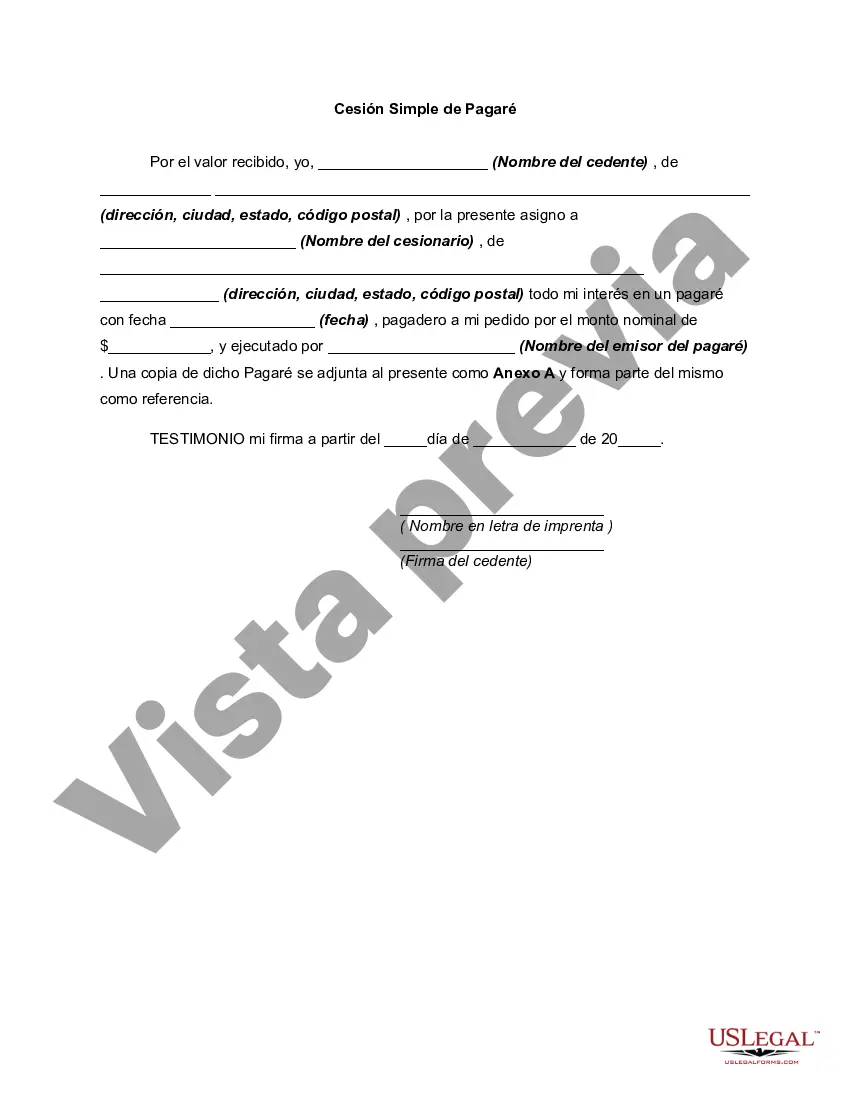

Title: Understanding the Utah Simple Promissory Note for Family Loan: Types and Detailed Description Introduction: A Utah Simple Promissory Note for Family Loan serves as a legally binding document that outlines the terms and conditions of a loan agreement between family members. It provides clarity and protection for both the borrower and the lender, ensuring a smooth and trustworthy financial transaction. This article aims to provide a detailed description and explore different types of Utah Simple Promissory Notes for Family Loans. Types of Utah Simple Promissory Note for Family Loan: 1. Fixed-Term Loan Note: A fixed-term loan note specifies a predetermined period within which the borrower must repay the loan. This type of promissory note is helpful when both parties agree on a specific deadline for repayment, providing clear expectations for both parties involved. 2. Installment Loan Note: An installment loan note allows the borrower to repay the loan amount in smaller, regularly scheduled payments over a specified period. This type of promissory note can be suitable when the lending family member prefers to receive the loan amount back in smaller increments over time. 3. Demand Loan Note: A demand loan note allows the lender to request repayment of the loan at any time. Unlike fixed-term or installment notes, this type of agreement provides flexibility by offering the lender the option to request full repayment whenever needed, without adhering to a specific timeline. Detailed Description: A Utah Simple Promissory Note for Family Loan consists of several essential elements that ensure a comprehensive agreement. These elements include: 1. Effective Date: The date when the promissory note becomes legally enforceable. 2. Parties Involved: The names, addresses, and contact details of the lender (often a family member) and the borrower. 3. Loan Amount: The specific sum of money lent to the borrower, clearly mentioned in both numerical and written formats. 4. Interest Rate: If applicable, the interest rate the borrower agrees to pay on the loan amount. 5. Repayment Terms: The repayment schedule, including the frequency, duration, and amount agreed upon for installment loans. For fixed-term loans, the due date and method of repayment are typically outlined. 6. Late Payment Penalties: Any consequences or penalties the borrower may face for delayed or missed payments. 7. Collateral: If applicable, any assets or property pledged as security against the loan amount. 8. Governing Law: The state laws and regulations that govern the promissory note. 9. Signatures: Both the lender and the borrower must sign the promissory note to acknowledge their agreement and commitment to the terms stated. Conclusion: A Utah Simple Promissory Note for Family Loan provides a transparent and legally binding agreement between family members lending and borrowing money. Whether it is a fixed-term, installment, or demand loan note, the details above should help you understand the different types and the components crucial for drafting such a document correctly. By ensuring clarity and protection, this type of promissory note establishes trust and fosters positive lending experiences within families.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Utah Pagaré Simple para Préstamo Familiar - Simple Promissory Note for Family Loan

Description

How to fill out Utah Pagaré Simple Para Préstamo Familiar?

If you have to total, acquire, or produce legitimate file templates, use US Legal Forms, the most important collection of legitimate varieties, which can be found on the Internet. Use the site`s easy and handy search to discover the paperwork you require. A variety of templates for business and individual purposes are categorized by types and suggests, or search phrases. Use US Legal Forms to discover the Utah Simple Promissory Note for Family Loan in just a few click throughs.

When you are already a US Legal Forms client, log in in your bank account and then click the Obtain button to get the Utah Simple Promissory Note for Family Loan. You may also access varieties you previously delivered electronically inside the My Forms tab of your respective bank account.

Should you use US Legal Forms initially, refer to the instructions beneath:

- Step 1. Be sure you have selected the form for that right town/country.

- Step 2. Use the Preview solution to look over the form`s articles. Don`t forget about to read through the description.

- Step 3. When you are not happy with the kind, take advantage of the Look for industry near the top of the monitor to locate other versions of your legitimate kind template.

- Step 4. Upon having identified the form you require, go through the Acquire now button. Select the prices program you prefer and add your qualifications to sign up for the bank account.

- Step 5. Approach the deal. You may use your Мisa or Ьastercard or PayPal bank account to finish the deal.

- Step 6. Choose the formatting of your legitimate kind and acquire it on your own product.

- Step 7. Comprehensive, edit and produce or indication the Utah Simple Promissory Note for Family Loan.

Each and every legitimate file template you get is the one you have eternally. You possess acces to each kind you delivered electronically in your acccount. Click on the My Forms area and pick a kind to produce or acquire once again.

Contend and acquire, and produce the Utah Simple Promissory Note for Family Loan with US Legal Forms. There are thousands of specialist and condition-specific varieties you can use for your personal business or individual demands.