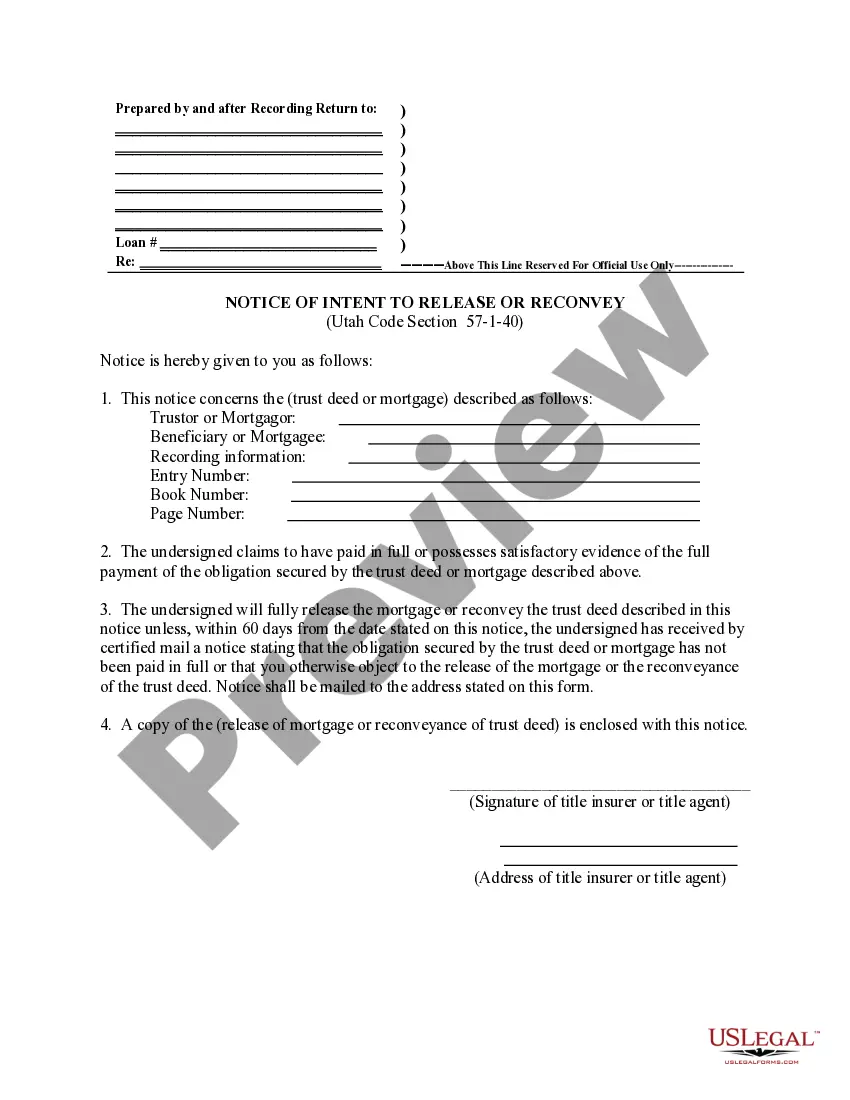

This form is a sample Notice of Intent to Reconvey (Category: Mortgages and Deeds of Trust) for use in Utah property transactions. Available in Word format.

Utah Notice of Intent to Reconvey

Description Re Convey

How to fill out Utah Notice Of Intent To Reconvey?

Looking for a Utah Notice of Intent to Reconvey online might be stressful. All too often, you find papers that you believe are alright to use, but discover later they are not. US Legal Forms provides more than 85,000 state-specific legal and tax documents drafted by professional attorneys in accordance with state requirements. Have any form you’re looking for within a few minutes, hassle free.

If you already have the US Legal Forms subscription, just log in and download the sample. It’ll instantly be added in to your My Forms section. In case you do not have an account, you should register and pick a subscription plan first.

Follow the step-by-step recommendations listed below to download Utah Notice of Intent to Reconvey from the website:

- See the document description and click Preview (if available) to check if the form meets your expectations or not.

- In case the form is not what you need, find others with the help of Search engine or the provided recommendations.

- If it is appropriate, click Buy Now.

- Choose a subscription plan and create an account.

- Pay via credit card or PayPal and download the template in a preferable format.

- Right after getting it, it is possible to fill it out, sign and print it.

Get access to 85,000 legal forms from our US Legal Forms library. In addition to professionally drafted templates, users may also be supported with step-by-step guidelines concerning how to get, download, and complete templates.

Form popularity

FAQ

A reconveyance is the official transfer of the property title after the mortgage has been paid in full. The processing time can vary based on the county in which the property is located and can take up to three months. You will need to contact your county for questions on their specific processing time.

Reconveyance is the transfer of a title to the borrower after a mortgage has been fully paid.

A mortgage holder issues a deed of reconveyance to indicate that the borrower has been released from the mortgage debt. The deed transfers the property title from the lender, also called the beneficiary, to the borrower. This document is most commonly used when a mortgage has been paid in full.

A mortgage holder issues a deed of reconveyance to indicate that the borrower has been released from the mortgage debt. The deed transfers the property title from the lender, also called the beneficiary, to the borrower. This document is most commonly used when a mortgage has been paid in full.

When a deed of trust/mortgage is paid in full, you can record a Full Reconveyance from the trustee stating publicly that the loan has been paid. The Full Reconveyance Form. is completed and signed by the trustee, whose signature must be notarized.

To convey again. to convey back to a previous position or place.

A document known as a substitution of trustee and full reconveyance identifies the person who has the authority to reconvey the property and remove the lien.Once the document is registered, it establishes the borrower as the sole owner of the property, which is now free and clear of the previous mortgage.

Complete the top area of the reconveyance deed. Enter the name of and address of the person who executed the deed of trust, the borrower or debtor. Refer to the original deed of trust for the name spelling. Complete the middle section, the trustee's name and address.