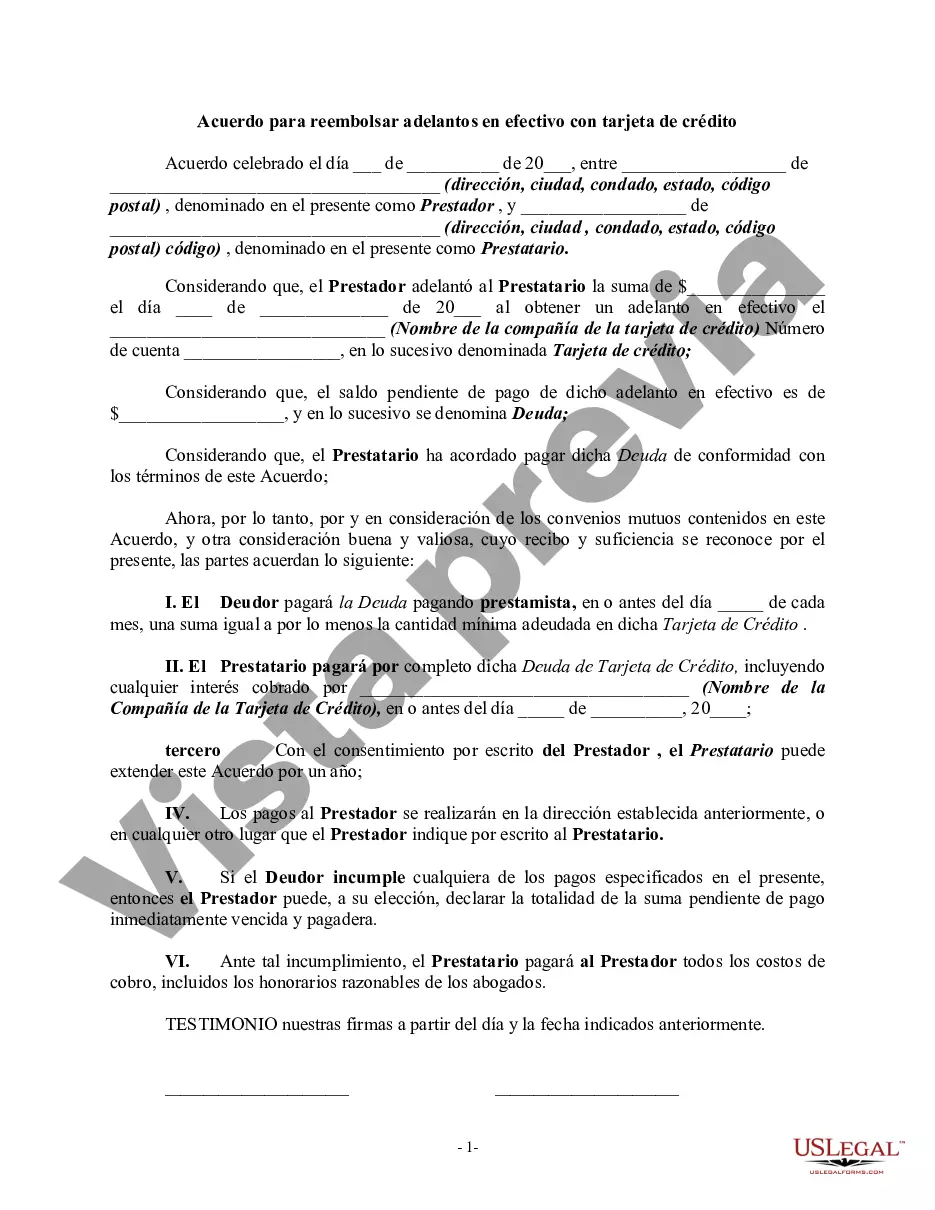

The Utah Agreement to Repay Cash Advance on Credit Card is a legal document that outlines the terms and conditions of obtaining a cash advance on a credit card in the state of Utah. This agreement serves as a contract between the credit card issuer and the cardholder, establishing the borrower's responsibility to repay the advanced funds along with any applicable fees and interest charges. The Utah Agreement to Repay Cash Advance on Credit Card typically includes important details such as the amount of the cash advance, the credit card account number, the interest rate for the cash advance, and any fees associated with the transaction. It also outlines the payment terms and due dates, along with any penalties or late fees that may be incurred for missed or late payments. In Utah, as in most states, there may be different types of agreements to repay cash advances on credit cards based on the specific terms and conditions established by each credit card issuer. Some common variations may include: 1. Fixed Interest Rate Agreement — This type of agreement specifies a set interest rate that will be applied to the cash advance. The interest rate remains constant throughout the repayment period, and the borrower knows exactly how much interest will accrue over time. 2. Variable Interest Rate Agreement — In this scenario, the interest rate applied to the cash advance fluctuates based on an index or benchmark rate, such as the prime rate. The terms of the agreement outline how the interest rate will be calculated and adjusted, providing transparency to the borrower. 3. Promotional Cash Advance Agreement — Credit card issuers occasionally offer promotional cash advance programs with special terms and conditions. For example, a cardholder may receive a lower interest rate or reduced fees for a limited period when accessing a cash advance. The agreement would specify the promotional terms, including eligibility requirements and the subsequent terms after the promotional period ends. It is crucial for cardholders to carefully review and understand the Utah Agreement to Repay Cash Advance on Credit Card before accepting a cash advance. By thoroughly familiarizing themselves with the terms and being aware of any potential fees, penalties, or changes in interest rates, borrowers can make informed decisions and effectively manage their finances.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Utah Acuerdo para reembolsar adelantos en efectivo con tarjeta de crédito - Agreement to Repay Cash Advance on Credit Card

Description

How to fill out Utah Acuerdo Para Reembolsar Adelantos En Efectivo Con Tarjeta De Crédito?

If you have to complete, acquire, or print out lawful papers layouts, use US Legal Forms, the most important selection of lawful kinds, which can be found on the Internet. Utilize the site`s easy and handy look for to discover the files you require. Various layouts for enterprise and individual functions are sorted by categories and says, or key phrases. Use US Legal Forms to discover the Utah Agreement to Repay Cash Advance on Credit Card in just a couple of click throughs.

Should you be already a US Legal Forms consumer, log in to the accounts and then click the Obtain key to have the Utah Agreement to Repay Cash Advance on Credit Card. You can even gain access to kinds you previously delivered electronically in the My Forms tab of your accounts.

Should you use US Legal Forms the very first time, refer to the instructions listed below:

- Step 1. Ensure you have chosen the form for that correct city/country.

- Step 2. Make use of the Review option to check out the form`s articles. Do not neglect to read the information.

- Step 3. Should you be not happy together with the develop, use the Look for area near the top of the monitor to locate other variations in the lawful develop web template.

- Step 4. When you have discovered the form you require, click the Purchase now key. Choose the costs strategy you favor and put your credentials to sign up for an accounts.

- Step 5. Procedure the deal. You can use your bank card or PayPal accounts to perform the deal.

- Step 6. Find the format in the lawful develop and acquire it on the product.

- Step 7. Complete, revise and print out or sign the Utah Agreement to Repay Cash Advance on Credit Card.

Every lawful papers web template you acquire is the one you have eternally. You might have acces to every develop you delivered electronically within your acccount. Click on the My Forms segment and pick a develop to print out or acquire yet again.

Contend and acquire, and print out the Utah Agreement to Repay Cash Advance on Credit Card with US Legal Forms. There are thousands of professional and express-specific kinds you can use for your personal enterprise or individual requires.