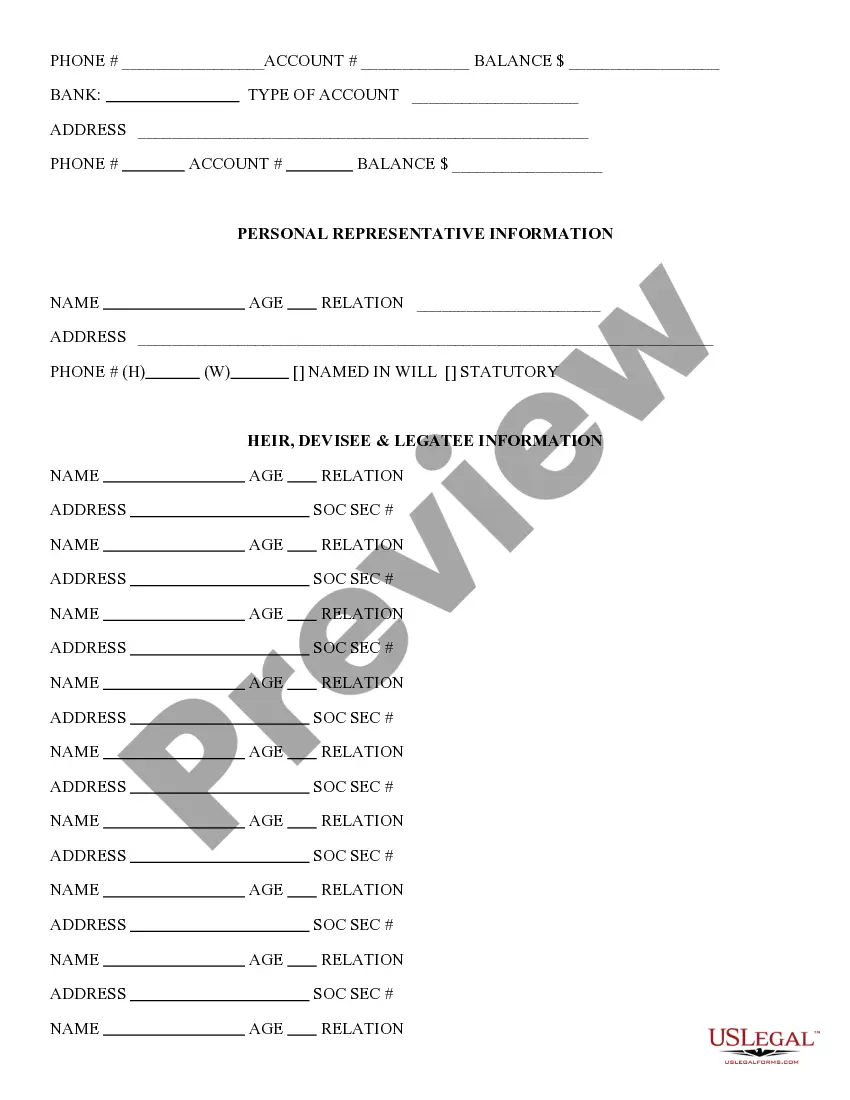

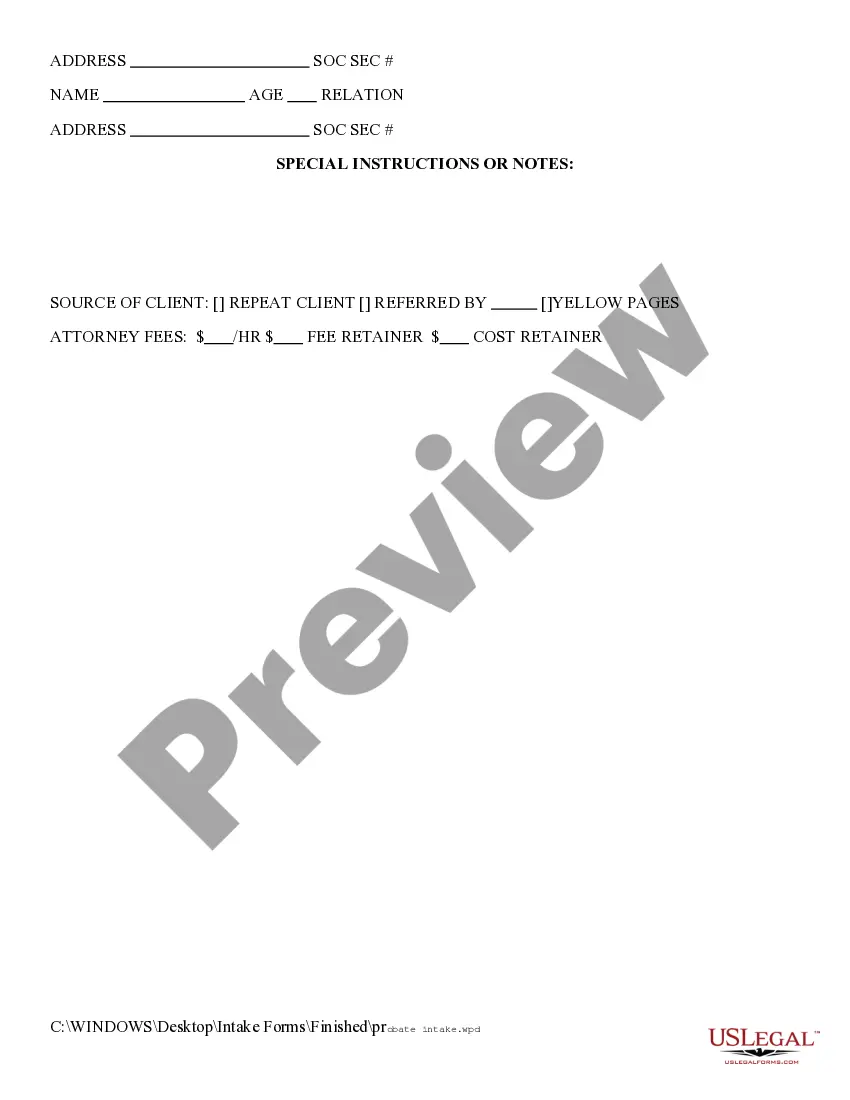

Information For Probate of Estate is a legal process that takes place when a person dies. It involves the gathering of information related to the deceased person's assets, debts, and liabilities, which are then used to determine how the estate should be distributed. Information For Probate of Estate typically includes personal information such as the deceased's name, date of birth, Social Security number, and the names and contact information of their heirs. It may also include details about the deceased's property, such as deeds, titles, mortgages, and bank accounts. In certain cases, it may also include information about the deceased person's will, trust, and other estate plans. There are two types of Information For Probate of Estate: probate documents and non-probate documents. Probate documents are those that are filed with the court and used to establish the deceased's rights to their assets. Examples of probate documents include the will, trust documents, and power of attorney documents. Non-probate documents are those that do not require court involvement and are used to transfer assets to the heirs. These documents may include beneficiary designations on life insurance policies, pay-on-death accounts, and transfer-on-death accounts.

Information For Probate of Estate

Description

How to fill out Information For Probate Of Estate?

If you’re searching for a way to appropriately prepare the Information For Probate of Estate without hiring a legal representative, then you’re just in the right spot. US Legal Forms has proven itself as the most extensive and reputable library of official templates for every private and business scenario. Every piece of documentation you find on our online service is created in accordance with federal and state regulations, so you can be sure that your documents are in order.

Follow these simple instructions on how to obtain the ready-to-use Information For Probate of Estate:

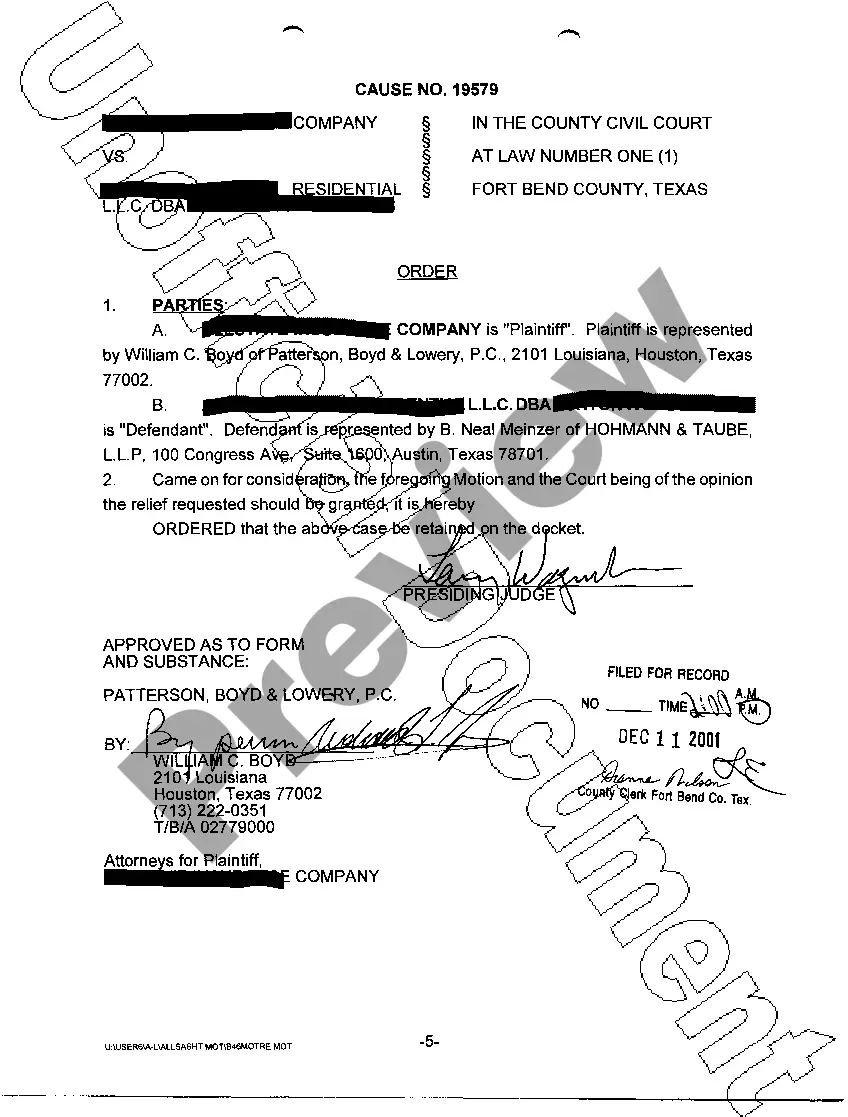

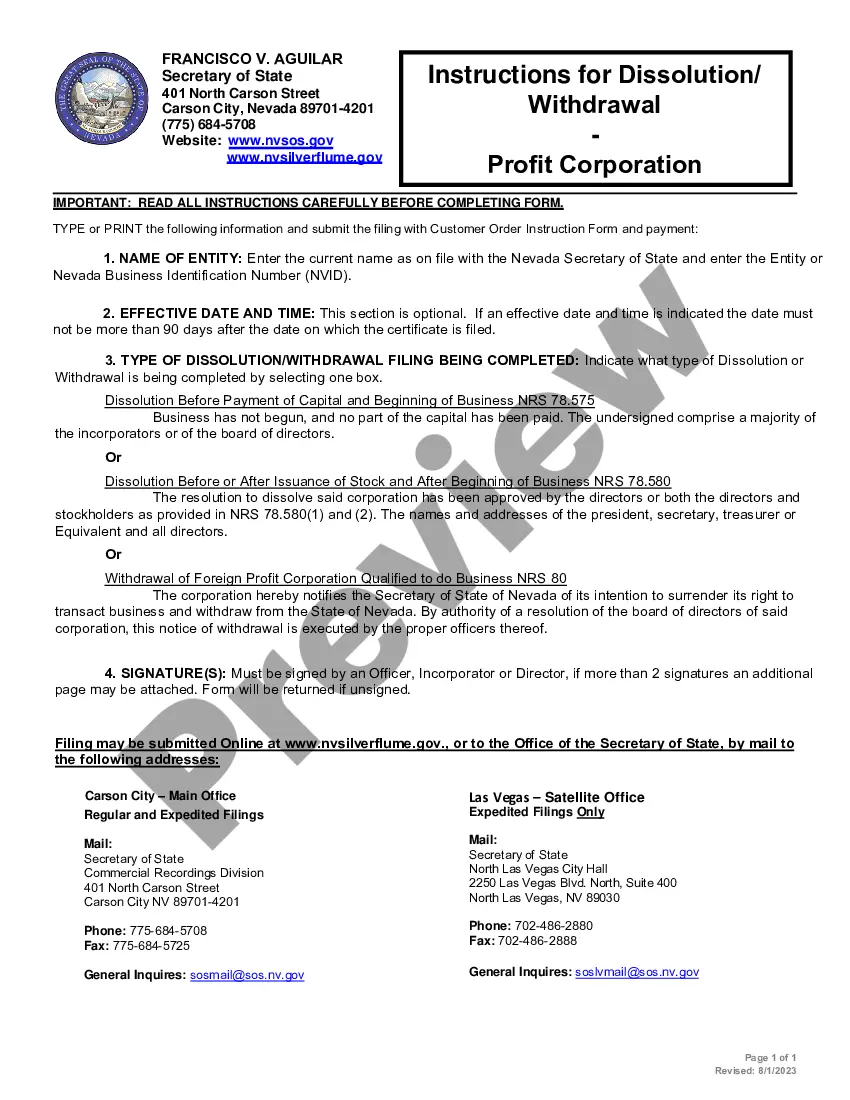

- Ensure the document you see on the page complies with your legal situation and state regulations by checking its text description or looking through the Preview mode.

- Type in the document name in the Search tab on the top of the page and choose your state from the dropdown to locate an alternative template if there are any inconsistencies.

- Repeat with the content verification and click Buy now when you are confident with the paperwork compliance with all the demands.

- Log in to your account and click Download. Register for the service and select the subscription plan if you still don’t have one.

- Use your credit card or the PayPal option to pay for your US Legal Forms subscription. The document will be available to download right after.

- Choose in what format you want to save your Information For Probate of Estate and download it by clicking the appropriate button.

- Import your template to an online editor to fill out and sign it rapidly or print it out to prepare your paper copy manually.

Another wonderful thing about US Legal Forms is that you never lose the paperwork you acquired - you can find any of your downloaded blanks in the My Forms tab of your profile whenever you need it.

Form popularity

FAQ

Illinois probate follows this general flow: contact the court, get appointed as personal representative, submit will if it exists, inventory and submit valuations of all relevant assets, have the court and beneficiaries approve it, and then distribute the assets to beneficiaries.

Estates that include pieces of property that are difficult to value can also slow down probate. It can take time for all parties to agree on the value of the unique assets, and disputes can easily arise between the estate's executor and the IRS over the asset's value for estate tax purposes.

The disadvantages of probating a will are many. The probate process is expensive, time consuming, and intrusive. Court costs, attorney fees, personal representative fees, bonds, and accounting fees all add up.

To be valid, your will must be: in writing, and. signed at the end by you and two witnesses, with all three being present together, and with all three seeing each other sign, and. intended by you to take effect as a will, and.

If you have living descendants, your spouse will get half of the inheritance, and your descendants will get the other half of the inheritance. However, grandchildren will only receive a share if their parents are not alive to receive their share.

Property that is jointly owned with a survivorship right will avoid probate. If one owner dies, title passes automatically to the remaining owner. There are three types of joint ownership with survivorship rights: Joint tenancy with rights of survivorship.