An Individual Transaction Indemnity Agreement is a contract between two or more parties that provides a mutual indemnity in the event of a breach of the terms and conditions of a specific transaction. This type of agreement is usually used to protect all parties involved in a transaction from any financial losses that may result from a breach of the terms and conditions of the transaction. There are two main types of Individual Transaction Indemnity Agreements: 1. Proportional Indemnity Agreement: This agreement requires each of the parties involved in a transaction to agree to bear an equal share of any losses that may be incurred due to a breach of the terms and conditions of the transaction. 2. Non-Proportional Indemnity Agreement: This agreement requires one party to bear the entirety of any losses that may be incurred due to a breach of the terms and conditions of the transaction. The other party will typically receive a monetary benefit in exchange for agreeing to this type of indemnity agreement.

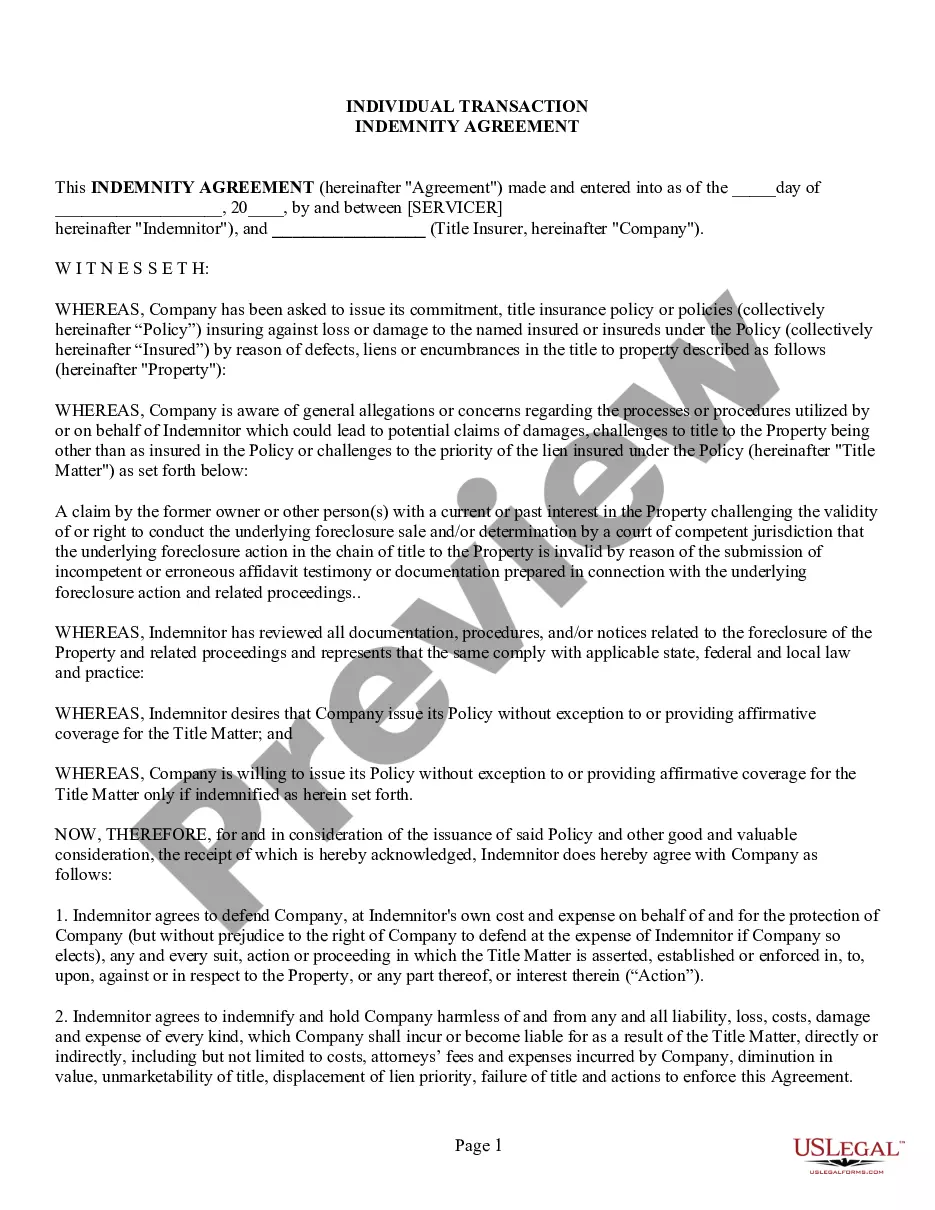

Indivdual Transaction Indemnity Agreement

Description

How to fill out Indivdual Transaction Indemnity Agreement?

Dealing with official documentation requires attention, precision, and using well-drafted blanks. US Legal Forms has been helping people across the country do just that for 25 years, so when you pick your Indivdual Transaction Indemnity Agreement template from our service, you can be certain it meets federal and state regulations.

Working with our service is straightforward and quick. To get the required paperwork, all you’ll need is an account with a valid subscription. Here’s a brief guide for you to find your Indivdual Transaction Indemnity Agreement within minutes:

- Remember to attentively check the form content and its correspondence with general and law requirements by previewing it or reading its description.

- Search for an alternative formal blank if the previously opened one doesn’t suit your situation or state regulations (the tab for that is on the top page corner).

- Log in to your account and save the Indivdual Transaction Indemnity Agreement in the format you prefer. If it’s your first experience with our website, click Buy now to proceed.

- Create an account, select your subscription plan, and pay with your credit card or PayPal account.

- Choose in what format you want to obtain your form and click Download. Print the blank or add it to a professional PDF editor to prepare it paper-free.

All documents are created for multi-usage, like the Indivdual Transaction Indemnity Agreement you see on this page. If you need them one more time, you can fill them out without re-payment - just open the My Forms tab in your profile and complete your document any time you need it. Try US Legal Forms and prepare your business and personal paperwork quickly and in full legal compliance!

Form popularity

FAQ

?Company/Business/Individual Name shall fully indemnify, hold harmless and defend and its directors, officers, employees, agents, stockholders and Affiliates from and against all claims, demands, actions, suits, damages, liabilities, losses, settlements, judgments, costs and expenses (including but not

Example 1: A service provider asking their customer to indemnify them to protect against misuse of their work product. Example 2: A rental car company, as the rightful owner of the car, having their customer indemnify them from any damage caused by the customer during the course of the retnal.

For example, A promises to deliver certain goods to B for Rs. 2,000 every month. C comes in and promises to indemnify B's losses if A fails to so deliver the goods. This is how B and C will enter into contractual obligations of indemnity.

Indemnity agreements, also known as indemnity clauses, play an integral role in contracts. That's because they are designed to punish the nonperforming party and reassure the damaged one they will be reimbursed for losses caused by the errant entity.

To indemnify, also known as indemnity or indemnification, means compensating a person for damages or losses they have incurred or will incur related to a specified accident, incident, or event.

An indemnity agreement is a contract that protects one party of a transaction from the risks or liabilities created by the other party of the transaction.

Example of Indemnity in Business The owner of a commercial property has been paying an insurance premium to an insurance company so that she can recover the costs for any loss or damage if a future bad event were to happen to the establishment.