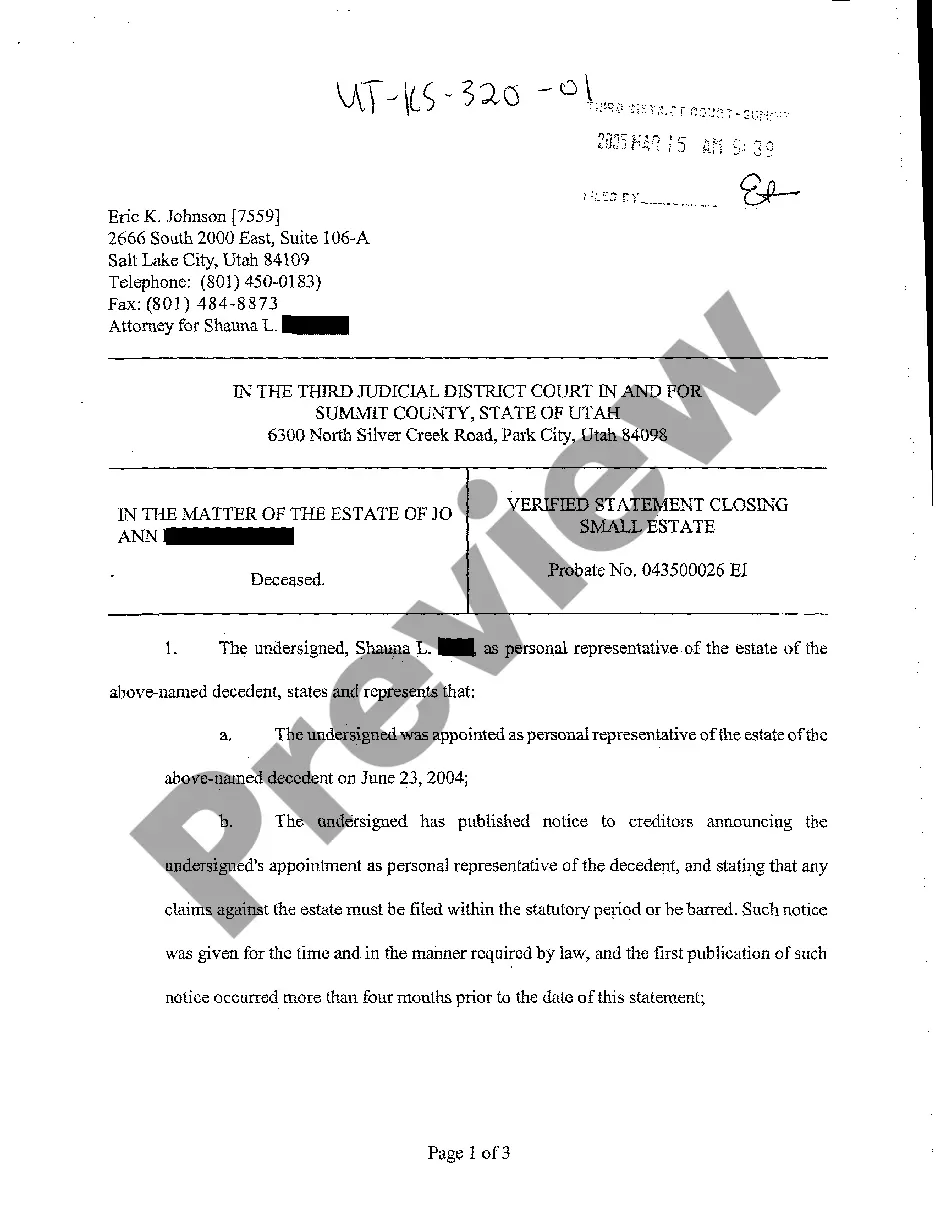

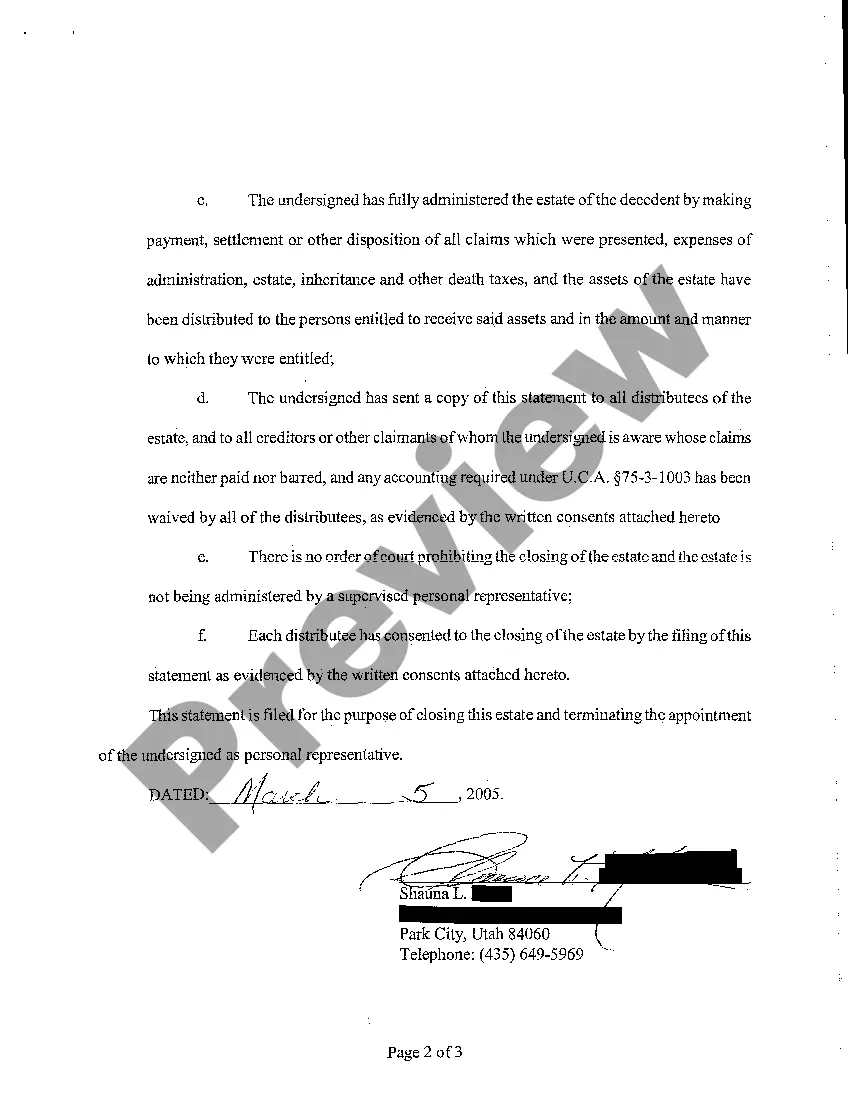

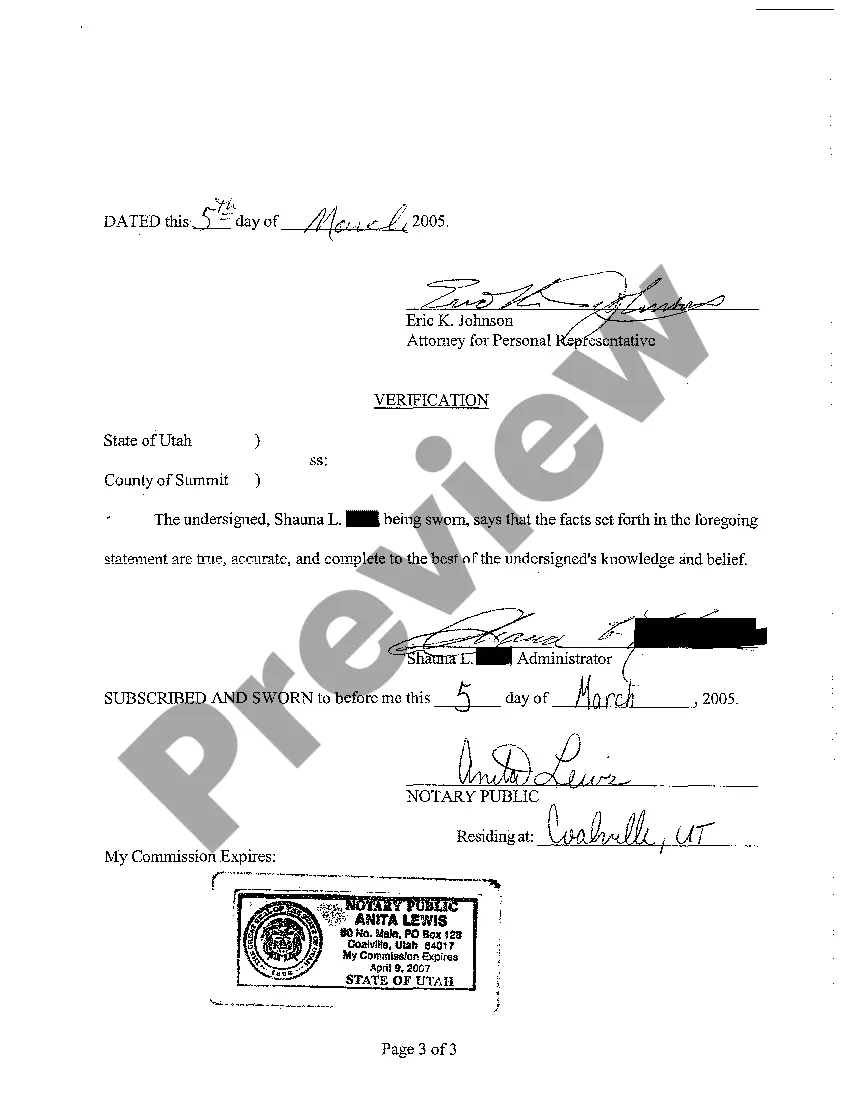

Utah Verified Statement Closing Small Estate

Description

How to fill out Utah Verified Statement Closing Small Estate?

Among hundreds of paid and free samples that you’re able to find on the net, you can't be certain about their reliability. For example, who created them or if they are qualified enough to deal with what you need those to. Always keep relaxed and use US Legal Forms! Find Utah Verified Statement Closing Small Estate samples made by skilled lawyers and avoid the high-priced and time-consuming process of looking for an lawyer and after that having to pay them to write a papers for you that you can easily find yourself.

If you have a subscription, log in to your account and find the Download button near the form you’re trying to find. You'll also be able to access all of your previously saved examples in the My Forms menu.

If you are using our platform the first time, follow the tips below to get your Utah Verified Statement Closing Small Estate quickly:

- Ensure that the file you discover applies where you live.

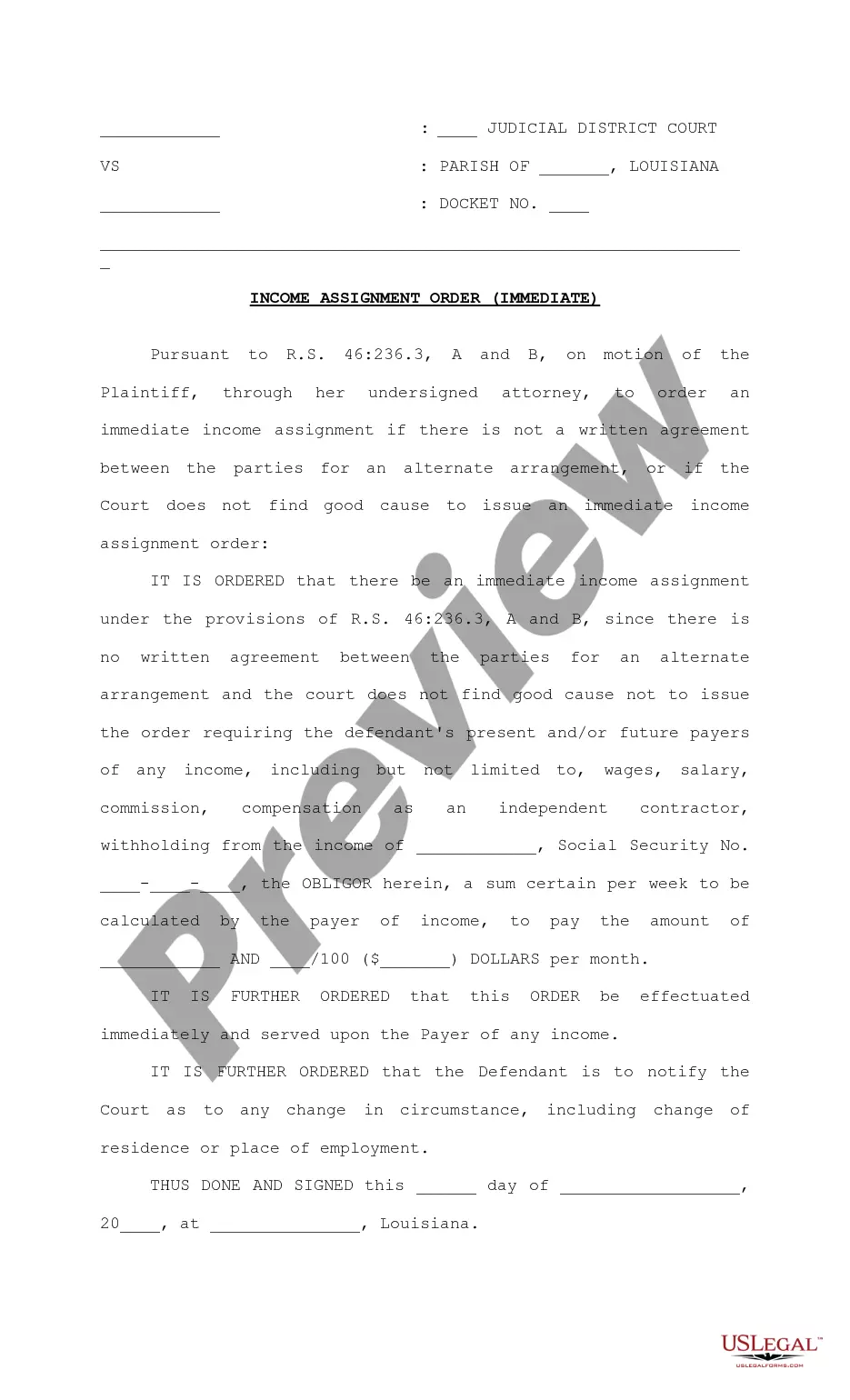

- Review the template by reading the description for using the Preview function.

- Click Buy Now to start the ordering procedure or look for another sample using the Search field in the header.

- Select a pricing plan and create an account.

- Pay for the subscription using your credit/debit/debit/credit card or Paypal.

- Download the form in the preferred file format.

Once you have signed up and purchased your subscription, you can use your Utah Verified Statement Closing Small Estate as often as you need or for as long as it continues to be valid where you live. Edit it with your preferred editor, fill it out, sign it, and print it. Do more for less with US Legal Forms!

Form popularity

FAQ

Write a Living Trust. The most straightforward way to avoid probate is simply to create a living trust. Name Beneficiaries on Your Retirement and Bank Accounts. For some, a last will is often a better fit than a trust because it is a more straightforward estate planning document. Hold Property Jointly.

Informal probate allows the estate to be probated through an administrative process without any court involvement and no court hearings. The estate is opened by an application and can be opened the day that the application is filed, or within a few days.

Probate is required if: the estate includes real property (land, house, condominium, mineral rights) of any value, and/or. the estate has assets (other than land, and not including cars) whose net worth is more than $100,000.

In Utah, you can make a living trust to avoid probate for virtually any asset you ownreal estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).

Generally, an executor has 12 months from the date of death to distribute the estate. This is known as 'the executor's year'. However, for various reasons the executor may have been delayed and has not distributed the estate within this time frame.

Notify all creditors. File tax returns and pay final taxes. File the final accounting with the probate court. Distribute remaining assets to beneficiaries. File a closing statement with the court.

In Utah, how long do I have to begin the probate process? You have up to three years after decedent's death to initiate the probate process. If more than three years have lapsed, you can no longer probate the will, and should instead file a determination of heirs to administer decedent's estate.

1) Petition the court to be the estate representative. 2) Notify heirs and creditors. 3) Change legal ownership of assets. 4) Pay Funeral Expenses, Taxes, Debts and Transfer assets to heirs.

If the total value of all the assets you leave behind is less than a certain amount, the people who inherit your personal property -- that's anything except real estate -- may be able to skip probate entirely. The exact amount depends on state law, and varies hugely.