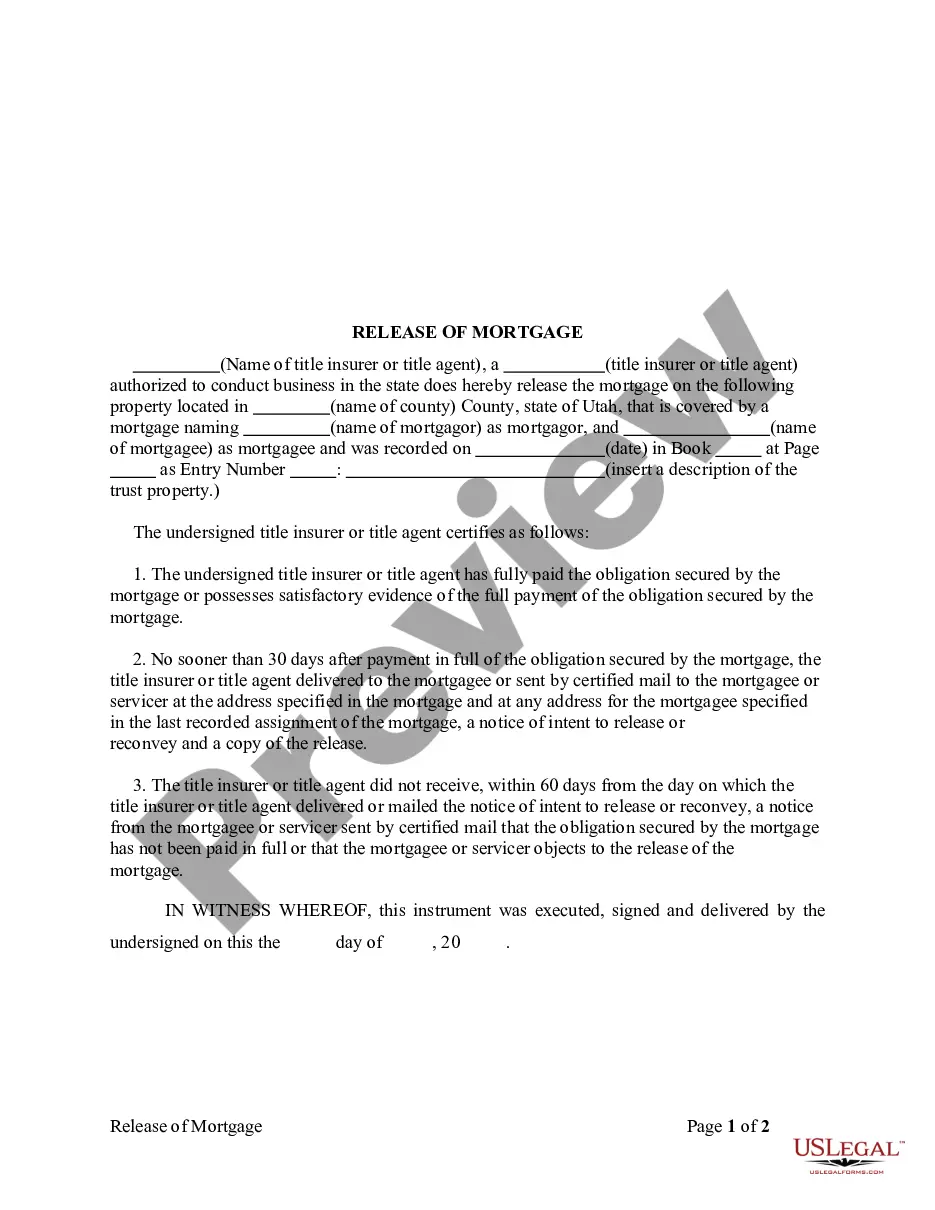

Release of Mortgage by Corporation

Assignments Generally: Lenders, or holders of mortgages or deeds of trust, often assign mortgages or deeds of trust to other lenders, or third parties. When this is done the assignee (person who received the assignment) steps into the place of the original lender or assignor. To effectuate an assignment, the general rules is that the assignment must be in proper written format and recorded to provide notice of the assignment.

Satisfactions Generally: Once a mortgage or deed of trust is paid, the holder of the mortgage is required to satisfy the mortgage or deed of trust of record to show that the mortgage or deed of trust is no longer a lien on the property. The general rule is that the satisfaction must be in proper written format and recorded to provide notice of the satisfaction. If the lender fails to record a satisfaction within set time limits, the lender may be responsible for damages set by statute for failure to timely cancel the lien. Depending on your state, a satisfaction may be called a Satisfaction, Cancellation, or Reconveyance. Some states still recognize marginal satisfaction but this is slowly being phased out. A marginal satisfaction is where the holder of the mortgage physically goes to the recording office and enters a satisfaction on the face of the the recorded mortgage, which is attested by the clerk.

Utah Law

Assignment: An assignment must be in writing and recorded.

Demand to Satisfy: None required. Lender or servicer who fails to release the security interest on a secured loan within 90 days after receipt of the final payment of the loan is liable. (see below)

Recording Satisfaction: Any trust deed, ... reconveyance of the trust property, if acknowledged as provided by law, is entitled to be recorded.

Marginal Satisfaction:

Penalty: A secured lender or servicer who fails to release the security interest on a secured loan within 90 days after receipt of the final payment of the loan is liable to another secured lender on the real property or the owner or titleholder of the real property for:

(a) the greater of $1,000 or treble actual damages incurred because of the failure to release the security interest, including all expenses incurred in completing a quiet title action; and

(b) reasonable attorneys' fees and court costs.

Acknowledgment: An assignment or satisfaction must contain a proper Utah acknowledgment, or other acknowledgment approved by Statute.

Utah Statutes

57-1-36. Trust deeds -- Instruments entitled to be recorded -- Assignment of a beneficial interest.

Any trust deed, substitution of trustee, assignment of a beneficial interest under a trust deed, notice of assignment of a beneficial interest, notice of default, trustee's deed, reconveyance of the trust property, and any instrument by which any trust deed is subordinated or waived as to priority, if acknowledged as provided by law, is entitled to be recorded. The recording of an assignment of a beneficial interest under a trust deed or a notice of assignment of a beneficial interest does not in itself impart notice of the assignment to the trustor, or the trustor's heirs or personal representatives, so as to invalidate any payment made by the trustor, or the trustor's heirs or personal representatives, to the person holding the note, bond, or other instrument evidencing the obligation by the trust deed.

57-1-38. Release of security interest.

(1) As used in this section:

(a) "Revolving credit line" means an agreement between the borrower and a secured lender who agrees to loan the borrower money on a continuing basis so long as the outstanding principal amount owed by the borrower does not exceed a specified amount.

(b) "Secured lender" means:

(i) a mortgagee on a mortgage;

(ii) a beneficiary on a trust deed;

(iii) a person that holds or retains legal title to real property as security for financing the purchase of the real property under a real estate sales contract; and

(iv) any other person that holds or retains a security interest in real property to secure the repayment of a secured loan.

(c) (i) "Secured loan" means a loan or extension of credit, the repayment of which is secured by a mortgage, a trust deed, the holding or retention of legal title under a real estate sales contract, or other security interest in real property, whether or not the security interest is perfected.

(ii) A judgment award secured by a judgment lien is not of itself a secured loan. A subsequent written agreement between a judgment creditor and a judgment debtor concerning payment of the judgment is a secured loan if it otherwise qualifies under the definition in Subsection (1)(c)(i).

(d) "Security interest" means an interest in real property that secures payment or performance of an obligation. Security interest includes a lien or encumbrance.

(e) "Servicer" means a person that services and receives loan payments on behalf of a secured lender with respect to a secured loan.

(2) This section may not be interpreted to validate, invalidate, alter, or otherwise affect the foreclosure of a mortgage, the exercise of a trustee's power of sale, the exercise of a seller's right of reentry under a real estate sales contract, or the exercise of any other power or remedy of a secured lender to enforce the repayment of a secured loan.

(3) A secured lender or servicer who fails to release the security interest on a secured loan within 90 days after receipt of the final payment of the loan is liable to another secured lender on the real property or the owner or titleholder of the real property for:

(a) the greater of $1,000 or treble actual damages incurred because of the failure to release the security interest, including all expenses incurred in completing a quiet title action; and

(b) reasonable attorneys' fees and court costs.

(4) A secured lender or servicer is not liable under Subsection (3) if the secured lender or servicer:

(a) has established a reasonable procedure to release the security interest on a secured loan in a timely manner after the final payment on the loan;

(b) has complied with this procedure in good faith; and

(c) is unable to release the security interest within 90 days after receipt of the final payment because of the action or inaction of an agency or other person beyond its direct control.

(5) A secured lender under a revolving credit line shall close the revolving credit line and release the security interest if the secured lender receives:

(a) payment in full from a third party involved in a sale or loan transaction affecting the security interest; and

(b) (i) a request from a third party for full payoff of the credit line; or

(ii) a written request to close the credit line.