Agreement for Rights under Third Party Deed of Trust

Description Agreement Third Party

How to fill out Debtor Right All?

Searching for a Agreement for Rights under Third Party Deed of Trust on the internet can be stressful. All too often, you see papers that you simply think are ok to use, but find out later they are not. US Legal Forms offers more than 85,000 state-specific legal and tax forms drafted by professional lawyers in accordance with state requirements. Have any form you are searching for within a few minutes, hassle free.

If you already have the US Legal Forms subscription, simply log in and download the sample. It will instantly be added in your My Forms section. If you don’t have an account, you need to register and pick a subscription plan first.

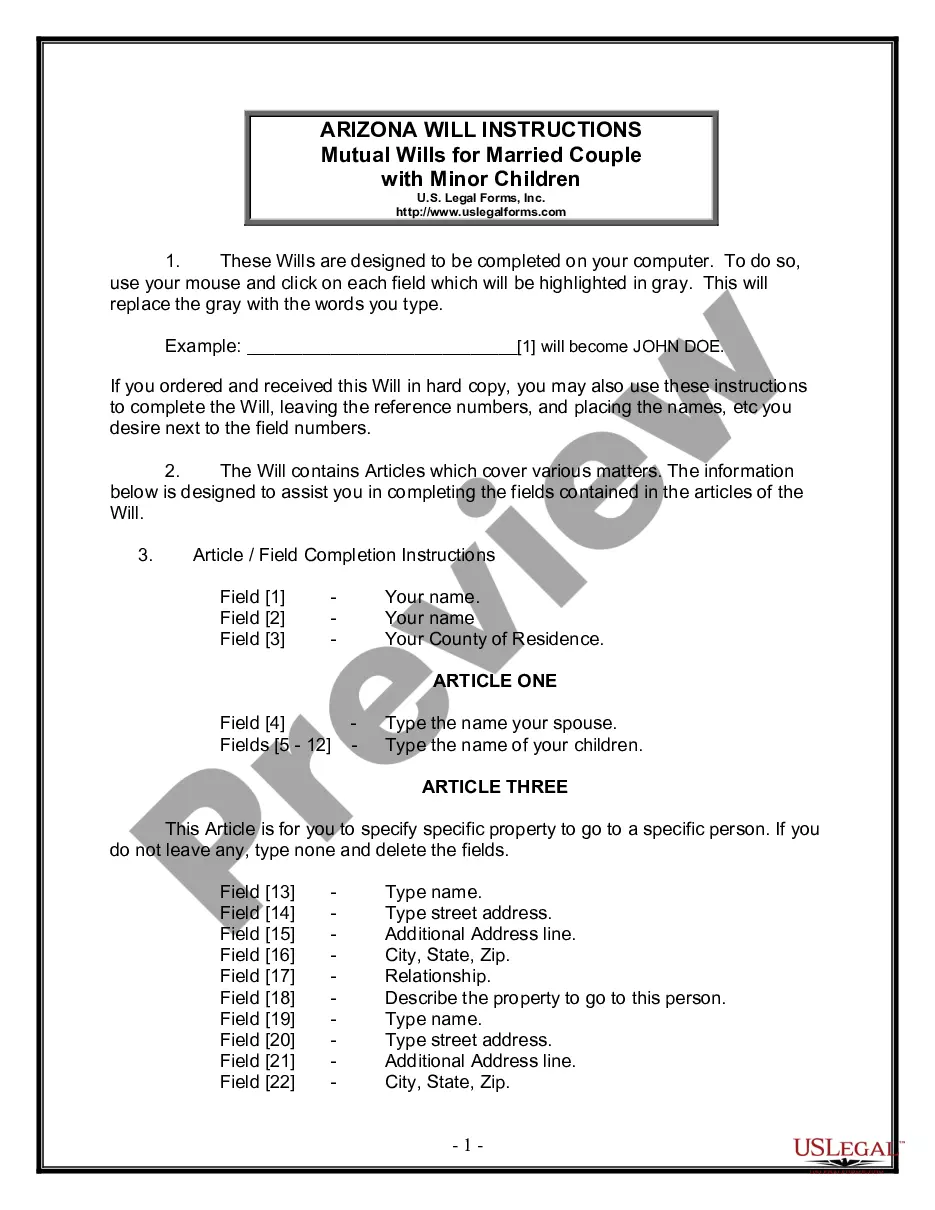

Follow the step-by-step recommendations listed below to download Agreement for Rights under Third Party Deed of Trust from our website:

- Read the document description and press Preview (if available) to verify whether the template suits your requirements or not.

- If the document is not what you need, find others using the Search engine or the provided recommendations.

- If it’s right, click on Buy Now.

- Choose a subscription plan and create an account.

- Pay via credit card or PayPal and download the document in a preferable format.

- After downloading it, you can fill it out, sign and print it.

Obtain access to 85,000 legal forms right from our US Legal Forms catalogue. In addition to professionally drafted samples, users will also be supported with step-by-step instructions on how to get, download, and complete templates.

Third Party Payment Agreement Template Form popularity

Under Deed Trust Other Form Names

Agreement Deed Trust Sample FAQ

A third-party special needs trust is created and funded by someone other than the special needs person.The trustee is free to invest the funds with any financial advisor; the statute does not make any limitations. At the beneficiary's death, the trust funds pass to whomever the trustee names.

A third-party SNT can be either irrevocable or revocable. Revocable A revocable trust is a trust in which the grantor can revoke or change the trust terms at any time. Only third-party SNTs can be revocable.

If only the parents will contribute and don't expect to do so except as part of their estate plan, then the special needs trust can be revocable, meaning you can change it at any time.

At the beneficiary's death, in most cases the SNT will be terminated. The trustee is responsible for dissolving the trust and fulfilling the instructions laid out in the trust document.In addition, the SNT will owe money to the state if the person with special needs received Medicaid benefits during her lifetime.

In general, trust structures are intended to provide a legal way to title and hold assets to be used to support one or more beneficiaries. Special needs trusts are similar and are used to benefit someone who has physical or mental disabilities.

There are three main types of special needs trusts: the first-party trust, the third-party trust, and the pooled trust. All three name the person with special needs as the beneficiary.

Failure to set up a special needs trust might affect them, even if not as much as another person who receives, say, SSI and Medicaid. Even someone receiving Medicare will have some effect from having a higher income.