This form is a notice of a failure to make a required payment when due pursuant to a promissory note. The form also contains a warning to the breaching party that legal action will be taken unless the breach is remedied on or before a certain date. This form is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a notice in a particular jurisdiction.

The Utah Notice of Default in Payment Due on Promissory Note is a legal document used to notify a borrower that they have failed to make the necessary payments on a promissory note as agreed upon. This notice serves as a formal communication from the lender to the borrower, indicating that immediate action is required to remedy the default and bring the account up to date. In Utah, the Notice of Default in Payment Due on Promissory Note is an essential step in initiating the foreclosure process if the borrower fails to rectify the default within the specified timeframe. The notice must comply with the Utah Code and clearly state the amount of the payment due, the date it was due, any applicable penalties or fees, and a deadline for making the payment. It is crucial for the lender to follow the legal requirements and send the notice via certified mail or personal delivery. Different types of Utah Notice of Default in Payment Due on Promissory Note may vary depending on the type of loan or agreement. This can include loans for residential properties, commercial properties, or other types of loans. Each type may have its unique requirements and timelines for resolving the default, which should be clearly outlined in the notice. The purpose of the Utah Notice of Default in Payment Due on Promissory Note is to give the borrower an opportunity to cure the default and avoid further legal action. It is essential for borrowers to take the notice seriously and seek legal advice if needed to understand their rights and options. Failure to respond or rectify the default may lead to the lender proceeding with foreclosure proceedings, which can result in the loss of the underlying collateral. In summary, the Utah Notice of Default in Payment Due on Promissory Note is a vital legal document used in mortgage and lending transactions. It serves to notify borrowers of their failure to make payments on a promissory note and initiates the process of rectifying the default. It is crucial for borrowers to seek professional advice and address the notice promptly to avoid potential foreclosure and other adverse consequences.The Utah Notice of Default in Payment Due on Promissory Note is a legal document used to notify a borrower that they have failed to make the necessary payments on a promissory note as agreed upon. This notice serves as a formal communication from the lender to the borrower, indicating that immediate action is required to remedy the default and bring the account up to date. In Utah, the Notice of Default in Payment Due on Promissory Note is an essential step in initiating the foreclosure process if the borrower fails to rectify the default within the specified timeframe. The notice must comply with the Utah Code and clearly state the amount of the payment due, the date it was due, any applicable penalties or fees, and a deadline for making the payment. It is crucial for the lender to follow the legal requirements and send the notice via certified mail or personal delivery. Different types of Utah Notice of Default in Payment Due on Promissory Note may vary depending on the type of loan or agreement. This can include loans for residential properties, commercial properties, or other types of loans. Each type may have its unique requirements and timelines for resolving the default, which should be clearly outlined in the notice. The purpose of the Utah Notice of Default in Payment Due on Promissory Note is to give the borrower an opportunity to cure the default and avoid further legal action. It is essential for borrowers to take the notice seriously and seek legal advice if needed to understand their rights and options. Failure to respond or rectify the default may lead to the lender proceeding with foreclosure proceedings, which can result in the loss of the underlying collateral. In summary, the Utah Notice of Default in Payment Due on Promissory Note is a vital legal document used in mortgage and lending transactions. It serves to notify borrowers of their failure to make payments on a promissory note and initiates the process of rectifying the default. It is crucial for borrowers to seek professional advice and address the notice promptly to avoid potential foreclosure and other adverse consequences.

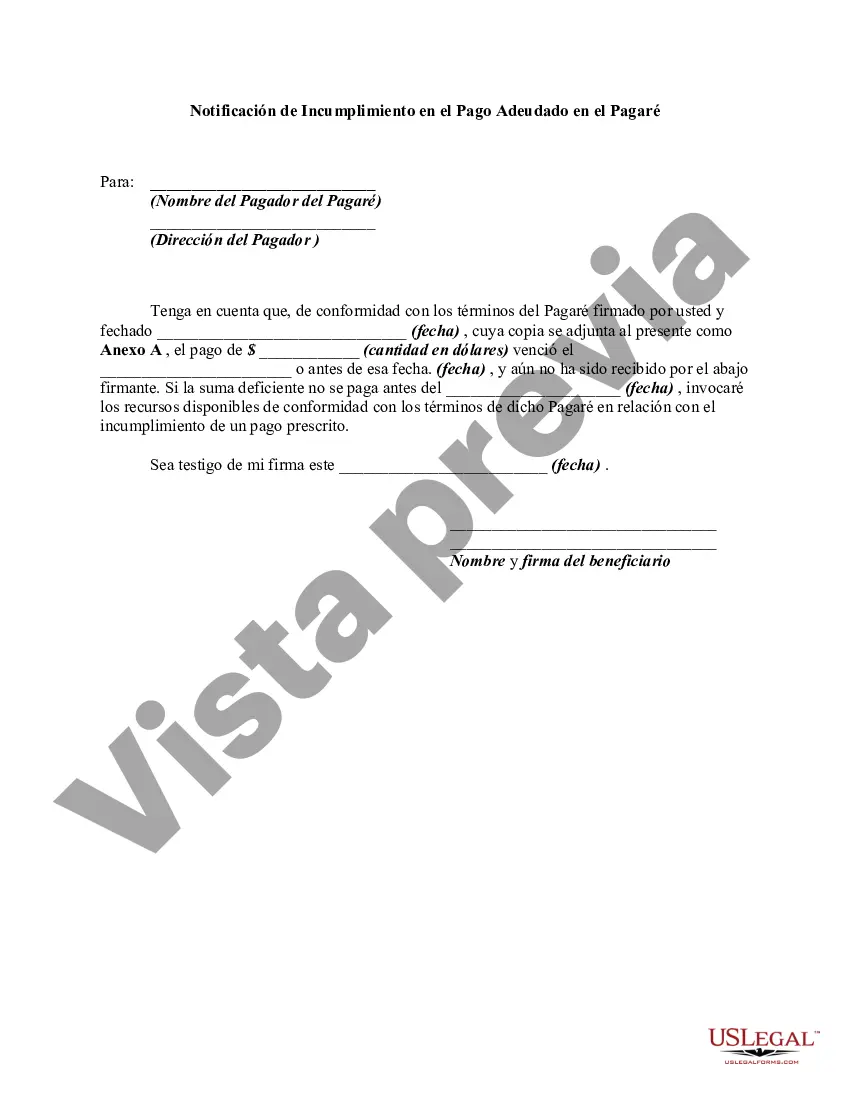

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.