Utah Agreement to Compromise Debt by Returning Secured Property: Understanding the Key Terms and Types Introduction: In the realm of debt settlement and compromise, the Utah Agreement to Compromise Debt by Returning Secured Property plays a crucial role. This legally binding agreement enables debtors and creditors to reach a mutually beneficial resolution by returning secured property to settle outstanding debts. Understanding the key terms and variations of this agreement is essential for anyone seeking debt relief in Utah. Key Terms: 1. Debt Compromise: A debt compromise refers to a negotiated settlement between a debtor and creditor to resolve a delinquent debt. In the case of returning secured property, this involves the debtor agreeing to surrender certain collateral as a means of satisfying the debt. 2. Secured Property: Secured property refers to assets used as collateral to secure a loan or debt. Common examples include real estate, vehicles, equipment, or any other valuable possessions agreed upon in the initial loan agreement. 3. Agreement to Compromise Debt: This document serves as a legal contract outlining the terms and conditions agreed upon by both the debtor and creditor for settling the debt through returning secured property. Types of Utah Agreement to Compromise Debt by Returning Secured Property: 1. Real Estate Agreement: This type of agreement focuses on using real estate property as collateral for the debt settlement. It outlines specific details such as the property's location, estimated value, and terms for its transfer or sale to the creditor. 2. Vehicle Agreement: When debts are secured by automobiles, trucks, or motorcycles, a vehicle agreement variation is employed. It includes information about the vehicle's make, model, VIN number, and condition, along with details regarding its transfer or sale. 3. Equipment Agreement: In cases where outstanding debts are secured by equipment or machinery, an equipment agreement is utilized. This document lists the equipment's specifications, condition, and outlines the terms for its return or transfer to the creditor. 4. Personal Property Agreement: When the secured property encompasses valuable personal possessions other than real estate, vehicles, or equipment, a personal property agreement is drafted. This agreement describes the items, their estimated values, and the terms of their return or transfer for debt settlement. Conclusion: The Utah Agreement to Compromise Debt by Returning Secured Property provides a practical mechanism for debtors to regain control of their finances through the return of secured assets. Whether it involves real estate, vehicles, equipment, or personal property, these agreements offer a way to settle debts and avoid more severe financial consequences. Understanding the key terms and variations within this agreement is vital for both debtors and creditors seeking an equitable compromise.

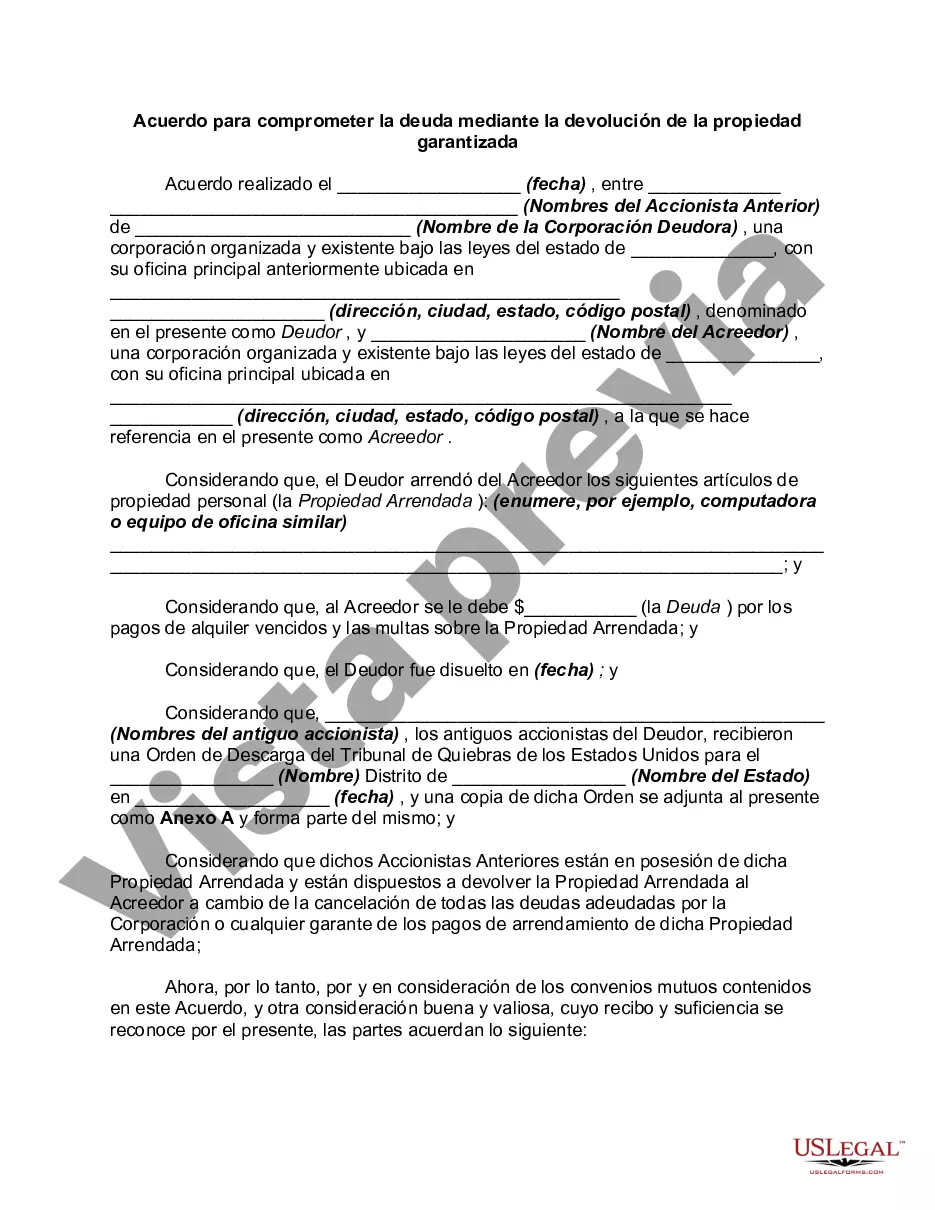

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Utah Acuerdo para comprometer la deuda mediante la devolución de la propiedad garantizada - Agreement to Compromise Debt by Returning Secured Property

Description

How to fill out Utah Acuerdo Para Comprometer La Deuda Mediante La Devolución De La Propiedad Garantizada?

Are you presently in the situation where you need to have papers for both organization or individual uses virtually every day time? There are tons of lawful record templates available online, but discovering versions you can depend on isn`t straightforward. US Legal Forms gives a large number of kind templates, such as the Utah Agreement to Compromise Debt by Returning Secured Property, which are composed to satisfy federal and state requirements.

In case you are currently knowledgeable about US Legal Forms internet site and have your account, basically log in. Following that, you can down load the Utah Agreement to Compromise Debt by Returning Secured Property web template.

Unless you have an account and need to begin using US Legal Forms, adopt these measures:

- Obtain the kind you will need and ensure it is for the proper town/region.

- Use the Preview switch to analyze the form.

- Browse the outline to ensure that you have chosen the appropriate kind.

- When the kind isn`t what you`re searching for, use the Search field to obtain the kind that meets your needs and requirements.

- Whenever you get the proper kind, just click Buy now.

- Opt for the rates program you desire, submit the required info to generate your money, and buy the transaction using your PayPal or bank card.

- Pick a handy paper file format and down load your version.

Get every one of the record templates you have purchased in the My Forms food selection. You can get a extra version of Utah Agreement to Compromise Debt by Returning Secured Property anytime, if needed. Just select the required kind to down load or produce the record web template.

Use US Legal Forms, one of the most comprehensive collection of lawful types, to save lots of efforts and stay away from faults. The support gives appropriately manufactured lawful record templates which you can use for a selection of uses. Make your account on US Legal Forms and begin making your daily life easier.