Utah Assignment and Transfer of Stock refers to the legal process of transferring ownership of stocks or shares from one entity or individual to another within the state of Utah. This process involves the assignment of rights, duties, and obligations related to the ownership of stocks. The Utah Assignment and Transfer of Stock can be categorized into various types, such as: 1. Voluntary Assignment and Transfer: This type of assignment and transfer occurs when the current stockholder willingly transfers their ownership rights to another party. It may involve the execution of a stock transfer agreement between both parties, specifying the terms and conditions of the transfer. 2. Involuntary Assignment and Transfer: In certain situations, the assignment and transfer of stock can be involuntary. It can occur due to legal actions, such as bankruptcy, court orders, or the enforcement of a lien. 3. Intergenerational Transfer: This type of stock transfer involves transferring ownership from one generation to another, typically within a family. It often entails planning and executing estate or succession plans to ensure a smooth transition and comply with Utah laws and regulations. 4. Corporate Restructuring Transfer: In cases of mergers, acquisitions, or corporate reorganizations, the assignment and transfer of stock is necessary to consolidate the ownership and align it with the new structure. These transfers comply with relevant Utah corporate laws and regulations governing such transactions. 5. Pledge or Collateral Transfer: Stockholders may use their stocks as collateral for loans or financial transactions. In such cases, transferring stock ownership temporarily to the lender, often through a pledge agreement, secures the loan or transaction. Once the obligations are fulfilled, the ownership is transferred back to the original stockholder. 6. Intermediary or Broker-Assisted Transfer: Stock brokerage firms or intermediaries facilitate the assignment and transfer of stock on behalf of their clients. They ensure that the transfer follows the necessary legal requirements set by the state of Utah and the relevant regulatory bodies. Utah Assignment and Transfer of Stock involves various legal considerations, including compliance with the Utah Securities Act, proper documentation, and adherence to any specific requirements set by the company issuing the stock. It is important to consult legal professionals or seek advice from experts to ensure compliance and a smooth transfer process.

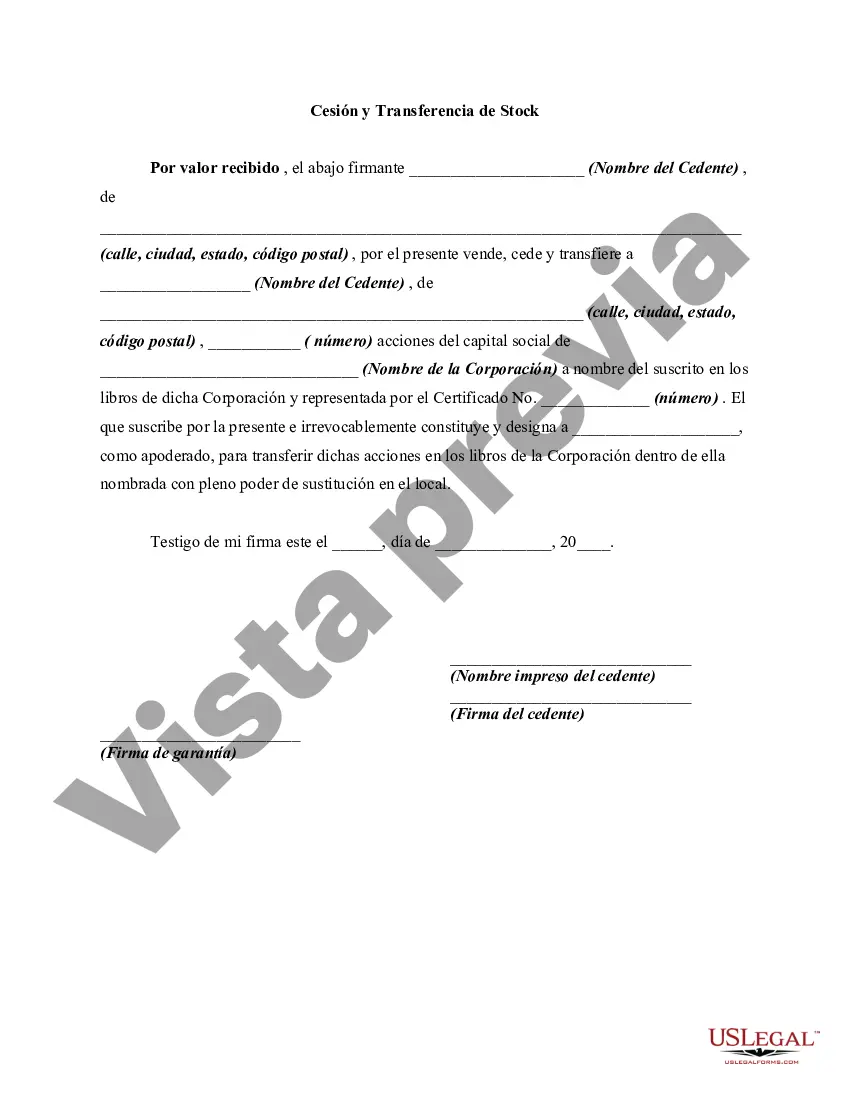

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Utah Cesión y Transferencia de Stock - Assignment and Transfer of Stock

Description

How to fill out Utah Cesión Y Transferencia De Stock?

Are you in the place the place you require paperwork for sometimes business or individual functions virtually every day time? There are plenty of legitimate file layouts available on the Internet, but getting versions you can rely isn`t straightforward. US Legal Forms delivers 1000s of kind layouts, like the Utah Assignment and Transfer of Stock, which are written in order to meet state and federal needs.

If you are presently acquainted with US Legal Forms internet site and possess a free account, basically log in. Next, you are able to download the Utah Assignment and Transfer of Stock design.

Unless you come with an bank account and need to start using US Legal Forms, follow these steps:

- Discover the kind you will need and make sure it is for that correct town/area.

- Take advantage of the Review button to review the shape.

- Look at the information to actually have selected the right kind.

- When the kind isn`t what you are searching for, make use of the Lookup industry to find the kind that meets your requirements and needs.

- When you discover the correct kind, click on Purchase now.

- Opt for the rates program you want, complete the specified info to produce your account, and pay for the order using your PayPal or charge card.

- Select a hassle-free file format and download your backup.

Get every one of the file layouts you might have bought in the My Forms food selection. You can aquire a additional backup of Utah Assignment and Transfer of Stock any time, if required. Just click on the essential kind to download or produce the file design.

Use US Legal Forms, probably the most substantial selection of legitimate kinds, to conserve time as well as avoid errors. The service delivers professionally manufactured legitimate file layouts that you can use for a selection of functions. Generate a free account on US Legal Forms and commence creating your lifestyle a little easier.