Clauses Relating to Initial Capital contributions

Description

How to fill out Clauses Relating To Initial Capital Contributions?

Use US Legal Forms to obtain a printable Clauses Relating to Initial Capital contributions. Our court-admissible forms are drafted and regularly updated by skilled lawyers. Our’s is the most comprehensive Forms catalogue on the internet and provides reasonably priced and accurate templates for customers and lawyers, and SMBs. The documents are categorized into state-based categories and a few of them can be previewed before being downloaded.

To download samples, customers must have a subscription and to log in to their account. Press Download next to any form you want and find it in My Forms.

For individuals who do not have a subscription, follow the following guidelines to quickly find and download Clauses Relating to Initial Capital contributions:

- Check out to ensure that you have the correct form in relation to the state it is needed in.

- Review the form by looking through the description and by using the Preview feature.

- Press Buy Now if it’s the template you want.

- Generate your account and pay via PayPal or by card|credit card.

- Download the template to the device and feel free to reuse it many times.

- Make use of the Search engine if you want to get another document template.

US Legal Forms offers a large number of legal and tax samples and packages for business and personal needs, including Clauses Relating to Initial Capital contributions. More than three million users have already used our platform successfully. Choose your subscription plan and have high-quality forms within a few clicks.

Form popularity

FAQ

An equity contribution agreement occurs between two parties that are agreeing to pool together cash, capital, and other assets into a company to conduct business. The capital is provided in exchange for a portion of the equity in the company venture.The nature and terms of the agreement between the two parties.

An initial capital contribution is commonly seen as being given in exchange for membership in an LLC. However, while not typical, a person could contribute something to a company without being given membership, and a person could also be given membership without making any contribution.

Your contribution to the LLC as a member is called your capital contribution, your contribution to the ownership. This capital contribution gives you a share in the LLC, and the right to a percentage of the profits (and losses). If you are the only member, you have 100% of the ownership.

In business and partnership law, contribution may refer to a capital contribution, which is an amount of money or assets given to a business or partnership by one of the owners or partners. The capital contribution increases the owner or partner's equity interest in the entity.

In business and partnership law, contribution may refer to a capital contribution, which is an amount of money or assets given to a business or partnership by one of the owners or partners. The capital contribution increases the owner or partner's equity interest in the entity.

Many communities impose a capital contribution (sometimes called an initiation fee) on new owners. This is a one-time, nonrefundable fee paid by the buyer at closing. These fees usually go into a special account used to fund capital improvements and repairs in the community. Both Fla.

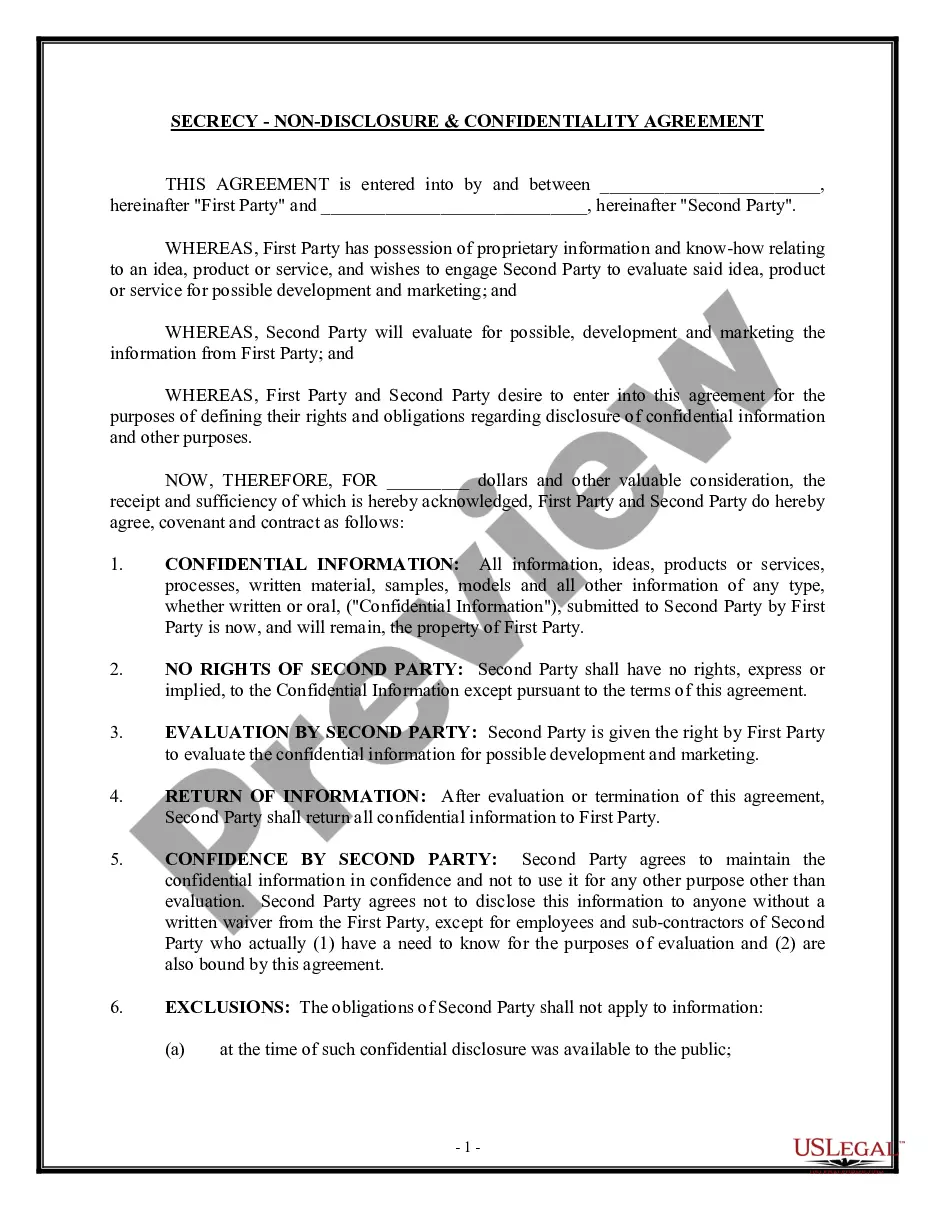

A contribution agreement (also known as a deed of contribution) for use in a share purchase transaction involving several sellers. It sets out the basis upon which the sellers intend to apportion between them any liability arising under the warranties, indemnities and tax covenant in the share purchase agreement.

A capital contribution is an act of giving money or assets to a company or organization. When an investor or partner gives money for your business, this is called a contribution. But this differs from another form of contribution, such as a loan.Depending on the agreement, the capital doesn't have to be paid back.