- Instant access to the funds via an ATM or check card; - A check can be lost or stolen anywhere between the sender and the intended payee; - Payments made electronically can be less expensive to the payor.

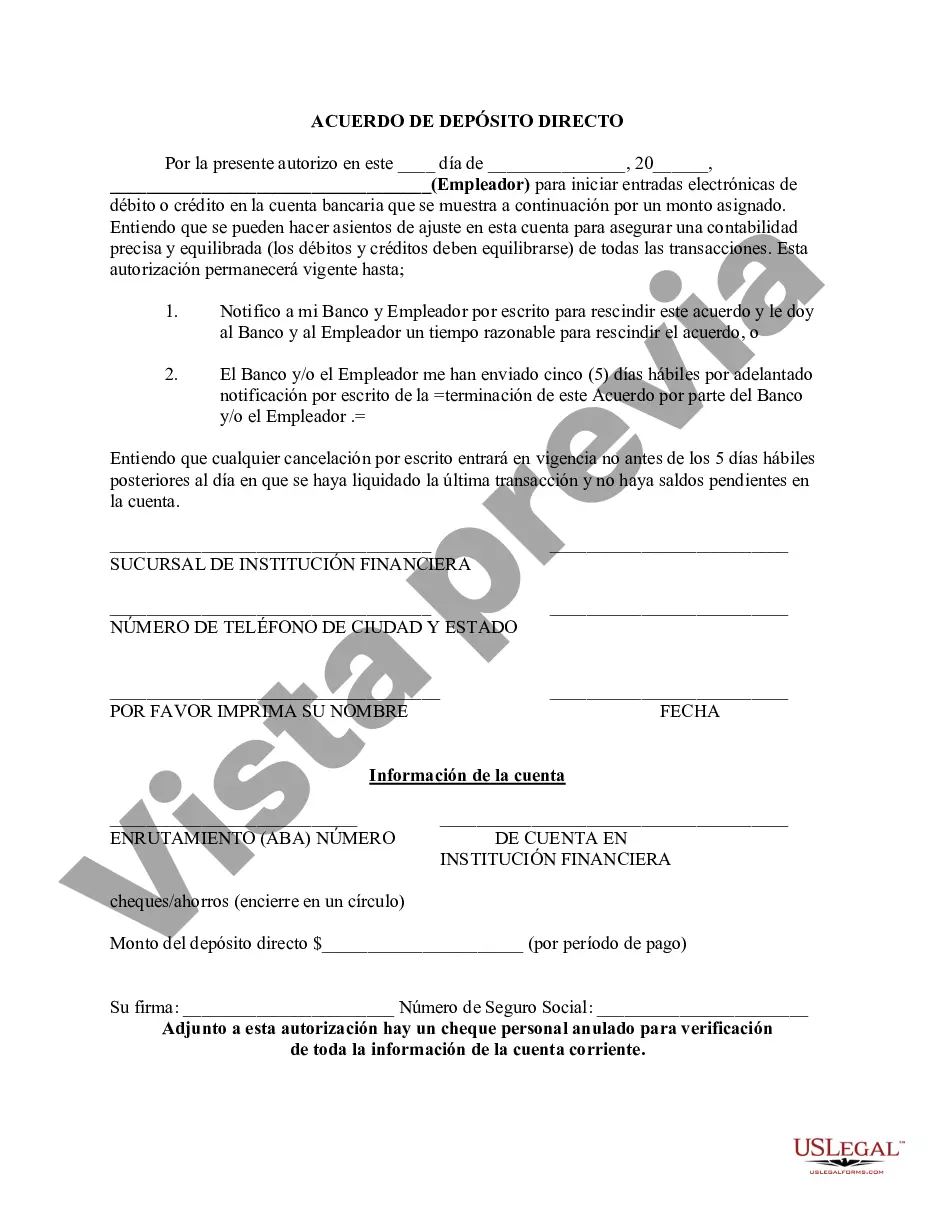

Direct deposit eliminates mailing delays and alleviates the need to go somewhere to cash or deposit your check. The Utah Direct Deposit Agreement is a legally binding contract between an individual and their financial institution that enables the direct deposit of funds into their account. This agreement allows the individual to conveniently receive their salary, benefit payments, or other sources of income directly into their bank account, eliminating the need for physical checks or manual transfers. The Utah Direct Deposit Agreement outlines the terms and conditions under which the direct deposit service will be provided. It includes crucial details such as the individual's account information, the financial institution's responsibilities, and the individual's rights and obligations. Key components of the Utah Direct Deposit Agreement may include the following: 1. Account Authorization: This section requires the individual to provide their consent for the financial institution to deposit funds directly into their account. It may specify the types of payments eligible for direct deposit, such as payroll, government benefits, or tax refunds. 2. Account Information: The agreement includes the individual's account details, including the account number and routing number, to ensure accurate and secure transfer of funds. It may also require the individual to notify the financial institution promptly of any changes to this information. 3. Verification: The agreement may stipulate that the individual needs to review their account statements regularly to verify the accuracy of the deposits. Any discrepancies or errors should be promptly reported to the financial institution for resolution. 4. Cancellation or Modification: This section outlines the procedures for canceling or modifying the direct deposit service. It may specify the notice period required or any fees associated with such changes. 5. Liability and Dispute Resolution: The agreement may contain provisions related to the financial institution's liability in case of unauthorized transactions or errors. It could also outline the dispute resolution process, including any arbitration clauses or steps to escalate complaints. Different types of Utah Direct Deposit Agreements may exist depending on the financial institution or the purpose of the deposit. Examples include employer direct deposit agreements, government benefit direct deposit agreements, or tax refund direct deposit agreements. While the overall structure and key elements of these agreements may be similar, they may have slight variations to cater to the specific context or requirements associated with each type of direct deposit.

The Utah Direct Deposit Agreement is a legally binding contract between an individual and their financial institution that enables the direct deposit of funds into their account. This agreement allows the individual to conveniently receive their salary, benefit payments, or other sources of income directly into their bank account, eliminating the need for physical checks or manual transfers. The Utah Direct Deposit Agreement outlines the terms and conditions under which the direct deposit service will be provided. It includes crucial details such as the individual's account information, the financial institution's responsibilities, and the individual's rights and obligations. Key components of the Utah Direct Deposit Agreement may include the following: 1. Account Authorization: This section requires the individual to provide their consent for the financial institution to deposit funds directly into their account. It may specify the types of payments eligible for direct deposit, such as payroll, government benefits, or tax refunds. 2. Account Information: The agreement includes the individual's account details, including the account number and routing number, to ensure accurate and secure transfer of funds. It may also require the individual to notify the financial institution promptly of any changes to this information. 3. Verification: The agreement may stipulate that the individual needs to review their account statements regularly to verify the accuracy of the deposits. Any discrepancies or errors should be promptly reported to the financial institution for resolution. 4. Cancellation or Modification: This section outlines the procedures for canceling or modifying the direct deposit service. It may specify the notice period required or any fees associated with such changes. 5. Liability and Dispute Resolution: The agreement may contain provisions related to the financial institution's liability in case of unauthorized transactions or errors. It could also outline the dispute resolution process, including any arbitration clauses or steps to escalate complaints. Different types of Utah Direct Deposit Agreements may exist depending on the financial institution or the purpose of the deposit. Examples include employer direct deposit agreements, government benefit direct deposit agreements, or tax refund direct deposit agreements. While the overall structure and key elements of these agreements may be similar, they may have slight variations to cater to the specific context or requirements associated with each type of direct deposit.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.