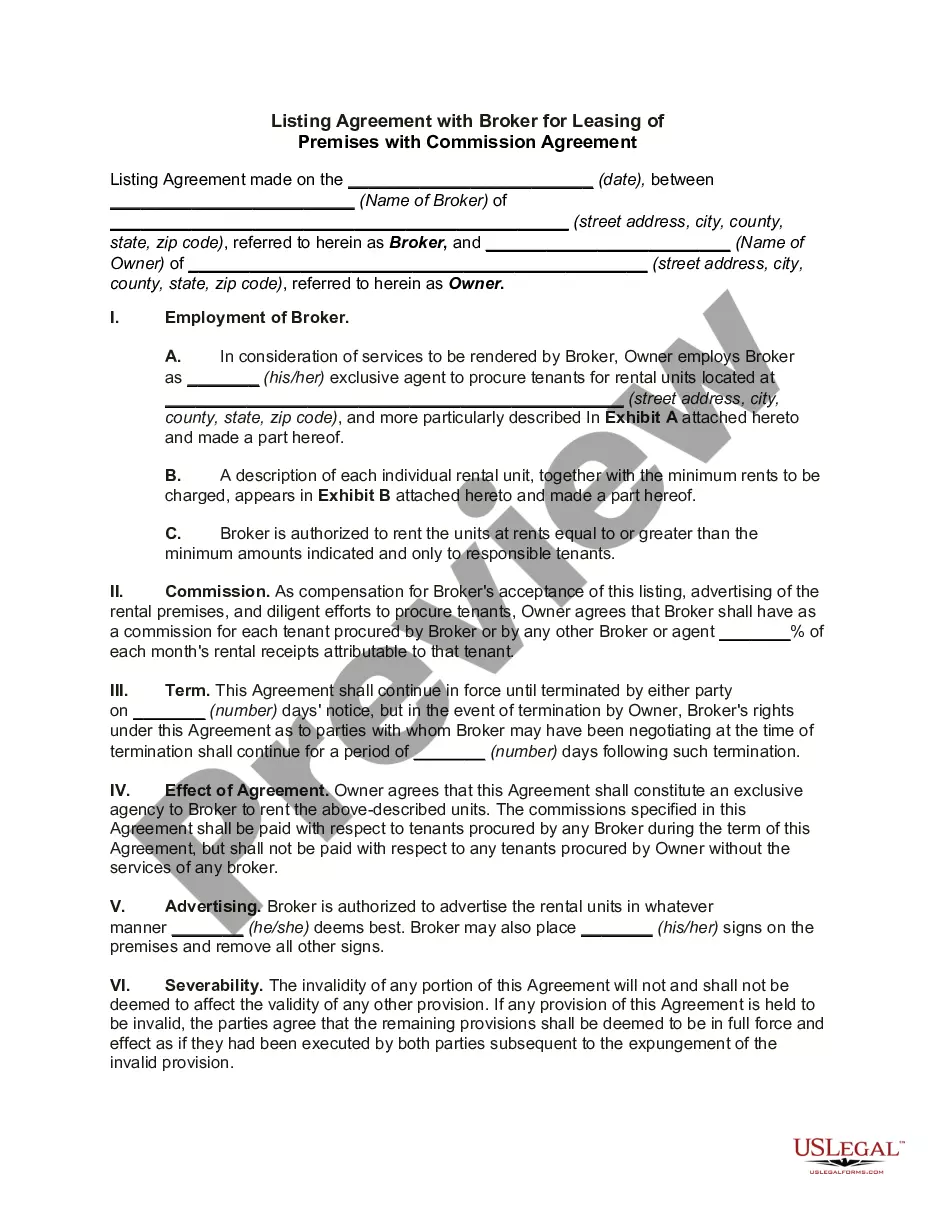

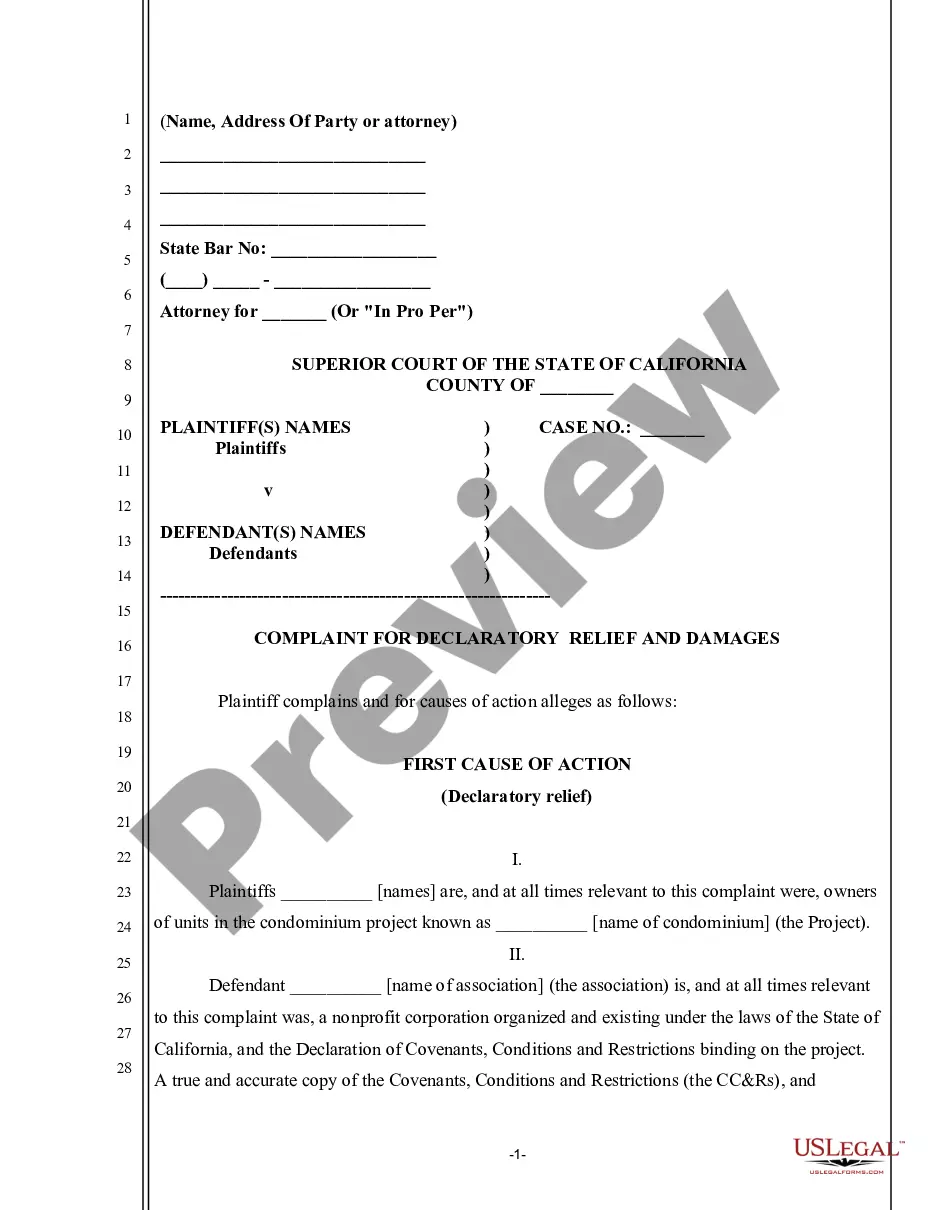

The Utah Multistate Promissory Note — Unsecure— - Signature Loan is a legally binding document used in Utah to establish the terms and conditions of a loan between a lender and a borrower. This type of loan is typically granted without any collateral requirement, solely based on the borrower's promise to repay the borrowed amount. In Utah, there are several variations of the Multistate Promissory Note — Unsecure— - Signature Loan, tailored to meet different needs and circumstances. The most common types include: 1. Fixed Interest Rate: This type of loan carries a predetermined interest rate that remains constant throughout the loan term. It provides borrowers with the advantage of predictable monthly payments, making budgeting easier. 2. Variable Interest Rate: Unlike a fixed interest rate loan, this type of loan has an interest rate that fluctuates based on changes in the market or an index. Borrowers may benefit from lower rates initially but should be prepared for potential rate increases in the future. 3. Short-Term Loan: Designed for borrowers who need funds for a specific, immediate purpose, a short-term loan has a relatively brief repayment period. Typically, these loans are repaid within a year or less, making them ideal for temporary financial needs. 4. Long-Term Loan: This loan option allows borrowers to repay the borrowed amount over an extended period. Long-term loans are suitable for larger loan amounts, as they offer a lengthier timeframe for repayment, resulting in lower monthly payments. However, borrowers should consider that longer loan terms may result in higher total interest paid. 5. Revolving Line of Credit: Unlike a traditional loan, a revolving line of credit allows borrowers to access funds up to a predetermined credit limit, repay them, and then borrow again. This option provides flexibility and can be useful for ongoing or variable expenses. The Utah Multistate Promissory Note — Unsecure— - Signature Loan is an accessible and flexible financing option for individuals seeking personal loans. It is essential for borrowers to carefully review and understand the terms and conditions outlined in the specific loan agreement to ensure compliance and avoid any potential negative consequences. Before signing any loan agreement, it is advisable for borrowers to consult with legal or financial professionals for guidance tailored to their specific situation.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Utah Pagaré de varios estados - Sin garantía - Préstamo de firma - Multistate Promissory Note - Unsecured - Signature Loan

Description

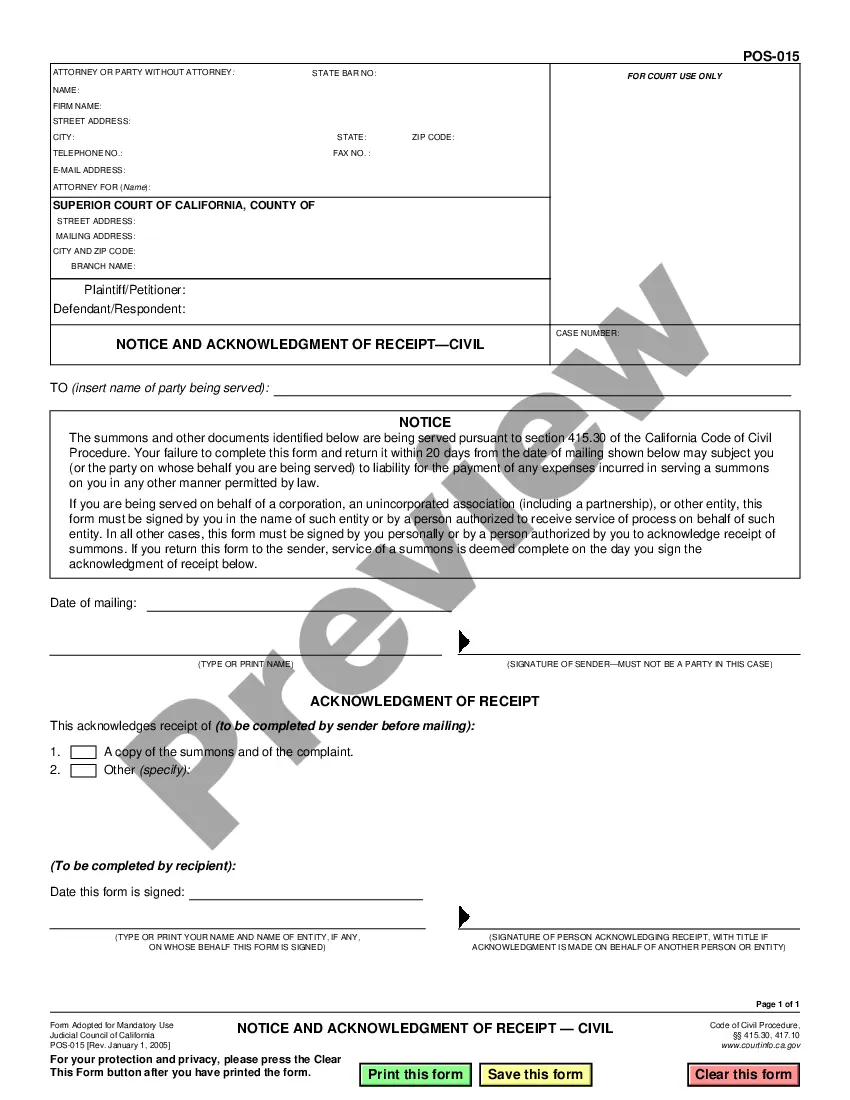

How to fill out Utah Pagaré De Varios Estados - Sin Garantía - Préstamo De Firma?

Have you ever found yourself in a situation where you require paperwork for both professional and personal purposes nearly every day.

There are numerous legitimate document templates accessible on the internet, but finding reliable versions can be challenging.

US Legal Forms provides a wide array of form templates, such as the Utah Multistate Promissory Note - Unsecured - Signature Loan, which are designed to comply with state and federal regulations.

Once you find the right form, click on Buy now.

Choose the pricing plan you prefer, enter the required information to set up your account, and complete the transaction using your PayPal or credit card.

- If you are already familiar with the US Legal Forms site and possess an account, simply Log In.

- Then, you can download the Utah Multistate Promissory Note - Unsecured - Signature Loan template.

- If you don’t have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/county.

- Use the Preview button to review the document.

- Check the details to ensure that you have selected the correct form.

- If the form is not what you are looking for, utilize the Lookup field to find the form that suits your needs.

Form popularity

FAQ

An unsecured promissory note may be considered a security, especially if it is sold as an investment and relies on the issuer’s financial health. In Utah, this categorization often hinges on how the note is marketed and the expectations it creates for investors. Engaging with professionals can help clarify how your unsecured note aligns with securities law in Utah.

(1) A promissory note is an unconditional promise in writing made by one person to another signed by the maker, engaging to pay, on demand or at a fixed or determinable future time, a sum certain in money, to, or to the order of, a specified person or to bearer.

In order for the promissory note to be valid, the borrower needs to sign it. The lender may require the borrower to sign this document in front of a notary to guarantee the signature.

Signatures. Generally, promissory notes do not need to be notarized. Typically, legally enforceable promissory notes must be signed by individuals and contain unconditional promises to pay specific amounts of money. Generally, they also state due dates for payment and an agreed-upon interest rate.

Unsecured Promissory NotesAn unsecured promissory note is an obligation for payment without any property securing the payment. If the payor fails to pay, the payee must file a lawsuit and hope that the payor has sufficient assets that can be seized to satisfy the loan.

An unsecured note is a loan that is not secured by the issuer's assets. Unsecured notes are similar to debentures but offer a higher rate of return. Unsecured notes provide less security than a debenture. Such notes are also often uninsured and subordinated.

In order for a promissory note to be valid and legally binding, it needs to include specific information. "A promissory note should include details including the amount loaned, the repayment schedule and whether it is secured or unsecured," says Wheeler.

An unsecured promissory note is an obligation for payment without any property securing the payment. If the payor fails to pay, the payee must file a lawsuit and hope that the payor has sufficient assets that can be seized to satisfy the loan.

There is no legal requirement to have a Utah promissory note notarized. To execute the note, the borrower and any co-signer to the loan must sign and date the agreement.

Even if you have the original note, it may be void if it was not written correctly. If the person you're trying to collect from didn't sign it and yes, this happens the note is void. It may also become void if it failed some other law, for example, if it was charging an illegally high rate of interest.

Interesting Questions

More info

Mutual Funds ETFs Options Roth Fundamental Analysis Technical Analysis Investment strategy for stock picking, value investing, high frequency trading, day trading, etc. View Investing Essentials Markets Stocks Mutual Funds ETFs Options Roth Fundamental Analysis Technical Analysis Fundamental analysis. Fundamental analysis helps you find out whether a stock is going to do well or not over a short period of time. You buy low sell high. See how to do it yourself. It takes hours and hours to make a profit but at least when you do it right you have made a good investment, and it makes your future a lot more secure. View Investing Essentials Markets Stocks Mutual Funds ETFs Options Roth Fundamental Analysis Technical Analysis Watch market changes, market direction and the trends of large and small companies. Technical analysis helps you understand how a market actually works. Technical analysis in an office is a little different.