A Utah Letter of Credit, also known as a Utah LC, is a financial instrument widely used in commercial transactions to provide payment security. It serves as a guarantee from a financial institution in Utah, such as a bank, to pay the beneficiary a specified amount of money within a specific timeframe. This document acts as a promise to ensure that the seller will receive payment for goods or services rendered, even if the buyer fails to fulfill their payment obligations. Utah Letters of Credit are governed by the Uniform Commercial Code (UCC), which provides a legal framework for their usage and protection. These instruments are widely used in various industries, including international trade, construction, and real estate, to mitigate payment risks and foster trust between parties involved in business transactions. There are several types of Utah Letters of Credit that cater to different business needs: 1. Commercial Letter of Credit: This type of Utah LC is primarily used in international trade, where the buyer's bank issues a written undertaking to the seller, ensuring payment upon presentation of compliant documents, such as invoices, shipping documents, and certificates of origin. 2. Standby Letter of Credit: A Utah standby LC acts as a financial guarantee for non-performance or default in contractual obligations. It is often used in construction projects, as the bank assures the beneficiary that it will pay a specified amount if the contractor fails to fulfill their duties. 3. Revocable Letter of Credit: This type of Utah LC can be modified or canceled by the issuing bank without prior notice to the beneficiary. However, revocable LC's are rarely used, as they provide limited security for the seller. 4. Irrevocable Letter of Credit: An irrevocable Utah LC cannot be altered or canceled without the consent of all parties involved. It provides greater security for the beneficiary, as the payment guarantee is considered independent of the buyer's creditworthiness. 5. Confirmed Letter of Credit: A confirmed Utah LC involves a second bank, usually the beneficiary's bank, guaranteeing payment in addition to the issuing bank. This type of LC provides an additional layer of security for the seller, particularly in international transactions. Utah Letters of Credit are essential tools for fostering trust and facilitating trade between parties involved in commercial transactions. They ensure that both the buyer and seller have financial protection and enable businesses to expand their operations by minimizing payment risks. It is important to consult with experienced professionals, such as attorneys or financial advisors, to ensure the proper usage and implementation of Utah Letters of Credit in accordance with applicable laws and regulations.

Utah Letter of Credit

Description

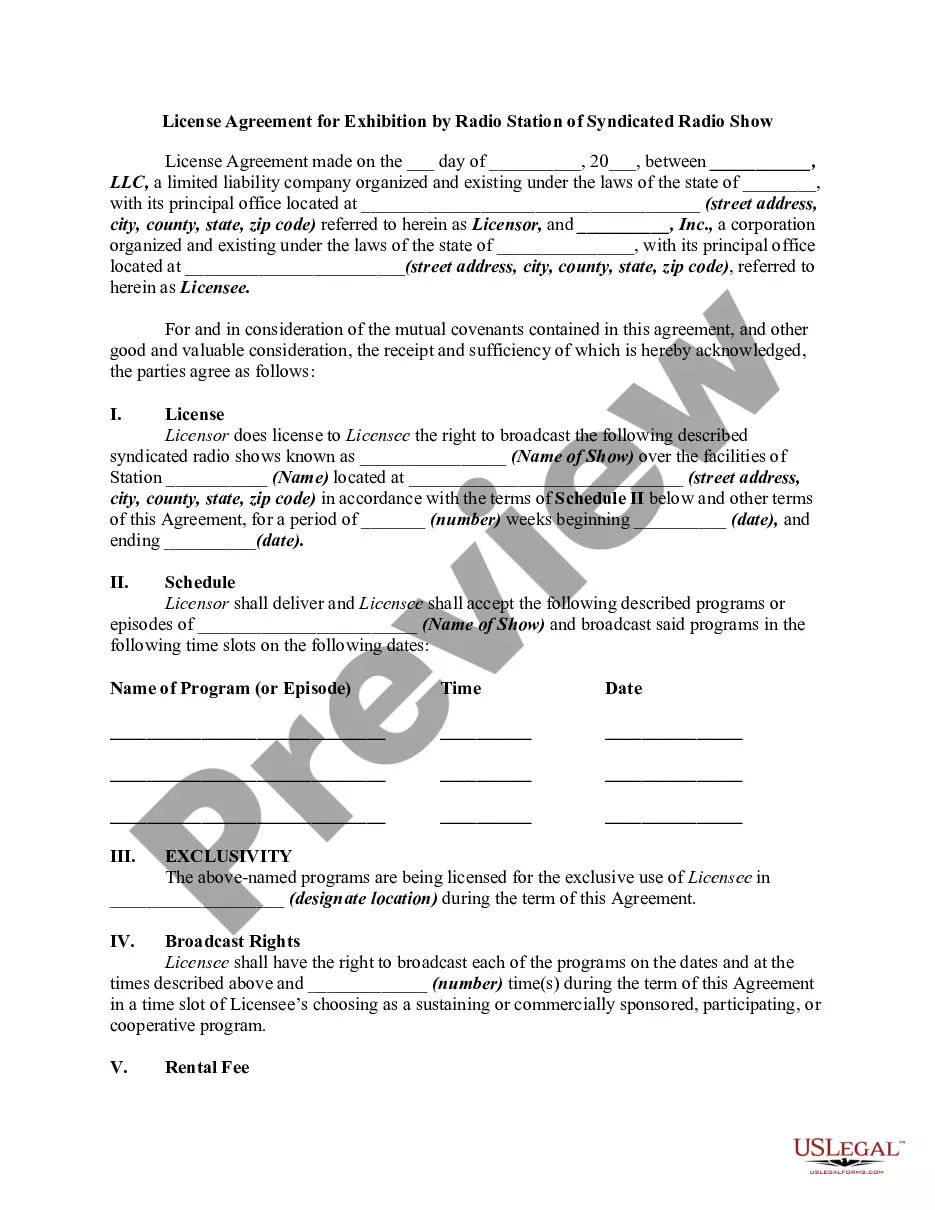

How to fill out Utah Letter Of Credit?

Choosing the right legal file design might be a struggle. Naturally, there are plenty of web templates available online, but how will you obtain the legal form you need? Use the US Legal Forms website. The services delivers thousands of web templates, such as the Utah Letter of Credit, that can be used for organization and personal requires. Every one of the kinds are checked by pros and fulfill state and federal requirements.

In case you are previously authorized, log in for your accounts and then click the Download key to have the Utah Letter of Credit. Make use of your accounts to look from the legal kinds you might have ordered formerly. Check out the My Forms tab of your respective accounts and get one more copy of your file you need.

In case you are a fresh customer of US Legal Forms, here are simple instructions so that you can adhere to:

- Initial, make certain you have selected the right form for your town/state. You can look over the shape making use of the Preview key and browse the shape outline to make certain this is the best for you.

- When the form fails to fulfill your requirements, utilize the Seach field to find the appropriate form.

- Once you are certain the shape is proper, go through the Get now key to have the form.

- Choose the costs program you want and enter in the required information and facts. Create your accounts and pay money for the transaction making use of your PayPal accounts or credit card.

- Select the file file format and acquire the legal file design for your device.

- Full, revise and printing and sign the attained Utah Letter of Credit.

US Legal Forms will be the greatest library of legal kinds for which you will find numerous file web templates. Use the service to acquire skillfully-manufactured documents that adhere to express requirements.