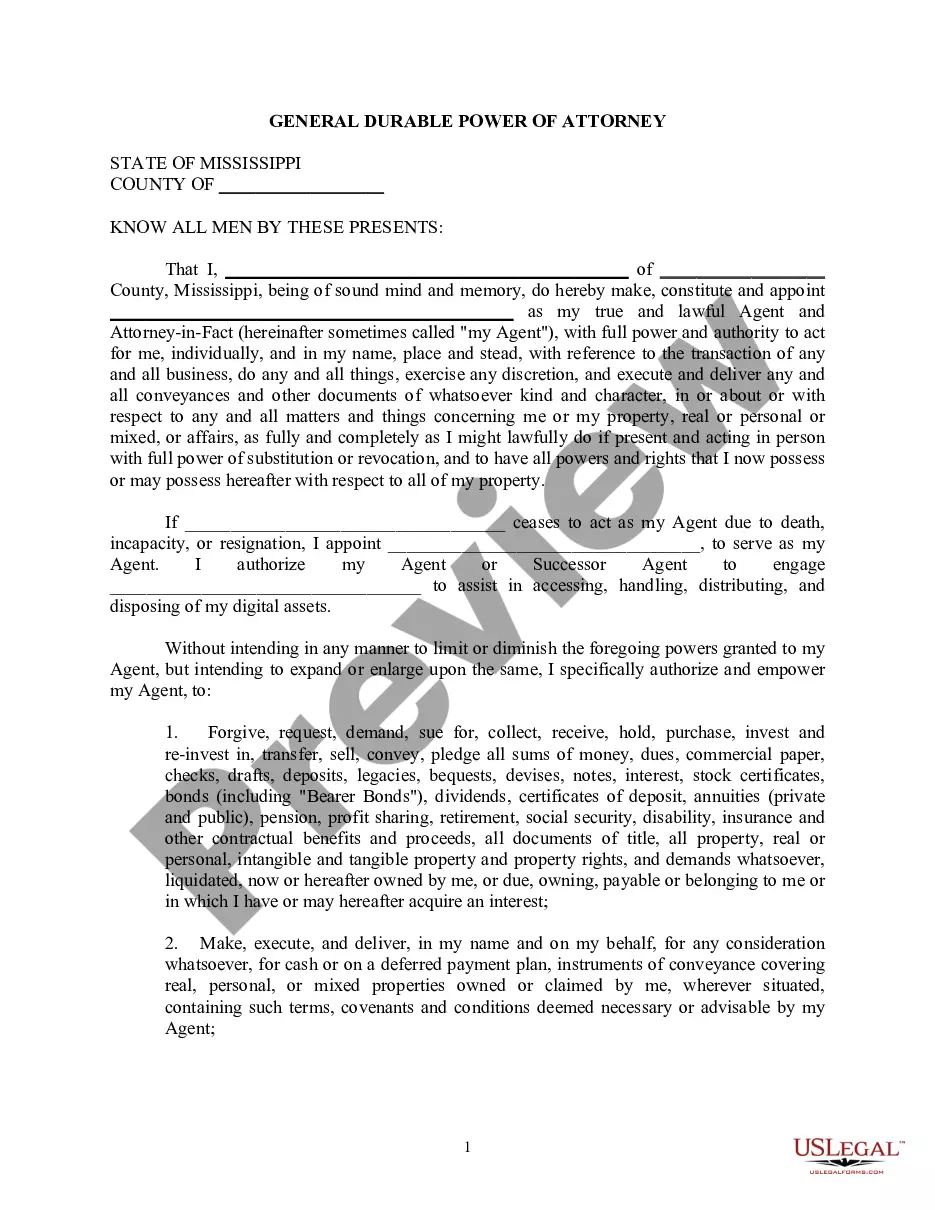

How to fill out Affidavit That Primary Term Of Lease Not Extended By Additional Bonus Payment By Lessor?

When it comes to drafting a legal document, it’s easier to delegate it to the experts. However, that doesn't mean you yourself cannot get a template to utilize. That doesn't mean you yourself can’t get a sample to utilize, however. Download Affidavit That Primary Term of Lease Not Extended by Additional Bonus Payment by Lessor straight from the US Legal Forms site. It offers a wide variety of professionally drafted and lawyer-approved documents and samples.

For full access to 85,000 legal and tax forms, users just have to sign up and select a subscription. After you’re registered with an account, log in, search for a certain document template, and save it to My Forms or download it to your device.

To make things less difficult, we’ve incorporated an 8-step how-to guide for finding and downloading Affidavit That Primary Term of Lease Not Extended by Additional Bonus Payment by Lessor fast:

- Make confident the form meets all the necessary state requirements.

- If possible preview it and read the description prior to buying it.

- Press Buy Now.

- Select the suitable subscription for your needs.

- Make your account.

- Pay via PayPal or by debit/bank card.

- Select a preferred format if a number of options are available (e.g., PDF or Word).

- Download the file.

As soon as the Affidavit That Primary Term of Lease Not Extended by Additional Bonus Payment by Lessor is downloaded you may fill out, print and sign it in almost any editor or by hand. Get professionally drafted state-relevant documents in a matter of seconds in a preferable format with US Legal Forms!

Form popularity

FAQ

Bonus pay is additional pay given to an employee on top of their regular earnings; it's used by many organizations as a thank-you to employees or a team that achieves significant goals. Bonus pay is also offered to improve employee morale, motivation, and productivity.

In accordance with the terms of the Principal Act, every employee who draws a salary of INR 10,000 or below per month and who has worked for not less than 30 days in an accounting year, is eligible for bonus (calculated as per the methodology provided under the Principal Act) with the floor of 8.33% of the salary

THE PAYMENT OF BONUS ACT, 1965 The minimum bonus of 8.33% is payable by every industry and establishment under section 10 of the Act. The maximum bonus including productivity linked bonus that can be paid in any accounting year shall not exceed 20% of the salary/wage of an employee under the section 31 A of the Act. 1.

It means Bonus is paid for the previous year. It can be paid as part of monthly salary. Bonus has to be paid for the previous financial year. That has been prescribed because profit is declared for previous financial year.

In accordance with the terms of the Principal Act, every employee who draws a salary of INR 10,000 or below per month and who has worked for not less than 30 days in an accounting year, is eligible for bonus (calculated as per the methodology provided under the Principal Act) with the floor of 8.33% of the salary

Definition: A monetary payment made to an employee over and above their standard salary or compensation package. Bonuses are one of the ways employers reward their employees for a job well done. And offering regular, significant bonuses is a way to keep your best people from looking elsewhere for a job.

10,000 per month who has worked for not less than 30 days in an accounting year, shall be eligible for bonus for minimum of 8.33% of the salary/wages even if there is loss in the establishment whereas a maximum of 20% of the employee's salary/wages is payable as bonus in an accounting year.

Objective: The objective of the Payment of Bonus Act is to reward the employee of the organization by sharing the profits earned and is linked to productivity. Applicable to: The Payment of Bonus Act is applicable to any establishment with 20 or more employees or any factory with 10 or more employees.

Bonus is a reward that is paid to an employee for his good work towards the organisation. The basic objective to give bonus is to share the profit earned by the organisation amongst the employees and staff members.10,000 per month for the purpose of payment of bonus, their salaries/wages would be deemed to be Rs.