Preparing legal paperwork can be a real stress unless you have ready-to-use fillable templates. With the US Legal Forms online library of formal documentation, you can be certain in the blanks you find, as all of them comply with federal and state laws and are examined by our specialists. So if you need to fill out Mortgage Note Buyer to Seller, our service is the perfect place to download it.

Obtaining your Mortgage Note Buyer to Seller from our catalog is as simple as ABC. Previously registered users with a valid subscription need only log in and click the Download button once they find the correct template. Afterwards, if they need to, users can get the same blank from the My Forms tab of their profile. However, even if you are unfamiliar with our service, signing up with a valid subscription will take only a few moments. Here’s a quick guideline for you:

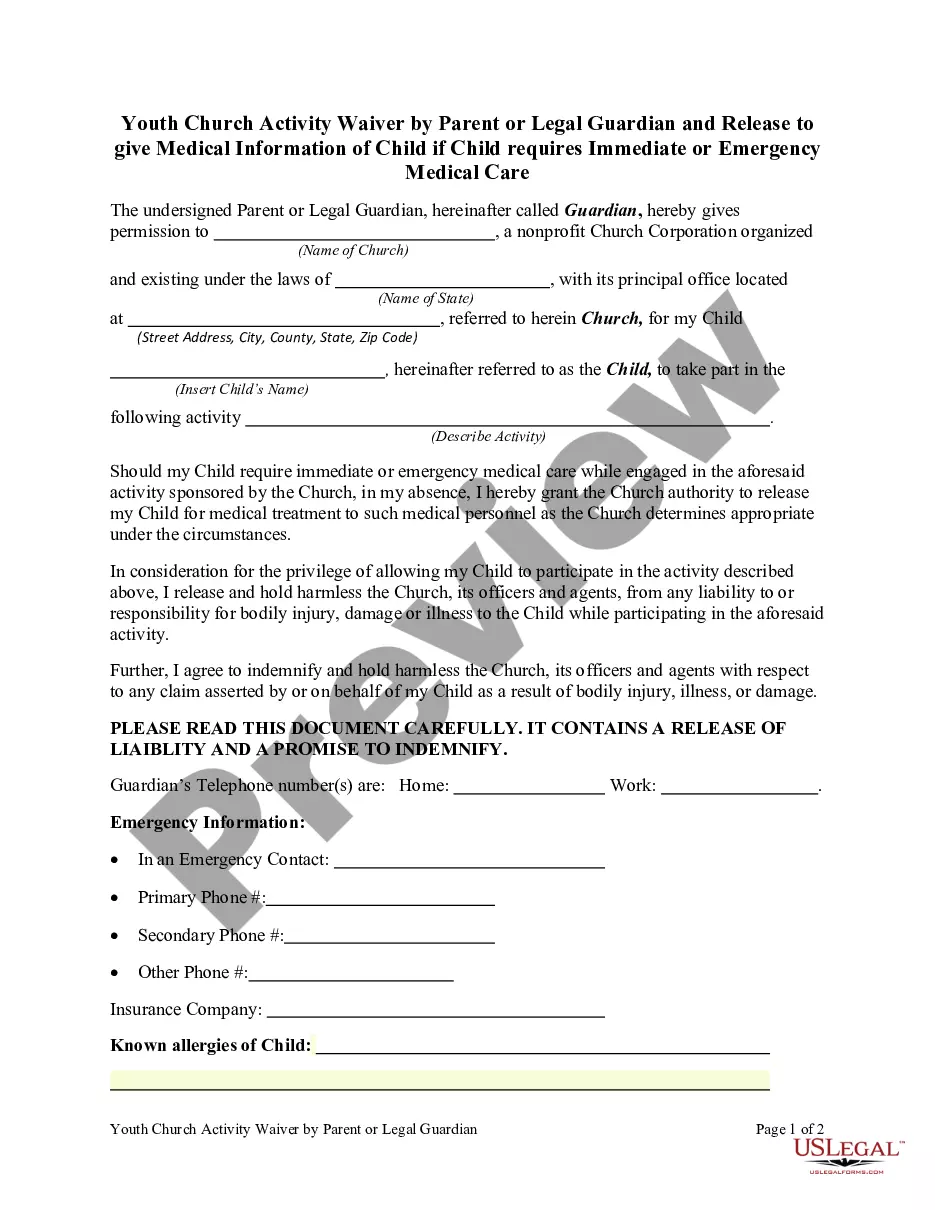

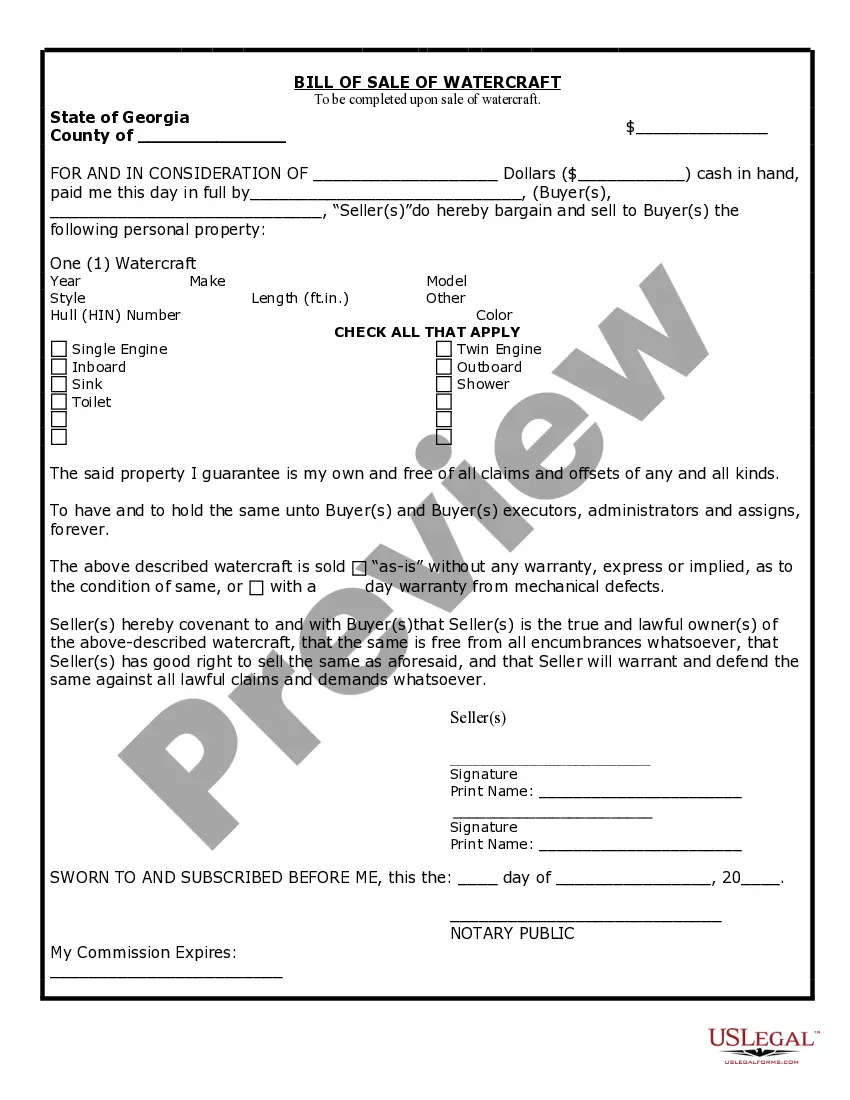

- Document compliance check. You should attentively examine the content of the form you want and check whether it suits your needs and fulfills your state law regulations. Previewing your document and looking through its general description will help you do just that.

- Alternative search (optional). Should there be any inconsistencies, browse the library using the Search tab above until you find an appropriate template, and click Buy Now when you see the one you want.

- Account registration and form purchase. Sign up for an account with US Legal Forms. After account verification, log in and choose your preferred subscription plan. Make a payment to proceed (PayPal and credit card options are available).

- Template download and further usage. Select the file format for your Mortgage Note Buyer to Seller and click Download to save it on your device. Print it to complete your paperwork manually, or take advantage of a multi-featured online editor to prepare an electronic copy faster and more efficiently.

Haven’t you tried US Legal Forms yet? Subscribe to our service now to obtain any official document quickly and easily any time you need to, and keep your paperwork in order!

Once you decide to work with a company that buys mortgage notes, you can call them or complete a form online to get an offer. A mortgage note is usually sold to a buyer when the seller no longer wants to wait for the payments and needs a lump sum of cash immediately.Selling a mortgage note is a streamlined and straightforward 5-step process. Get a free quote for a lump sum cash offer today. Selling your mortgage note doesn't have to be a long, drawn out process. By following these easy steps, you can have cash in your hand in less than a month. Selling a mortgage note isn't always a quick process, but it is fairly straightforward. The seller may opt for a full buy-out or a partial sale. If you are considering selling your note, call a nationwide direct mortgage note buyer like Seascape Capital to understand the best options. We make the process of selling a mortgage note easy!