The Utah Assumption Agreement of Loan Payments is a legal document that outlines the terms and conditions under which a borrower can assume the responsibility of repaying an existing loan. This agreement is commonly used in real estate transactions, where a buyer agrees to take over the monthly loan payments from the seller. The Utah Assumption Agreement of Loan Payments serves to protect both the original lender and the new borrower. It ensures that the new borrower understands their obligations and responsibilities regarding the loan and provides a clear framework for the transfer of loan repayment duties. There are different types of Utah Assumption Agreement of Loan Payments, depending on the specific circumstances of the loan transfer: 1. Residential Assumption Agreement: This type of agreement is most frequently used when a buyer purchases a residential property with an existing mortgage. The buyer assumes the loan payments and becomes responsible for fulfilling all terms of the original loan agreement. 2. Commercial Assumption Agreement: In commercial real estate transactions, this type of assumption agreement is employed. It allows a buyer to assume the outstanding loan balance and related repayment obligations in the purchase of a commercial property. 3. Assumption Agreement with Release: This agreement is used when the original borrower seeks to be relieved of all loan obligations and transfers them to a new borrower. The new borrower assumes the loan payments entirely, and the original borrower is released from any further responsibility. 4. Federal Housing Administration (FHA) Assumption Agreement: This specific type of assumption agreement is utilized when the loan being assumed is insured by the Federal Housing Administration. It outlines the conditions under which the new borrower can assume the FHA loan and comply with the FHA regulations. In all Utah Assumption Agreements, several essential elements should be included: — Names and contact information of all parties involved, including the original lender, the new borrower, and possibly the seller in real estate transactions. — Description of the loan being assumed, including the outstanding balance, interest rate, and term. — Explicit statement of the new borrower's agreement to assume the loan, along with a confirmation that they will fulfill the loan obligations according to the original loan terms. — Provisions for default, including the consequences for the new borrower if they fail to meet the terms of the assumption agreement. — Indemnification clauses that protect the original lender from any claims or liabilities arising from the assumption of the loan. — Signature lines for all parties involved, along with the date of agreement execution. In summary, the Utah Assumption Agreement of Loan Payments is a legally binding document that enables a borrower to assume an existing loan, typically in real estate transactions. It exists in various forms, such as residential, commercial, with release, and FHA assumptions, tailored to specific circumstances. Through this agreement, the transfer of loan repayment responsibilities is properly documented, protecting all parties involved.

Utah Assumption Agreement of Loan Payments

Description

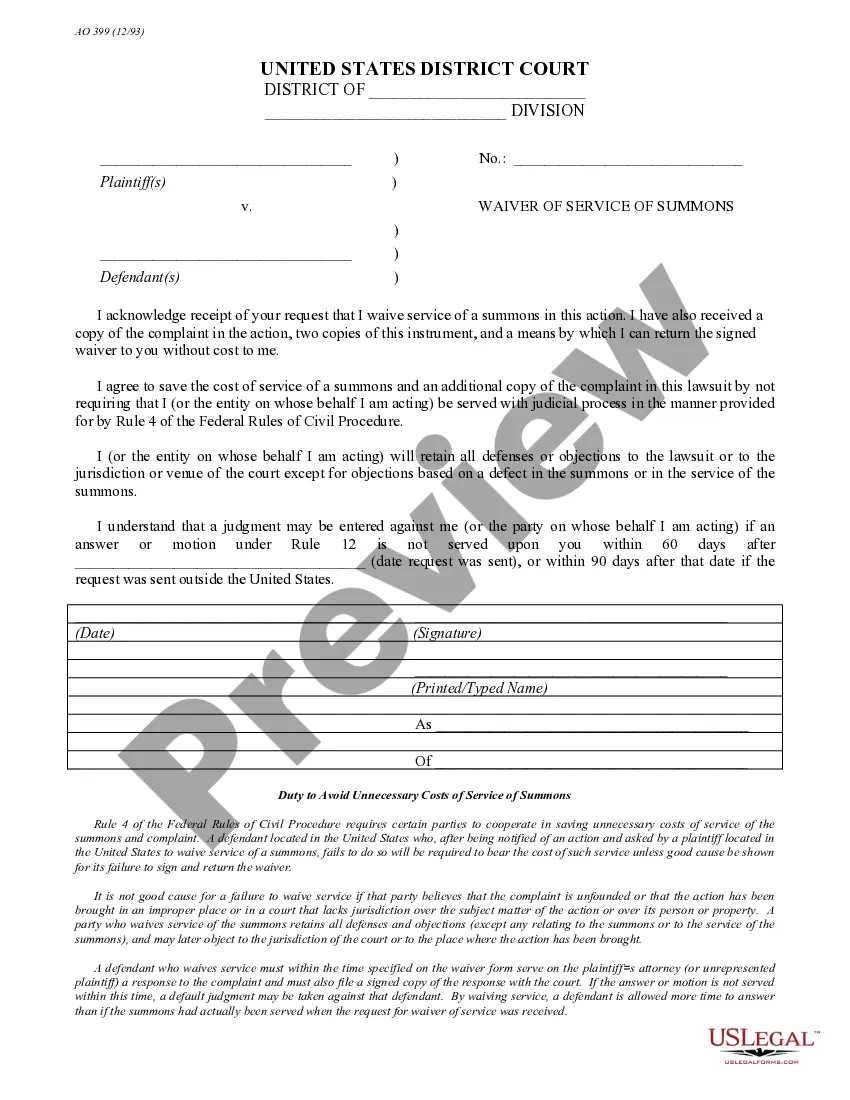

How to fill out Assumption Agreement Of Loan Payments?

Choosing the best legal record format can be a struggle. Obviously, there are a variety of themes available on the Internet, but how can you find the legal type you need? Utilize the US Legal Forms internet site. The service gives thousands of themes, such as the Utah Assumption Agreement of Loan Payments, which you can use for business and private needs. All the types are checked by specialists and meet up with state and federal demands.

When you are currently registered, log in for your bank account and click on the Obtain key to get the Utah Assumption Agreement of Loan Payments. Make use of your bank account to check with the legal types you have ordered previously. Go to the My Forms tab of your bank account and obtain yet another version of your record you need.

When you are a whole new end user of US Legal Forms, allow me to share straightforward directions so that you can follow:

- Initially, make certain you have chosen the right type for the city/county. You are able to check out the shape using the Review key and look at the shape description to ensure this is the right one for you.

- If the type does not meet up with your requirements, make use of the Seach discipline to discover the proper type.

- When you are sure that the shape is acceptable, select the Buy now key to get the type.

- Choose the costs program you want and enter in the needed information and facts. Build your bank account and pay money for the transaction using your PayPal bank account or charge card.

- Opt for the submit formatting and download the legal record format for your system.

- Complete, revise and produce and indicator the attained Utah Assumption Agreement of Loan Payments.

US Legal Forms may be the greatest collection of legal types that you will find different record themes. Utilize the service to download skillfully-made files that follow status demands.

Form popularity

FAQ

Buying ?Subject to? the Mortgage While the deed is transferred to your name and you agree to make the mortgage payments, the person selling you the house is still responsible for paying the loan.

When a buyer buys property and assumes a mortgage, the buyer becomes primarily liable for the debt and the seller becomes secondarily liable for the debt. "Assume" means the buyer takes on liability, and the seller is no longer primarily liable. "Subject to" means the seller is not released from responsibility.

Updated March 7, 2022. In real estate transactions, an assumption agreement allows a third party to ?assume? or take over the loan of the property's seller. Mortgages may be assumed when the house is sold, a divorcing spouse is awarded the property in a settlement or when someone inherits property.

An assumable mortgage clause allows a buyer to take over mortgage payments for an existing loan on behalf of a seller. The original homeowner is released from any liability toward the loan, while the buyer assumes responsibility for the mortgage payments and ownership of the property.

A seller is still responsible for any debt payments if the mortgage is assumed by a third party unless the lender approves a release request releasing the seller of all liabilities from the loan. If approved, the title of the property is transferred to the buyer who makes the required monthly repayments to the bank.

Loan assumption, however, allows a buyer to take over the current owner's mortgage while the loan's terms ? including the repayment period and interest rate ? remain the same. Ultimately, it can help people get into a home at a lower interest rate even as the housing market around them becomes more expensive.

Most conventional mortgages are not assumable, but many government-backed loans (FHA, VA, USDA) are. The lender must approve you assuming the mortgage, and at the closing, you must compensate the old borrower for the amount they've paid off.