Release of Mortgagor

Description

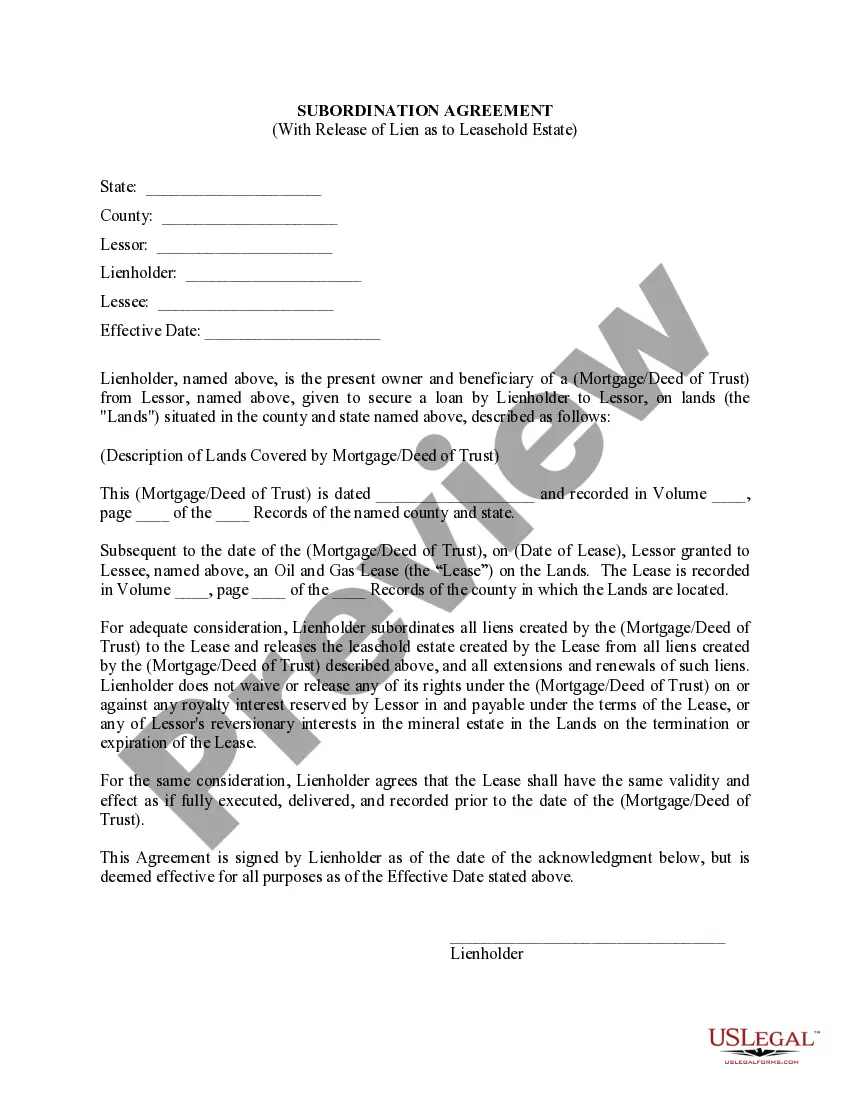

How to fill out Release Of Mortgagor?

Preparing legal paperwork can be a real stress if you don’t have ready-to-use fillable templates. With the US Legal Forms online library of formal documentation, you can be confident in the blanks you find, as all of them comply with federal and state regulations and are checked by our specialists. So if you need to complete Release of Mortgagor, our service is the best place to download it.

Obtaining your Release of Mortgagor from our catalog is as easy as ABC. Previously registered users with a valid subscription need only sign in and click the Download button after they locate the proper template. Later, if they need to, users can get the same blank from the My Forms tab of their profile. However, even if you are unfamiliar with our service, signing up with a valid subscription will take only a few moments. Here’s a quick guide for you:

- Document compliance verification. You should carefully review the content of the form you want and ensure whether it suits your needs and complies with your state law regulations. Previewing your document and looking through its general description will help you do just that.

- Alternative search (optional). If you find any inconsistencies, browse the library using the Search tab above until you find a suitable template, and click Buy Now once you see the one you need.

- Account creation and form purchase. Create an account with US Legal Forms. After account verification, log in and choose your most suitable subscription plan. Make a payment to proceed (PayPal and credit card options are available).

- Template download and further usage. Select the file format for your Release of Mortgagor and click Download to save it on your device. Print it to complete your paperwork manually, or use a multi-featured online editor to prepare an electronic copy faster and more efficiently.

Haven’t you tried US Legal Forms yet? Sign up for our service today to obtain any official document quickly and easily any time you need to, and keep your paperwork in order!

Form popularity

FAQ

A security release fee is a small fee that needs to be paid immediately. It is actually at the borrower's request and payable when both parties agree to discharge valid security. Once this step is done, you will have the power to get a hold of your title deeds for the land and properly.

Novation. In novation, the mortgage lender participates in and agrees to the full transfer of liability from the seller to the buyer. Because the lender is able to put the buyer through the underwriting process, it is willing to release the seller from all future responsibility for the mortgage payments.

A Deed Release Fee (also referred to as a mortgage completion fee, redemption administration fee or discharge fee) is an administration fee charged by mortgage lenders once a mortgage has been repaid to cover the legal costs involved with returning the title deed to you.

More Definitions of Release Fee Release Fee means one hundred twenty percent (120%) of the portion of the Loan attributed by the Lender to the Release Property.

Borrowers who can no longer afford to stay in their home may consider a Mortgage Release?, also known as a deed-in-lieu of foreclosure, to avoid foreclosure. This is also a good alternative for homeowners who are unable to sell their property, whether for a full payoff or a short sale.

Borrowers who can no longer afford to stay in their home may consider a Mortgage Release?, also known as a deed-in-lieu of foreclosure, to avoid foreclosure. This is also a good alternative for homeowners who are unable to sell their property, whether for a full payoff or a short sale.

A mortgagor is the borrower in the home buying process. A mortgagee approves the mortgagor for a loan, and the mortgagor is expected to pay back the amount they borrowed, plus interest, in installments over as long as 30 years.

The purpose of a mortgage discharge fee is to cover the costs associated with closing out your loan, such as filing paperwork and other administrative tasks. It's important to note that this isn't an additional cost; rather, it's part of what you already owe on your mortgage loan.