The Utah Articles of Incorporation for a Not for Profit Organization with Tax Provisions is a legal document that establishes the existence of a nonprofit organization in the state of Utah. This document outlines various details and provisions related to the organization's purpose, structure, and tax benefits. Below, we will delve further into the key components and types of Utah Articles of Incorporation, Not for Profit Organization, with Tax Provisions. 1. Purpose: The Utah Articles of Incorporation highlight the mission and purpose of the nonprofit organization. This section should clearly define the objectives and activities the organization aims to undertake in order to qualify for tax-exempt status. 2. Name and Principal Office: The document specifies the official name of the nonprofit organization, which must comply with Utah state laws. Additionally, it includes the physical address of the principal office, where official correspondence will be received. 3. Duration: This section indicates whether the organization intends to exist perpetually or for a specific period. Many nonprofits choose to operate indefinitely to ensure continuity in fulfilling their mission. 4. Registered Agent: A Utah nonprofit organization must have a registered agent who is responsible for accepting legal documents and official notices on behalf of the organization. The registered agent’s address is also provided in this section. 5. Members and Governance: Depending on the nonprofit's structure, this section outlines the various classes or types of members involved, such as general members, voting members, or board members. It may also detail the procedures for electing or removing board members, ensuring transparency and accountability within the organization. 6. Dissolution Clause: This clause specifies the steps that need to be taken in the event of the organization's dissolution, including the distribution of remaining assets to other tax-exempt organizations, as per Utah laws. Utah Articles of Incorporation for Not for Profit Organizations with Tax Provisions can be further categorized based on the organizational structure: 1. Public Benefit Corporation: This type of nonprofit organization serves the public interest or a specific segment of the population. It aims to provide services, support, or resources to benefit the community as a whole. 2. Mutual Benefit Corporation: Such organizations operate primarily for the benefit of their members rather than the public. Examples include country clubs or professional associations where members derive direct advantages from the organization's activities. 3. Religious Corporation: A religious nonprofit organization focuses on promoting and advancing religious beliefs and practices. It may establish places of worship, provide religious education, and carry out charitable activities aligned with its religious mission. The Utah Articles of Incorporation, Not for Profit Organization, with Tax Provisions, plays a vital role in formally establishing a nonprofit organization within the state. By complying with the relevant legal requirements and including all necessary components, an organization can ensure its eligibility for tax-exempt status and operate in accordance with Utah laws.

Utah Articles of Incorporation, Not for Profit Organization, with Tax Provisions

Description

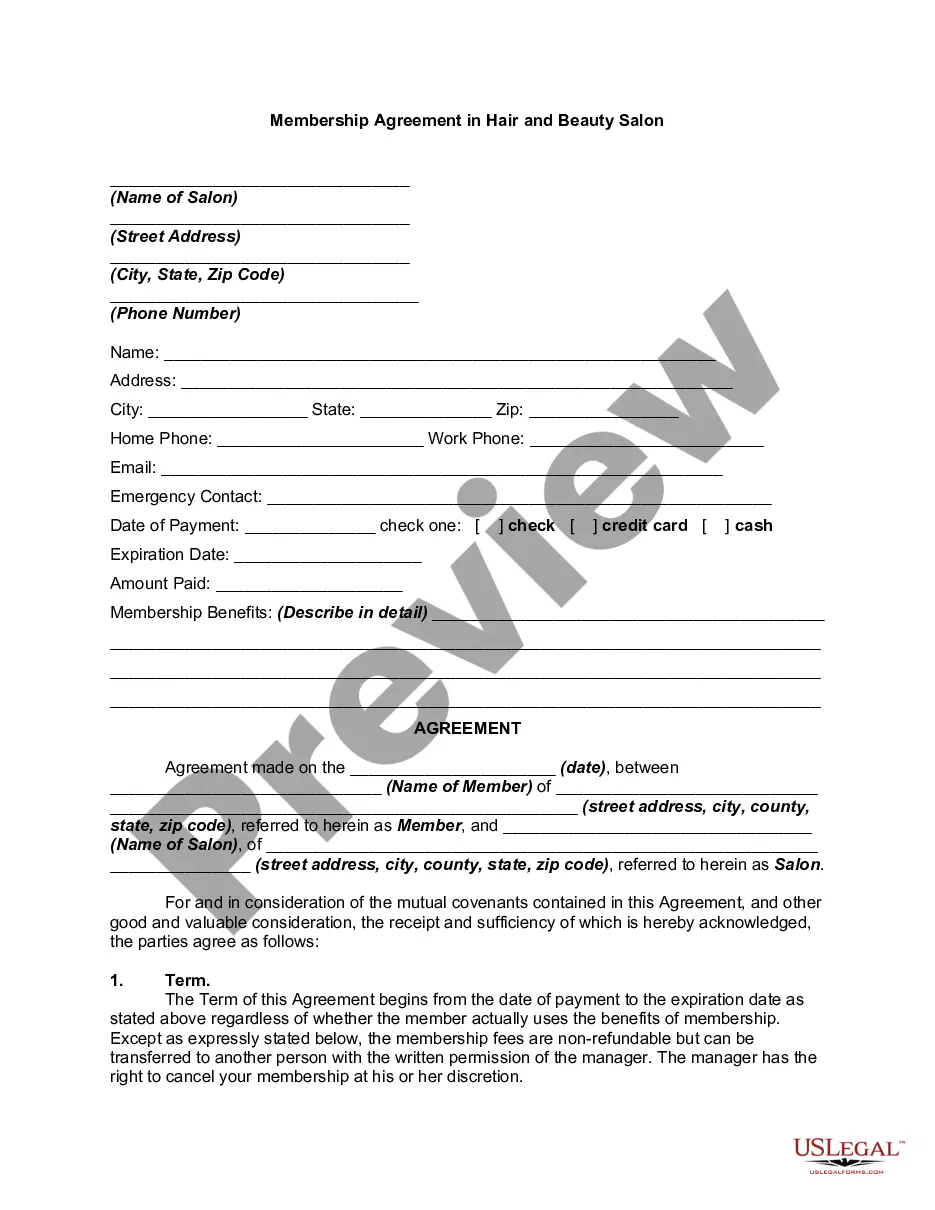

How to fill out Utah Articles Of Incorporation, Not For Profit Organization, With Tax Provisions?

If you have to total, down load, or print legitimate papers web templates, use US Legal Forms, the largest assortment of legitimate types, that can be found on the Internet. Make use of the site`s basic and practical research to get the documents you will need. Numerous web templates for organization and personal uses are sorted by types and claims, or search phrases. Use US Legal Forms to get the Utah Articles of Incorporation, Not for Profit Organization, with Tax Provisions in just a few clicks.

In case you are currently a US Legal Forms buyer, log in to the account and click the Down load button to have the Utah Articles of Incorporation, Not for Profit Organization, with Tax Provisions. You can also entry types you previously delivered electronically in the My Forms tab of the account.

If you are using US Legal Forms the first time, refer to the instructions beneath:

- Step 1. Make sure you have selected the form for that proper metropolis/country.

- Step 2. Take advantage of the Preview method to look over the form`s articles. Never overlook to learn the information.

- Step 3. In case you are unsatisfied with all the type, take advantage of the Lookup industry at the top of the monitor to discover other variations of the legitimate type template.

- Step 4. Once you have identified the form you will need, click the Get now button. Opt for the pricing strategy you choose and put your qualifications to sign up for the account.

- Step 5. Method the financial transaction. You may use your bank card or PayPal account to finish the financial transaction.

- Step 6. Pick the format of the legitimate type and down load it on your own system.

- Step 7. Total, change and print or indicator the Utah Articles of Incorporation, Not for Profit Organization, with Tax Provisions.

Each legitimate papers template you buy is your own property permanently. You may have acces to every single type you delivered electronically inside your acccount. Click on the My Forms section and choose a type to print or down load yet again.

Remain competitive and down load, and print the Utah Articles of Incorporation, Not for Profit Organization, with Tax Provisions with US Legal Forms. There are thousands of skilled and condition-distinct types you can use for the organization or personal demands.