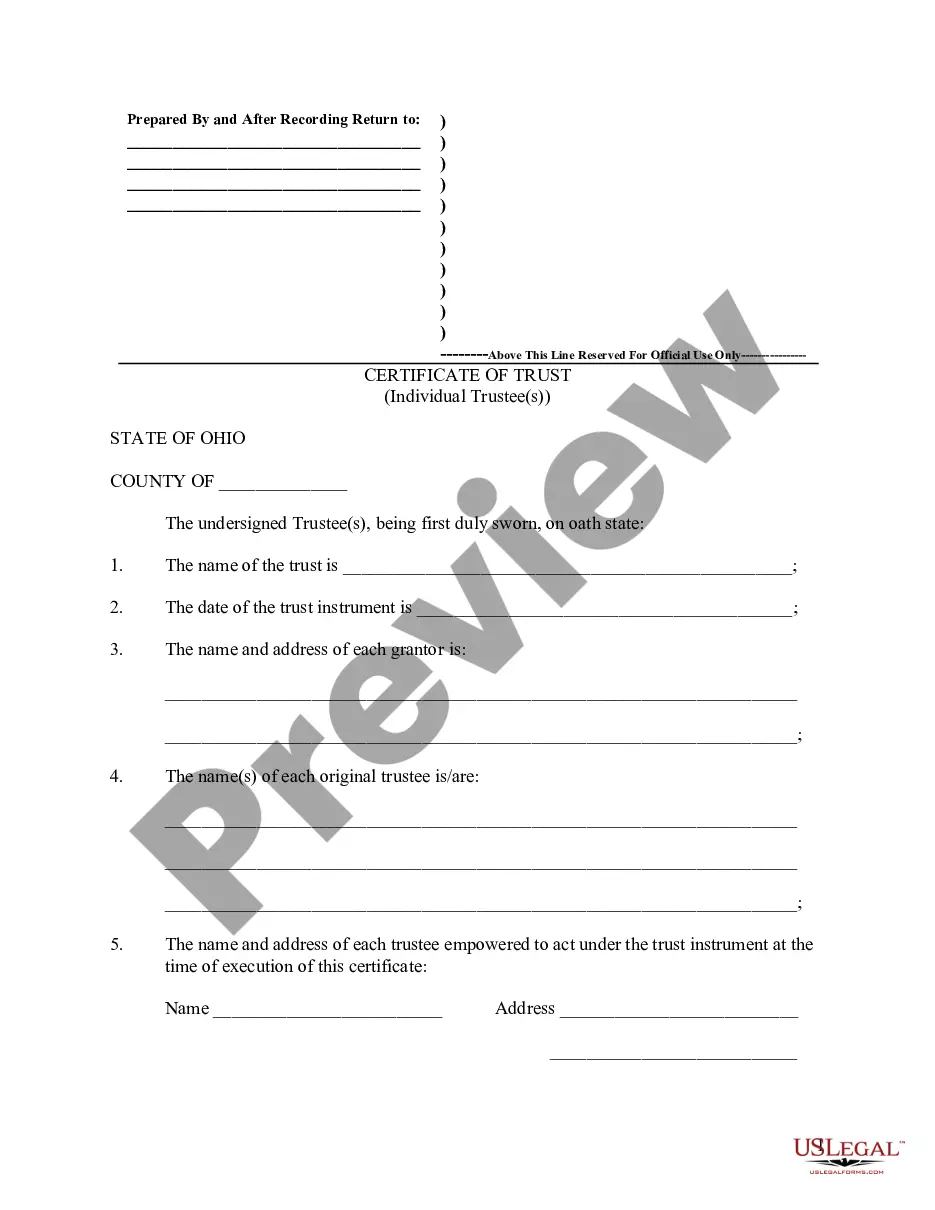

An irrevocable trust established to qualify contributions for the annual federal gift tax exclusion for gifts of a present interest. The trust is named Crummey because of a case involving a family named Crummey. The trust contains Crummey Powers, enabling a beneficiary to withdraw assets contributed to the trust for a limited period of time.

The Utah Sprinkling Trust for Children During Granter's Life and for Surviving Spouse and Children after Granter's Death, also known as the Crummy Trust Agreement, is a legal arrangement that allows individuals to distribute assets to their children during their lifetime and provide for their children and surviving spouse after their death. This trust is designed to offer financial security and flexibility while minimizing potential estate tax implications. The Crummy Trust Agreement is named after the case of Crummy v. Commissioner, which established the concept of the "Crummy power." This power allows the trust beneficiaries to withdraw a certain portion of the contributed assets within a limited time frame, typically 30 days. By having this withdrawal right, the contributions are considered present interest gifts for tax purposes, thus qualifying for the annual gift tax exclusion. There are different types of Utah Sprinkling Trusts that can be established to ensure the well-being of the children during the Granter's lifetime and for their continuing support after the Granter's death. Some of these types include: 1. Irrevocable Sprinkling Trust: This type of trust cannot be modified or revoked once established. It provides the Granter with greater protection against creditors and estate taxes while allowing them to gradually distribute assets to their children. 2. Revocable Sprinkling Trust: Unlike the irrevocable trust, this type of trust can be modified or revoked during the Granter's lifetime. It offers more flexibility but may not provide the same level of asset protection and tax benefits as an irrevocable trust. 3. Discretionary Sprinkling Trust: With this type of trust, the trustee has the authority to determine when and how the trust assets will be distributed. This gives the trustee more control over managing the funds and ensuring they are used in the best interest of the beneficiaries. 4. Incentive Sprinkling Trust: This trust may include specific conditions and incentives that beneficiaries must fulfill to receive distributions. For example, beneficiaries may need to attain certain educational or career milestones before being eligible for trust distributions. In summary, the Utah Sprinkling Trust for Children During Granter's Life and for Surviving Spouse and Children after Granter's Death Crummyey Trust Agreement is a versatile estate planning tool to provide financial security to children during the Granter's lifetime and ensure support for the surviving spouse and children after the Granter's death. The different types of sprinkling trusts offer various levels of asset protection, flexibility, and control, allowing individuals to tailor the trust to their specific needs and objectives.