Clauses Relating to Dividends, Distributions

Description

How to fill out Clauses Relating To Dividends, Distributions?

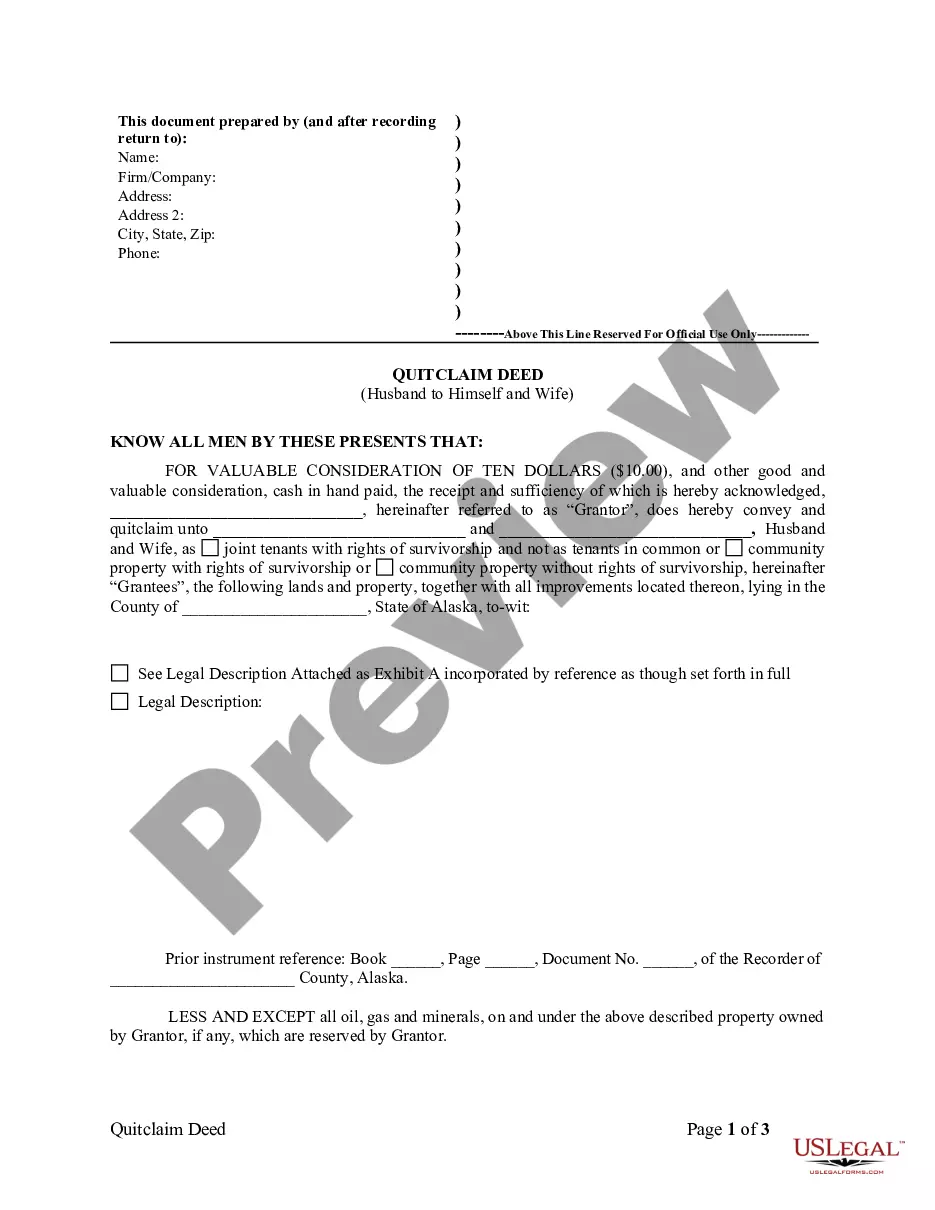

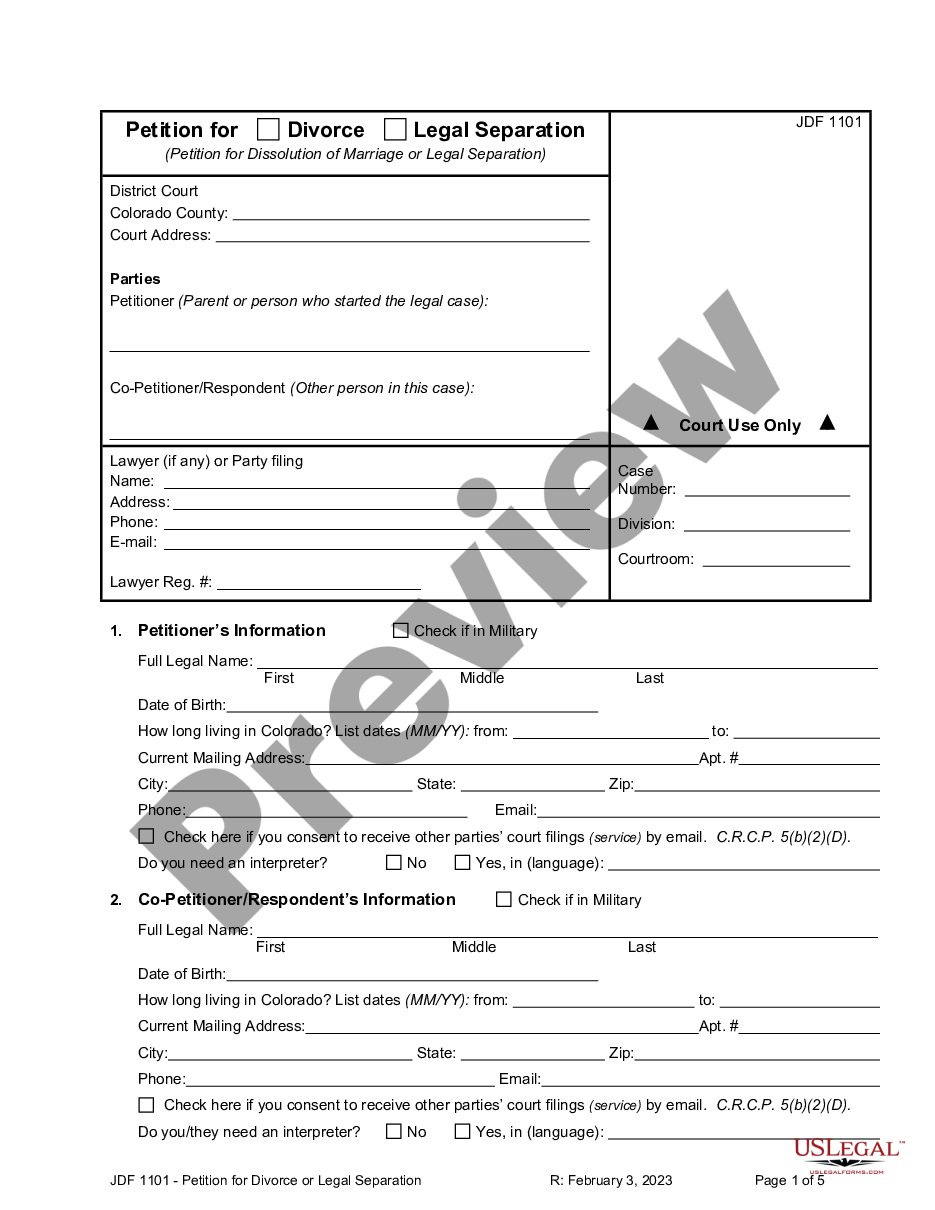

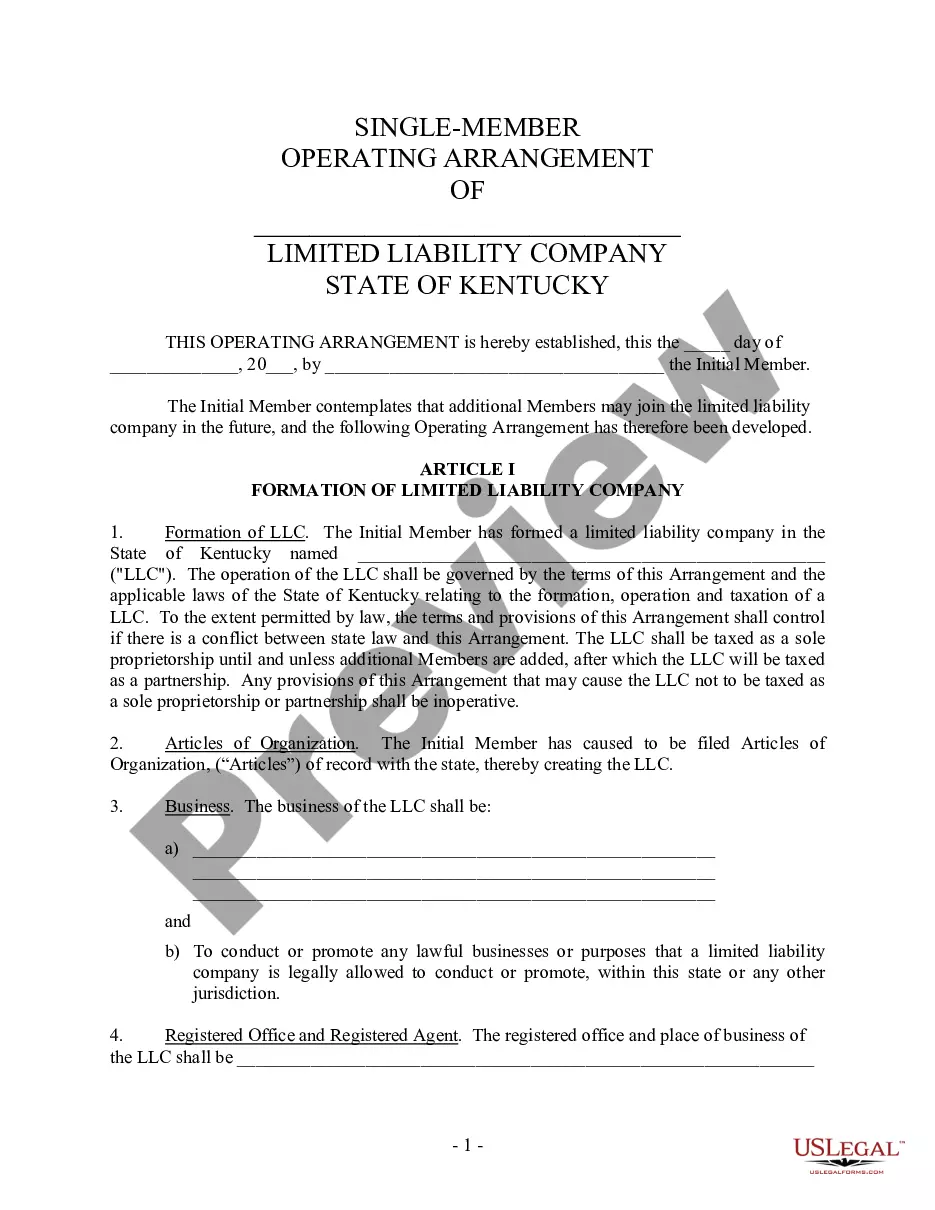

Use US Legal Forms to get a printable Clauses Relating to Dividends, Distributions. Our court-admissible forms are drafted and regularly updated by professional attorneys. Our’s is the most complete Forms catalogue online and offers reasonably priced and accurate samples for consumers and lawyers, and SMBs. The documents are grouped into state-based categories and a number of them can be previewed before being downloaded.

To download samples, customers must have a subscription and to log in to their account. Click Download next to any template you need and find it in My Forms.

For individuals who don’t have a subscription, follow the tips below to quickly find and download Clauses Relating to Dividends, Distributions:

- Check out to ensure that you get the right form in relation to the state it is needed in.

- Review the form by reading the description and by using the Preview feature.

- Press Buy Now if it’s the template you need.

- Create your account and pay via PayPal or by card|credit card.

- Download the form to your device and feel free to reuse it many times.

- Use the Search field if you want to find another document template.

US Legal Forms offers a large number of legal and tax templates and packages for business and personal needs, including Clauses Relating to Dividends, Distributions. Above three million users already have used our platform successfully. Select your subscription plan and obtain high-quality documents in just a few clicks.

Form popularity

FAQ

A dividend is a payment a company can make to shareholders if it has made a profit. You cannot count dividends as business costs when you work out your Corporation Tax.You must usually pay dividends to all shareholders.

In the simplest sense, you only need to own a stock for two business days to get a dividend payout. Technically, you could even buy a stock with one second left before the market close and still be entitled to the dividend when the market opens two business days later.

Dividends are distributions of property by a corporation to the shareholder or owner of the corporation out of the earnings or profits of the corporation. Dividends are typically paid in the form of cash but may be paid in other types of property.

Open the separate account with the scheduled bank and deposit the amount of dividend payable in the account within 5 Days of Declaration of dividend. 5. Dividend payable in cash may be paid by Cheque or warrant or through any other electronic mode to the shareholders entitled to the payment of the dividend.

As per Rule 3, the conditions for declaration of dividend in the event of inadequacy or absence of profits in any year are as follows: (1) The rate of dividend declared shall not exceed the average of the rates at which dividend was declared by it in the three years immediately preceding that year.

Before a cash dividend is declared and subsequently paid to shareholders, a company's board of directors must decide to pay the dividend and in what amount. The board must agree on the cash amount to be paid to the shareholders, both individually and in the aggregate.

Cash Dividend: Cash dividend is the most popular form of dividend payout. Stock dividend: If any company issues additional shares to common shareholders without any consideration then the action becomes stock dividend. Property dividend: Scrip dividend : Liquidating dividend:

The company generates profits. The management team decides some excess profits should be paid out to shareholders (instead of being reinvested) The board approves the planned dividend. The company announces the dividend (the value per share, the date when it will be paid, the record date, etc.)

If dividends are paid, a company will declare the amount of the dividend, and all holders of the stock (by the ex-date) will be paid accordingly on the subsequent payment date. Investors who receive dividends may decide to keep them as cash or reinvest them in order to accumulate more shares.