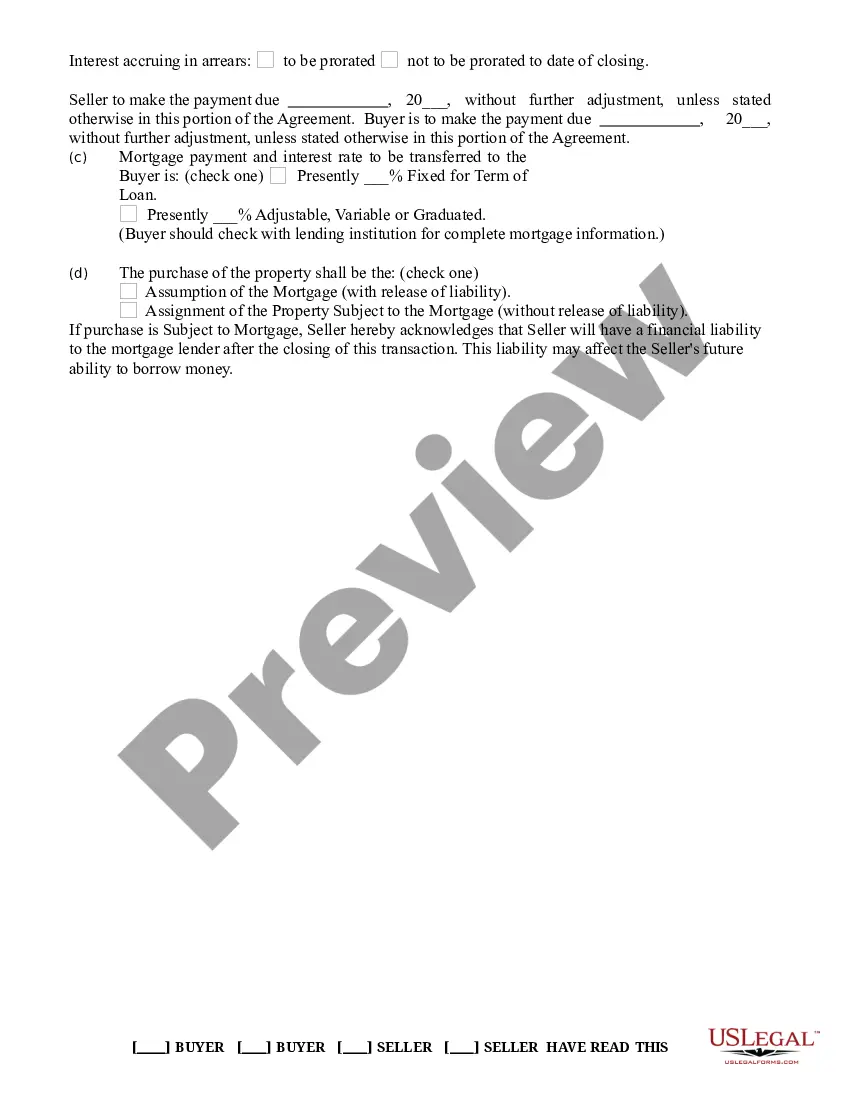

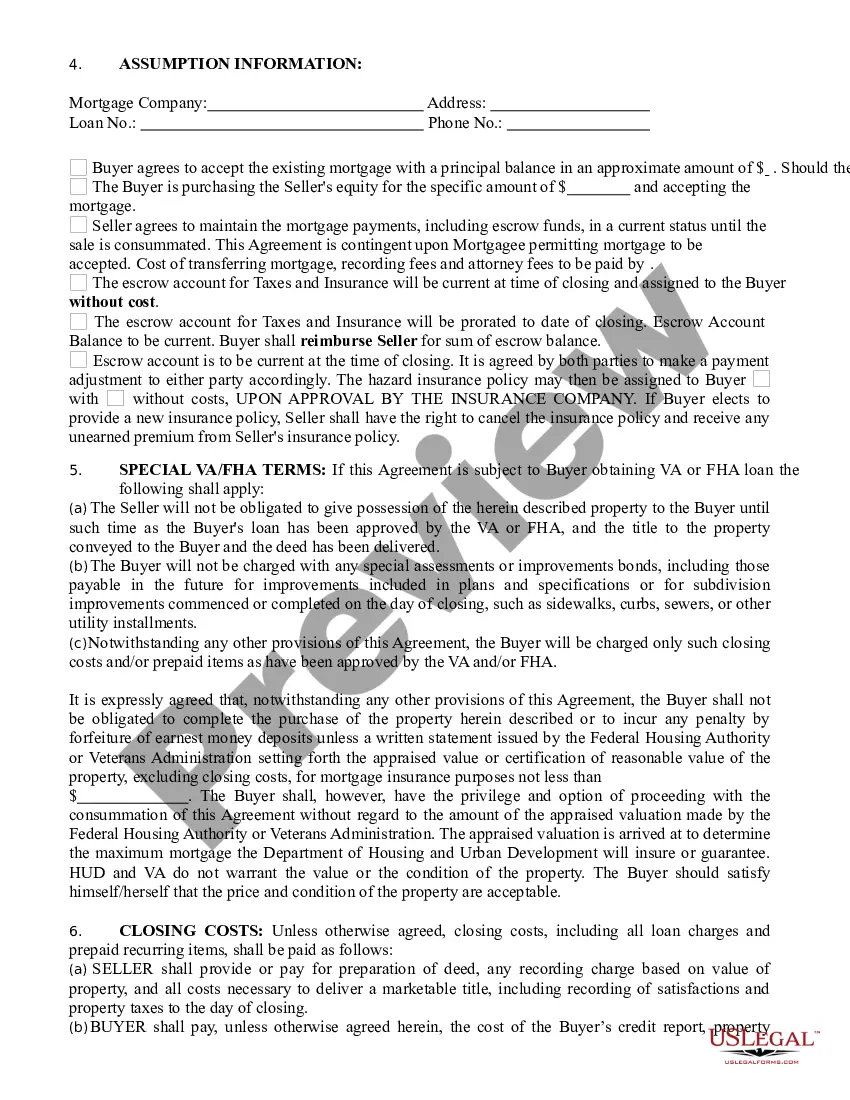

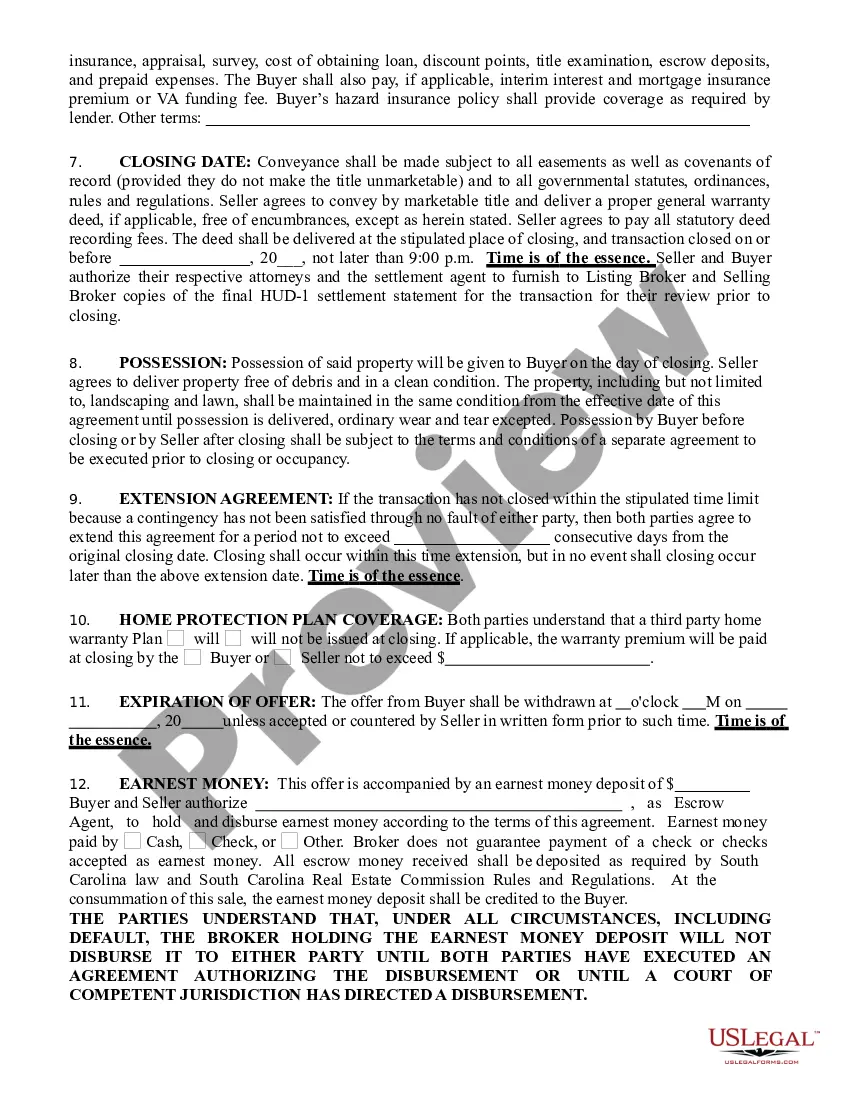

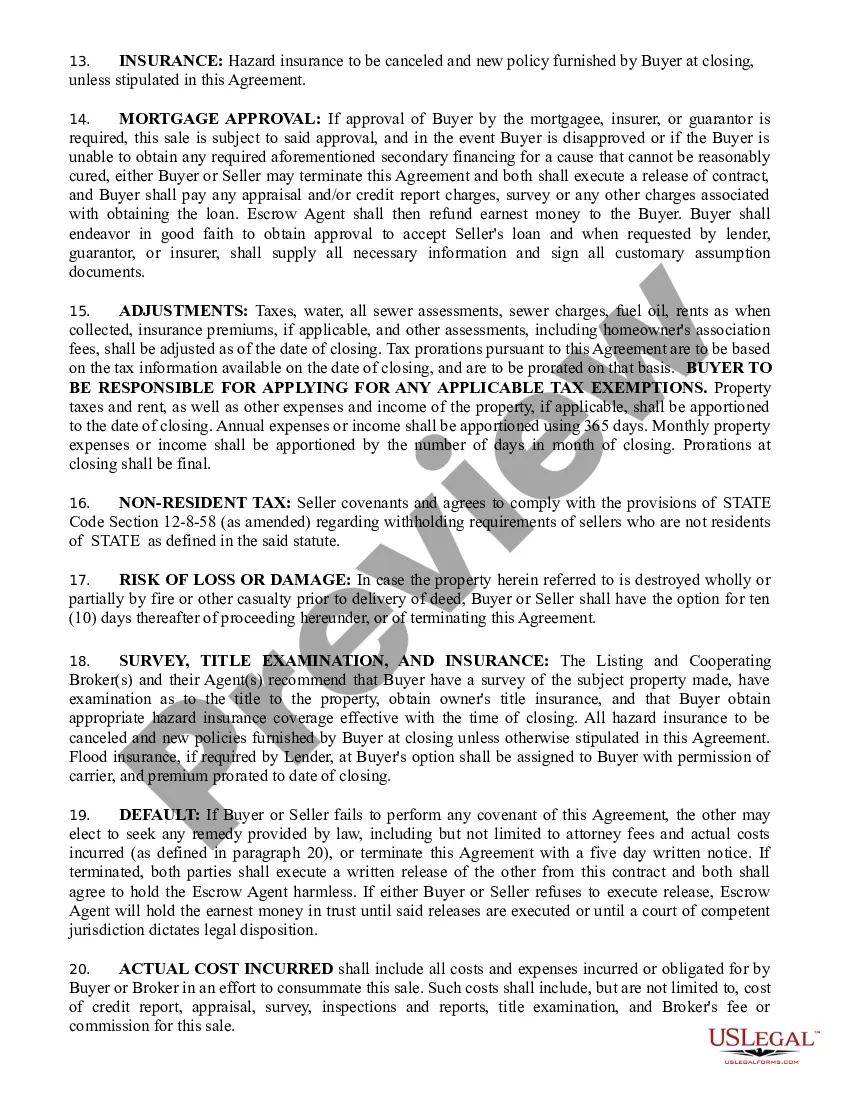

An Agreement to Buy and Sell Real Estate Assumption of Mortgage is a legally binding document between a buyer and seller of real estate. It outlines the terms and conditions of the sale, including the purchase price, financing terms, and the assumption of a mortgage loan. The agreement also outlines the responsibilities of both the buyer and seller, such as the seller's responsibility to deliver a title free of liens and the buyer's responsibility to assume the mortgage loan. The agreement also includes provisions for any contingencies, such as a home inspection or financing requirements. Different types of Agreement to Buy and Sell Real Estate Assumption of Mortgage include: 1. Purchase Agreement: This outlines the essential terms of the sale, such as the purchase price, financing terms, and the assumption of a mortgage loan. 2. Financing Contingency: This outlines the buyer's responsibility to obtain financing for the purchase within a certain timeframe and any potential remedies if financing is not obtained. 3. Home Inspection Contingency: This outlines the buyer's responsibility to obtain a home inspection and any potential remedies if the inspection reveals any deficiencies. 4. Title Contingency: This outlines the seller's responsibility to deliver a title free of liens and any potential remedies if the title is not free of liens. 5. Closing Contingency: This outlines the buyer's and seller's responsibilities in the closing process, including deadlines for closing and any potential remedies if either party fails to meet their obligations.

Agreement to Buy and Sell Real Estate Assumption of Mortgage

Description

How to fill out Agreement To Buy And Sell Real Estate Assumption Of Mortgage?

How much time and resources do you typically spend on drafting formal paperwork? There’s a better option to get such forms than hiring legal specialists or wasting hours searching the web for a proper blank. US Legal Forms is the leading online library that offers professionally designed and verified state-specific legal documents for any purpose, including the Agreement to Buy and Sell Real Estate Assumption of Mortgage.

To obtain and prepare an appropriate Agreement to Buy and Sell Real Estate Assumption of Mortgage blank, adhere to these simple steps:

- Look through the form content to ensure it meets your state regulations. To do so, check the form description or use the Preview option.

- In case your legal template doesn’t meet your needs, locate a different one using the search tab at the top of the page.

- If you already have an account with us, log in and download the Agreement to Buy and Sell Real Estate Assumption of Mortgage. Otherwise, proceed to the next steps.

- Click Buy now once you find the right blank. Select the subscription plan that suits you best to access our library’s full opportunities.

- Create an account and pay for your subscription. You can make a transaction with your credit card or through PayPal - our service is absolutely safe for that.

- Download your Agreement to Buy and Sell Real Estate Assumption of Mortgage on your device and fill it out on a printed-out hard copy or electronically.

Another advantage of our library is that you can access previously acquired documents that you securely keep in your profile in the My Forms tab. Get them at any moment and re-complete your paperwork as frequently as you need.

Save time and effort completing official paperwork with US Legal Forms, one of the most trusted web solutions. Join us today!

Form popularity

FAQ

A Simple Assumption is where the buyer takes over on the mortgage payments from the seller. This is a private transaction where title to the home passes from the seller to the buyer, and requires less involvement from the lender.

Once the assumption has been approved, you'll also have to pay closing costs, but these are generally lower when you assume a mortgage compared to getting one on your own.

An assumption clause is a provision in a mortgage contract that allows the seller of a home to pass responsibility for the existing mortgage to the buyer of the property. In other words, the new homeowner assumes the existing mortgage and?along with it?ownership of the property that secures the loan.

A loan assumption agreement is an agreement between a lender, original borrower, and a new borrower, where the new borrower agrees to assume responsibility for the debt owed by original borrower. These agreements are commonly seen in mortgages and real estate.

Advantages. If the assumable interest rate is lower than current market rates, the buyer saves money straight away. There are also fewer closing costs associated with assuming a mortgage. This can save money for the seller as well as the buyer.

An assignment and assumption agreement is used after a contract is signed, in order to transfer one of the contracting party's rights and obligations to a third party who was not originally a party to the contract.

When a buyer buys property and assumes a mortgage, the buyer becomes primarily liable for the debt and the seller becomes secondarily liable for the debt. "Assume" means the buyer takes on liability, and the seller is no longer primarily liable. "Subject to" means the seller is not released from responsibility.

An assumable mortgage allows a homebuyer to assume the current principal balance, interest rate, repayment period, and any other contractual terms of the seller's mortgage. Rather than going through the rigorous process of obtaining a home loan from the bank, a buyer can take over an existing mortgage.