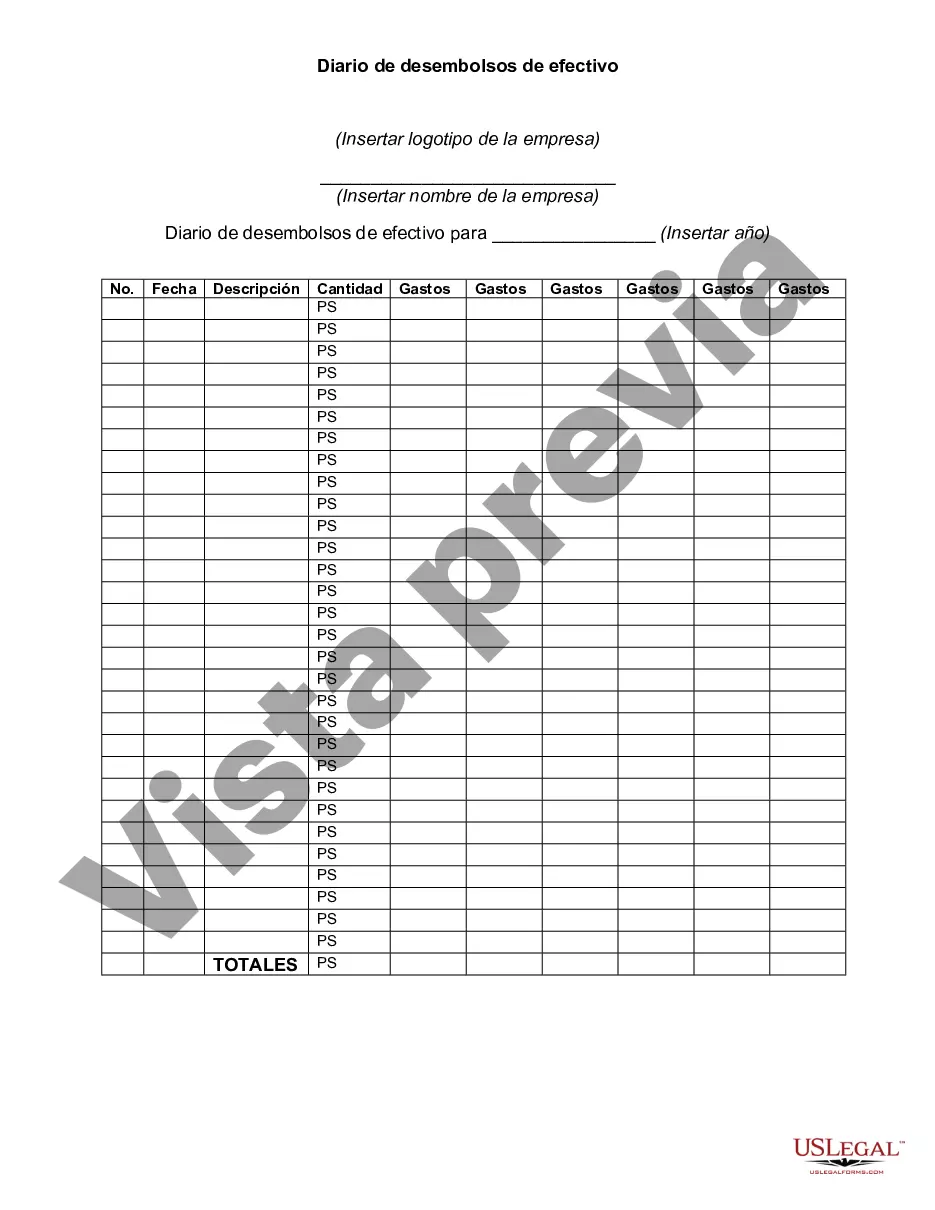

A check disbursements journal is a book used to record all payments made in cash such as for accounts payable, merchandise purchases, and operating expenses.

Utah Check Disbursements Journal is a financial record-keeping document used by organizations in the state of Utah to record and track their check disbursements. This journal serves as a comprehensive and organized record of all outgoing checks and payments made by the organization. The Utah Check Disbursements Journal is designed to help businesses and institutions maintain accurate financial records and ensure transparency. It captures essential information related to each disbursement, such as the check number, date, payee, purpose of payment, and the amount disbursed. This information allows organizations to keep track of their expenses, reconcile accounts, and identify any discrepancies or errors. By maintaining a Check Disbursements Journal, businesses in Utah can easily identify and reference specific payment transactions when needed. It provides a permanent record that can be used for auditing purposes or during financial reviews. Additionally, having a comprehensive record of check disbursements enables organizations to maintain a detailed history of their financial activities, which can be useful for analyzing spending patterns and making informed financial decisions. Different types of Utah Check Disbursements Journals may vary based on the specific needs and preferences of different organizations. Some businesses may choose to use a physical, paper-based journal where each entry is handwritten or printed. Others may prefer to utilize electronic spreadsheets or dedicated accounting software to record and organize the disbursed checks. Regardless of the format chosen, the key purpose of the Utah Check Disbursements Journal remains the same — to serve as a reliable and organized record of all outgoing check payments made by the organization. It plays a crucial role in maintaining financial accuracy, compliance, and accountability for businesses operating in Utah.

Utah Check Disbursements Journal is a financial record-keeping document used by organizations in the state of Utah to record and track their check disbursements. This journal serves as a comprehensive and organized record of all outgoing checks and payments made by the organization. The Utah Check Disbursements Journal is designed to help businesses and institutions maintain accurate financial records and ensure transparency. It captures essential information related to each disbursement, such as the check number, date, payee, purpose of payment, and the amount disbursed. This information allows organizations to keep track of their expenses, reconcile accounts, and identify any discrepancies or errors. By maintaining a Check Disbursements Journal, businesses in Utah can easily identify and reference specific payment transactions when needed. It provides a permanent record that can be used for auditing purposes or during financial reviews. Additionally, having a comprehensive record of check disbursements enables organizations to maintain a detailed history of their financial activities, which can be useful for analyzing spending patterns and making informed financial decisions. Different types of Utah Check Disbursements Journals may vary based on the specific needs and preferences of different organizations. Some businesses may choose to use a physical, paper-based journal where each entry is handwritten or printed. Others may prefer to utilize electronic spreadsheets or dedicated accounting software to record and organize the disbursed checks. Regardless of the format chosen, the key purpose of the Utah Check Disbursements Journal remains the same — to serve as a reliable and organized record of all outgoing check payments made by the organization. It plays a crucial role in maintaining financial accuracy, compliance, and accountability for businesses operating in Utah.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.